Buying the STORe

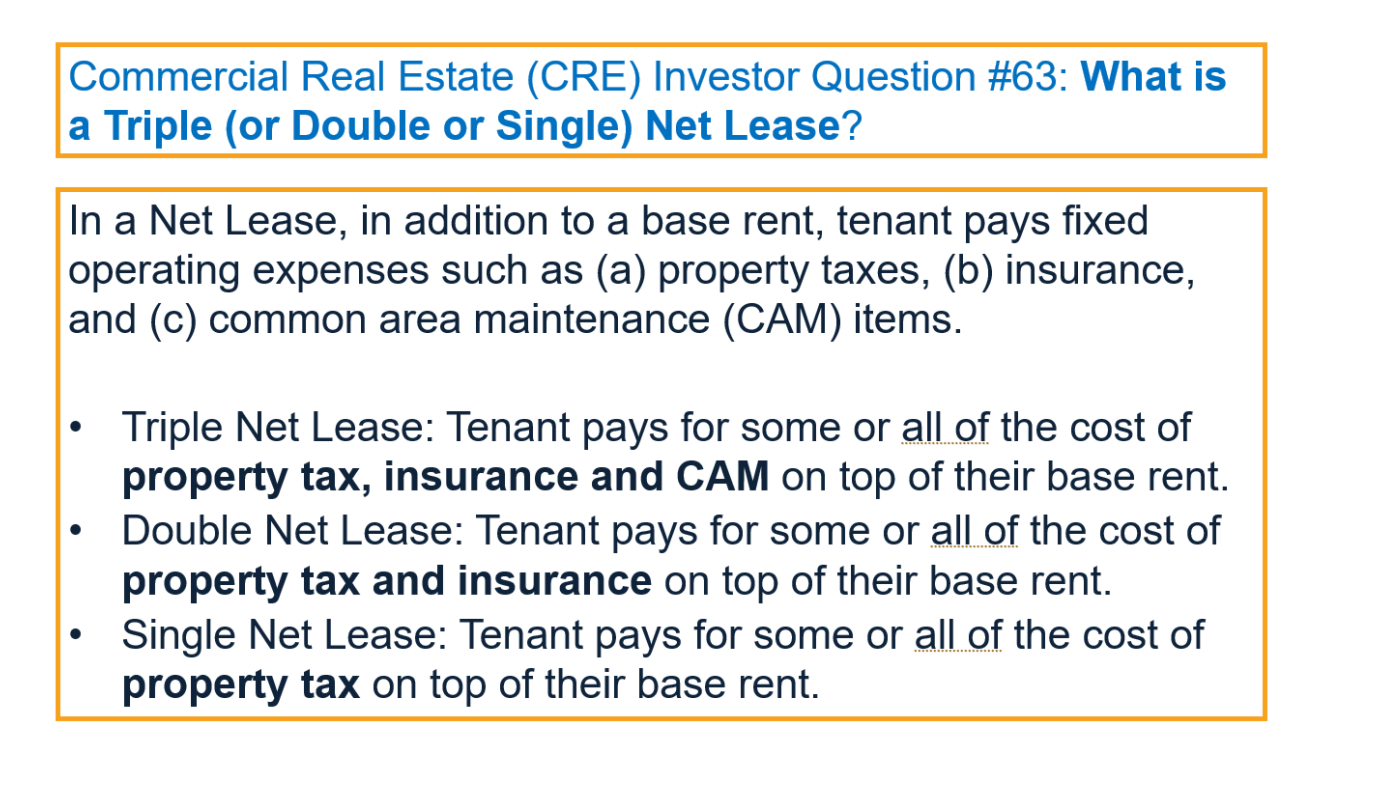

I've taken a position in Store Capital (STOR). I'd previously Tweeted about this position but figured I write a bit more about why I think this triple net lease REIT is an attractive opportunity for long term investors. STOR shares have been hit as:

-Co-founder/Chairman CEO Chris Volk departed in 4Q21 - in the additional resources section below I've included his last letter to shareholders which might give you a sense of why shareholders would have preferred he stick around.

-Individual property rent growth is insufficient to keep up with soaring inflation. Triple net leases have long terms with fixed annual rent increases (about 1.8%). This pales in comparison to the massive rent hikes seen in the apartment and industrial sectors. Similarly rising interest rates reduce the attractiveness of NNN real estate by lowering cash on cash returns.

-In addition, there is concern about US consumer spending /potential recession due to stimulus hangover/soaring inflation/interest rates. A slowdown in consumer spending could make it more difficult for some of STOR's tenants to meet rent obligations.

Unlike many of the REITs I've written about, STOR does NOT trade at a meaningful discount to NAV (trades at a slight premium actually). However, there are several aspects to the investment which I find appealing including:

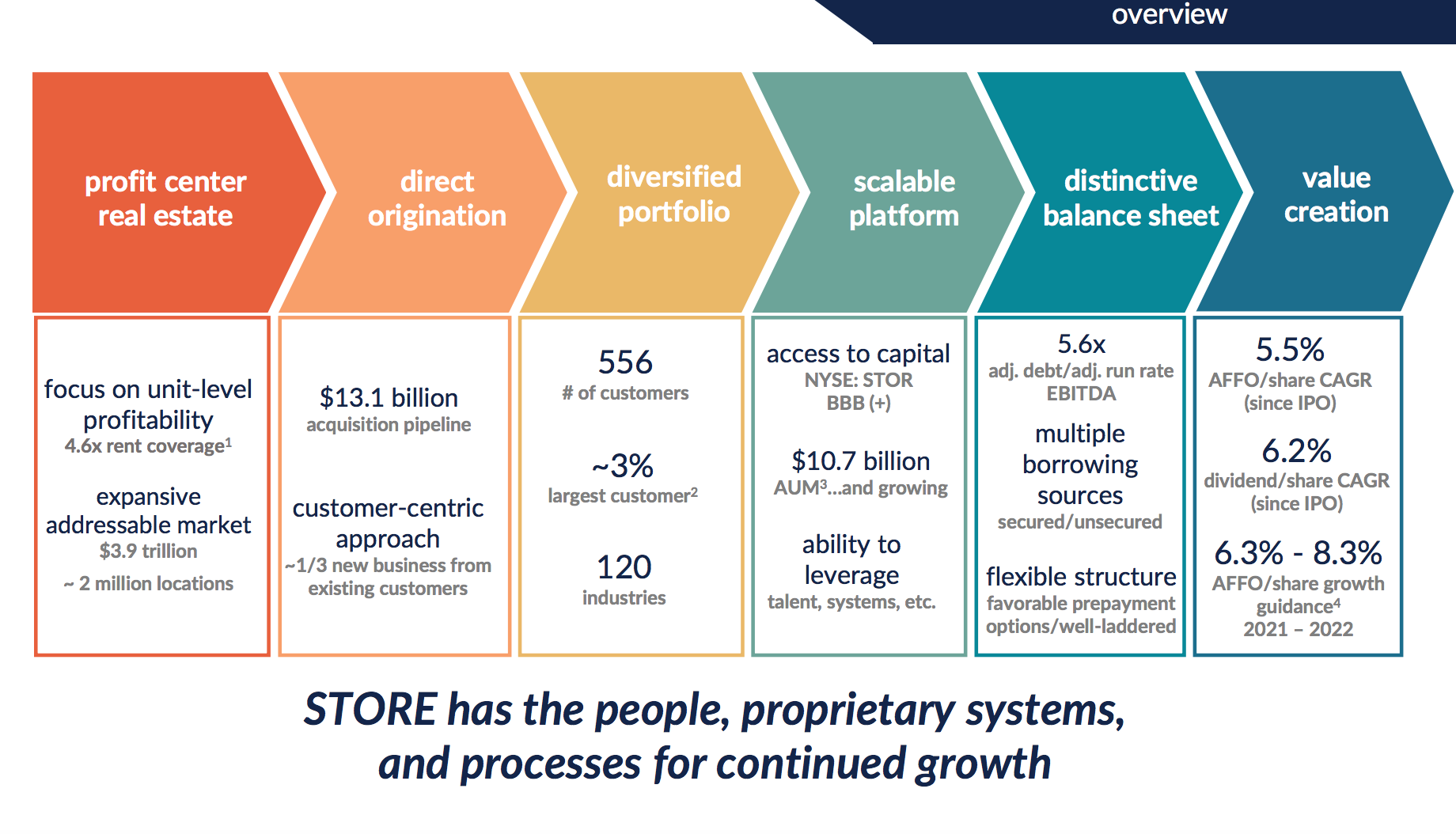

STOR's business model is essentially based on its ability to create investment grade contracts from non investment grade tenants by writing smarter contracts. STOR's tenants (customers) typically decide to engage in a sale lease back transaction with STOR in order to free up capital for growth (as opposed to borrowing from a bank). As such, STOR directly sources properties from tenants (as opposed to buying properties through brokers). STOR creates long term NNN contracts on profit center real estate under master lease agreements. What is profit center real estate? Most retailers/restaurants/service providers have a dispersion in the profitability of their locations - some locations are phenomenally profitable, some generate average profitability while other locations are barely profitable/unprofitable.

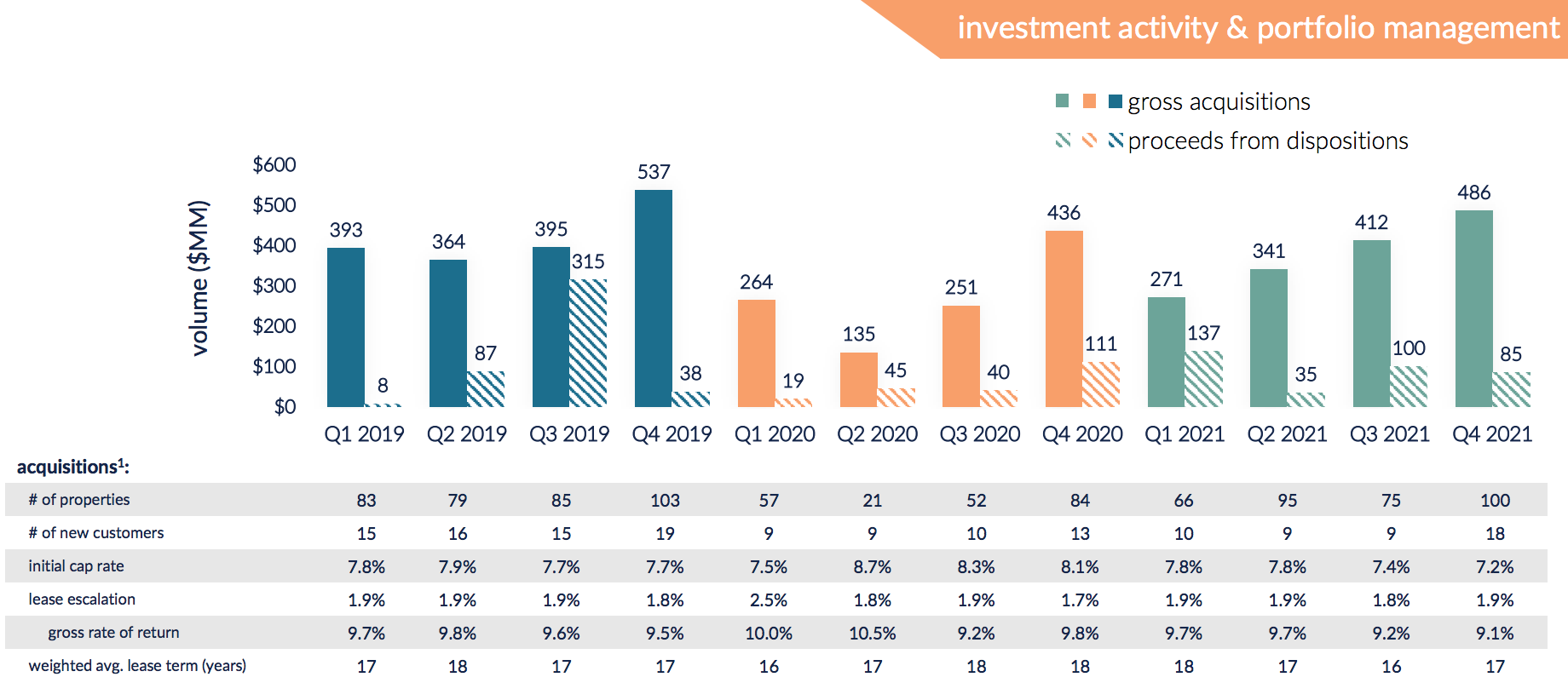

By sourcing directly from tenants, STOR is able to cherry pick properties underlying the most profitable locations with ample rent coverage (unit level EBITDAR vs. rent) at a basis less than replacement cost. Importantly STOR avoids marginal locations (those which are most likely to encounter problems and struggle to make lease payments). Also important is that STOR's tenants enter into master leases with STOR whereby defaulting on rent payment for a single store is a default on all locations owned by STOR. This can help protect STOR in a scenario where the tenant 1/has multiple properties leased from STOR of which some are significantly underperforming 2/the company is considering a restructuring (i.e. bankruptcy) which would otherwise allow its successor company to shed some of the less attractive locations. Effectively in order to retain the good locations, the company (or its successor) must continue to pay rent on less good locations.

Like NNN peers, STOR had some rent was deferred in 2020 during the depths of COVID but notably its tenants remained in business (ultimately paying the deferred rent in 2021), a testament to STOR's strong underwriting. This is well described in the 2020 CEO letter which I've linked to below.

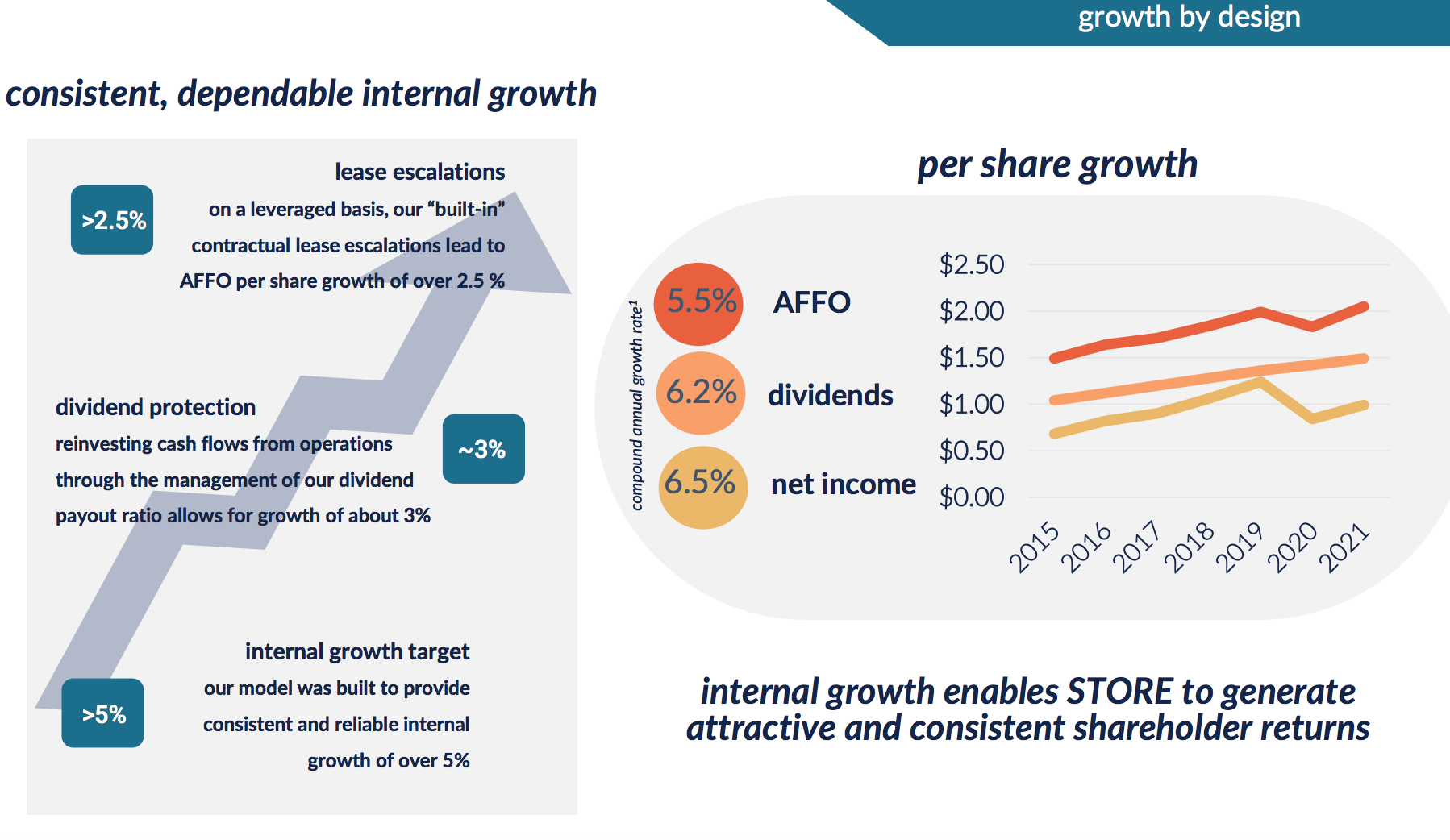

This differentiated strategy (most NNN REITs are focused mainly on investment grade tenants and ignore STOR's target market) gives STOR a long runway of opportunities for the next decade++. Cap rates for acquisitions offer a significant spread (150-175 bps) over 'investment grade' NNN properties. Further, the annual rent escalators (~1.8%) tend to be 50-100 bps greater than those embedded in investment grade contracts. This gives STOR the ability to accretively grow AFFO/share over time. While inflation is outstripping individual property rent growth, AFFO per share should increase in excess of 5% per year:

As shown above, STOR should be able to grow its annual AFFO per share 5%+ due to 1/ annual rent bumps (lease escalators) 2/ STOR's payout ratio is only 70% - it uses the remaining cash flow to purchase more real estate and generate more rent/NOI/AFFO. With shares yielding a little better than 5% and 5% expected growth (before accessing capital markets) it seems reasonably conservative to expect that STOR should return a little better than 10% per year (assuming a flat P/AFFO multiple).

Shareholders are likely to do better than 10% pa as

1/ STOR will most likely access capital markets to make accretive acquisitions (should add another 2-3% pa). As we sit today, STOR trades at a low 6 cap rate (for most of its public history it has traded between 5.2-6.5%). However, STOR is able to purchase properties at cap rates in excess of 7% (implying accretion from deals -see below). Historically the spread has been more attractive as cap rates have compressed while STOR's shares have traded poorly as of late. A spread of 150-200 bps is more in line with what we've seen from STOR historically.

2/ as mentioned below, STOR trade at a discount to NNN peers - a re-rating would boost shareholder returns.

Despite the numerous positive characteristics outlined above, STOR share are not expensive relative to triple net peers. While investment grade NNN focused peers like Realty Income (O) and Agree (ADC) trade at P/AFFO multiples of 17-18x, at a recent price of $29.50, STOR trades at just 13.4x. While STOR is temporarily out of favor, ultimately I think it will re-rate to levels in-line w/ O and ADC. Coupled with AFFO growth this suggests investors could earn in excess of 15% per year over a 5 year horizon.

Risks include:

-Triple net lease REITs NNN have may continue to trade poorly if inflation accelerates or interest rates rise

-A recession could cause some tenants to default on lease obligations.

Song:

Additional resources:

https://s25.q4cdn.com/107258882/files/doc_financials/2020/q4/STORE_2020-CEO-Letter-FINAL.pdf

Disclaimer: As always, this is NOT investment advice. Do your own work.

Eric Bokota owns shares of STOR

Private Eye Capital Newsletter

Join the newsletter to receive FREE actionable investment ideas.