Why would any long term investor not own Essex Property Trust (ESS)?

Note: A very very rough draft was sent to our FREE Actionable Investment Idea Newsletter subscribers on Friday. If you like being in the know and want FREE weekend reading, be sure to sign up NOW (note that you must confirm your email address within 8 minutes of signing up, otherwise you have to do it again.). It's FREE!!

Simplistically, the investment case for Essex Property Trust (ESS) is as follows:

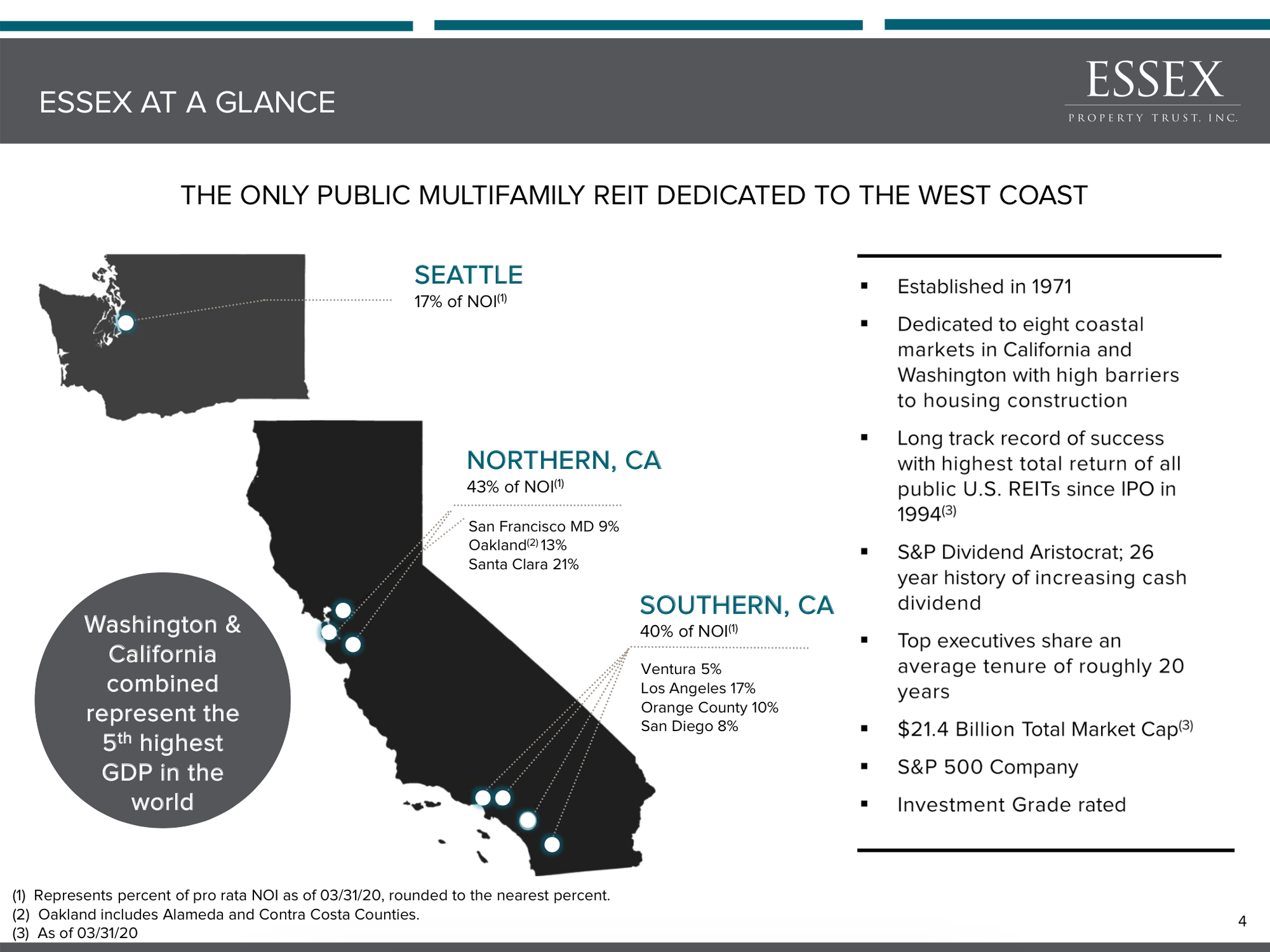

1) Pure play apartment REIT focused solely on the West Coast. Essex benefits greatly from the continued and unending growth of the tech sector in Silicon Valley/Seattle and the ongoing growth of the entertainment industry in LA.

2) Supply is constrained in a way few people appreciate. There are important reasons supply will never come to market in a meaningful way in SF Bay area/Silicon Valley and LA.

3) Best in class management team lead by Mike Schall -beyond best in class actually - Schall is one of the best executives in any industry.

4) Fortress balance sheet with LTV below 25% and debt to cap of around 32%. ESS is extremely well positioned to benefit from any COVID related disruption and opportunities which may present themselves.

5) While much noise is made about the eviction moratoriums, during July 2020, cash delinquencies were just 2.7% (so rent collection above 97%). This is an IMPROVEMENT over the second quarter as economically hard-hit tenants have moved out and occupancy sats at 96.2% at 7/31/20. This is despite a statewide eviction moratorium since covid began. ESS tenants are knowledge workers (tech) who can and are working from home. And paying their rent.

6) While much has been written about weakness in the urban core, 85+% of ESS's apartments are suburban!

7) Clarity on property taxes (largest expense line for apartment REITs) due to California Prop 13 which limits property tax increases to 2% per year.

8) In addition to being a fantastic set of assets with a conservative balance sheet in the steadiest and best pair of hands, ESS is way too cheap at just $215 per share. I think it is worth at least $350 per share. No activist or PE group needed or wanted. Let Schall & Co do their thing and...relax and collect a 3.8% divvy (and growing; dividend increased even during 2020 despite the pandemic).

California Love. Pure and Simple. And 83% of NOI comes from California - roughly split between Northern (SF bay area) and Southern (LA/OC/San Diego) with the remainder coming from the Seattle area. As long time readers know (ok readers for 3 weeks or however long I've been doing this), I am an unabashed California enthusiast.

While ESS has over 240 apartment buildings, it is not geographically diverse. Essex owns & operates only in Northern California, Southern California, and Seattle. Fortunately SF/LA/Seattle are the best apartment markets on the planet as every meaningful US tech company (and global really, other than Alibaba/Tencent) is located in ....wait for it...California & Seattle!!

DEMAND

While California has a few challenges, it is home to the 3 of the 10 largest (Facebook, Google, Apple) companies in the world by market cap as well as Tesla, Netflix, Salesforce, Nvidia (to name a few). Seattle has two of them (Microsoft and Amazon). There is long term structural income growth in these markets which supports housing prices.

To me this is blatantly obvious. Headlines suggest that CA will fall apart. Headlines have suggested that before. It hasn't. It won't. Why would you not bet on SF/LA/Seattle over the long term?

I have no long term doubts about the California economy despite its headline grabbing problems. Be sure to read my CA apartment/ apartment REIT demand thesis and see how many hundred $billion companies are located here (if you already read it, it may be worth another look as it has been cleaned up/updated/improved). Seriously read it. This isn't clickbait.

SUPPLY - or lack thereof

The supply side of the CA apartment REIT thesis is as, if not more, compelling than the demand side. Silicon Valley/SF bay area and greater LA metro residential real estate supply is so restricted (building codes, by environmental/earthquake codes, by prohibitive construction costs) that new supply really cannot enter in any meaningful way. I'll probably write a book on this (clearly I'm a nerd who loves to type) at some point but here are a couple of thoughts:

Essex's stock ticker is ESS but maybe a better one would be CBU. C.B.U. Can't. Build. Up. LA is incredibly flat. Trust me. I'm a hiker - see the pic below. Note the absence of tall buildings in LA. You can see Century City and beyond that Downtown LA (DTLA - one of the few places you can build) but other than that...flat!

Everything, particularly residential property, is pretty much restricted to 35-40 feet in height (3-4 story apartment buildings). This is the result of incredibly restrictive zoning laws put into place in the 1950s-60s which sought to preserve the vista (views) and protect and grow property values (homeowners, voters, prop 13 - not going to digress now but I'll come back here in a later post).

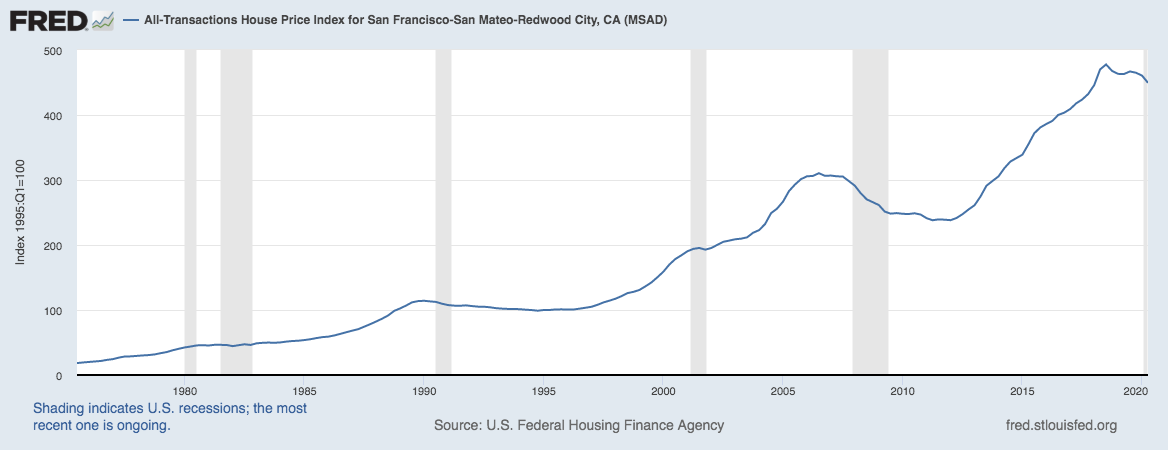

SF Bay Area/Silicon Valley is very similar in its land use restrictions. Here's a picture (not from one of my hikes) which shows the flatness/CBU (Can't Build Up) situation which constrains supply:

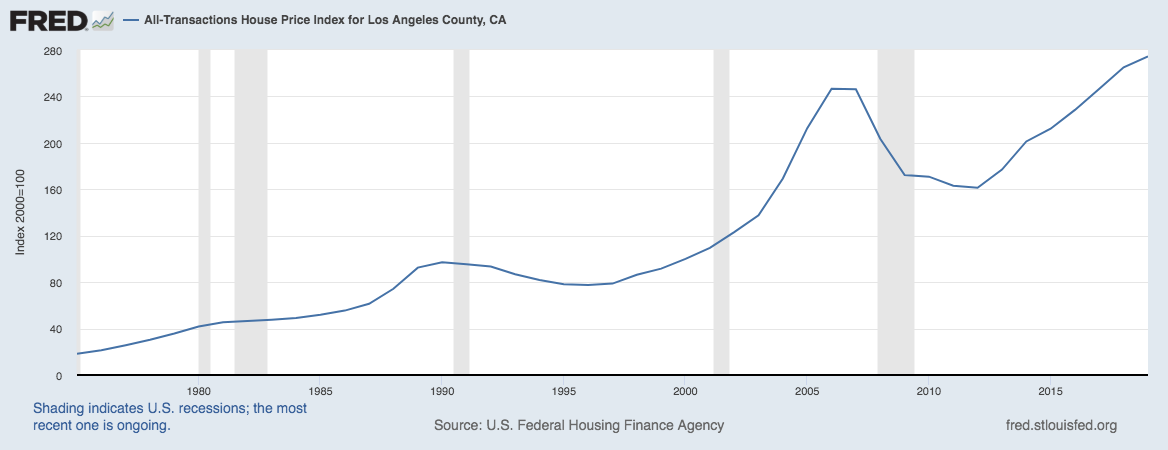

Local government policy, both restriction via of supply via strict zoning (municipal) and Prop 13 (state - which limits property tax hikes to 2% per year), have been incredibly successful in growing single family home property values in LA and SFs over the past 45 years, as shown below:

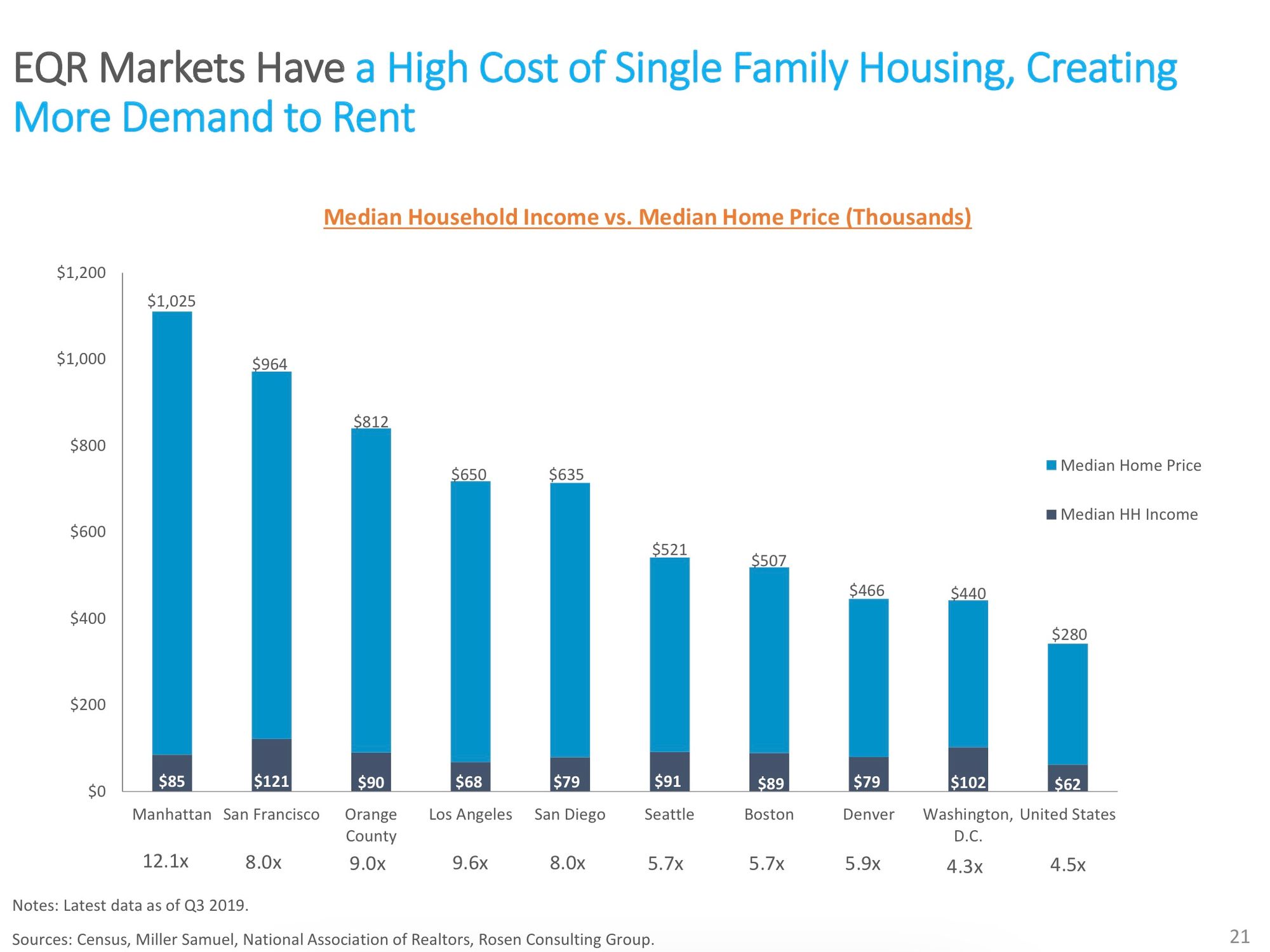

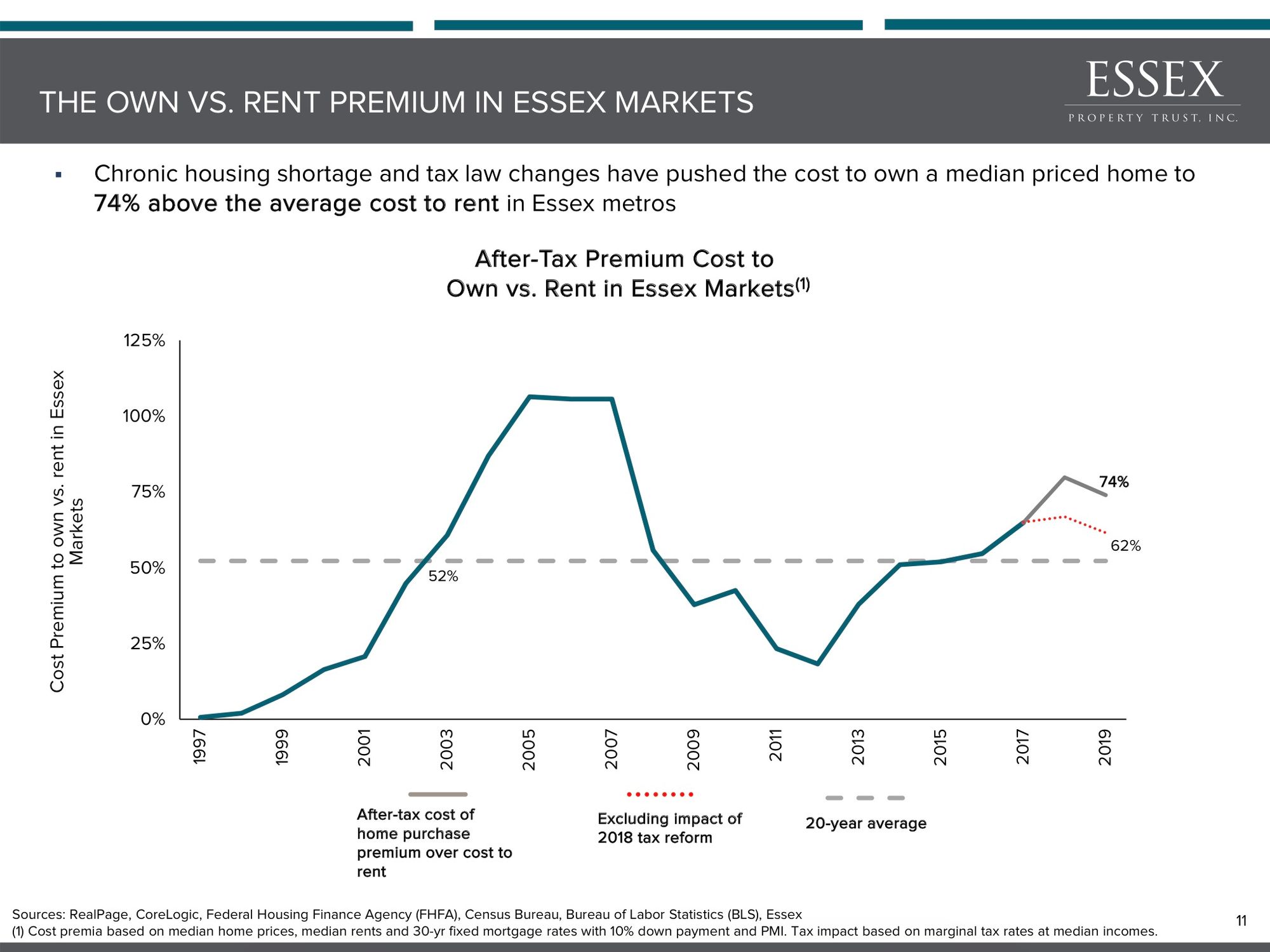

This compares very favorably to the remainder of the country (more than double the rate of annual appreciation). As single family property values have grown, apartment rents have increased steadily as millions of residents are renters by necessity given the high cost of housing in SF & Los Angeles. This is best seen in a slide from a recent Equity Residential presentation:

As you can see above, after Manhattan, the 5 markets which have the most 'insulation' from competition (home purchases by renters) - 4 are in CA (83% of ESS NOI comes from these markets) and the 5th is Seattle (accounts for 17% of NOI for ESS or all of its non CA exposure). Said/shown differently, many renters would have to cough up a lot more $ per month to become homeowners:

Strong Demand + Very Limited Supply = Fantastic Shareholder Returns

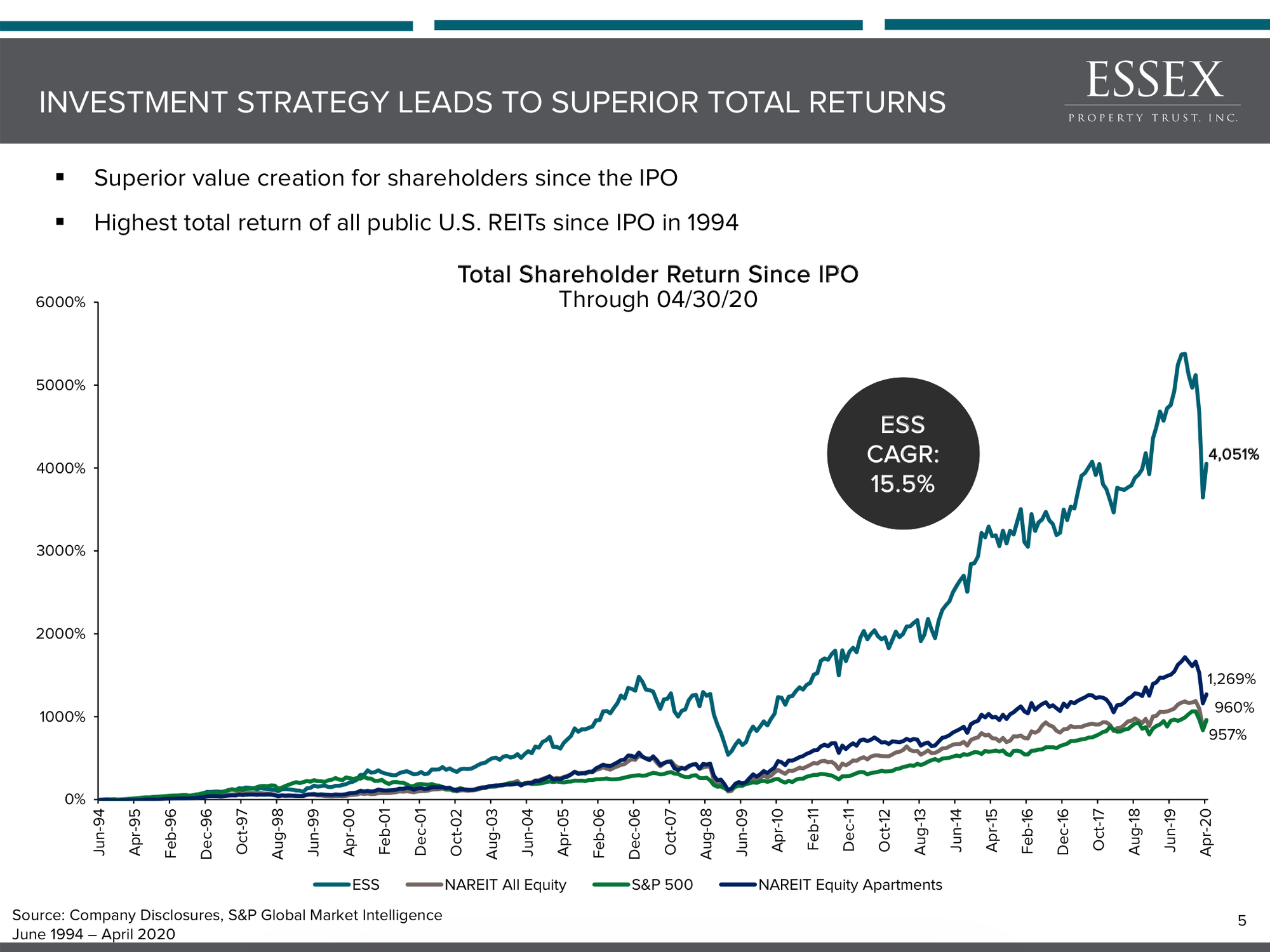

So we have structurally limited supply married to beautiful long term growing demand as far as the eye can see. This has been borne out in the numbers and there are no better numbers to look at and see this than those of the Essex Property Trust (ESS) - at a high level:

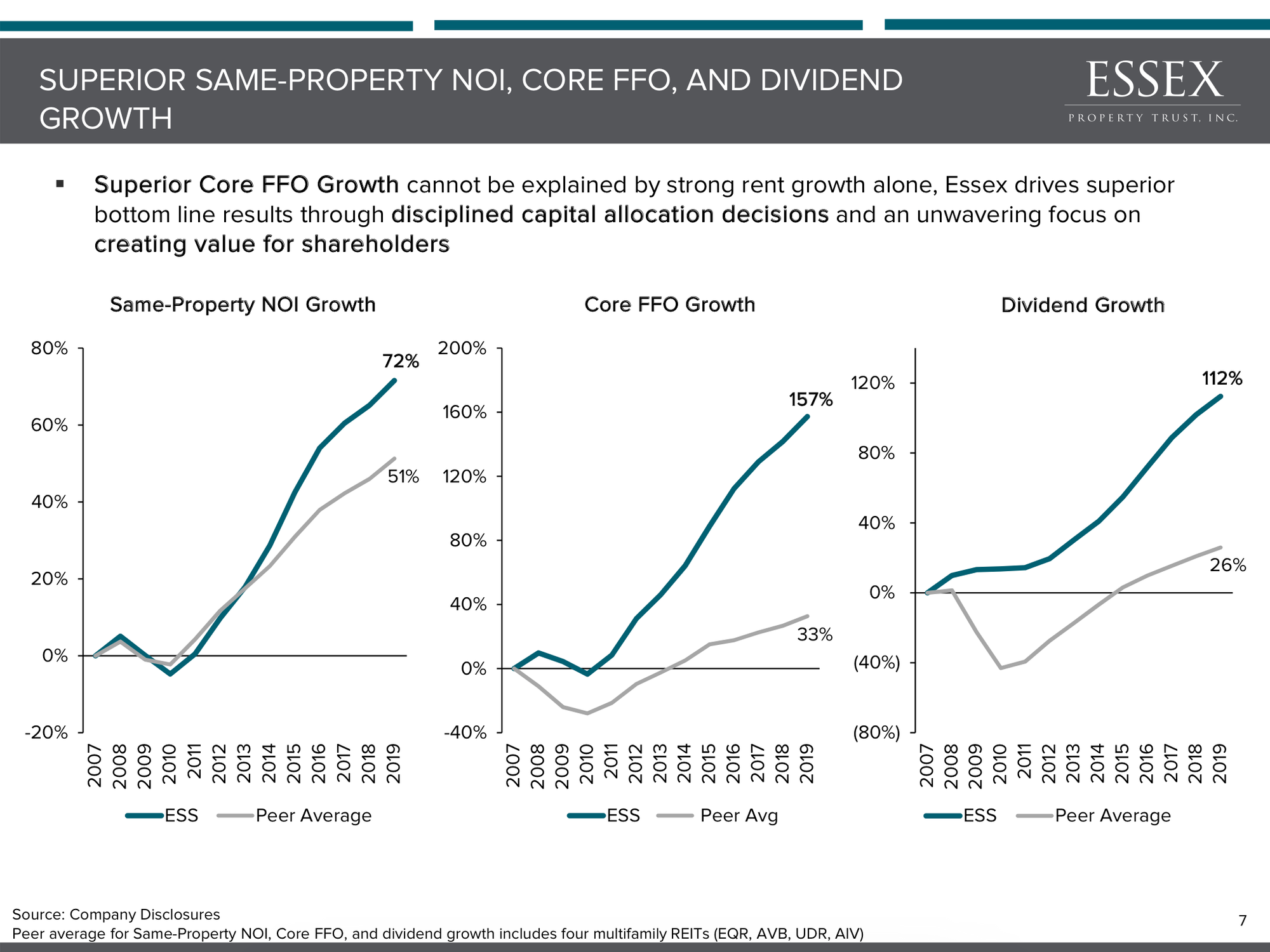

With long term rents increasing at a rate greater than 3% (due to the supply & demand factors outlined above) and expenses structurally limited (biggest expense is CA property taxes which are capped at 2% annual hikes), there is positive operating leverage. Over the past 12 years, same property NOI has grown at 4.6% per annum.

Safe Balance Sheet with Plenty of Firepower

Like AVB and EQR, Essex has a very clean balance sheet which will allow it to opportunistically create value for shareholders. Debt is long term and fixed rate. Available liquidity exceeds $1.5 billion and the company generates tremendous free cash flow even during the covid pandemic.

Less than 10% of of NOI is encumbered at the property level giving ESS tremendous financial flexibility. The debt market has no concerns about the health of ESS as evidenced by the August issuance of $600 million in long term debt at 2.3%.

I'll elucidate later but LTV is well below half of what you'd see responsible people do in the private market and ESS has tremendous financial flexibility and firepower. Also see what I wrote about AVB, this applies to ESS as well - but ESS will do even better because, well, there is only one Mike Schall. And like AVB, ESS has approval to buy back stock at a big discount to my estimate of fair value. Through July 31, 2020, ESS had repurchased $223 million in stock (@ ~$226/share) and has over $200 million remaining on its buyback authorization.

Management

Which brings me to...Mike Schall & the team at Essex. If the book Outsiders (great read) is ever updated, I'd be outraged (to the extent I become outraged - I learned to meditate here in California) were Schall not included. If you find the multi-housing fascinating, and in particular the California multi-housing industry fascinating, I'd recommend going back and reading all the ESS quarterly earnings transcripts for the last 12 years or so (free masterclass alert).

That's a 12 year same-property NOI CAGR of 4.6% for ESS vs. peers averaging in the mid 3s. Note that starting point incredibly ugly as 2007 is right before housing tanks - today's housing market is MUCH stronger as there has been a decade plus of under-building in sharp contrast rather than the mass overbuilding which lead up to the great financial crisis of 2008-09.

Now obviously using 2019 as an endpoint is more favorable than using, say 2021 as I guesstimate the pandemic/ recession takes 8% off NOI (so that would be ~3.3% NOI CAGR over 14 years). Of course that is pretty unfavorable as it includes a big housing market implosion at the beginning and a global pandemic at the end. I think it's fair to assume a 5% NOI bounce in 2022, another 5% in 2023 and then we have a 16 year SS NOI CAGR of something like 3.5%.

However, the SS NOI CAGR doesn't take into account management creating value through capital allocation. Beyond optimizing the financial performance of the properties operationally, here are some of the things Schall & Co do to make money for $hareholder$:

Essex management buys back stock when it is below NAV and more attractive than the opportunity set - assets cannot be had anywhere near the price at which ESS shares sell. They were buying it last quarter and the quarter before ($223 million purchased in the seven months to 7/31/20, $200 million remains on current buyback authorization). ESS has divested some assets (at 4.3-4.4% cap rates in my estimate - during the pandemic) and raised $600 million in new debt (1.76% 10y fixed, 2.67% 30 year fixed) and could very well be buying back more stock now. Selling assets at a 4.3% cap rate to buy back stock north of a 5% cap rate (note this after the pandemic hit) is nicely value accretive. Selling debt at a 2.3% interest rate to buy back more heavily undervalued stock would be heavenly (highly accretive to NAV per share).

Valuation

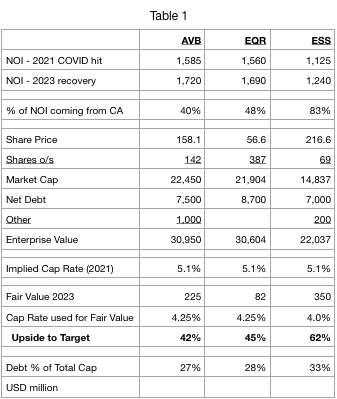

Because ESS operates only in supply constrained West Coast markets with incredible long term demand, I award it a lower cap rate than ascribed to AVB and EQR.

For those who are new to real estate valuation, a lower cap rate simply means a higher EV/EBITDA multiple. Honestly I think the appropriate cap rate is lower than 4% (particularly since the 10y is at 70 bps and the 30 year is at 146 bps). In this context, one could easily put together a cogent argument that ESS should trade at a 3% cap rate (or lower but I let's hold off on that for now) given the demand, supply, interest rate, management, etc. At 3% we are talking about a $500 share price - assuming a 5% divvy CAGR from 2020-2023 (150 bps below 25 year historical average because I'm a conservative guy), this would still be a 1.9% dividend yield in 2023 at $500 per share.

If you want more info/reasons to be long megacities like SF/LA/Seattle I'd recommend you check out my recent work on AVB and EQR. Also read my bit on why we look to the private market in valuing these assets (I'm putting together some IRR models to assure you that the buyers at 4-4.25% cap rates are indeed 'rational' - I'll get these out reasonably soon).

This can be cross checked by looking at EV/unit which works out to about $355,000 for ESS vs. recent dispositions north of $500k (see 'Valuation' section AVB for recent comps).

Eric & California

To be sure: I am quite biased. I own ESS stock. A bunch of it. And as some of you know, I live in LA now after 7.5 long years in Chicago. Prior to Chicago, I'd spent 3 years in San Diego. When I was working/'living' in Chicago, despite the allure of gold (but fear of golden handcuffs), I ultimately I couldn't escape the magnetic pull of Cali. So I boomeranged back. Some people are now fleeing for Phoenix, Dallas, Atlanta, whatever. They will be replaced by some richer people. But like me, some will never get Cali out of their heads and hearts and they will return.

It is highly unlikely I'd ever live anywhere other than Southern California. There is no real economic reason for me to be here. Several of my friends who live else where occasionally point out how 'uneconomic' it is to live here (high taxes). But whatever. I've got money and there is no place I'd rather live.

Risks

Stock goes down in short term due fears surrounding to covid/eviction moratoriums/economy/election fears. I'm not worried about this because: a) eviction moratorium is a nothing burger/company has dealt with it all year long and has high earning knowledge workers who can pay their rent (b) I'm a long term and don't care if the stock goes down.

Prop 13 risk - not up this November but if split roll passes multi-housing could be next on the docket. Wouldn't kill thesis but could take away some of the upside. I'll discuss more later (probably an entire post) but there are several reasons I don't see this happening.

For more on ESS visit this follow up article and this one. And this one.

Disclosure: Eric Bokota is LONG ESS

As always, it is entirely possible I'm wrong (find me on another platform and bark at me). Do your own work.

Private Eye Capital Newsletter

Join the newsletter to receive FREE actionable investment ideas.