Columbia Property Trust (CXP) go-private deal suggests significant upside for Kilroy

Paid

Members

Public

To follow me on Twitter (more timely updates), click here [https://twitter.com/PrivateEyeCap]. By my calculations, CXP is getting done at about a 6.3% cap rate. Some of the headline #s I saw don't appear to have ascribed value to the company's development portfolio.

Altice USA- Yes 2Q net adds disappointed but...I think ATUS could triple in 3-4 years

Paid

Members

Public

Quick and dirty: Since reporting 2Q results a couple weeks ago, cable broadband provider Altice USA (ATUS) shares have fallen -17% to $28 and now trade at very low valuation multiples. While 2Q net subscriber additions were modestly disappointing, as shown below, I believe the resurgence of NYC explains this

Lots to like in Kilroy's 2Q conf call

Paid

Members

Public

While Kilroy shares have languished over the past few months, the business continues to make steady progress: * As previously mentioned, during 2Q, development activity commenced for Kilroy Oyster Point Phase 2 (KOP2). Life sciences vacancy in South San Francisco is very low at sub 2% and rents continue to hit

Essex Property Trust- muted 1Q; 2H21 and 2022 likely to shine

Paid

Members

Public

Essex Property Trust (ESS - initial piece here [https://www.privateeyecapital.com/why-would-any-long-term-investor/] & follow up [https://www.privateeyecapital.com/tag/ess/]) posted a slightly better than expected set of results. Shares declined slightly - the market appears to be disappointed that ESS did not increase full year NOI guidance

Things are quite good for sunbelt apartment owners

Paid

Members

Public

Both Camden (CPT) and Mid American (MAA) reported results this week. Operating results are strong - CPT's new lease rents inflected positively and are +4.4% in April (blended lease rates for April of 4.5%). MAA reported even stronger results (slightly different geographic mix - CPT slowed

The market fears office but I love Kilroy

Paid

Members

Public

Kilroy Realty (KRC- find previous writeups here [https://www.privateeyecapital.com/tag/krc/]) - Kilroy completed the sale of a large San Francisco office property for $1.1 billion and reported an ‘as expected’ set of 1Q results (office leases are long term so there aren’t huge Q to

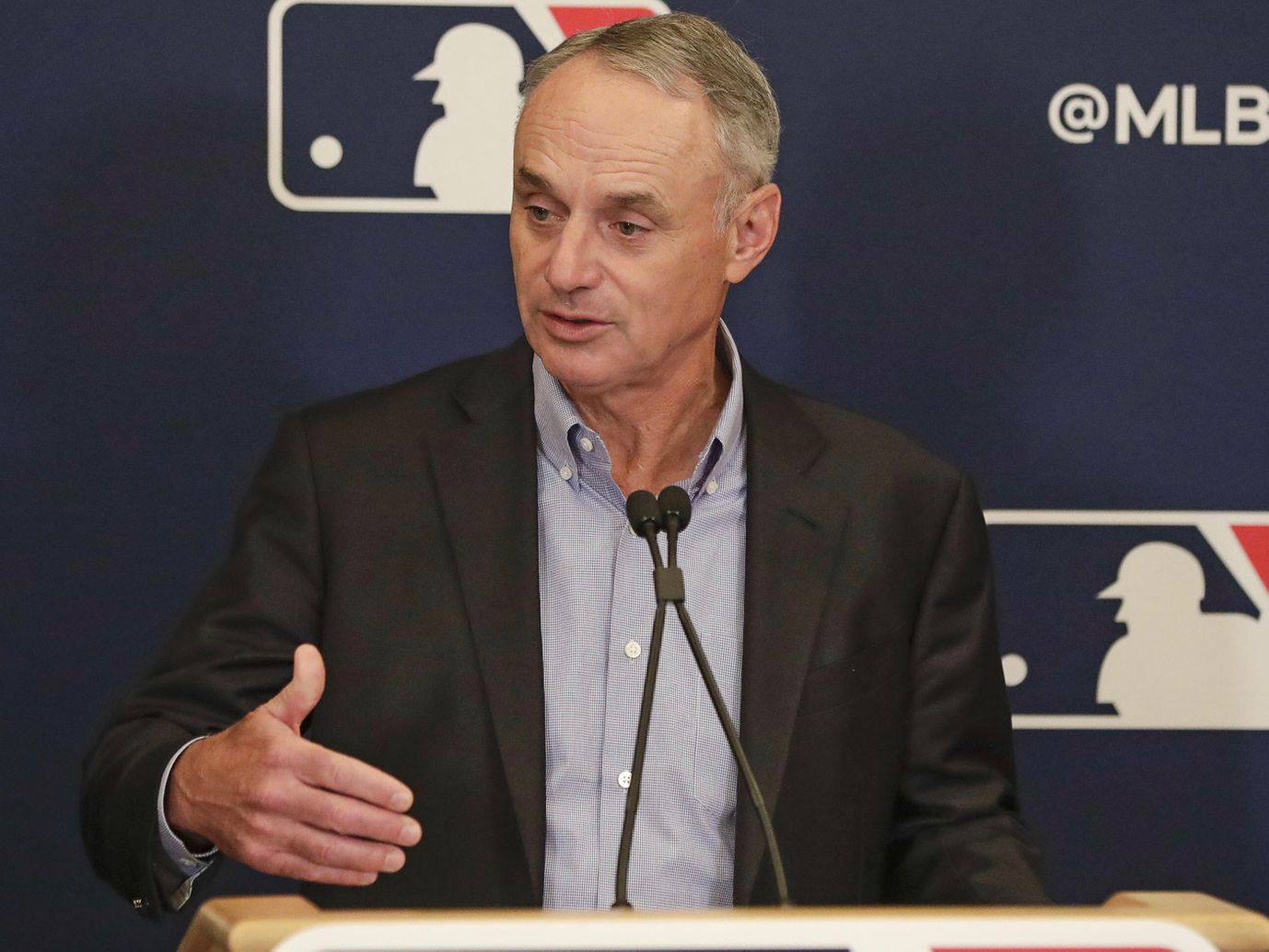

Atlanta Braves: MLB Commish talks 'replacement cost'

Paid

Members

Public

Atlanta Braves (BATRA/ BATRK - initial writeup here [https://www.privateeyecapital.com/have-you-ever-wanted-to-own-an-mlb-team/]) - MLB commissioner Rob Manfred gave us a glimpse into the cost of marginal supply [https://www.si.com/mlb/2021/04/27/rob-manfred-mlb-expansion-fee-over-2-billion] (or replacement cost, if you prefer) by stating that the franchise fee for

Invitation Homes - strong start to 2021

Paid

Members

Public

Invitation Homes (INVH - initial writeup here [https://www.privateeyecapital.com/invitation-homes/]) reported a very strong start to 2021.A decade+ of underbuilding, the maturing of the millennials (marriage, kids, burbs), increased work flexibility (fewer days in the office/ more time at home) and ultra low mortgage rates have caused