Essex Property Trust- muted 1Q; 2H21 and 2022 likely to shine

Essex Property Trust (ESS - initial piece here & follow up) posted a slightly better than expected set of results. Shares declined slightly - the market appears to be disappointed that ESS did not increase full year NOI guidance like 'California heavy' apartment peers Equity Residential (EQR). I'm not too concerned about this given that ESS has a more suburban portfolio (85% of ESS is suburban) and has not suffered to the same extent as EQR who has a more urban portfolio which saw a sharper fall and may be poised for a steeper recovery as cities bounce back. Secondly, ESS management tends to be fairly conservative and given all of the uncertainty in the timing of California's recovery (83% of ESS NOI comes from the Golden State vs. 35-45% at AVB/EQR), it seems more prudent to wait and see before increasing guidance.

Year over year comparisons were difficult. Given that 1Q20 was peak operating results (COVID hadn't taken hold yet) whereas 1Q21 includes the flow through of rent concessions, lower rental rates, and of course the cost of uncollectible accounts. This lead to a year over year NOI decline of 12.3% (sequentially, things look much better for revenue/NOI).. Recall there is a lag between the economy and results reported by apartment owners as the flow through effect of concessions/lower rental rates takes a few quarters to work through reported results. This was evident last year as Essex 2Q20 showed positive YoY NOI growth as leases signed pre-pandemic bolstered results even though real-time conditions had worsened. We are now seeing this in reverse with leases signed in the recession working through reported numbers.

ESS maintains portfolio occupancy just south of 97%. With strong occupancy and demand set to come back (see below), Essex is in position to push rental rates. Similarly, concessions have come down significantly an are now around just 1 week. And of course comparisons get easier as we progress through 2021 (pandemic started to be felt in results in 2H20). I continue to expect strong results in 2H21 and beyond.

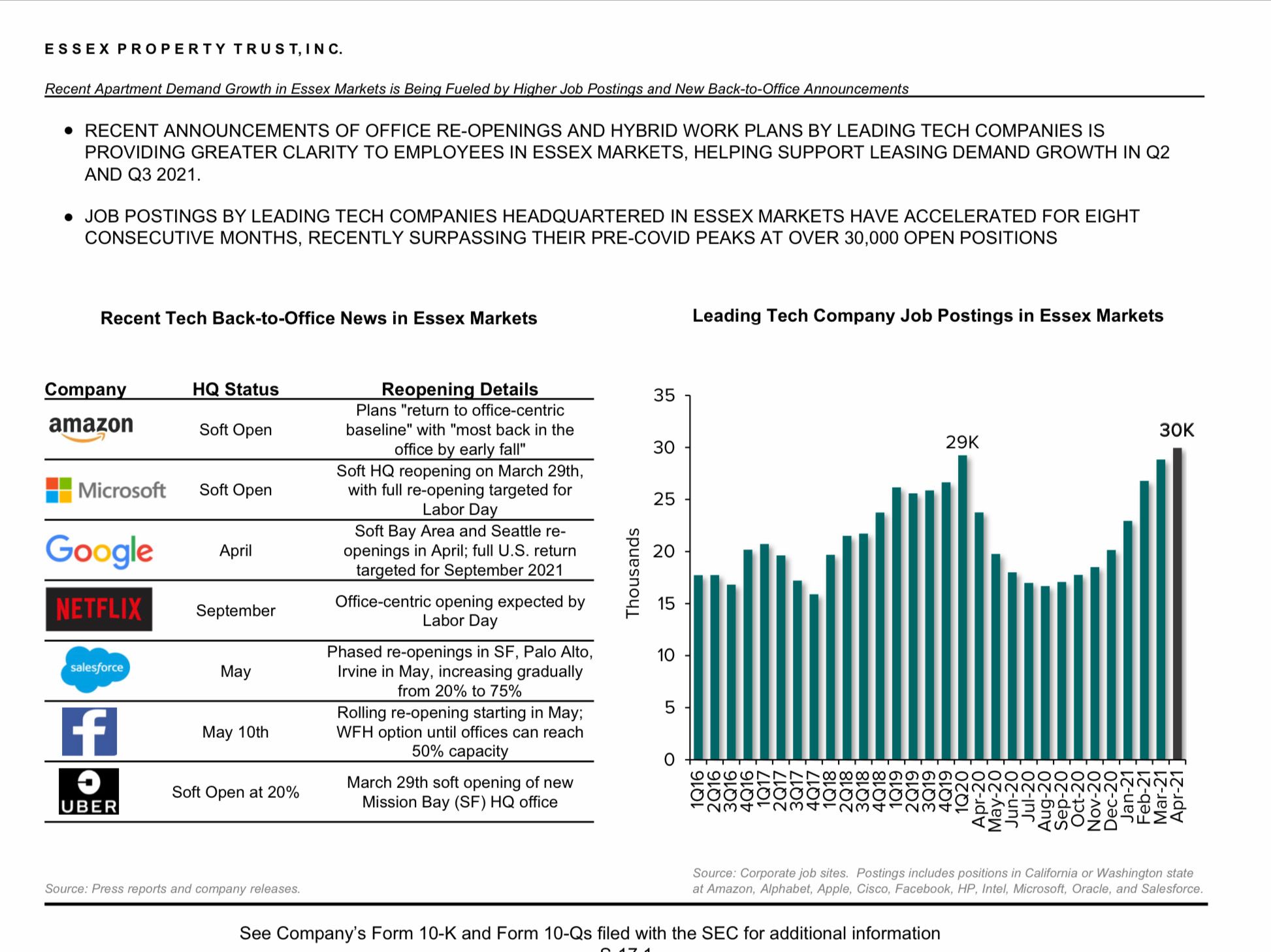

The outlook for apartment demand in the Bay Area is strong. Below is a picture of the big tech job openings in Essex markets which have returned to peak levels. Coupled with strong venture capital raises, the outlook for job growth (and apartment demand) is bright (particularly as workers are called back to the office):

Meanwhile management noted that shoot permits in the film/tv industry shot up +45% in March (month over month), setting up a strong economic recovery in LA during 2H21.

Last but not least, in the private market, apartment buildings in Essex markets continue to trade around pre-pandemic levels (high 3s on current NOI; low 3s on peak NOI for urban buildings hard hit by Covid driven exodus). Here is management commentary from last week's earnings call:

While ESS had been using property sale proceeds to repurchase shares (NOTE: this make a tremendous amount of sense when shares trade at a large discount to NAV as ESS shares did a few short months ago), with the gap to NAV closing, management now expects to opportunistically seek transactions. Though the private market for apartments is strong, given the dislocation which has occurred in CA, coupled w/ ESS management prowess for value creation, I'm hopeful that opportunities will emerge.

As CA continues to recover, I see NAV for ESS of $350 or so looking out a couple years. Given the fantastic track record of management, I believe shares will eventually trade at a premium to NAV.

Song:

As always, THIS IS NOT INVESTMENT ADVICE. Do your own work.

Eric Bokota owns shares of ESS.

Private Eye Capital Newsletter

Join the newsletter to receive FREE actionable investment ideas.