What's does one do after losing a lot of weight? Buy ALL new clothes!!

GLP-1 weigtht loss drugs like Ozempic have been a top story in financial news over the past few weeks wreaking havoc on shares of food and medical device companies. Stock market participants believe major changes are afoot in American consumption patterns and are voting with their wallets. While the verdict is still out on the ultimate impact of GLP-1 drugs, I see an overlooked opportunity for outsize share price gains in a couple of heavily-shorted apparel retailers Nordstrom's (JWN) and Kohl's (KSS). My thesis here is quite simple:

When people lose weight, their clothes no longer fit. Time to go shopping!

Studies have shown that, on average, using GLP-1 for weight loss produces a 12-15% loss in body mass. After experiencing dramatic weight loss, people's clothes simply won't fit anymore. Time to go shopping!

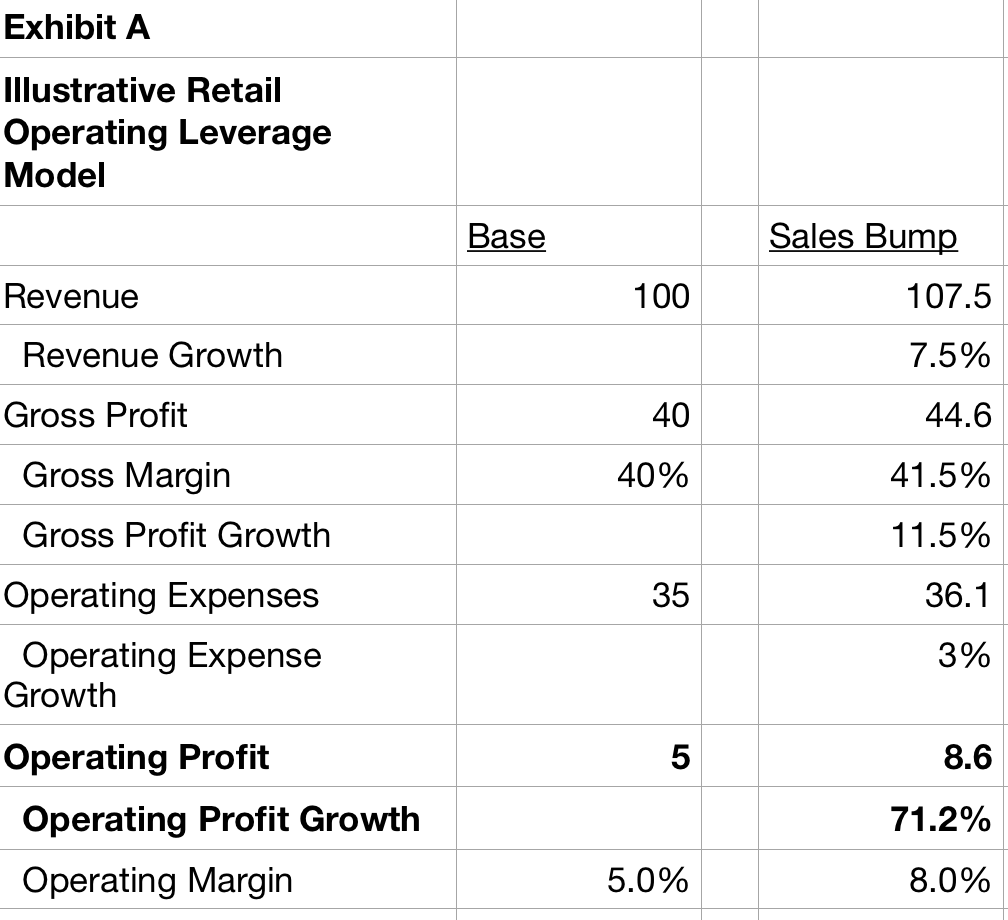

I see the potential for a boom in revenue at apparel retailers as slimmed down Americans are forced to replace their entire wardrobe. There is significant operating leverage in retail-> an increase in revenue can have a dramatic increase in operating profit and EPS. As shown below, with a largely fixed cost base (rent, labor, product sourcing, corporate), I believe that a 7-8% increase in revenue can drive a ~70% increase in EPS.

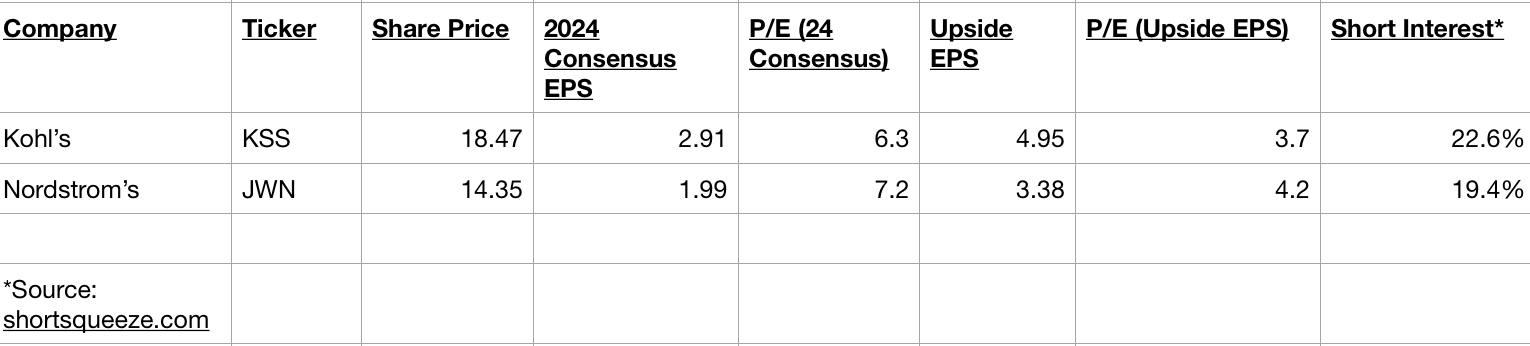

With shares trading at/near multiyear lows, I see the possibility of outsized gains in two heavily discounted apparel retailers - Kohl's $KSS and Nordstrom's $JWN.

As you can see, shares of Kohl's and Nordstrom trade at low multiples of current 2024 consensus EPS estimates (no weight loss shopping boom benefit). As shown in the operating leverage illustration above (Exhibit A), assuming a 7-8% increase in revenue with a modest gross margin benefit (less discounting due to higher demand) could produce a ~70% increase in operating profit (potentially larger impact to EPS given largely fixed debt service costs).

While my upside EPS estimate is significantly higher than current consensus, both JWN and KSS have achieved this level (higher actually) of EPS multiple times over the past decade (and of course their share prices were much higher then). JWN is my preferred way to play this as it has a higher income clientele (generally GLP-1 used for weight loss does not qualify for insurance coverage and costs $10k/year out of pocket).

Should these stocks simply maintain their current 6-7x P/E multiples on higher earnings levels, there is the potential for significant (70%) stock price appreciation. Further, positive earnings momentum frequently leads to higher P/E multiples. Should multiples re-rate to 10-12x P/E multiples (both JWN and KSS have historically traded in this range multiple times over the past decade), the stocks could double or triple.

It is also worth nothing that both JWN and KSS are HEAVILY SHORTED stocks with short interest (per shortsqueeze.com of 19-22%). Should short sellers awaken to the possibility of a GLP-1 driven surge in EPS, we could see shares of JWN/KSS appreciate rapidly.

Disclaimer:

-Nothing on this article is investment advice.

-Author has a LONG position in KSS and JWN.

-This investment idea is speculative in nature. It is too early to say whether GLP-1 will actually achieve mass adoption for weight loss. KSS and JWN are low quality businesses and carry substantial debt burdens.

Song:

Private Eye Capital Newsletter

Join the newsletter to receive FREE actionable investment ideas.