$ESS

Essex Property Trust- muted 1Q; 2H21 and 2022 likely to shine

Paid

Members

Public

Essex Property Trust (ESS - initial piece here [https://www.privateeyecapital.com/why-would-any-long-term-investor/] & follow up [https://www.privateeyecapital.com/tag/ess/]) posted a slightly better than expected set of results. Shares declined slightly - the market appears to be disappointed that ESS did not increase full year NOI guidance

Essex FY results & Private (REAL) market update

Paid

Members

Public

The results themselves are very much what I would expect based on what we saw in 2H20 and management's past commentary on trends.Importantly, ESS management provided 2021 earnings guidance (was previously suspended due to COVID related uncertainty), resumed the share buyback (had been paused due to uncertainty)

LA is set to BOOM!

Paid

Members

Public

Happy new year - As I’ve mentioned previously, I believe that LA is on the precipice of a large, Hollywood-driven boom (I’m guessing 2H21) as: 1. Working through the backlog of un-produced film & TV from 2020 as COVID shut down production schedules for much of 2020. 2.

Don't believe everything that you read over and over again

Paid

Members

Public

Apartment REIT investors have heard two refrains throughout 2020: 1) California is dead (2) Urban areas are dead. To read the news, the death of CA seems a given -after all we lost not only Joe Rogan but Elon Musk and Oracle. Today after hours we have a sizable counterfactual.

Essex Property Trust 3Q Results - pretty, pretty good.

Paid

Members

Public

Key observations: * Strong operational performance in occupancy, rent, NOI and cash collections. Trends at Essex improved heading from 3Q into October. While on a cash basis (allocation of free rent to period where free rent was borne by ESS), NOI was down a little over 10% but on GAAP/ straight

Germany's Vonovia & the Case for Cap Rate Compression at Essex

Paid

Members

Public

A rough draft of this article was sent to subscribers to our FREE Actionable Investment Idea Newsletter [https://www.privateeyecapital.com/signup/] in advance of publication on privateeyecapital.com . If you like being in the know and want FREE weekend reading, be sure to sign up NOW. It's

Essex Property Trust (ESS): What Goldman Sachs says vs. What Goldman Sachs does

Paid

Members

Public

This past week again saw the West Coast Apartment REITs in the red despite continued positive apartment operating data points and private market commentary. This provides long term investors with what I believe to be an excellent opportunity. Today I will touch upon: 1) Update on September apartment rental collections

The prudent sounding verbiage in sell-side reports can lead to terrible investment outcomes

Paid

Members

Public

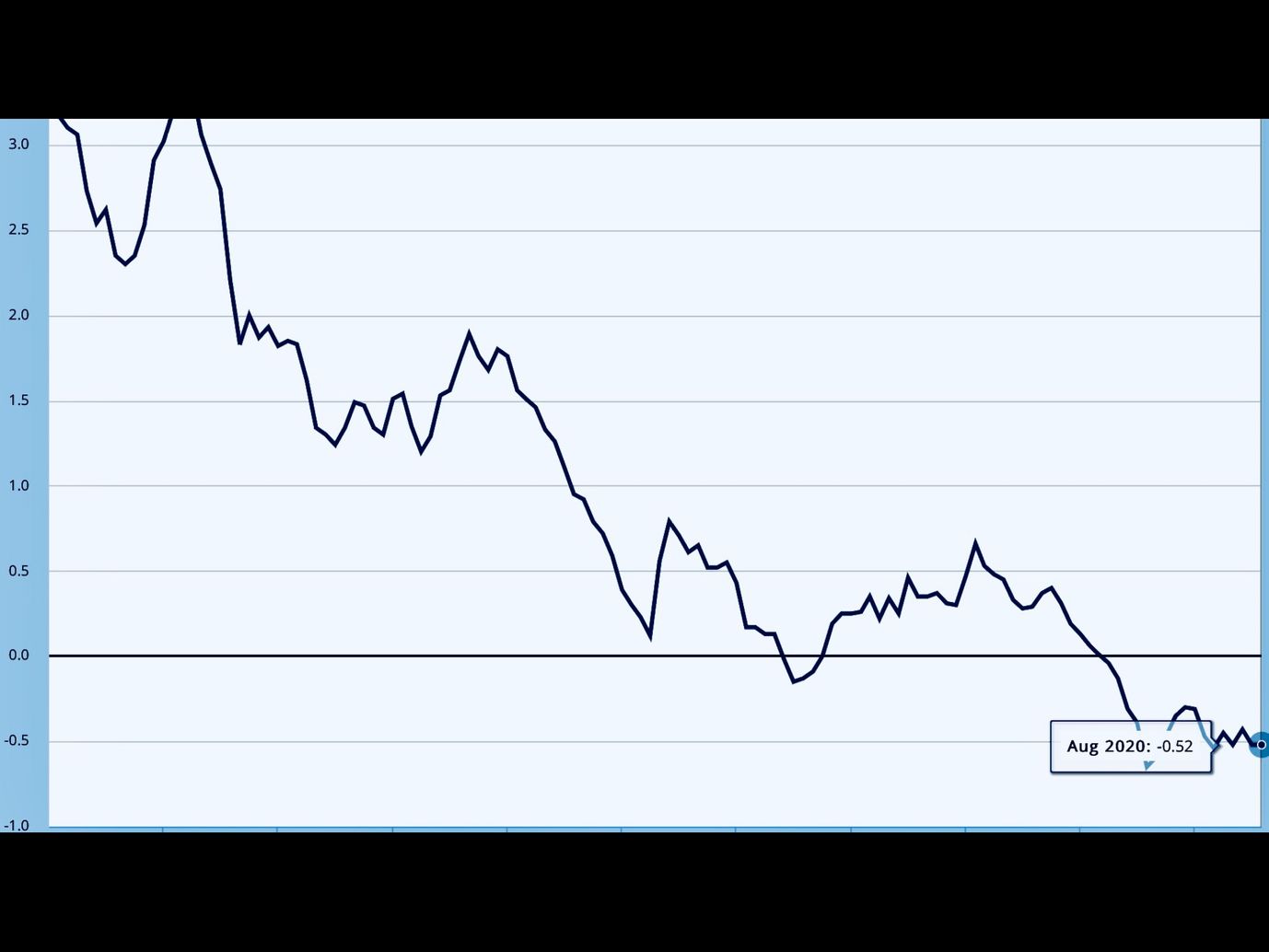

This is in response to Baird's enlightening research piece (Seeking Alpha synopsis here [https://seekingalpha.com/news/3614408-wait-for-rent-growth-to-bottom-on-apartment-reits-baird] ) earlier this month letting us all know to wait for rents to bottom before buying apartment REITs. The wizards at Baird think this is what worked last time. Let me