Basics

10 year Treasury hits one year high

Paid

Members

Public

Last week, interest rates and inflation came back into focus as the 10 year treasury yield hit its highest levels in one year.The ten year treasury rate has doubled since I started this site a mere 6 or so months ago as inflation expectations have increased and market participants

Index Weightings Help Explain Why Many Bargains Abound in REIT-land

Paid

Members

Public

I’ve been writing quite a bit about apartment REITs lately. Any time I identify numerous bargains within one specific sector or sub-sector, I’m effectively saying that I am right and the market (stock price) is wrong. With billions of dollars invested and hundreds (if not thousands) of analysts/

Calculating NAV per share

Paid

Members

Public

A REIT's NAV per share (Net Asset Value) is usually significantly higher than its stated accounting book value under US GAAP. I've received a few inquiries on how to calculate the estimated NAV for a REIT and have compiled this quick tutorial. Materials required: Annual/Quarterly

Back to Basics/ Apartment REIT concepts

Paid

Members

Public

It has been brought to my attention that readers might benefit from a distilled version of the framework/concepts I use in evaluating apartment REITs. Here I discuss: 1. basic supply & demand for apartment markets and discuss how this impacts rents 2. the renter pool in gateway cities vs.

Glossary of Apartment REIT Terms

Paid

Members

Public

NOI (Net Operating Income) - Total property level operating revenue less total property operating expenses. If thinking about REITs versus other types of business, NOI is akin to adjusted EBITDA but adds back corporate overhead expenses. The rationale for doing so is that when apartment assets are bought and sold,

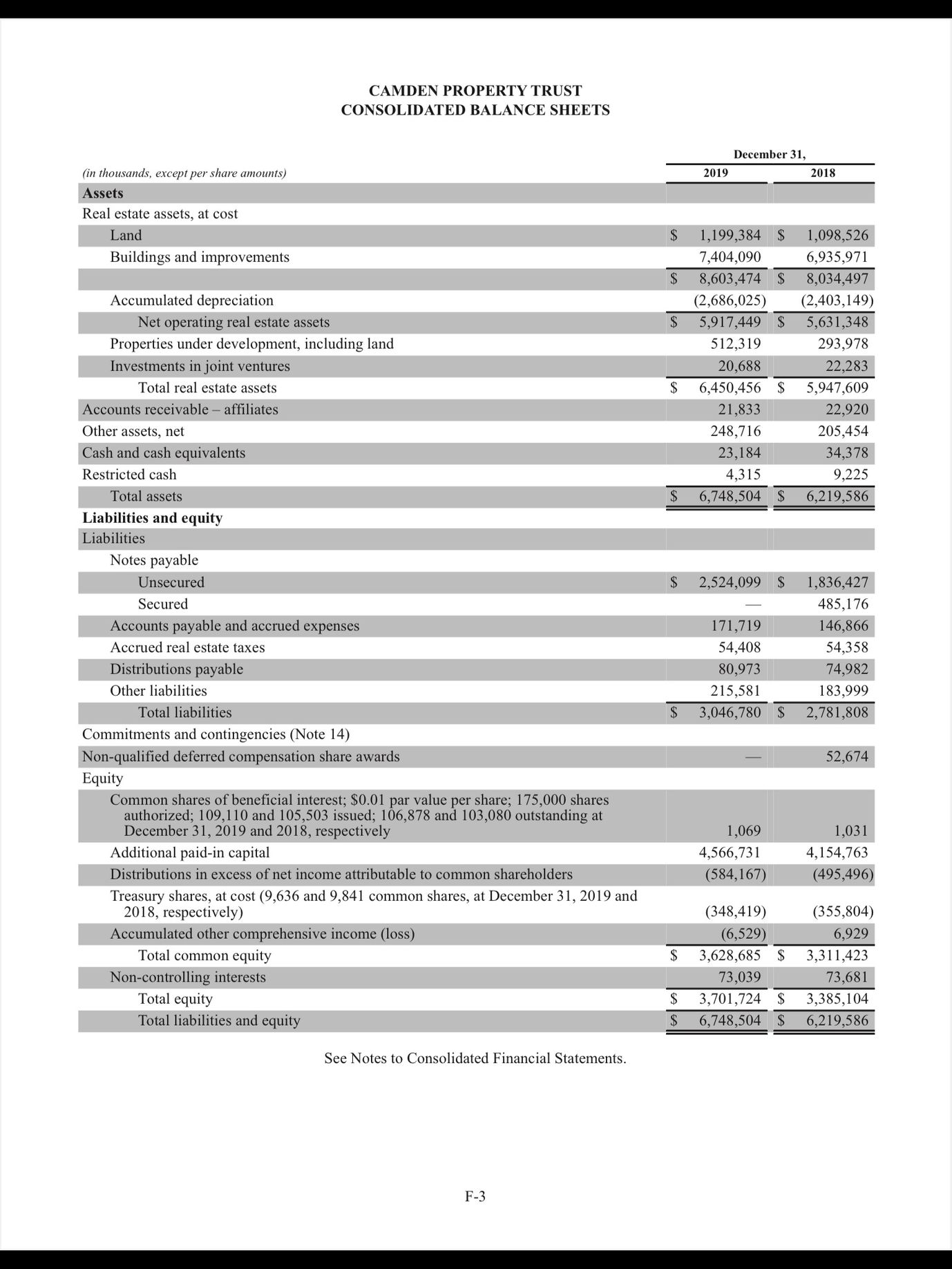

How I think about REIT balance sheets

Paid

Members

Public

To me, the most relevant factors are the following: 1) LTV or Loan to Value - this is the total amount of debt relative to the total value of the properties owned by the REIT. 2) Structure of debt - recourse vs. non recourse 3) Term to maturity & covenants

Creating value via Apartment Development

Paid

Members

Public

The reader may be wondering: with private market pricing at all time highs, other than share buybacks, how can the apartment REITs deploy capital at high rates of return? Development. Camden and other apartment REITs have demonstrated an ability to develop assets at attractive yields (NOI of development / cost of

Are private buyers crazy? How buying at an apartment complex at a 4 cap can generate a 10% IRR

Paid

Members

Public

While publicly traded apartment REITs have fallen considerably YTD, the private market [https://www.privateeyecapital.com/why-public-investors-should-care-deeply-about-the-private-market/] (the private market represents ~95% of US apartment assets; just 5% of US apartments trade publicly as REITs) for apartments has soared and in many markets is at or approaching new highs. With