Essex (ESS): Following up

I received a few questions, via private message, regarding the our piece on the Essex Property Trust (ESS) and I wanted to follow up (without attribution to the person/organization asking the question of course - we understand the value of anonymity). The main concerns are the main concerns center around 1) poor share performance of REITs thus far in 2020 (2) concerns about the recent downgrade of ESS by Goldman Sachs. In addition there are some specific concerns which we address in what I will call (3) the Appendix:

1) Concerns about poor share price performance of the REIT space as a whole in 2020. Yes REITs have certainly underperformed - many of which (hotels, retail, office) have underperformed for very rational reasons.

COVID has decimated hotel cash flow - actually many hotel owners in the US are burning cash and piling up debt. There are questions about the ability of many hotel owners to service their debt. While travel will certainly resume, most hotel owners will have higher debt levels (many significantly so) and some hotel owners will have to turn over the keys to their lenders (or issue equity at low prices which reduces each shareholders % ownership in the assets). Thus value to hotel owners' equity has been permanently impaired in many cases.

On the retail side, COVID mandated shutdowns called into question the viability of many retail tenants - occupancy will likely decline here for years and asking rents have and will probably continue to decline. Current cash flows are dramatically reduced because of non-payment of rent. There is likely to be permanent diminution of capital in the retail REIT space as well and share prices reflect this.

Work from home has called into question the amount of office space that will be needed in the future. While the general consensus is that few of us will never report to the office, there are legitimate questions about what percentage of hours worked will be worked in the office. This, in turn, creates concerns regarding the amount of office space required and the associated implications for vacancy and rents.

However, in the apartment space, there are no major changes. People still need a place to live. California remains a very desirable place to live.

Certainly there are some short term (but significant) disruptions to the economy of Southern California as tourism has ground to a halt and production in the entertainment industry in Los Angeles has temporarily stopped. But does anyone believe for a second that TV/movies/streaming content will not resume production in record amounts ASAP (look at all the streaming services launched -they all need content and lots of it...and ASAP!!)? Will people permanently stop taking vacations to Los Angeles, San Diego, Laguna Beach or Santa Barbara? No.

While rents and NOI have declined slightly for apartment operators, this is a rounding error in the grand scheme of things. Essex is still generating tremendous amounts of cash flow. It is not piling up debt. It will not need to dilute its shareholders - actually it is repurchasing stock so shareholders have a greater % ownership in the company's apartment assets (exact opposite of situation for hotels).

Unlike hotels and retail REITs which 'suspended' their dividends to preserve cash, ESS increased its dividend in 2020 despite the pandemic (as did EQR and AVB).

In short the baby has been thrown out with the bathwater.

2) Goldman Sachs downgrade (this was done publicly -most of you are already aware): As some of you have seen, Goldman Sachs downgraded shares of ESS and reduced its target price. As best I can tell, the factors cited are all short term in nature - small potential temporary hits to earnings and cash flow. A few things with regard to the Goldman downgrade:

A) our modeling and fair value estimate already takes into account an 8-9% hit to NOI as a result of COVID/pandemic. Based on the results experienced YTD, this seems reasonably conservative.

B) While things could be slightly worse than I've estimated in the grand scheme of things $20-40 million is a rounding error (30 to 50 cents of value) when assessing the value of the Essex Property Trust. ESS has a market capitalization north of $14 billion and an enterprise value greater than $20 billion.

C) I have reached out to Mr. Skidmore (covering analyst at Goldman) a couple of times to better understand his thinking for the downgrade. He has not gotten back to me (yet).

I suspect he simply wanted to better align his target price with the current share price. Sell side (brokers) firms with no skin in the game do that regularly. It will be interesting to see how his target price changes in the future.

If you are an institutional investor, you might want to access Goldman's work on ESS/the apartment REIT space/California apartments and compare it to mine. Maybe even give Mr. Skidmore a ring. I'd be curious to get your thoughts.

3) The Appendix - this will just be Question/concern and a quick reply/response and maybe a link. Here we go:

a) Wildfires - yes this actually happens pretty much every year here. This year it started earlier and in some ways it is worse. The timing is particularly unfortunate as we Californians love to take refuge outside and the air quality obviously isn't great. This too shall pass.

There is an old adage to 'buy when there is blood in the streets'. In this case I'm buying 'when there's smoke & ash in the air'.

b) Concerns/Misinformation about rent declines - to be sure, rents for certain units and/or certain properties owned by ESS have declined. However, someone public who 'should' know better on Twitter replied and said rents are down 30% in SF Bay area. FALSE. For a few properties, notably a disadvantageously positioned lease-up such as one that happens to be located in Downtown SF (I define & discuss lease-up dynamics in the 'Development: How Avalon..' section of the Avalon Bay writeup) rents could possibly be 30% below what was expected at the time of underwriting.

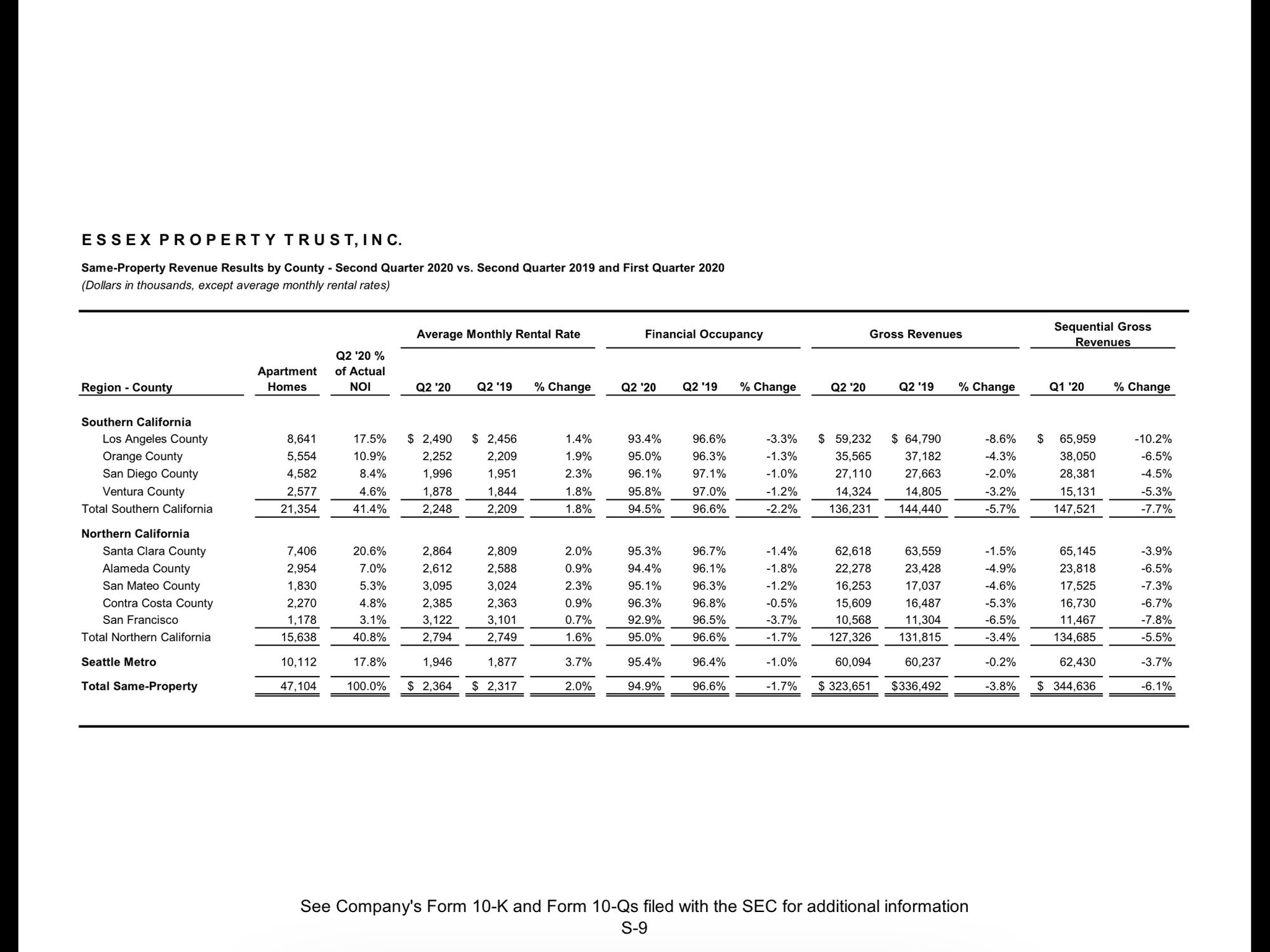

However, that might be one or two apartment buildings out of the 247 owned by ESS. Overall, for Essex's apartment portfolio, rents were actually UP during 2Q (on a year over year basis). From ESS 2Q results:

c) Incentives. Same person on Twitter. Free Rent incentives are an ongoing fact of life in the apartment rental space on a situational basis. For a large operator like ESS, with 247 properties, some buildings somewhere will always be offering incentives.

Heavy incentives (6 weeks to 2 months free) are typically used in lease-ups but sometimes for buildings next to lease ups (a competitive response). Fortunately because supply can't come into the market very often due to onerous building restrictions described in the writeup, these types of incentives are rare.

Beyond that, incentives are a little higher in most places and much higher in a few. It will be ok.

d) Somehow I neglected to include that most of ESS properties are suburban and not high-rise buildings in urban areas. For Essex, 85-90% are suburban - even more favorable that AVB - why is this? Because urban areas represent a tiny portion of LA/SF - i.e. the lack of tall buildings which is a cornerstone of the investment case here.

Song:

Eric Bokota bought more ESS. $350 fair value estimate.

As always, NEVER take my word for anything - do your own work!

Private Eye Capital Newsletter

Join the newsletter to receive FREE actionable investment ideas.