Does PS4.0 portend a buyout of Shurgard?

Paid

Members

Public

Recent leadership changes at Public Storage (PSA) & PS 4.0 plan suggest greater interest in acquisitive, international growth. Importantly, master capital allocator Shankh Mitra, CEO of Welltower, who has been on the PSA board since late 2020 is set to takeover as Chairman in April and purchased $25 million

Why I'm buying the Software Massacre

Paid

Members

Public

Software stocks got destroyed last week. It could very well get worse before it gets better. There are many negative headlines proclaiming the death of software at the hands of AI native upstarts like Anthropic's Claude and Salesforce's own internal difficulties deploying AI. Scary sounding stuff.

Why I'm Ballz Deep Large Cap US Residential REITs in ~450 words

Paid

Members

Public

Exceptionally low risk - Balance sheets have LTVs in the range of 20-33%. B/S risk is pretty close to zero. Housing = most basic need / zero risk of obsolescence/disruption (there are few bizes you can truly say this for). Supply risk is behind us. Deliveries set to fall off

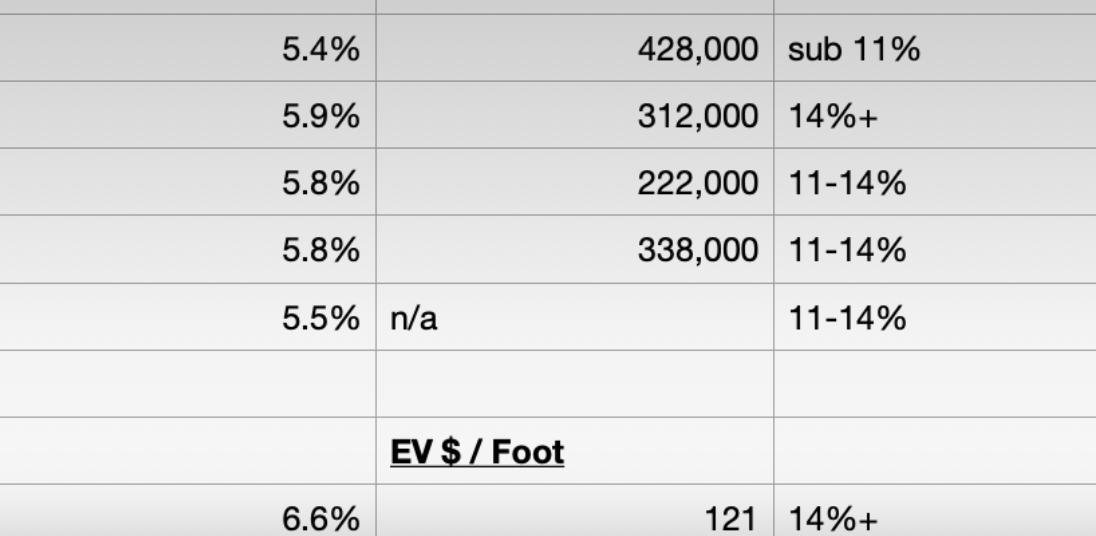

2Q25 Resi REIT thoughts + Cap Rates / Per Door / 4yr IRR

Paid

Members

Public

The voting machine turned decidedly sour on the resi REITs following reporting season. Here is my take: What the market didn't like: -As shown below, after starting the year strong, rent rebound/new lease rates have stalled: -Stabilization of new developments has been pushed out a teensy/tinsy

TT Electronics Plc: Fix it or Someone Else will

Paid

Members

Public

UK microcap TT Electronics Plc (TTG.LN) looks to have a very favorable risk/reward profile at 85p. In a base case, I see shares nearly doubling. With a solid B/S ~2x ND/EBITDA and two recent takeover approaches (at 125++p), I see limited fundamental downside - if

Cap Rates,EV per Door/Ft, Est IRRs for Selected REITs

Paid

Members

Public

REITs have broadly been beaten up as yields on the 10y have breached 4.7%. As such, I thought it would be timely to put out a valuation/comp page for a selection of REITs: On the whole I see low to mid teens IRRs as being very attractive returns

Tax Loss Selling: UK/Europe Edition

Paid

Members

Public

Here are some lower conviction ideas (read: smaller, in some cases much smaller weightings) that I've added or added to recently: Knight's Group Holding (KGH LN) - This UK microcap might be the cheapest thing I own. It's a highly acquisitive law firm which

The Most Wonderful Time of Year: Tax Loss Selling Season

Paid

Members

Public

I'm not gonna lie: buying something from someone who is selling it because it has gone down is exciting. While catching a falling knife doesn't feel great, tax loss selling can create very interesting opportunities. Today I will highlight a few securities I think have been