Equity Residential (EQR): Recap transaction could give shareholders ALL their money back while still owning ALL the apartments

The 9/14 $2.4 billion California apartment transaction lends credibility to the notion of being able to recapitalize Equity Residential (full writeup here), pay shareholders back 94-103% of their money invested (pretty much right away) and then still owning ALL the properties (and receiving a growing stream of dividends). Below I explore what EQR could look like in a re-capitalization transaction (same exercise could be done for AVB, etc) whereby the CA properties are valued consistently with the AIV private market transaction and leveraged to 75% LTV (loan to value - this is how the private market looks at REIT balance sheets).

To public market investors, a 75% LTV may seem risky or aggressive given that public market apartment REITs capital structures typically employ relatively little debt - most are sub 40% LTVs. However, most successful private market operators make much greater use of debt than we see in the public markets. The reasons for this are as follows:

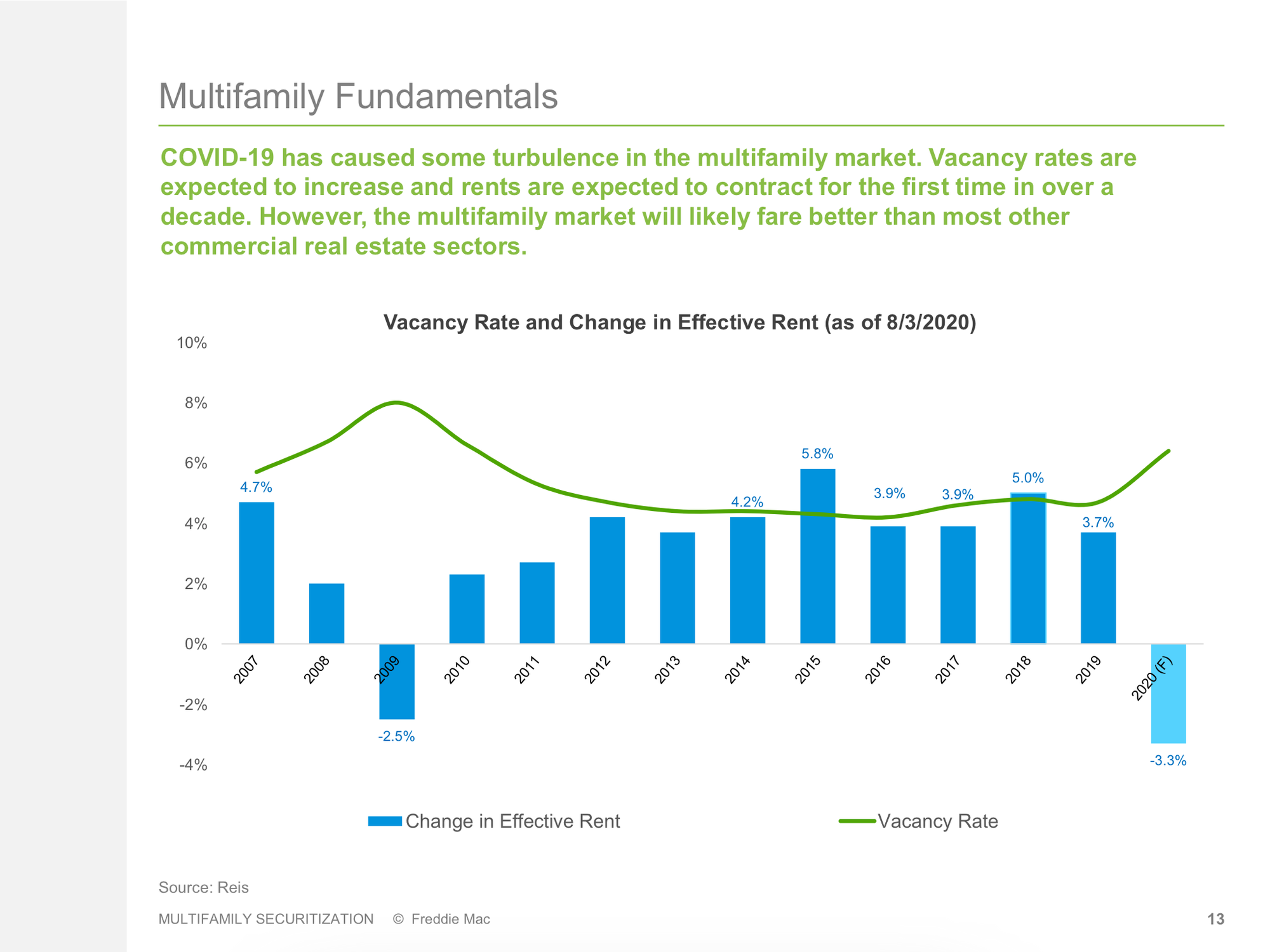

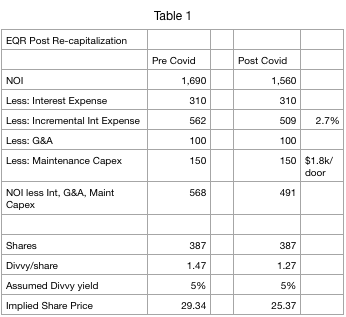

1) Ample availability of low cost loans for the multifamily sector - There are many participants in multifamily lending including banks, insurance companies, government agencies (Fannie/ Freddie/ FHA), CMBS, debt funds which are active in lending to multifamily investors. This strong supply of loans makes the cost of debt (interest rates) for multifamily properties very attractive, over the past decade, interest costs are typically priced at a spread in the range of 180-220 bps vs. 10 year Treasury rates for 70-75% LTV properties (10 year fixed rate, interest only for first 3 years). This would equate to a 2.7% interest rate given today's 10 year treasury sits below 0.7%.

2) Ability to use non-recourse leverage which limits the potential losses to equity investors. Non-recourse loans are secured by the property, not the borrower - this means that if the borrower does not perform, the lender takes the keys to the property and has no further recourse against the borrower. Even so, defaults are have been very low historically due to the stable cash flow profile of these assets.

3) Stable cash flow profile of multifamily assets - multifamily sector produces more stable rents and occupancy and has more predictable expenses (particularly in CA -thank you Prop 13!) and capital expenditures than other businesses and real estate assets (office for instance has much more volatility in rents and vacancy as well as a structurally higher capital expenditure profile; same for retail).

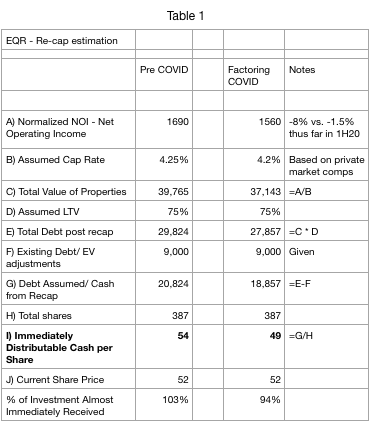

Here is a rough look at how such a transaction might look:

I use a 4.25% cap rate for the group as a whole and show how things look on 2021 #s (more punitive than the NOI used in the above transaction). I assume a 75% loan to value (should be quite do-able). I use financing rates for non-recourse lending which is much more costly than what we’ve seen EQR’s peers finance in the unsecured market (ESS sold 10 year unsecured fixed rate at 1.7% in mid August). This gives us the total amount of potential debt under such a scenario. I deduct existing debt and arrive at the amount of incremental debt which can be incurred - money which could be paid out to shareholders as a special dividend. As you can see, under this reasonable set of assumptions, EQR investors would receive 94-103% of their investment back immediately. I believe this can largely be structured as a return of capital which would minimize tax consequences to investors.

Importantly, under this scenario, EQR still owns ALL THE APARTMENT BUILDINGS - it just has to service the higher level of debt (but with attractive rates as we are seeing in the market today). So on a going forward basis, EQR would have the following cash flow available to distribute as dividends:

In this example, I chose a higher dividend yield to account for the higher leverage at the newly leveraged company (riskier at 75% LTV than 25%). Looked at differently, the $25-39 assumes a low 4s cap rate (again consistent with the private market which is the REAL market because only 5% of apartment assets trade publicly as REITs).

So to sum it up, the fair value of EQR is $74-84 ($54 received immediately + $29 in value of the all the apartments we still own) assuming this set of transactions. Looks like a pretty good deal.

My favorite of the 3 continues to be Essex (ESS). It too looks incredibly undervalued under such an analysis.

In the coming weeks I'll send out something on the following topics:

1) The coming boom in Los Angeles driven by an unprecedented backlog in film/TV. Everyone is watching streaming services at home. Content production stopped because of the pandemic. There are a host of well funded streaming services (not just NFLX/AMZN) which want (need) to make a splash - they need content and they need it ASAP. This will require many, many workers and most of it will be done right here in LA.

2) The story of Vonovia, a German apartment REIT which trades at a valuation well in excess of AvalonBay, Equity Residential, or our beloved Essex Properties. This is despite Vonovia having a lower growth profile and a management team we regard as being inferior to AVB, EQR and of course ESS (in case we haven't mentioned, we are big fans of Mike Schall & Co). I have had some interesting dialogue with German/European investors (I have quite a few contacts in European Capital Markets) who are becoming increasingly interested in stable, cash flow generative assets like apartment buildings in the US. Interest rates in most of Europe are...Negative. That makes apartment REITs like AVB, ESS and EQR incredibly attractive investment propositions to a group of investors which has a lot of capital looking for a home. I'm helping these investors to become familiar with these apartment REITs. Were ESS/EQR/AVB to merely be valued consistently with Vonovia, it implies a more than doubling of the share prices.

While the sellside is busy trying to guess what happens in the next hour, day, week, month or quarter, I'm focused on estimating the underlying value of the business/assets. Sellside myopia leads to poor investment decisions. Further Wall St banks like Goldman Sachs typically say one thing and do another. IMO their 'advice' should be taken with (several) a grain of salt.

My advice should also be taken with a grain of salt. Or several. Do your own work!

Eric Bokota owns shares of ESS, EQR, AVB, CLPR.

Private Eye Capital Newsletter

Join the newsletter to receive FREE actionable investment ideas.