Essex FY results & Private (REAL) market update

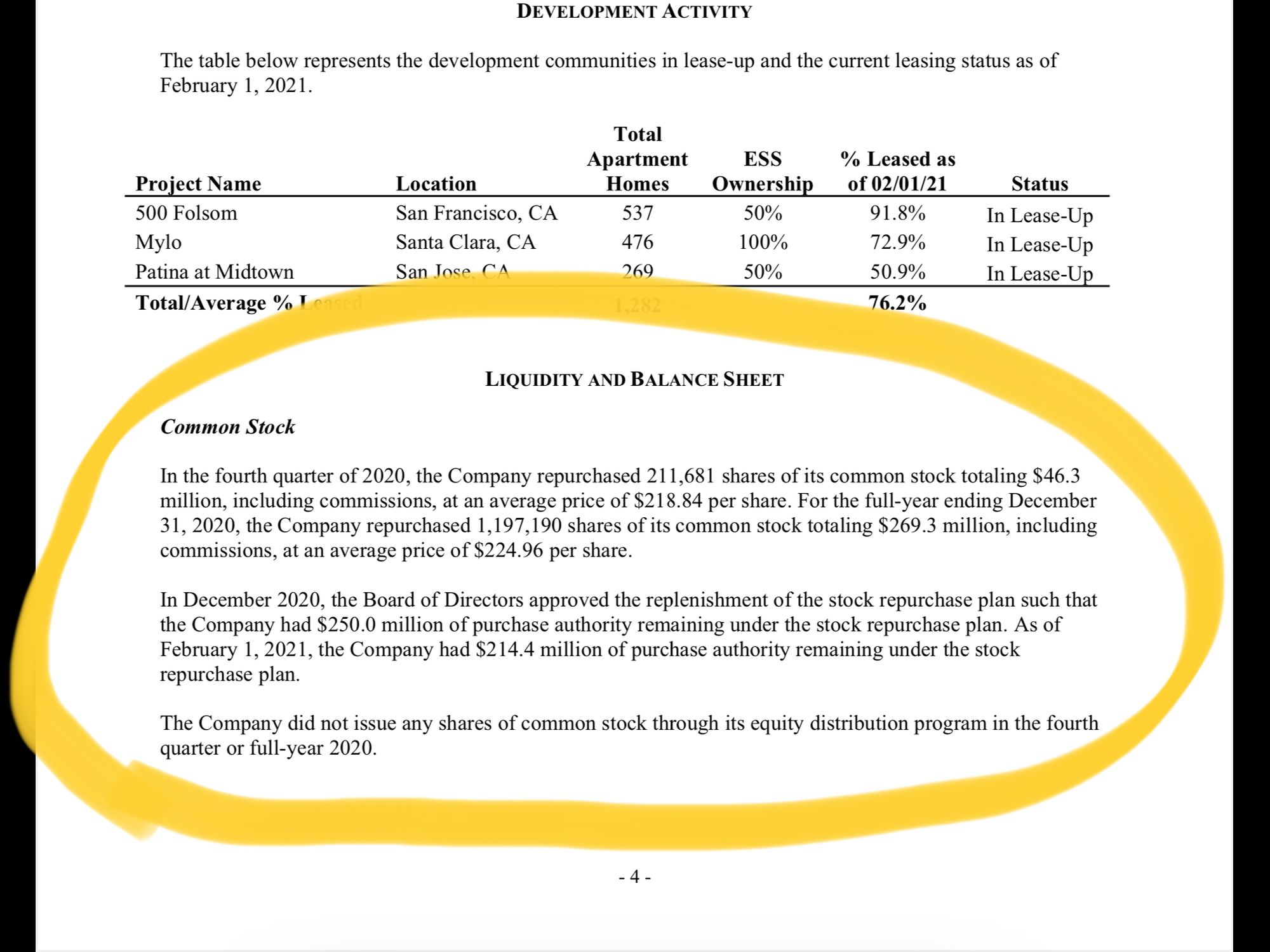

The results themselves are very much what I would expect based on what we saw in 2H20 and management's past commentary on trends. Importantly, ESS management provided 2021 earnings guidance (was previously suspended due to COVID related uncertainty), resumed the share buyback (had been paused due to uncertainty), and the board authorized a new $250 million buyback - these actions indicate greater management confidence relative to last quarter.

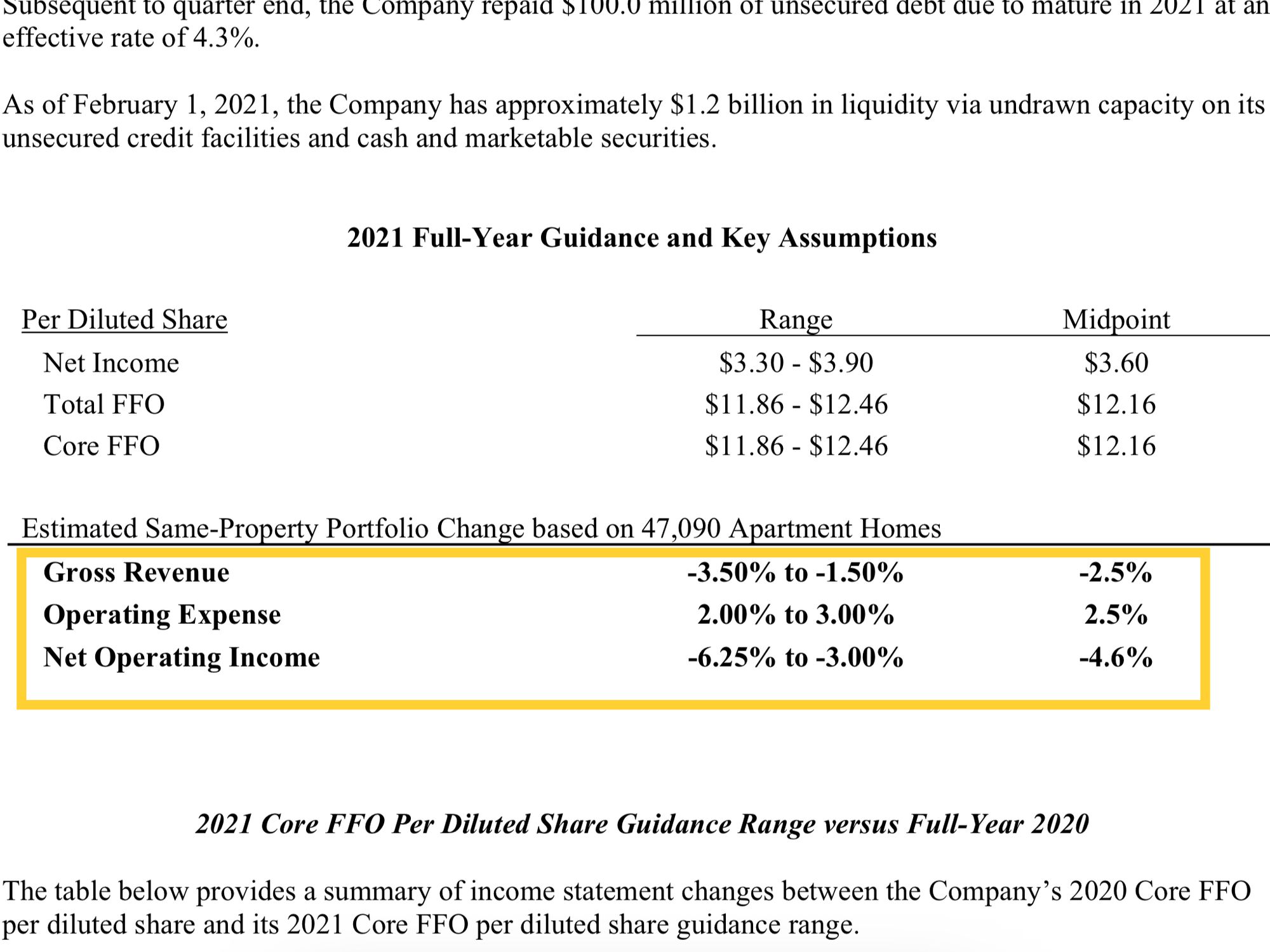

While management worked diligently to maintain occupancy (96.5%), 4Q NOI suffered as from: 1) lower rents/higher concessions and (2) elevated delinquency (collections of 97.3% during the quarter) as a result of the eviction moratorium. These issues are expected to continue to hamper results through 1H21 - comps become easier and headwinds ease considerably as we move into 2H21.

As most of you are no doubt aware, CA has suffered greatly from COVID with most tech workers told they wouldn't need to return to the office until 2H21 (negatively impacting SF Bay Area and Seattle and to some extent LA) , most of Hollywood preproduction/production/postproduction shut down (hurts LA), and tourism dead (LA). This will cause NOI to see a year over year decline in 1H21. As vaccination occurs, many workers return to offices, Hollywood production will be full speed ahead, and Americans will resume tourism. LA and SF will bounce back strong and management expects to see NOI growth in 2H. This all makes perfect sense to me.

The private market (real market as described below) for apartment assets in CA remains fairly strong despite the temporary hit to NOI that many assets are experiencing as a result of COVID related disruption. Unlike Essex shares (which remain down ~20% or so from pre-pandemic levels), private market valuations for assets in SF, LA, Seattle remain strong. On Friday's (2/5) call, management noted that private market values for suburban assets (the vast majority of ESS portfolio) are at or above pre-COVID levels. Similarly prices for hard hit urban assets have barely budged - management believes that these are down only 5% or so.

On the call ESS management described a hard hit urban SF property Essex is in the process of selling. The asset is being sold for a 3.8% cap rate on pre-COVID NOI (NOI has been hard hit- sale price equates to 3.2% cap rate on in-place NOI reflecting rent declines ). ESS is in the midst of selling two other assets (all 3 assets are being sold within +/- 2% of pre-COVID valuation). Similarly, AvalonBay (AVB) reported selling two SF Bay area assets during 4Q at 3.7-3.9% cap rates.

Some of the proceeds ESS receives from asset sales likely be used to repurchase stock - management noted that selling assets at fair value and buying back stock at a huge discount to NAV is the recipe for value creation in the current environment (ESS resumed their buyback during 4Q and got BOD approval for another $250 million).

Other long term things that matter:

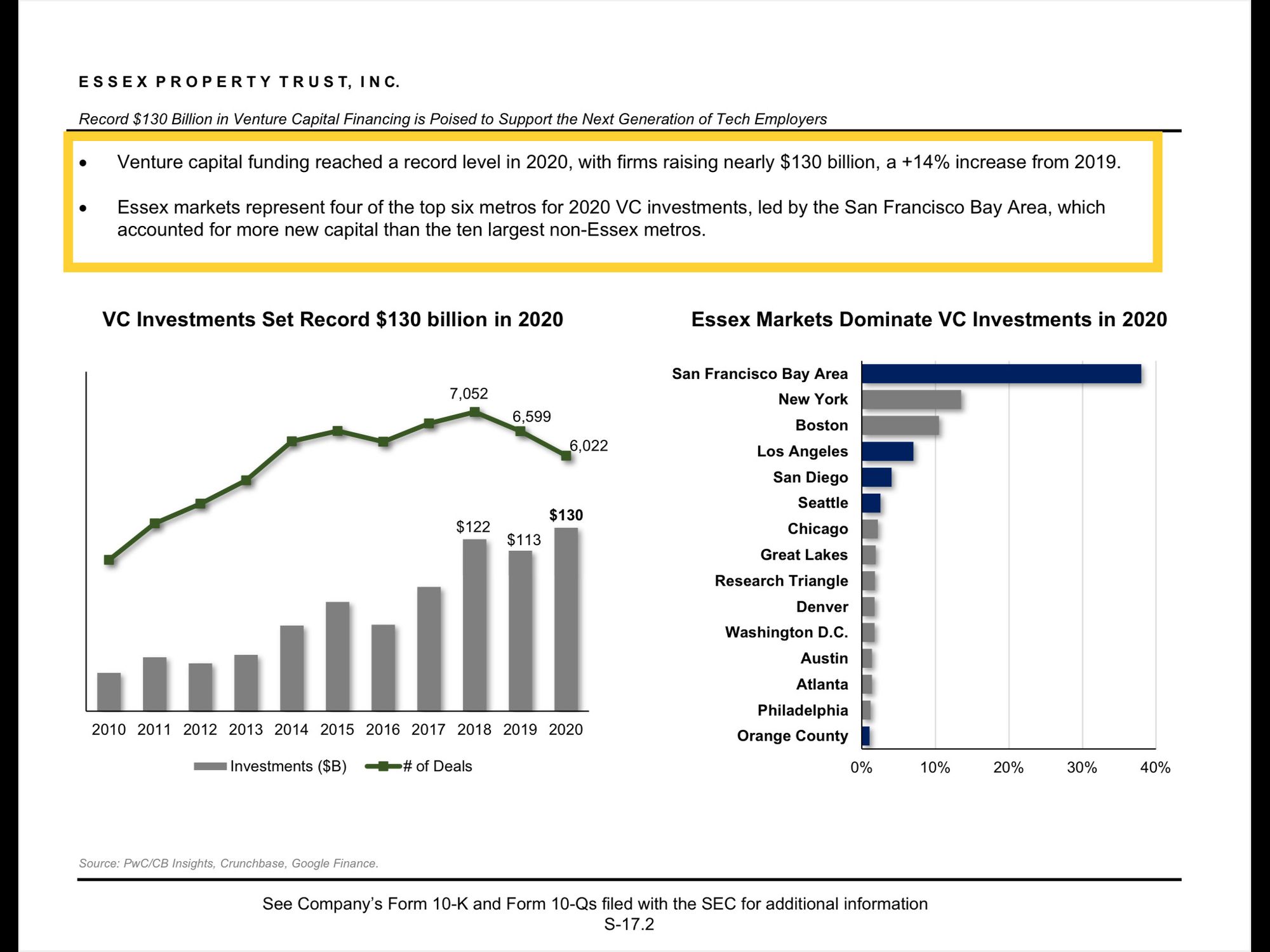

Venture capital continues to flow to SF Bay and LA. VC funding leads to jobs. Jobs lead to a need for housing. There will be plenty of job growth in ESS markets in 2021 and beyond:

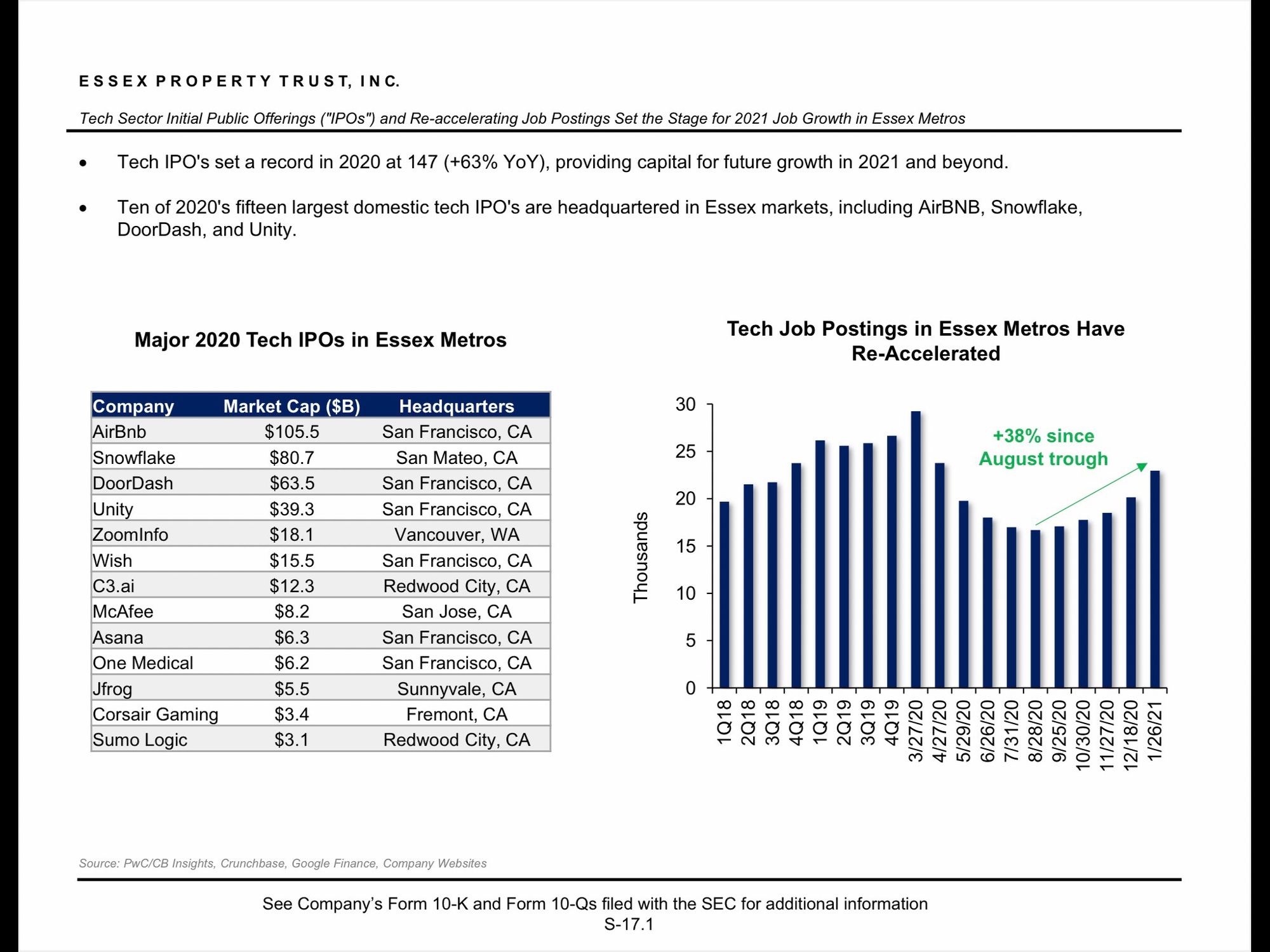

Successful companies sometimes then go on to IPO. Better funding -> more jobs in Essex markets. More need for housing. Little new supply. Rent and NOI grow:

Things that might 'matter' on a daily trading basis (not what I do here people) and that DO NOT MATTER AT ALL LONG TERM: SELL-SIDE OPINION (guesses?) and their quarterly FFO estimates (I can't think of a greater waste of time).

As I mention often, apartments are 95% privately owned (only 5% owned by REITs) and that the correct way to approximate the value an apartment REIT is to use private market transactions to ascertain the value of the assets owned by an apartment REIT. For whatever reason, rather than gathering and presenting this information, the sellside wizards at big brokerage firms see value in using historical trading patterns to guess where the REITs will trade in 6-12 months. As such, like the rest of the apartment REIT space, Essex is badly covered by sell side analysts and neglected by real estate ETFs like VNQ. This creates opportunities for astute investors with a long term time horizon.

Why not just go to Vegas or play the Wall St Bets casino? Other than Green Street (which actually uses private market data and does excellent work), in my less than humble opinion, it is BEST TO IGNORE the esteemed wizards at Goldman Sachs, Bank American, Morgan, Citi, Baird, Piper Sandler, Deutsche Bank, etc. Look at how their price targets (+/-40% in many cases - this is literally insane for these type of assets) swung around over the past 6 months despite readily available private market data showing price stability for the assets. Sell-side 'analysis' is entertainment only and I will give credit where credit is due: it is certainly entertaining. End of tirade.

My 2023 NAV estimate for ESS remains $350 per share (initiation piece here, more on ESS here). Given management's phenomenal track record I think shares should trade at a premium to this figure.

Song:

As always this is NOT INVESTMENT ADVICE. Do your own work.

Eric Bokota owns shares of ESS.

Private Eye Capital Newsletter

Join the newsletter to receive FREE actionable investment ideas.