Germany's Vonovia & the Case for Cap Rate Compression at Essex

A rough draft of this article was sent to subscribers to our FREE Actionable Investment Idea Newsletter in advance of publication on privateeyecapital.com . If you like being in the know and want FREE weekend reading, be sure to sign up NOW. It's FREE!!

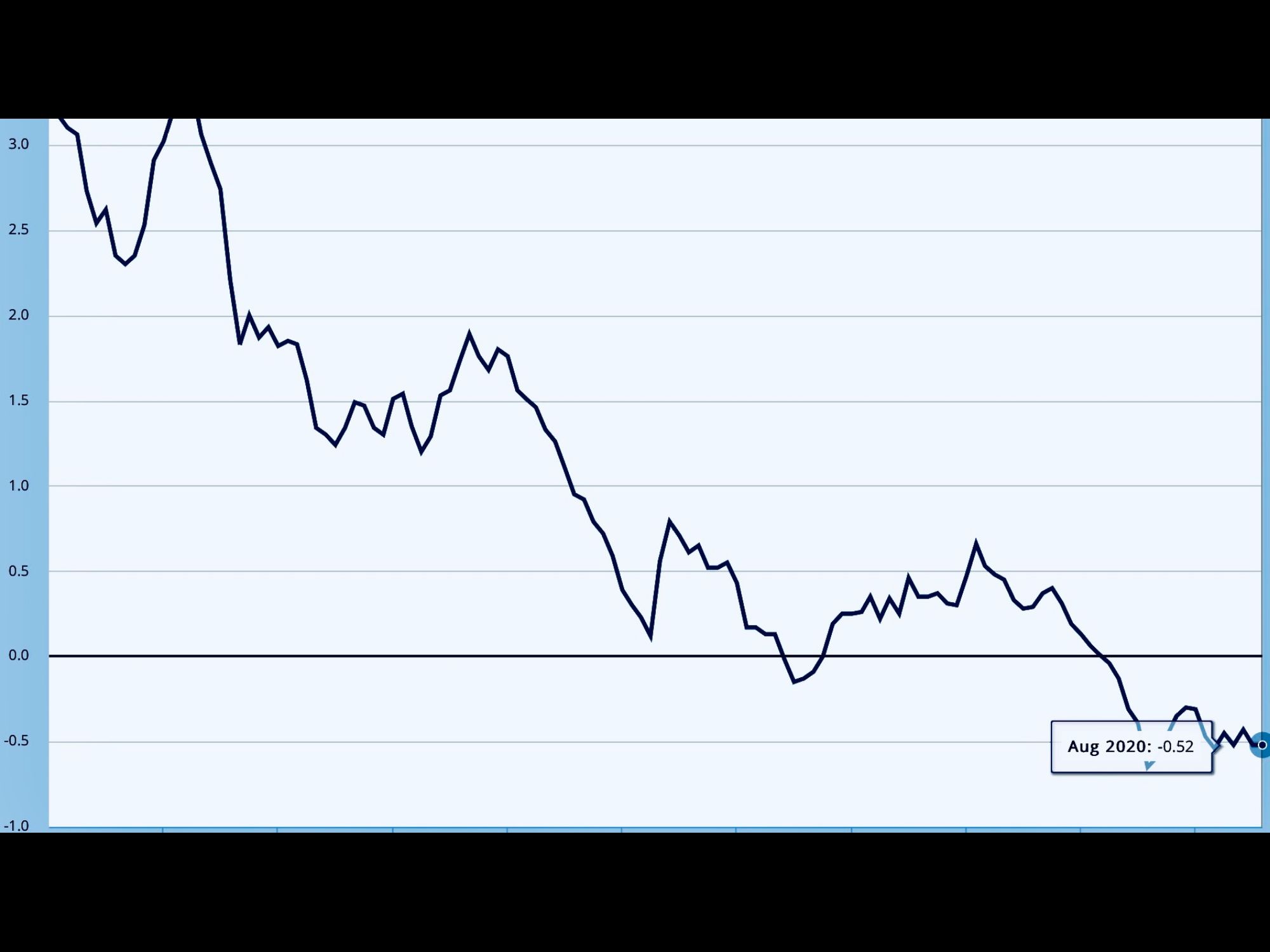

Can you guess what is featured in the chart above? 10 year German bund yields. Don't rub your eyes - they sit at negative 52 bps which means that in order for the Germany government to hold 'investor' money, it requires an annual PAYMENT of E520 for each E100,000 held. Some investment. The US is incrementally better as it will pay an investor about $700 for each $100,000 invested - well below any realistic measure of inflation but at least positive. This brings me to our topic du jour: cap rate compression in apartment real estate and its potential impact on the valuation of Essex Property Trust (ESS).

While the California apartment REITs trade at very low valuations (high implied cap rates), German apartment REITs - most notably Vonovia (VNA GR for Bloomberg users), trade at significantly higher valuations despite inferior growth prospects. Today I will compare the fundamentals (drivers of NOI and NOI growth) and valuation (cap rates) of Vonovia to Essex Property Trust (ESS). Importantly Vonovia operates in a highly regulated environment - German apartments are subject to onerous rent control regulation - regulations which would make CA seem laissez faire even if Prop 21 were to pass (I doubt it will).

The conclusion of this analysis is that ESS is woefully undervalued and presents a compelling opportunity for long term investors. Though my views are long term in nature, at the request of readers, I also discuss upcoming catalysts which could drive a meaningful upward revision in the valuation of Essex.

Brief Background on German apartments/Vonovia

Vonovia went public in 2013 and today is the largest owner of German apartments with about 360,000 German units (and another 60k in Sweden & Austria). Berlin & Munich represent about 16% of Vonovia’s German units.

Compared to properties owned by Essex (average age 27-28 years), Vonovia’s German apartments are much older, with 16% built prior to World War 2, 69% built between 1945 and 1980 and the remaining 15% constructed after 1980. All else equal, older properties tend to have greater maintenance capital expenditure requirements and should trade at higher cap rates.

Differences in Accounting - Germany/IFRS

Vonovia reports book value in accordance with IFRS (International Financial Reporting Standards) whereby Asset values (most notably Investment Property) are based on Fair/Market value. Under IFRS, book value is equal to NAV.

This is in stark contrast to book value calculation in the US whereby book value is based on Cost less Depreciation. In the US, book value bears no relation to the market value of properties as properties appreciate rather than depreciate. NAV must be calculated using market inputs.

Vonovia calculates asset value using 3.2-3.3% cap rates. However its shares trade at a premium to calculated NAV, implying a 3.1% cap rate for its apartment assets. Breaking this out by region, large cities Berlin & Munich trade at sub 3% cap rates.

Economy - Germany vs. California

The economic picture in Germany is notably worse than CA as Germany is not a global tech or entertainment hub (not only TV/film but also video games). The German economy is much more dependent on manufacturing and industrial production. This can be seen in German real economic growth (ranged from 0.6-2.6% 2014-2019) which has sorely lagged the US/California (California read GDP growth has ranged from 3-4% pa).

On a going forward basis, it seems highly unlikely that German economic growth can rival that of SF/LA given that SF/LA benefit from all things new economy (find our report here).

Supply / demand - Like California, supply growth in Germany is very limited due to construction costs and limited availability of land. Zoning restrictions also present challenges in Germany but do not seem to present the same barrier as we see in LA/SF (Can’t Build Up - described in my initial writeup on ESS).

Interest rates/ Growth/ Cap rates

In comparing cap rates, we must consider the differential in sovereign interest rates between Germany and the United States. While US 10y Treasuries yield an all time low of just 0.7%, this is actually much higher than the 10y German Bund which requires an ‘investor’ to PAY E540 for the privilege of locking up his/her E100,000 for a decade (10y Bund has a ‘yield’ of -0.54%). While much has been made of the Federal Reserve encouraging investors to move into risk assets in the US, in Germany this has been done gun to head.

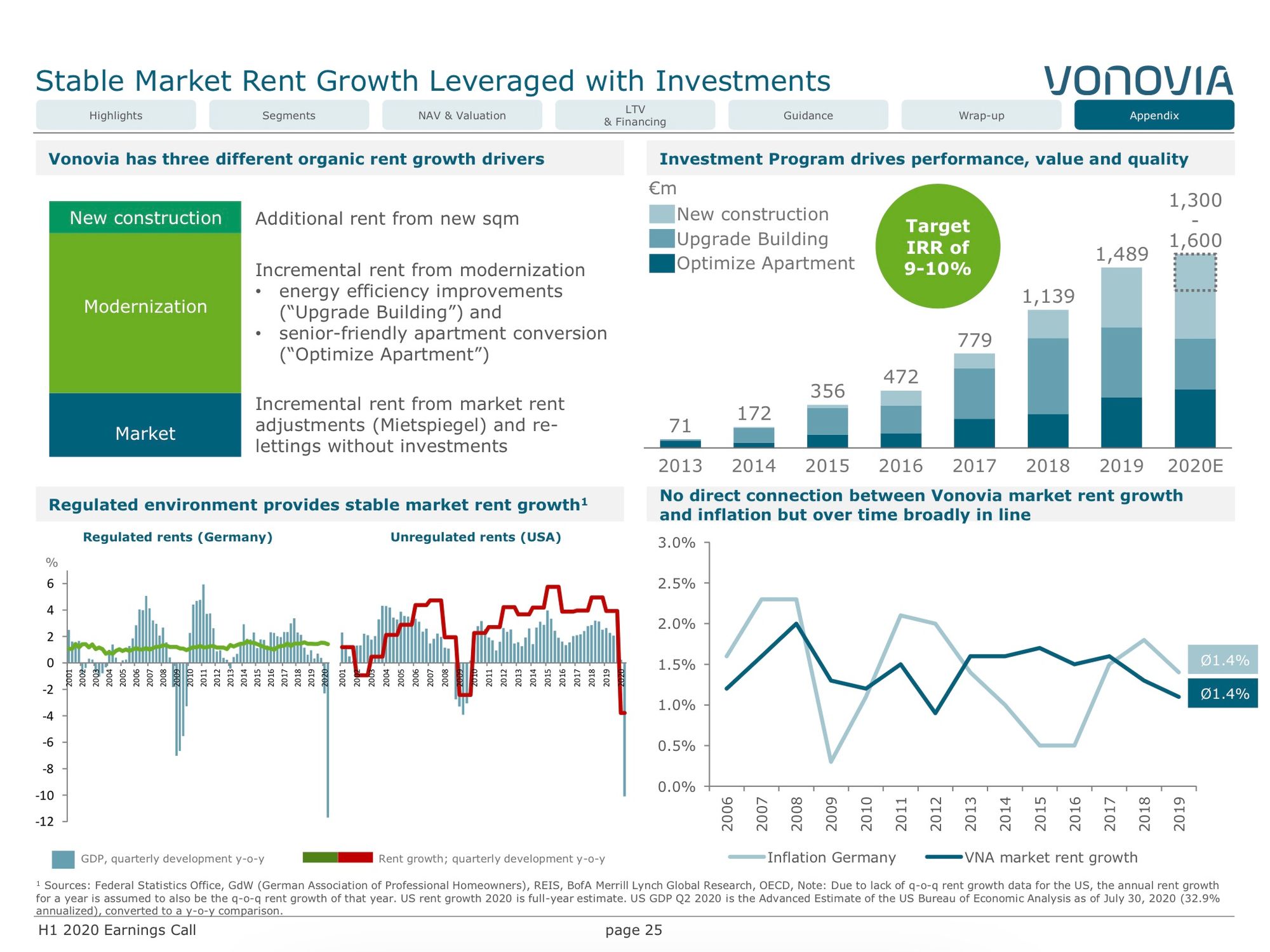

While there is a 124 bp differential in interest rates between Germany & the US, I believe that the differential in growth rates more than offsets this. In Germany renewal rents reprice in the 1-2% range (very strict rent control -got much stricter in Berlin earlier this year but VNA shareholders didn’t seem to care). Renewal rents typically price at 3%+ in CA (rent controlled apartments allow for 3% pa in Los Angeles/Santa Monica). Vonovia reports organic growth of 3-4% but this includes not units which are refurbished and re-let to new tenants at a higher rate (consistent w/ US reporting of ‘same store rent’) but also new buildings developed and purchased (this really isn’t organic).

With regard to refurbishment, because Vonovia’s buildings are so old, there is a greater amount of refurbishment expenditure necessary to generate the increased rents. Vonovia is quite stingy with disclosure but I’m trying to work out estimated IRR here (I’m at ~7%, below the 9-10% VNA advertises).

Conclusion & Upcoming Catalysts

Over time, I expect we will ultimately see cap rate compression in California. Were ESS to be valued on par with Vonovia at a 3.1% cap rate, its share price would be $480 (+125%). Were ESS (majority is metro LA/SF/Seattle) valued on par with Berlin/Munich, its per share value would be in excess of $500.

Private Eye Capital takes a long term approach - however, many readers (here and on other forums) have inquired about potential catalysts. Here is what I have to offer:

1) Failure to pass CA Prop 15 and or Prop 21. Both are already more than priced in. Note that Prop 15 is a gradual infringement on Prop 13 (keep property tax hikes limited to 2% pa). Because of Prop 13, CA has the most stable/visible property tax regime in the US. So while many states/munis will be scrambling for revenue and looking to pick the pockets of real estate owners, Prop 13 ensures this won't happen to multifamily owners in CA!

Homeowners = VOTERS!

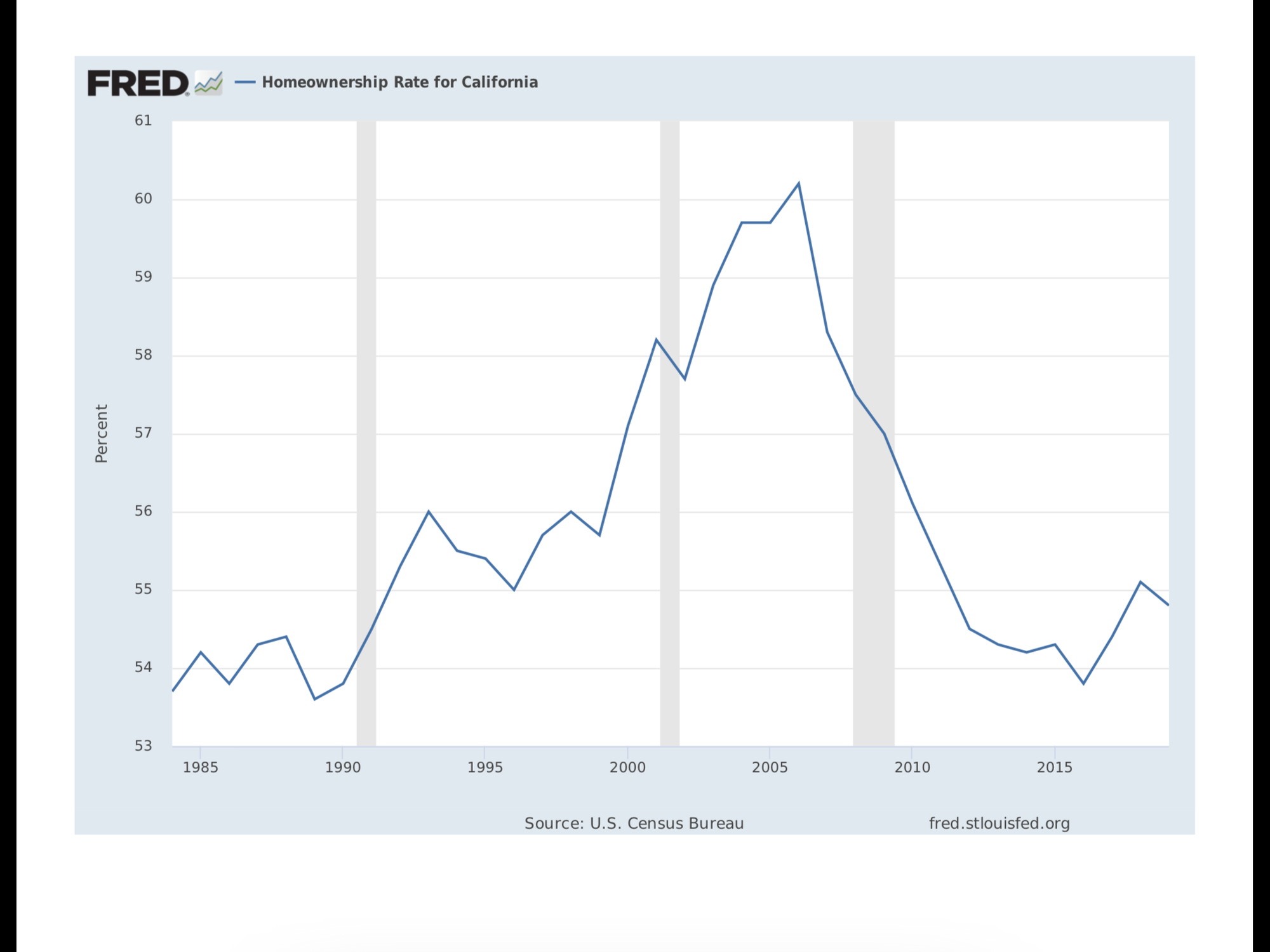

Also note that if somehow 15 did pass, this DOES NOT AFFECT MULTIFAMILY which has been excluded along with single family. With 54-55% homeownership in CA, even if 15 did pass, coming after multifamily would be a tougher task as this would threaten Single Family Homeowners both directly and indirectly (directly as this would lead to apartment to condo conversions - increasing supply and depressing prices; indirectly as homeowners would be forced to wonder if they are next).

2) The ferocious appetite of the private market forcing sell side ‘analysts’ (reports here, here, and here) to adopt realistic NAVs and price targets (their price targets today are just tracking the share price- there is very little analysis IMO). Just last week, Invesco paid what I estimate to be a low 4s cap rate for a collection of sub-scale, very old (50-100 years) buildings in Oakland. I was able to speak with a former owner of one of the buildings purchased by Invesco in this transaction who highlighted the disparity in quality in these assets vs. those owned by ESS, EQR, AVB. Like the CA apartment transactions in September (report here) this illustrates the undervaluation of the REITs. As I've mentioned many, many times, the private market is THE MARKET (report here).

3) Rebound in Hollywood/LA when Covid restrictions end. BX and other smart private market folks are investing $ billions in buying studio space as the streaming land grab sets off a decade of big spend by Disney +, AppleTV, Hulu, YoutubeTV, HBOMax, CBS streaming in addition to free spending NFLX and AMZN. I realize I owe readers a full writeup here.

4) Influx of foreign capital -compared to the aforementioned German apartment REITs or Bund yields, CA apartment REITs like ESS look like a pretty, pretty good deal.

5) A recapitalization transaction, returning a significant (nearly all) amount of the current share price, as highlighted last week (find here).

Coming back into...Fashion.

This is not investment advice! Assume I'm totally wrong and do your own work.

Eric Bokota is LONG ESS, EQR, AVB.

Private Eye Capital Newsletter

Join the newsletter to receive FREE actionable investment ideas.