Equity Residential: MEGACITIES will thrive and the PRIVATE MARKET SCREAMS BUY!

-Megacities like LA/NY/SF/Boston will continue to thrive long term. Apartment rents/occupancy are stable in the short term as well (relative to most businesses). EQR rent collections in 2Q were 97%. Occupancy sits at 95% even as we are now 6 months into COVID.

-Fortress balance sheet with loan to value less than 30%. Well positioned for opportunistic acquisitions or NAV accretive buybacks.

-At $55/share, Equity Residential trades at a significant discount to its private market value. The stock is inexpensive and has a dividend yield of 4.4%. The dividend was increased in 2020 despite the pandemic.

-The combination of stable revenue, a strong balance sheet, and low valuation make Equity Residential a safe stock for long term investors.

-Equity Residential could be attractive to an activist or private equity group, especially with the 10 year treasury at 0.7%.

Like most multi-housing (fancy term for apartments) REITs, Equity Residential (EQR) shares have been battered thus far in 2020, falling 40% from its 52 week high. The market's chief concern seems to be that megacities like SF, LA, and NY will see a population exodus as COVID/government restrictions imposed as a result of COVID make city living less attractive. While anything can happen in the short term, we firmly believe that cities are alive and well. As a long term investor, we view the current price as a great gift and are long shares of EQR.

Overview

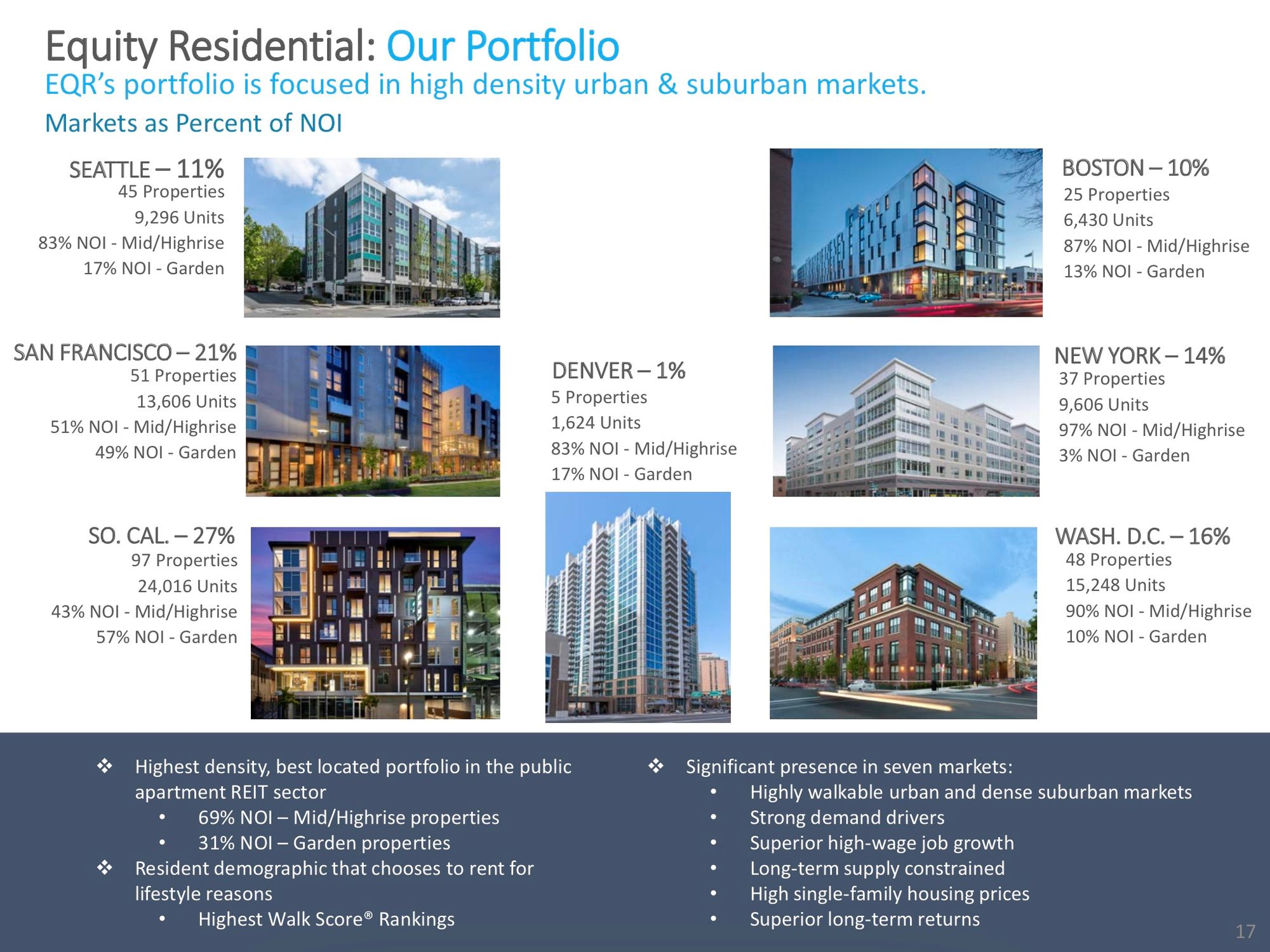

Equity Residential owns a collection of institutional quality apartment buildings in supply constrained markets with favorable long term characteristics.

While California has its challenges, it is home to the 3 of the 10 largest (Facebook, Google, Apple) companies in the world by market cap as well as Tesla and and Nvidia (among others). Seattle has two of them (Microsoft and Amazon). There is long term structural income growth in these markets which supports housing prices.

I'm a native Chicagoan who has no economic reason to live in LA. Taxes are high. Government is big. But..I have enough money to live here and I do. And I will. I love LA - beaches, hiking, incredible restaurants, an amazing fitness culture, great art museums, I could go on. I do business with the people I meet out and about. Has nothing to do with an office. I haven't been in an office for...nearly a decade. But I'll NEVER leave LA.

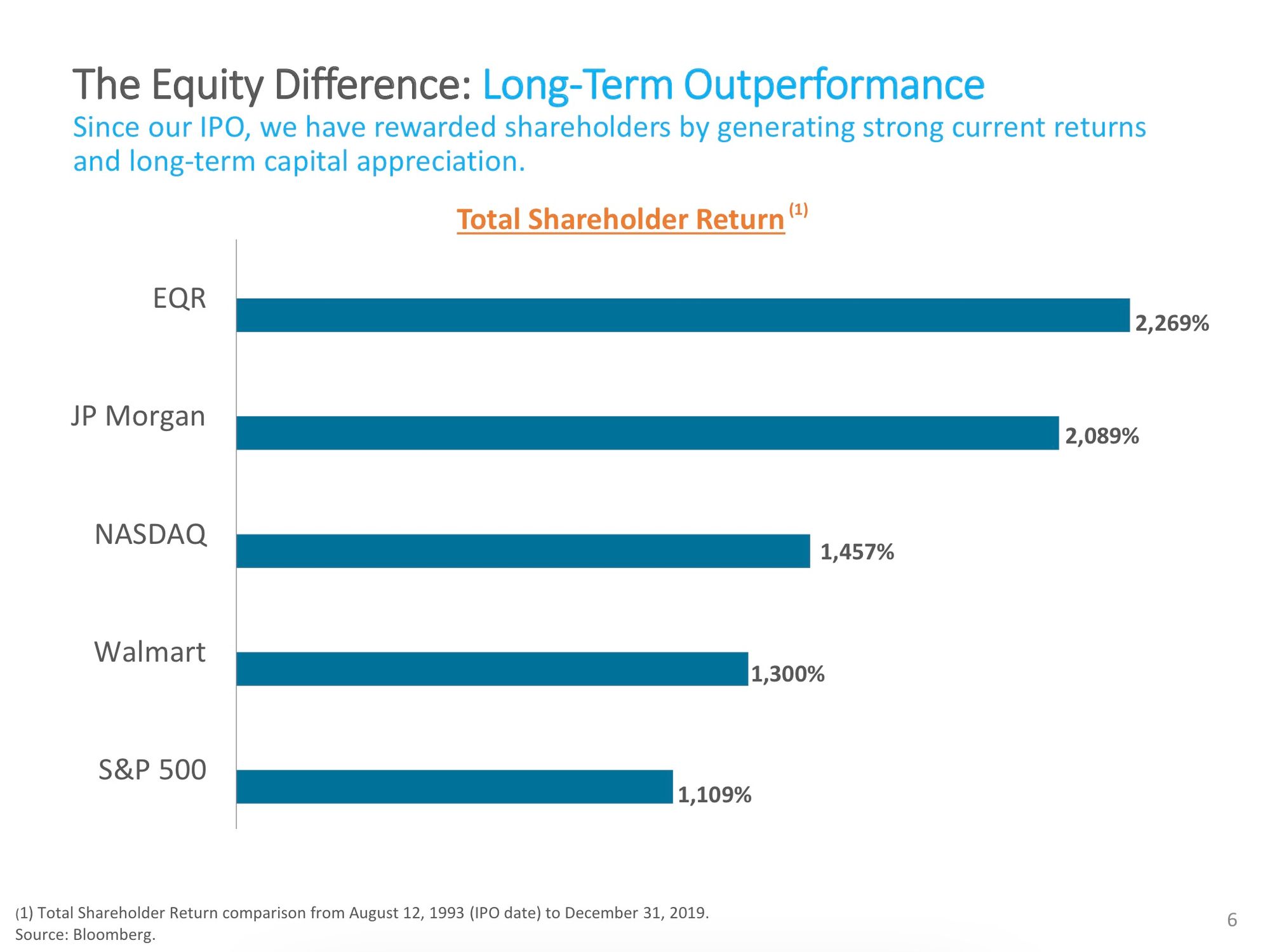

A LONG TERM WINNER

While shares have been very weak in 2020, EQR has done very, very well for its shareholders over the past 27 years. For long term, conservative investors, it seems like a must own to me.

Demand & Supply - both are INCREDIBLY FAVORABLE

Why are we so confident in the sustained growth of megacities? Megacities (NY, LA, SF) are physical two sided marketplaces. Lots and lots of people in a relatively small geographic area which create a perpetual virtuous circle. Consider:

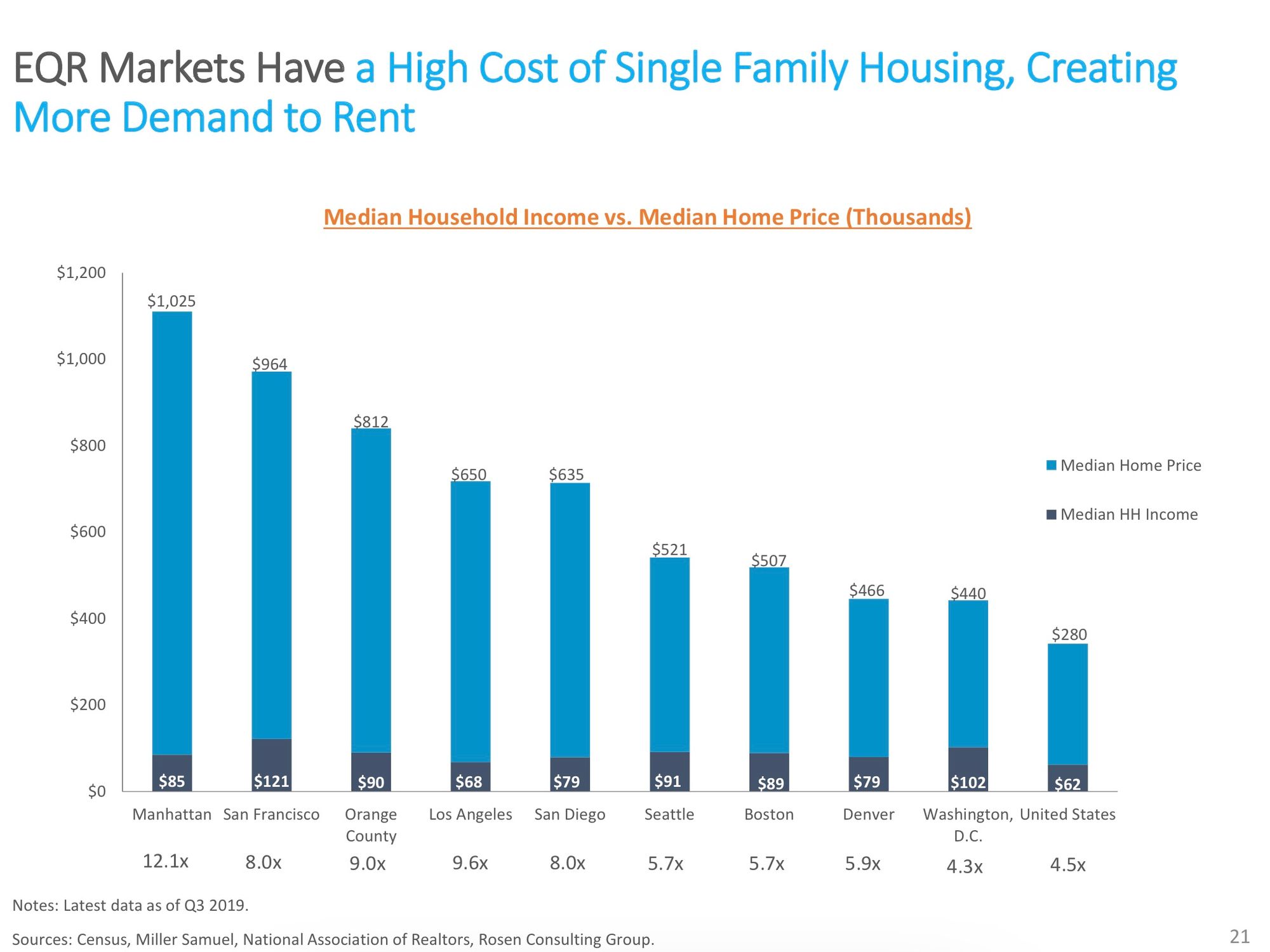

1) Job market - attracts the best entrepreneurs/employers/employees. This attracts the best global talent. Wages/household income are high. People have money to spend.

2) Dating 'market' -lots of potential mates. Meet lots of people, pick the right life partner.

3) Because household income is high, everything is on offer: wide range of restaurants, concerts, museums, theatre, sports events (NY/LA have two baseball teams, two basketball teams, hockey, etc.).

4) Tourism - Wealthy tourists from around the world visit megacities and spend a ton of money. It is tough to see it now but trust me...they'll return. Few will fly from Japan or England or China to visit Flagstaff or even Phoenix. They will go to NY/LA/SF. Some of these international visitors end up moving here and becoming residents.

It is a virtuous circle. When the pandemic fear passes and it is time to open new restaurants, hotels, theatres in NY/LA/SF because that is where the people and the money are. It is that simple. Some people will move out for economic reasons. They will be replaced by richer folks (US megacities pull from the global population). Household income income will grow. Megacities will continue to thrive. I don't expect to see people sporting I love Des Moines shirts anytime soon! I am highly confident in long term demand for tenancy in these markets.

One of my heroes lays it down much better than I ever could right here: https://www.nytimes.com/2020/08/24/opinion/jerry-seinfeld-new-york-coronavirus.html?auth=link-dismiss-google1tap

On the supply side, it is very difficult to build apartments at a price which makes economic sense (except for Class A or high-end luxury apartments with monthly rents of $4-5,000) in these markets. Limited land availability, zoning restrictions (SF/LA have incredibly strict zoning -that is why LA is the flattest city in America - go for a hike and look around!! I'll have more to say on this), and ever increasing construction costs make building challenging to say the least.

Further, as you can see above the cost to own in EQR's key markets is very high relative to the cost of renting (50-70% higher average monthly cost). This is a pricing umbrella which limits the ability of renters to become homeowners, ensuring a stable source of demand (or limited alternative supply). Said differently EQR's markets have true barriers to home ownership a sharp contrast with markets like Chicago, Phoenix, or Atlanta where the cost of home ownership is much more in line with renting.

Stable demand and limited supply bode well for rents and occupancy which gives us confidence in the sustainability of NOI over the medium and longer term (net operating income which is similar to adjusted EBITDA for real estate).

Balance Sheet

Equity Residential has a fortress balance sheet. It carries less than $9 billion of debt (vs. $21 billion market cap) so a loan to value (LTV) of just 30% (at market prices). This is in line with other large cap apartment REITs but is far below what is typically seen in the private market where LTVs typically range from 50-80%. This gives the company the flexibility to acquire additional assets or better yet repurchase stock (apartment REITs ESS and CLPR have recently initiated buybacks). Note that only 5% of apartments are traded as REITs - the rest is held by private market investors - we think public apartment REIT investors would be well served by paying closer attention to the private market.

Valuation

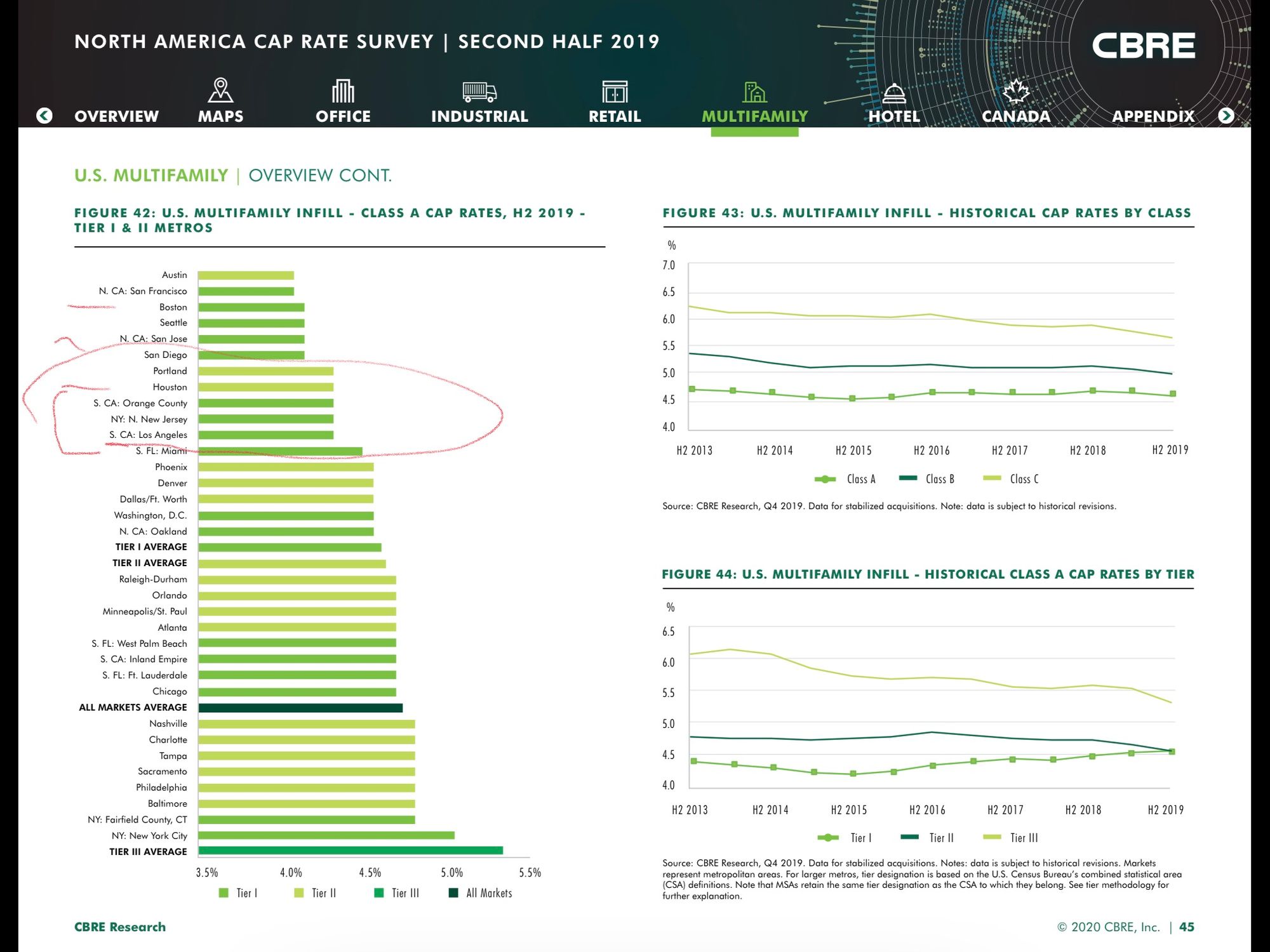

While there are a number of ways to look at the valuation, we again take our cues from the private market. In the private market, institutional grade assets such as those held by Equity Residential have traded at 3.5-5% cap rates (a cap rate is Net Operating Income divided by the price of the asset) over the past 6-7 years. This information (see slide below- anyone can download this for free) is readily available for free online from reputable sources like CBRE or JLL. Interest rates have come down, implying that when the world worries a little bit less about COVID, cap rates could compress further (look at what has happened to PE multiples for most stocks).

There is evidence that the private market is alive and well. At the epicenter of the crisis (and during the peak of the crisis), Clipper REIT refinanced a large Brooklyn property (Flatbush Gardens) at an implied 4.1% cap rate. Similarly and even more importantly (given EQR's California exposure), peer and fellow West Coast Rida Essex REIT (ESS) sold two properties at 4.3-4.4% cap rate during the second quarter (sale agreed in May, post pandemic outbreak). EQR management noted little change in the private market. We have had many, many conversations with private market participants over the past several months and have come to the same conclusion. We think cap rates are probably going lower. The 10 year treasury is trading at 70bps.

If we assumed that Equity Residential traded at a 4.25% cap rate (midpoint), shares could trade back to $80-90. Should shares continue to languish, it is possible we could see an activist become involved and 'broker' the sale of some or all of it's properties. In the meantime investors get to collect a stable and growing 4.4% yield. There is also the possibility that EQR recapitalize it's balance sheet which we will explore soon (time to drop some spreadsheets).

Risks

Regarding property taxes - EQR's largest exposure is California. Prop 13 is the 3rd rail of CA politics. I don't see it going away anytime soon (ever?). With prop tax growth capped at 2% p.a. in CA I see continued positive operating leverage for EQR from 2022.

The main risk is that the pandemic worsens and this negativity leads to a decline in the share price in the near term. We would not recommend this security for short-term investors. We would not recommend any security for short term investors. That's not what we are doing here.

However for investors with a 3-5 year time horizon, we see limited downside with the room for substantial capital appreciation while collecting a 4.4% dividend yield.

Disclosure: As you have probably guessed, I'm LONG EQR.

of course this isn't investment advice...do your own work.

Private Eye Capital Newsletter

Join the newsletter to receive FREE actionable investment ideas.