TT Electronics Plc: Fix it or Someone Else will

Paid

Members

Public

UK microcap TT Electronics Plc (TTG.LN) looks to have a very favorable risk/reward profile at 85p. In a base case, I see shares nearly doubling. With a solid B/S ~2x ND/EBITDA and two recent takeover approaches (at 125++p), I see limited fundamental downside - if

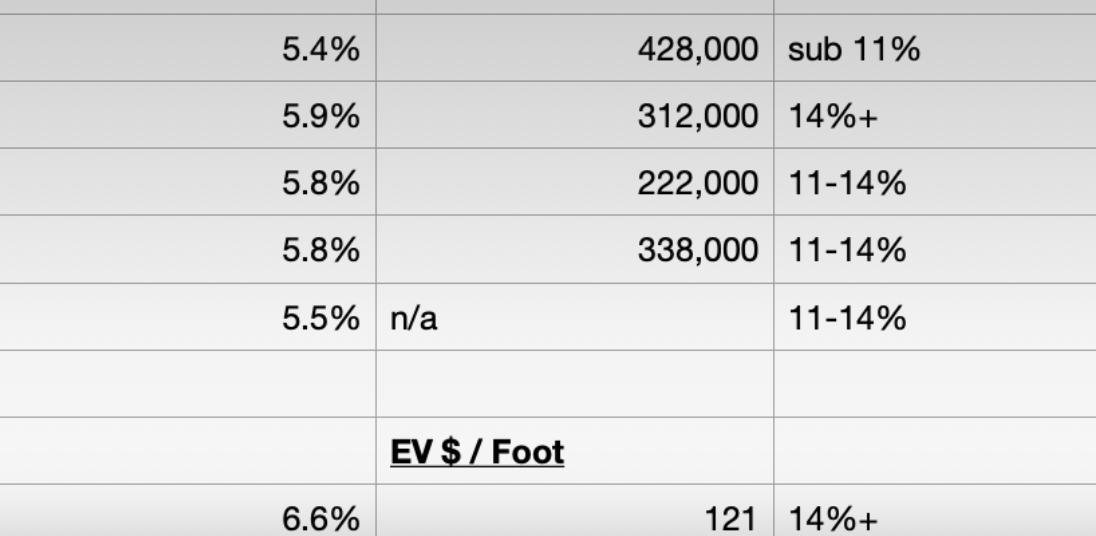

Cap Rates,EV per Door/Ft, Est IRRs for Selected REITs

Paid

Members

Public

REITs have broadly been beaten up as yields on the 10y have breached 4.7%. As such, I thought it would be timely to put out a valuation/comp page for a selection of REITs: On the whole I see low to mid teens IRRs as being very attractive returns

Tax Loss Selling: UK/Europe Edition

Paid

Members

Public

Here are some lower conviction ideas (read: smaller, in some cases much smaller weightings) that I've added or added to recently: Knight's Group Holding (KGH LN) - This UK microcap might be the cheapest thing I own. It's a highly acquisitive law firm which

The Most Wonderful Time of Year: Tax Loss Selling Season

Paid

Members

Public

I'm not gonna lie: buying something from someone who is selling it because it has gone down is exciting. While catching a falling knife doesn't feel great, tax loss selling can create very interesting opportunities. Today I will highlight a few securities I think have been

Updated Multifamily Cap Rates/Per Door/IRR Ests

Paid

Members

Public

With the large multifamily REITs having reported, I went ahead and updated my cap rate, per door, IRR estimates as shown below: Methodology/Assumptions: * Cap Rate shown uses current expected 2024e NOI (based on company guidance given over the past two weeks) and deducts 'Property Management Expenses'. * I

P10: Shorted & Distorted

Paid

Members

Public

Given the muted market reaction to the short report, it seems most have seen through it but whatever I'll throw my thoughts on the blog just for funzies. The crux of the 'Friendly Bear's' (to be referred to as FB) short report on P10

Congressional Leaders Propose Mass Eviction of Working Families

Paid

Members

Public

Senator Jeff Merkley (Democrat - Oregon) and Representative Adam Smith (Democrat - Washington) have proposed a piece of housing legislation which would inevitably force the eviction of hundreds of thousands of working families in the United States. Dubbed the “End Hedge Fund Control of American Homes Act of 2023”, legislation

Multifamily REITs: Cap rates, Per Door, Expected 4 year IRR

Paid

Members

Public

Thought I'd throw this up here in case people are interested. Methodology/Assumptions: * Cap Rate uses current expected NOI and deducts 'Property Management Expenses'. * Given the wall of supply hitting the sunbelt over the next 12-18 months, but relatively limited new supply in coastal markets, 2024