Ever wanted to own an apartment in NY? $CLPR

Private Eye Capital (PEC) LOVES NY. PEC believes $CLPR is VERY low risk and UNBELIEVABLY cheap. $CLPR management seems to agree and announced a large share buyback. $CLPR has a 5% divvy.

or several for that matter. Private Eye believes Clipper REIT (CLPR) is a VERY low risk security which offers significant upside potential.

-Solid Balance Sheet/No financial risk - non-recourse debt (I'm putting together a primer here to explain the beauty of non-recourse financing & multifamily financing in general) & ample liquidity. No upcoming debt maturities. CLPR's recent refinancing of their Flatbush property is instructive in this regard:

The refi occurred at the height of the pandemic in the epicenter of the pandemic (US). The terms of the deal are quite interesting as the bank provided 12 year financing which valued Flatbush using an implied ~4.1% cap rate (reflective of private market value- discussed below) at a 70% loan to value (LTV) and a 3.13% interest rate. This allowed CLPR to not only lower its cost of funding but pull cash out of the property which will allow management to take advantage of other opportunities - see below. This cash out refi is a private market transaction. It tells us that the stock is REALLY REALLY CHEAP.

-Fantastic apartment assets in Manhattan & Brooklyn. Very simple REIT with just 7 properties (67 buildings). 85% of CLPR's value is Brooklyn & Manhattan apartment assets. The 15% of non-apartment is mainly office. Office exposure is low risk due to long term lease to city of NY (rent bump of $7 mn over next 5 months).

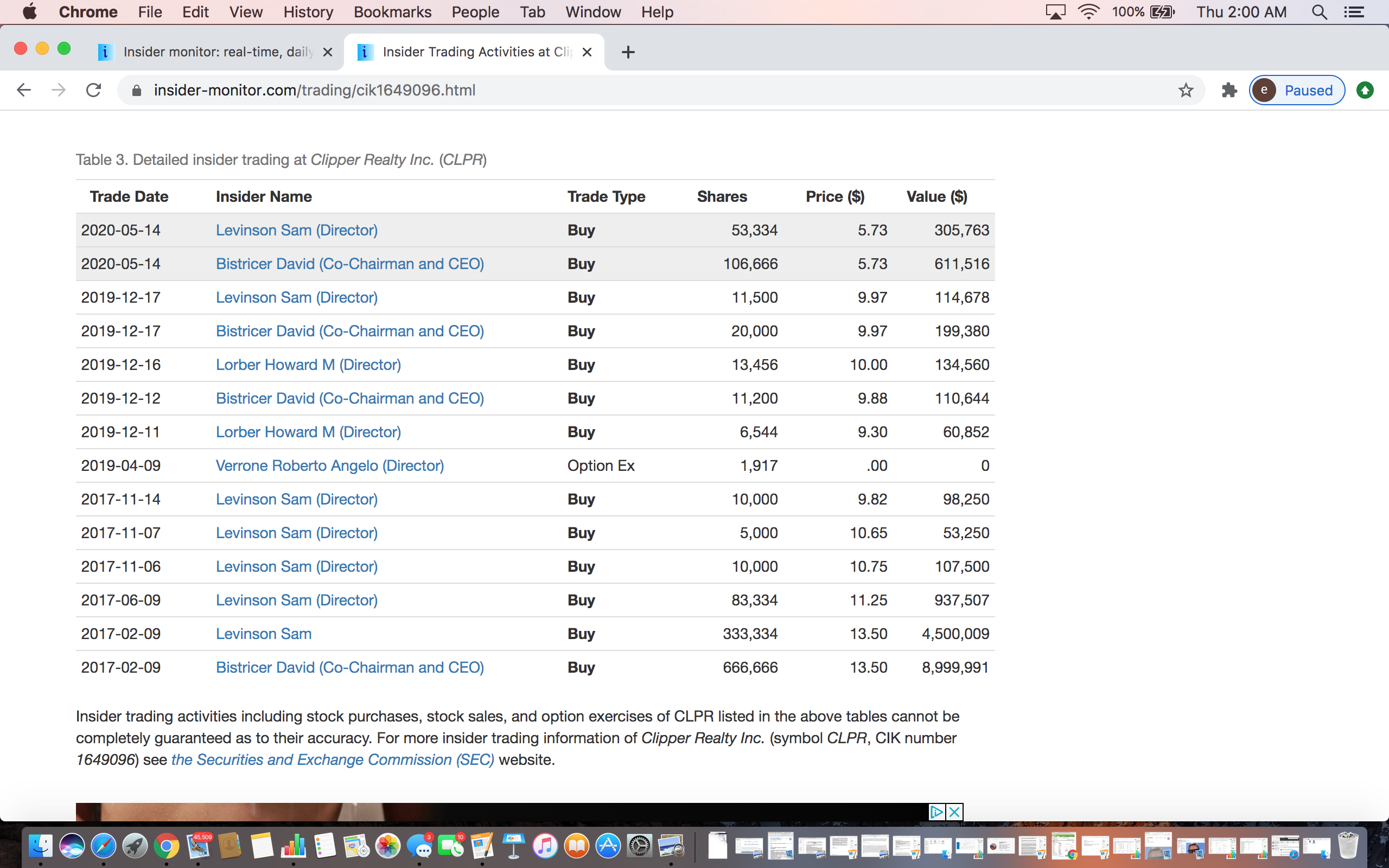

-Run by seasoned and capable executives (David Bistricer & Sam Levinson). Management/employees own ~65% of the company. As you can see below, executives have been BUYING stock regularly has been public. As best I can tell, they have NEVER SOLD A SHARE. THIS IS NOT A SMALL POINT - hence the obnoxious BOLDING.

-Trades at a massive discount to private market value. Basically the price at which we are buying CLPR shares would NEVER F'ING HAPPEN in the private market - the PRIVATE MARKET is the REAL market. Click on the underlined words preceding this sentence. Though you'd never see a deal like this in the private market, right now it is available to anyone with a brokerage account. When COVID panic ends, NY just might be considered cool again. NY will be sexy again. There's something about the megacity and some people (including me) think NY is a special place. With interest rates at all time lows and just a little love, CLPR shares could triple. And investors get paid 5% to wait.

-Supply is limited. There isn't much space available in Manhattan or Brooklyn. There are restrictive building codes and construction costs are high.

-Demand will always be high. NY is a megacity. NY is truly unique. If you don't know what a megacity is or why NY is unique, see our megacity page - there is a bunch more great megacity info in our EQR report. Jerry Seinfeld breaks it down https://www.nytimes.com/2020/08/24/opinion/jerry-seinfeld-new-york-coronavirus.html?auth=link-dismiss-google1tap

-Tremendous opportunity for value creation simply by buying back CLPR shares. CLPR announced $10 million repurchase authorization with 2Q results on 8/10. This is really just a way for management to own even more stock. Ever play Pac Man (I know..I'm old)? Management is using holding company cash and a very weak share price to vacuum up stock (or Pac-Man the shares). At current prices, this represents 3% of total shares outstanding but ~9% of free float. This could be a catalyst for share price appreciation.

-In addition to strong results from CLPR thus far in 2020, recent market data indicates rents are holding up well in Manhattan:

Here are a couple other ways to think about this...Visually...

That seems kinda cool...at least to me..

Lyrically:

Even if things stay very very ugly...we see very little, if any, real downside at current prices ($7-9).

Before I go let me warn you...first DON'T EVER TAKE MY WORD for anything. But if after doing your own work you come to the conclusion that you want to buy a few shares, be aware that CLPR doesn't trade that much and the stock can be quite volatile. If you decide to buy a little bit be sure to use LIMIT orders. Price is important.

As some of you have guessed, Eric Bokota LOVES NY. Eric Bokota is LONG CLPR.

Private Eye Capital Newsletter

Join the newsletter to receive FREE actionable investment ideas.