Why public investors should care DEEPLY about the Private market

In the apartment business, just ~6% of assets (by value) trade in the public market as REITs. That means that the rest of multifamily assets are in private hands - these assets are owned by traditional institutional investors (large pensions & endowments), private REITs (such as Blackstone's B-REIT), private funds/syndication deals (as you might see on Crowdstreet.com etc.), wealthy individuals, etc. I've interfaced with public and private market investors. To put it nicely, private market investors are much more sophisticated than REIT investors (both institutional & retail). However, private market assets are inaccessible to most investors. Because 94% of assets are in the private market, the private market is the REAL market. The private market tells you WHAT THE ASSETS ARE REALLY WORTH.

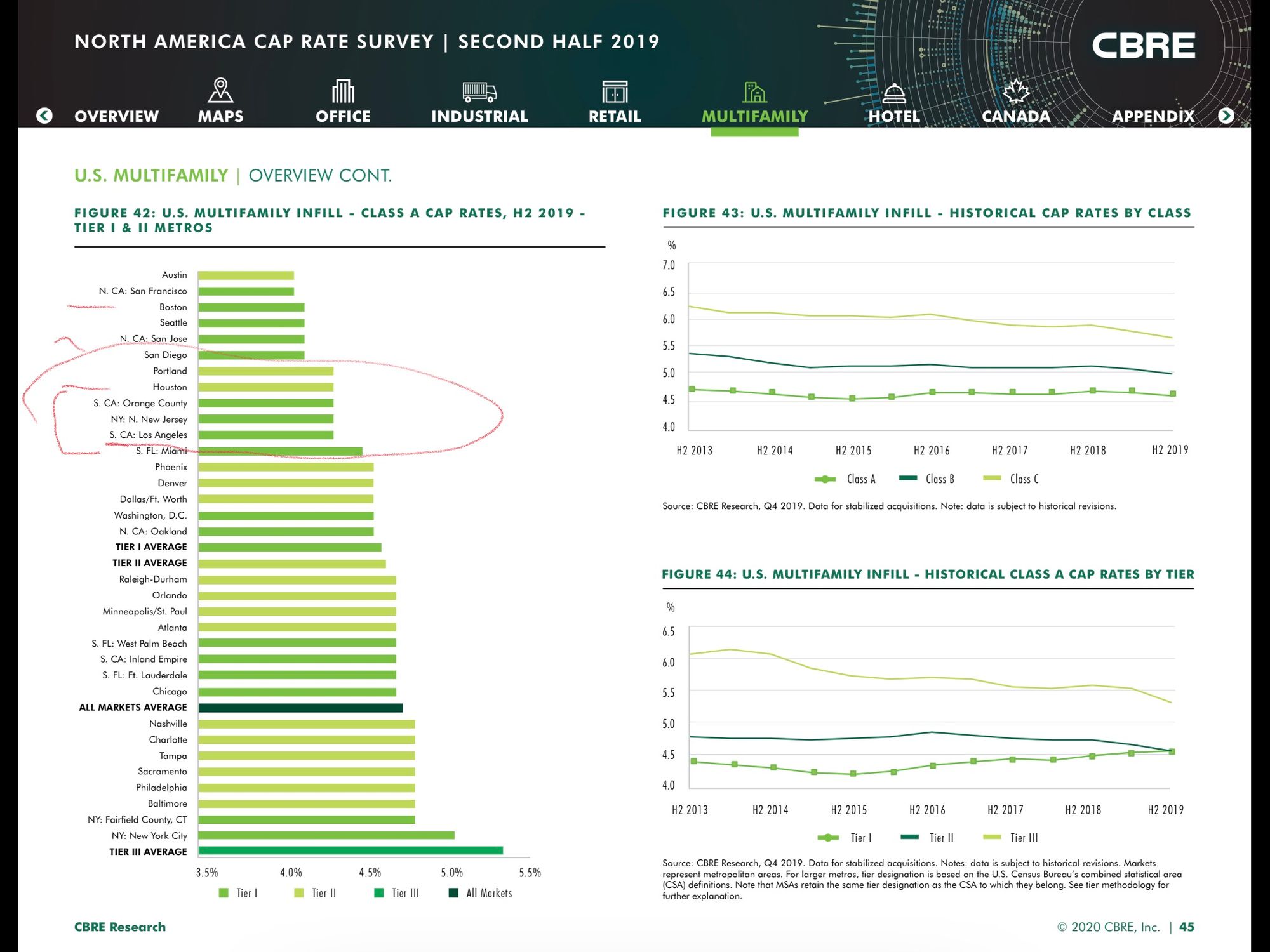

In the NY apartment market, assets have generally traded at cap rates ranging from 3.5-4.5% over the past 7-8 years (if you google around you can find lots of data to support this from much more reputable sources than myself). LA and SF are very similar.

Link to CBRE page where they give the great stuff shown above away free! I mean if you think I'm a nice guy for giving my stuff away, just google around for awhile - it's amazing what you can learn with a cup of coffee, an internet connect, and a willingness to call strangers.

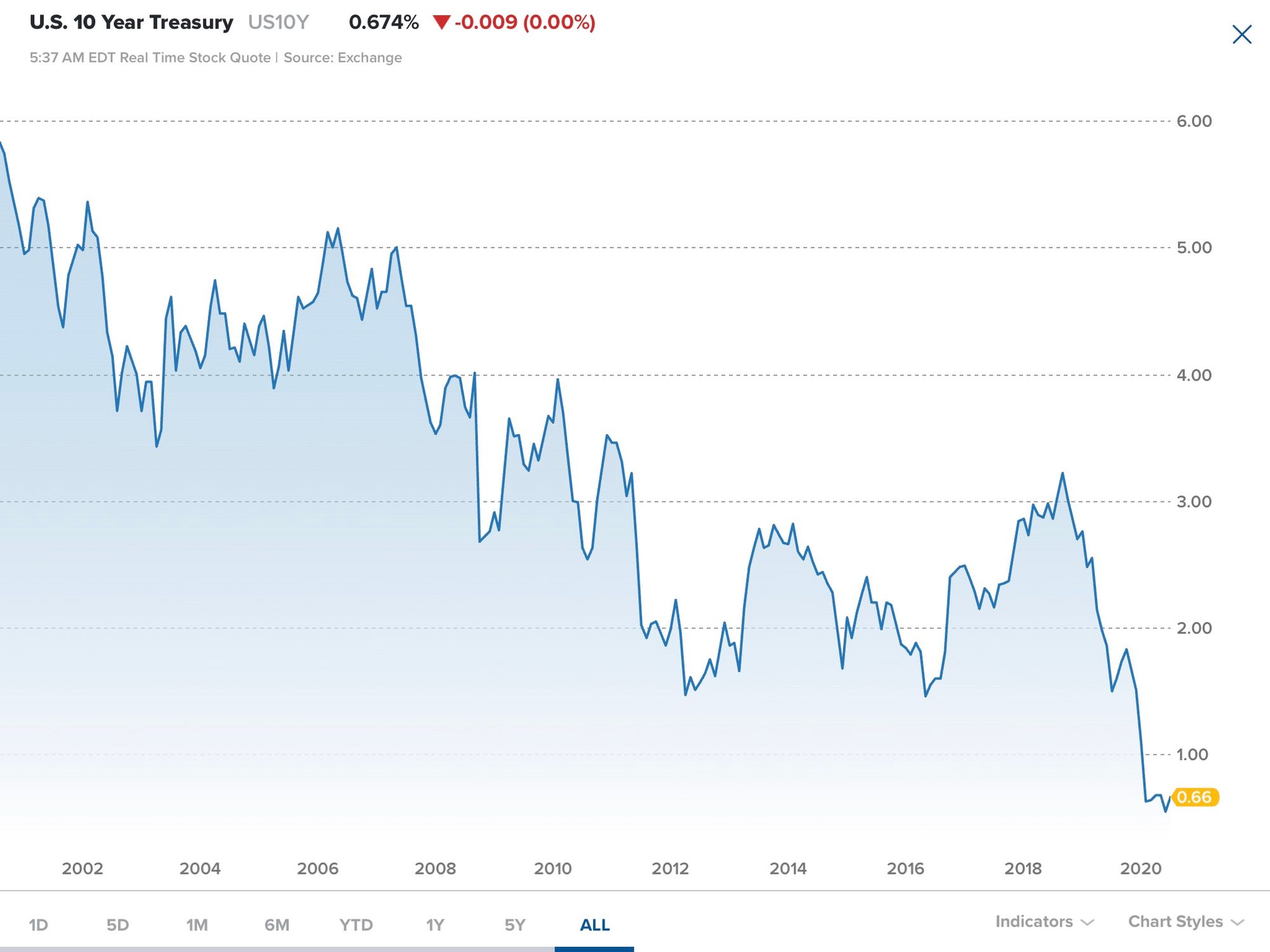

Why will private market participants pay more for apartment assets? The answer lies in the capital structure - while public REITs are INCREDIBLY CONSERVATIVE and use very little leverage (25-30% LTVs, or loan to value), private participants make greater use of debt with LTVs typically ranging from 50-80% (typically in a non recourse structure like our friends at CLPR). Debt has NEVER BEEN CHEAPER.

Source: CNBC - sidenote: Jim Cramer is an irresponsible asshole.

The bulk of these deals are done by private market participants. However, despite the numerous advantages of being public (daily liquidity, more flexible debt options, ability to buy back shares, etc) frequently public assets trade at a DISCOUNT to private market assets. In a rational world these assets would trade at a premium, reflective of the advantages previously outlined. Right now...the private and public markets aren't communicating:

But in the medium and long term, they will. They MUST. There are number of ways this can occur - we will address them in time..maybe later this week or early next. In a couple of years we expect something more like the Turtles song. Of course if you read between the lines, this implies almost nothing is publicly traded if apartment REIT shares stay depressed.

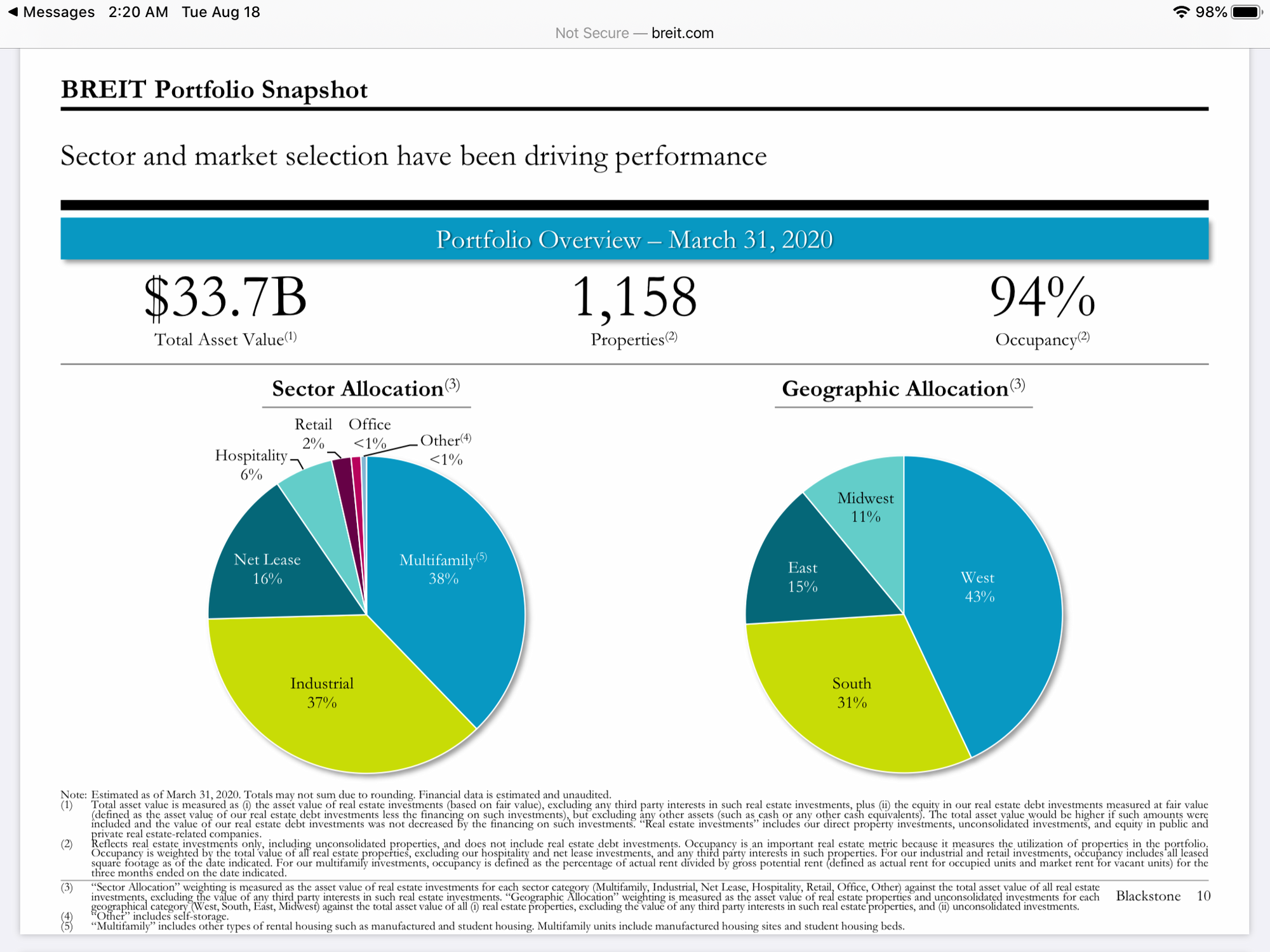

Blackstone's private REIT, B-REIT has been one of the most active acquirers of multifamily assets in recent years. It is raising capital at a rapid pace - it will continue to acquire lots of multifamily in the years ahead.

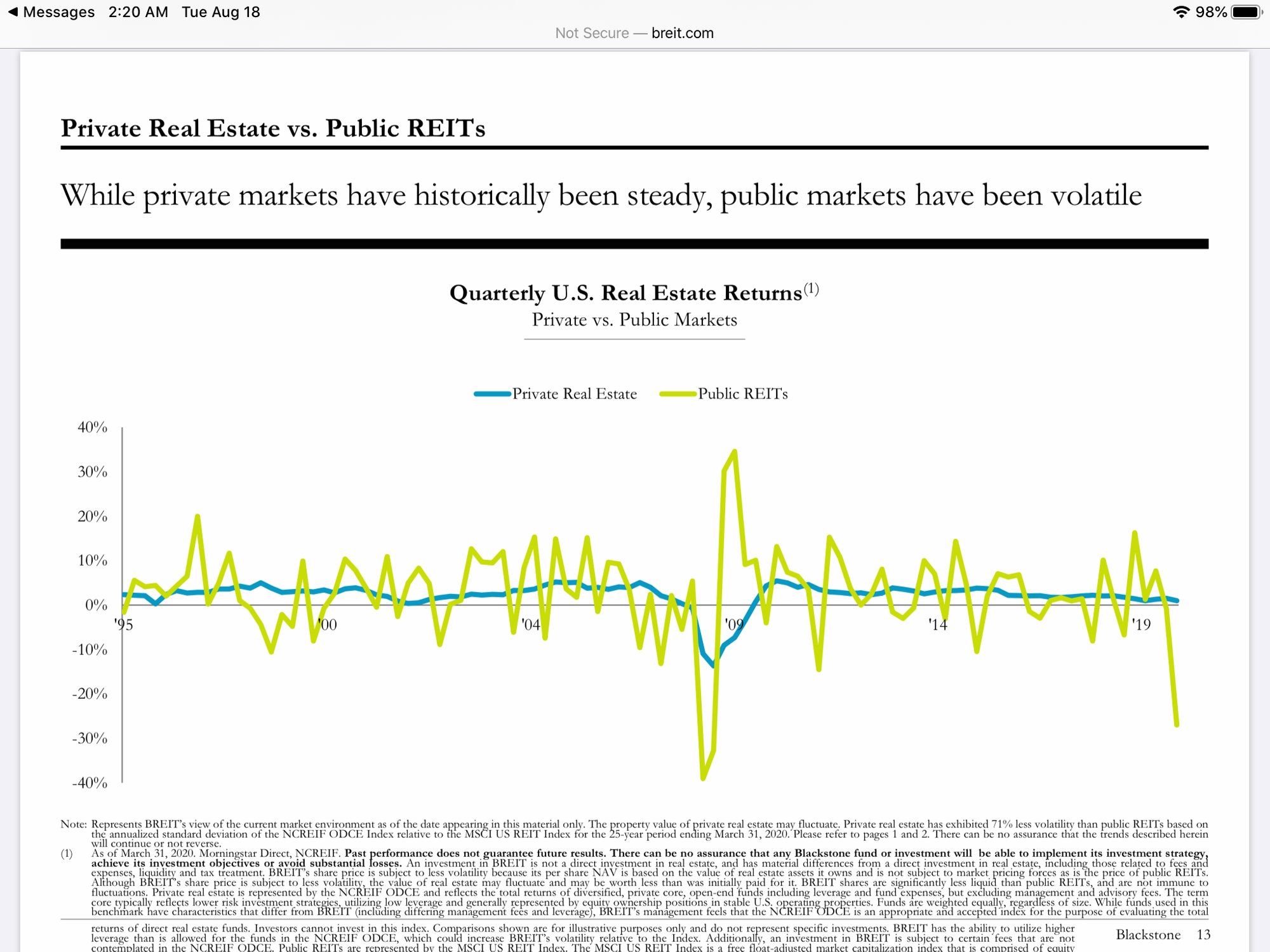

As you can see above, Blackstone has chosen to focus on multifamily. Below, Blackstone cites the resilience of the private market values vs. public ones (hint it helps that private capital is locked up and not subject to the whims of Mr. Market).

Note the sharp downward slope of the public line (light green) on the far right of the above chart. Unlike almost everything else in the public equity markets, apartment REITs have yet to recover. Contrast with the ever so stable value in the private market.

WHAT DO YOU THINK HAPPENS NEXT? What might Blackstone do to take advantage of the disconnect? I'll speculate for you at some point in the near future.

But what is going on in the private market now?

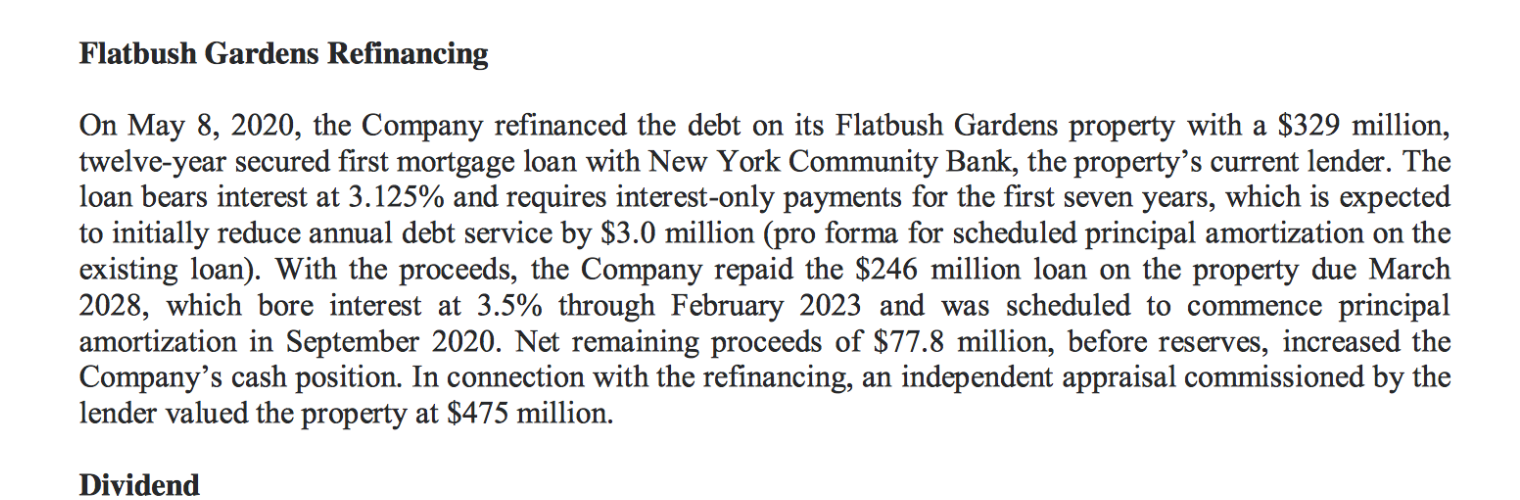

Answer - not that much though there is evidence that the private market is alive and well. At the epicenter of the crisis (and during the peak of the crisis), Clipper REIT refinanced a large Brooklyn property (Flatbush Gardens) at an implied 4.1% cap rate. Besides buy/sell deals (currently very slow due to pandemic), financing deals (and refinancing deals) are a form of private market transaction that provides not only information (estimated value of asset, etc) but can provide a liquidity event (distributions via dividends or share buybacks) to apartment asset owners- this occurs all the time in the private market in syndication deals as well as private funds. We'll talk more about the wonderful world of apartment financing in the future..and it is a wonderful, wonderful world.

From Clipper REIT's first quarter earnings report:

We know from Clipper's supplemental filings that the Flatbush property (Brooklyn) generates ~$19.5 million in NOI, implying a cap rate of 4.1% (=$19.5 million in NOI /$475 million valuation of the property). We know Clipper received a $329 million loan so that implies a loan to value of 70%. This is a very attractive financial structure which is commonly used in the private market to finance the apartment building acquisitions. Clipper did not cut its dividend - it maintained it and is using some of the $77 million it extracted from the deal to buy back stock. This is NAV per share accretive capital allocation at its best.

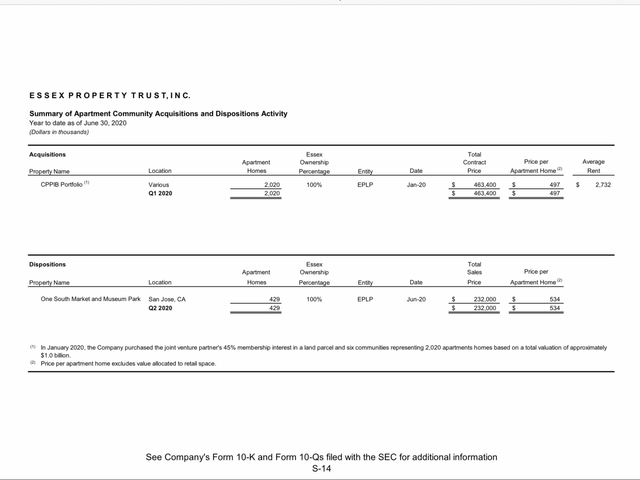

Source: Essex 2Q20 Quarterly Supplemental

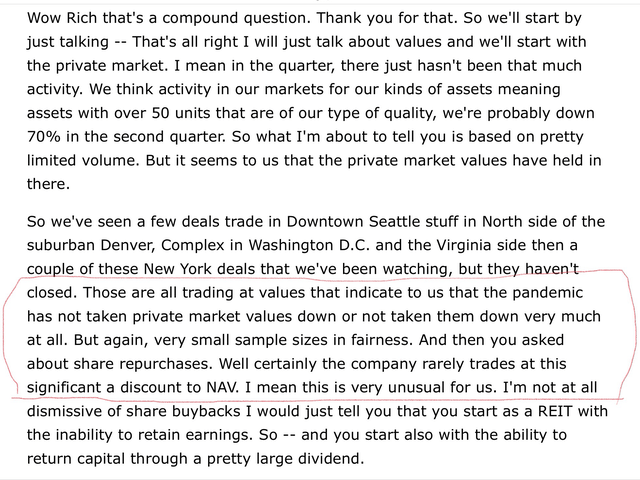

Similarly, Essex REIT sold two properties in San Jose at $534,000 per unit in June (shown above under dispositions). By using various rental sites (Zillow, apartments.com), making a few phone calls and estimating an NOI margin (NOI divided by rental income), I estimate that these properties were sold at at a cap rate of 4.3-4.4%. On both its first and second quarter conference calls Essex noted that private market values had held up well, noting flat to slightly declining values relative to the period prior to the pandemic. Similarly EQR management noted little change in the private market.

Source: EQR second quarter transcript (courtesy of Seeking Alpha)

I have had many, many conversations with private market participants over the past several months (post pandemic outbreak) and have come to the same conclusion, fueling my enthusiasm for public multifamily.

Besides buy/sell deals (currently very slow due to pandemic), financing deals (and refinancing deals) are a form of private market transaction that provides not only information (estimated value of asset, etc) but can provide a liquidity event (distributions via dividends or share buybacks) to apartment asset owners.

By contrast, public debt markets for apartment REITs have shown a dramatically different opinion than the equity REIT market, taking their cue from the massive decline in the 10 year treasury. Here are a couple recent debt issuances in the space:

On Aug 10, 2020 - Essex issued 10 and 30 year unsecured at 1.75% and 2.67% YTMs, respectively.

.jpg)

Avalon Bay tapped the debt market in May. It paid the princely sum of 2.5% for 10 year unsecured, though I suspect it would be sub 2% today.

To summarize: We think that the public apartment REITs are STUPID CHEAP. There is a clear path to closing this massive valuation gap. Like fashion, our work here at Private Eye Capital is NEVER FINISHED...stay tuned - the easiest way to do that is to sign up for our FREE Actionable Idea Investment NEWSLETTER! Get our investment ideas before they appear on the site. Be sure to confirm email to get on the list.