Essex Property Trust (ESS): What Goldman Sachs says vs. What Goldman Sachs does

This past week again saw the West Coast Apartment REITs in the red despite continued positive apartment operating data points and private market commentary. This provides long term investors with what I believe to be an excellent opportunity. Today I will touch upon:

1) Update on September apartment rental collections & private market operator commentary

2) Highlight (an alarming!) Disconnect between Goldman’s ‘official’ opinion on Essex Property Trust and the positions held by Goldman Sach’s REIT fund - hint: it owned a bunch of Essex (find Private Eye Capital reports on ESS here) as of 8/30/20.

3) Provide some facts and thoughts about Prop 15 & Prop 21

4) $260 billion in dry private equity real estate powder (levered could be $750 Billion-$1 trillion) and a song

Operating Trends/ Private market update

Real time data from NHMC released last week showed that professionally managed apartment owners (not just the REITs but includes data from the private market) show that September collections remain strong at 90.1% despite the lapse of federal unemployment benefits and a nationwide eviction moratorium. Calls with private market operators confirm

- Strong rent collections - mid 90s

- Outside of select downtown properties, rents remain very stable despite an eviction moratorium. This too is quite different than the narrative cited in popular media and loudly regurgitated by Jon Litt, a real estate hedge fund manager who intimated that he had a short position in AVB a couple weeks back.

- The private market for apartment assets is transacting at prices not materially different from pre-pandemic pricing. Syndicators and private fund investors are awash in capital. The private market is THE market in multihousing given that just 5% of apartments trade publicly as REITs.

- While the media/market chit-chat has focused on the need for additional stimulus to ensure the ability of renters to continue to make rent payments, the reality is very different for the megacity apartment REITs given that knowledge workers earn high incomes ($150k+) while working from home and…paying their rent!

The really smart kids at Blackstone (the best talent doesn’t go to Goldman anymore - the best talent stopped joining GS a decade or so ago - can be seen in a long term chart of GS stock; compare it to BX) own 121,000 multihousing units. 38% of BX’s B-REIT was invested in multihousing assets at 6/30/20. Blackstone understands that cap rate compression (given the sustained decline in long term interest rates globally) in real estate will likely play a much larger role in valuation (as opposed to relatively small changes in NOI) of real estate (from 9/15/20 Seeking Alpha transcript):

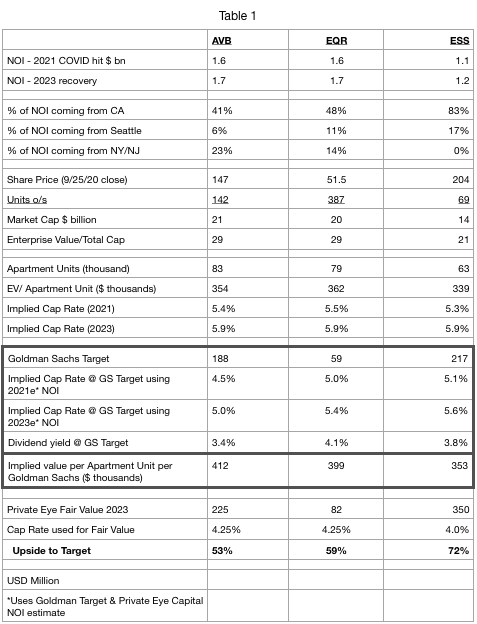

Cap rate moves have an outsized impact on real estate valuation. There are very reasonable reasons to expect meaningful cap rate compression. As we sit today, cap rate spreads for Essex sit ~470 bps over the 10 year treasury (vs. avg of 280 bps over the past 20 years). Given how low interest rates are, it could be argued that even 280 bps is too high. Using 280 bps (against a 70 bp 10 year treasury), implies cap rates of 3.5% which would put Essex shares well north of $400.

Goldman/Sellside - seriously WTF?

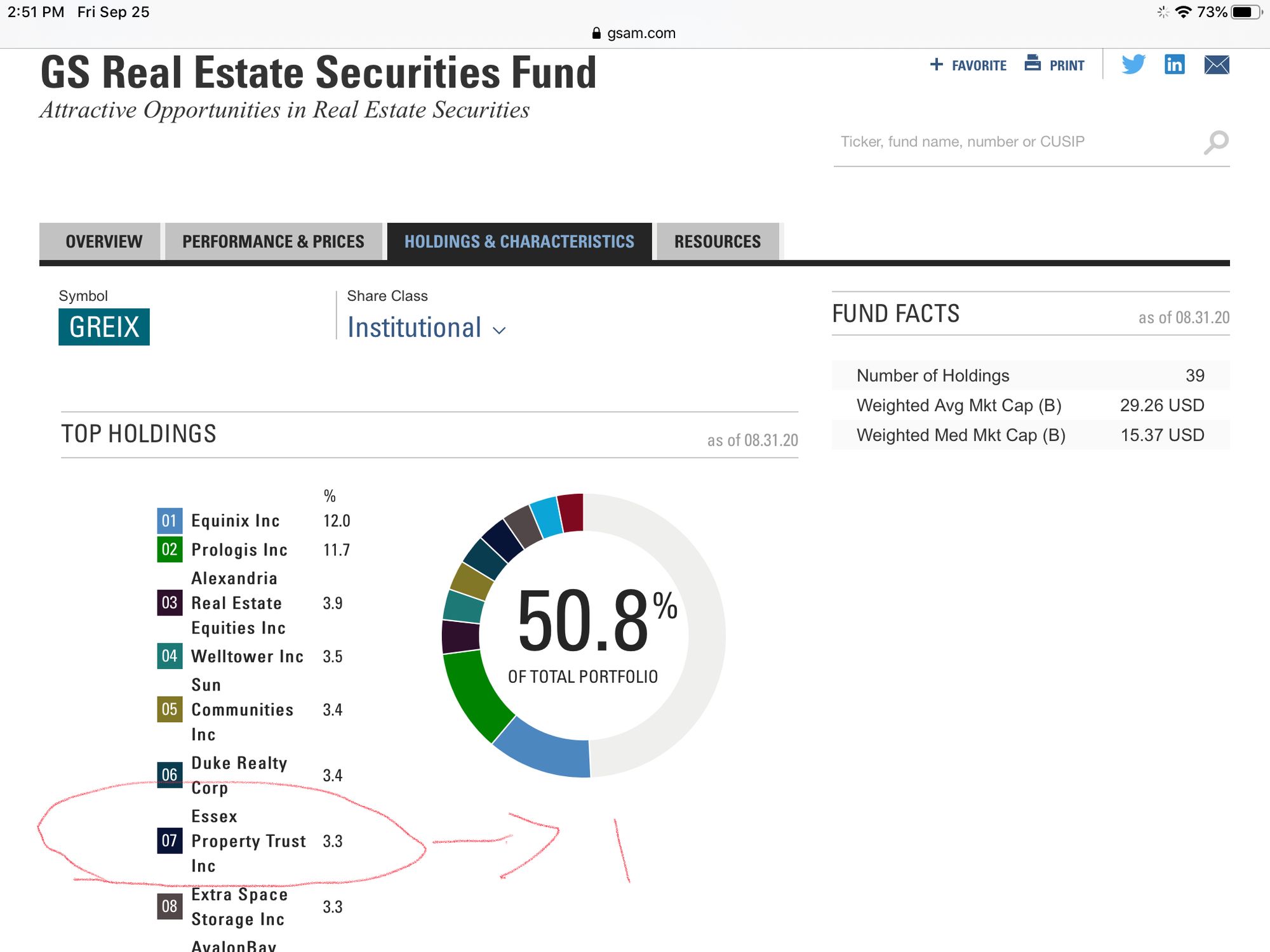

There is a big disconnect between sell side brokerage firm ratings and the actual behavior of the fund managers at these very same firms. Essex Property Trust, which was downgraded to a SELL at Goldman (with the price target revised down from $260 to $217 on 9/9, was the LARGEST APARTMENT REIT holding (and 7th largest position overall) in the Goldman Sachs REIT fund (GREIX) as of 8/31/2020!!! In GREIX, ESS is a larger position than ‘Buy’ rated AVB. Wtf? I doubt the long tenured managers of the Goldman REIT fund sold the position in ESS based on the recommendation of paper analyst turned apartment REIT expert Richard Skidmore (who has been on the job ~15 months).

Valuation - the world according to Goldman's Skidmore:

It is tough to see how it makes sense that AVB would be worth 17% more per unit (uses Goldman’s Fair Value per share to calculate market capitalization & enterprise value) than Essex or trade at a meaningfully lower dividend yield/cap rate given that AVB (while excellent) has underperformed ESS operationally over any meaningful period of time.

Historically ESS had a higher value per unit - for good reason IMO, given its heavy weighting toward California/SF Bay Area real estate which has high replacement costs and rents. But not in Skidmore's world. The people at Goldman who are allocating actual capital don’t seem to believe this nonsense either.

Similarly while Morgan Stanley’s sell side analyst has an Equal Weight on AVB, the Morgan Stanly REIT fund has an overweight (relative to the index or multihousing) position in…AVB! You can go on down the list. Not to beat a dead horse but here is my commentary on a recent Baird ESS downgrade dripping with short term guessing (I've included a rap song as this is an entertainment website).

While that might not come as a surprise to Wall St veterans, a visitor from another planet (or just a thinking person) might say…WTF?

Why would anyone listen to these sell side 'analysts'?

Prop 15, Prop 21

Amongst ugly headlines, some areas which are of particularly concern for CA multihousing real estate observers/investors include the November elections Prop 15 split roll whereby commercial properties will face higher property taxes & Prop 21 which seeks to allow for stricter rent control in some municipalities.

Prop 15 specifically excludes multifamily housing!! Even if Prop 15. passes, multifamily will still be taxed the same as single family housing with maximum allowed property tax increases of 2% per year under Prop 13. Fears of a surge in property taxes are unfounded. While much concern exists around property taxes in many places (including Red states), the reality is that Prop 13 means that California multifamily has the GREATEST transparency and most stable (not to mention favorable) property tax regime in the nation. It is instructive to consider that Prop 15 specifically treats residential property differently from industrial, office, and retail properties because anything which impinges on residential properties/Prop13 has shown to be political suicide even in a state as Blue as California.

With regard to Prop 21, I will make four brief points and interested readers can find more here:

- Prop 21 is bad policy which won’t pass because it will exacerbate the housing crisis -even Governor Newsom understands this and has come out in opposition of Prop 21

- Prop 21 won’t pass because it threatens home values

- Prop 21, if passed, won’t be as bad as feared

- Prop 21 is already more than priced into the share prices of the CA multihousing REITS

- Prop 21 does NOTHING to increase the supply of apartments (affordable or otherwise) in CA

How is it that apartment REITs trade at 35-40% discounts to NAV despite a very well capitalized private market? So much private equity capital is looking for real estate deals today; lever it up and total dry powder is $750 BILLION to $1 Trillion. Enough to easily buy every single US multifamily REIT.

Wall Street 'analysts' aren’t the only culprits in the bizarre share price action observed in the West Coast apartment REITs. 30-35% of West Coast apartment REIT shares are owned by ETFs (such as VNQ). As you may be aware ETF fund flows tend to ignore fundamental factors - asset quality, leverage & balance sheet structure, management quality, occupancy, lease rates, suburban vs. urban mix, and last but certainly not least private market trends/valuation. This is just buy/sell voting and because so many investors (speculators?!) feel burned by REITs - (REIT indices are down 15-20% YTD vs. a flattish performance in SPY), this mindless selling provides the thinking long-term investor a great advantage.

I realize I owe readers A) a piece on the coming boom in LA driven by Hollywood’s resurgence (B) some thoughts on German multihousing REIT Vonovia (in the interim there is a piece on www.valueinvestorsclub.com which can be accessed as a guest; I do NOT own Vonovia) which I believe helps to highlight the tremendous upside CA multihousing REITs. These pieces will come in due course - I’m still speaking with entertainment folks in LA so that I can present something substantial on Hollywood. There have been some positive developments in the past week which can be found here and here.

Thanks for reading and enjoy the rest of your Sunday.

This is not investment advice. Eric Bokota might not know what he is talking about. Do your own work!

Eric Bokota owns shares of ESS, EQR, AVB, and CLPR.

Private Eye Capital Newsletter

Join the newsletter to receive FREE actionable investment ideas.