Columbia Property Trust (CXP) go-private deal suggests significant upside for Kilroy

To follow me on Twitter (more timely updates), click here.

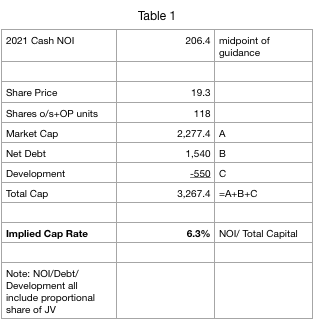

By my calculations, CXP is getting done at about a 6.3% cap rate. Some of the headline #s I saw don't appear to have ascribed value to the company's development portfolio. Here are the #s I'm using:

Note: All figures (NOI, Debt, Development) Proportionally consolidate JVs

Anyway, I suspect the cap rates for NYC/Wash DC portions (60-65% of port) were higher than the SF Bay Area portion. Further, unlike KRC which has an average age less than 10 years old, most of the CXP building are 30+ years old. This makes a big difference when it comes to cap rates because 1/ newer buildings tend to re-lease more quickly at higher effective rents and 2/ newer buildings require less capex/ tenant improvements and thus convert a higher percentage of NOI into actual distributable free cash flow.

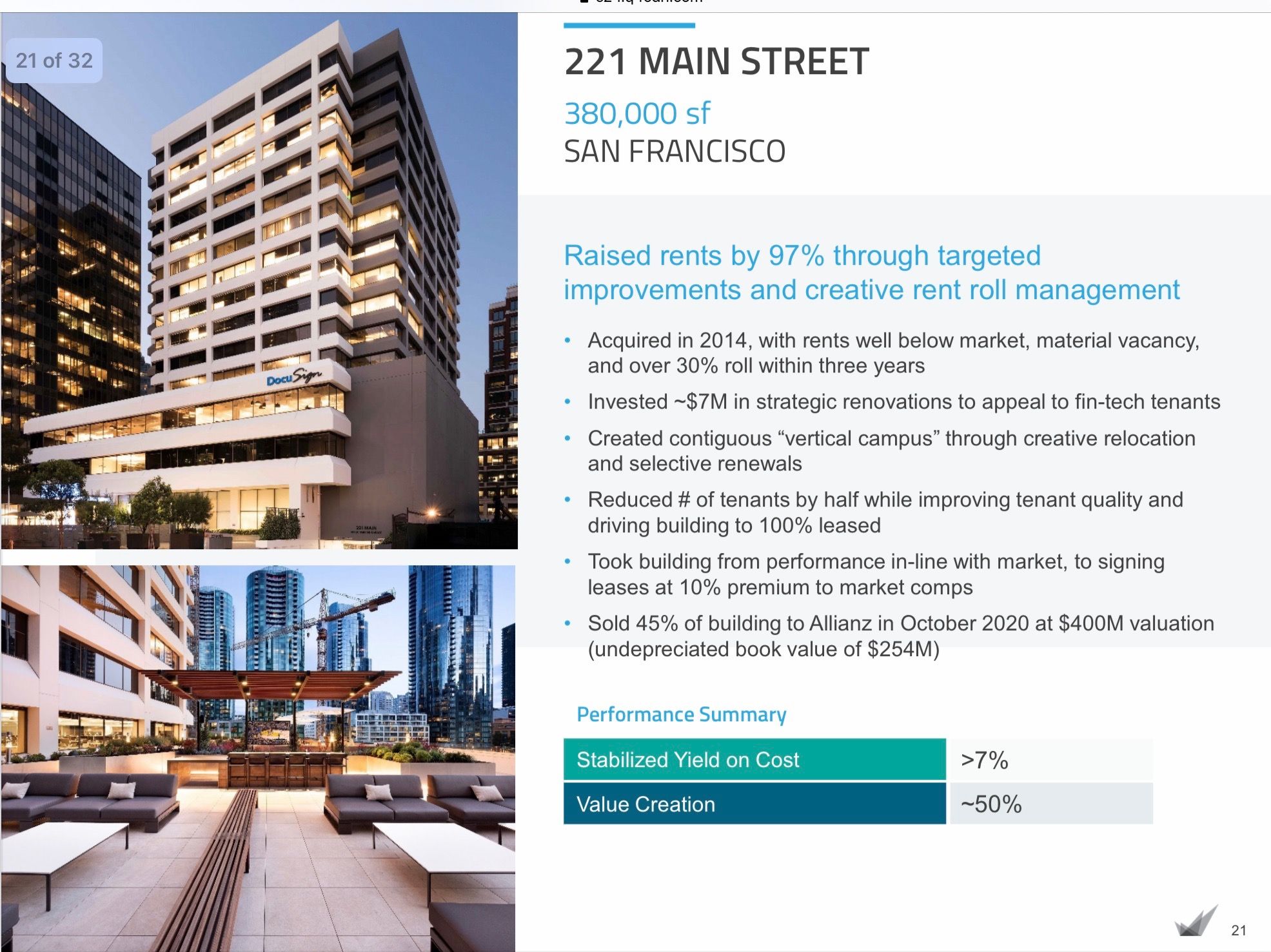

As for the 35-40% of the CXP portfolio is in the Bay Area including 221 Main St, in which a partial interest was sold to Allianz (note Allianz owns PIMCO, the buyer of CXP - several JVs w/ Allianz &CXP so they should know the portfolio well) in Oct 2020 at $1,050/ ft (shown below) whereas KRC trades a hair over $700/ft.

All told, it is good to see private equity commit capital to the megacity office asset class. Recall Kilroy sold The Exchange in San Francisco earlier this year for a huge price ($1,440/ft, 4.7% cap rate) to KKR ->> newer buildings with modern floorplates (and credit tenants) still command premium pricing.

With the 10y @ 1.35% and debt markets wide open, buyers should be able to realize a decent levered return at these prices. There is a giant wall of private money flowing into the market (has driven multifam cap rates into the mid 3s, industrial cap rates into the low 3s, life sci into the 4s).

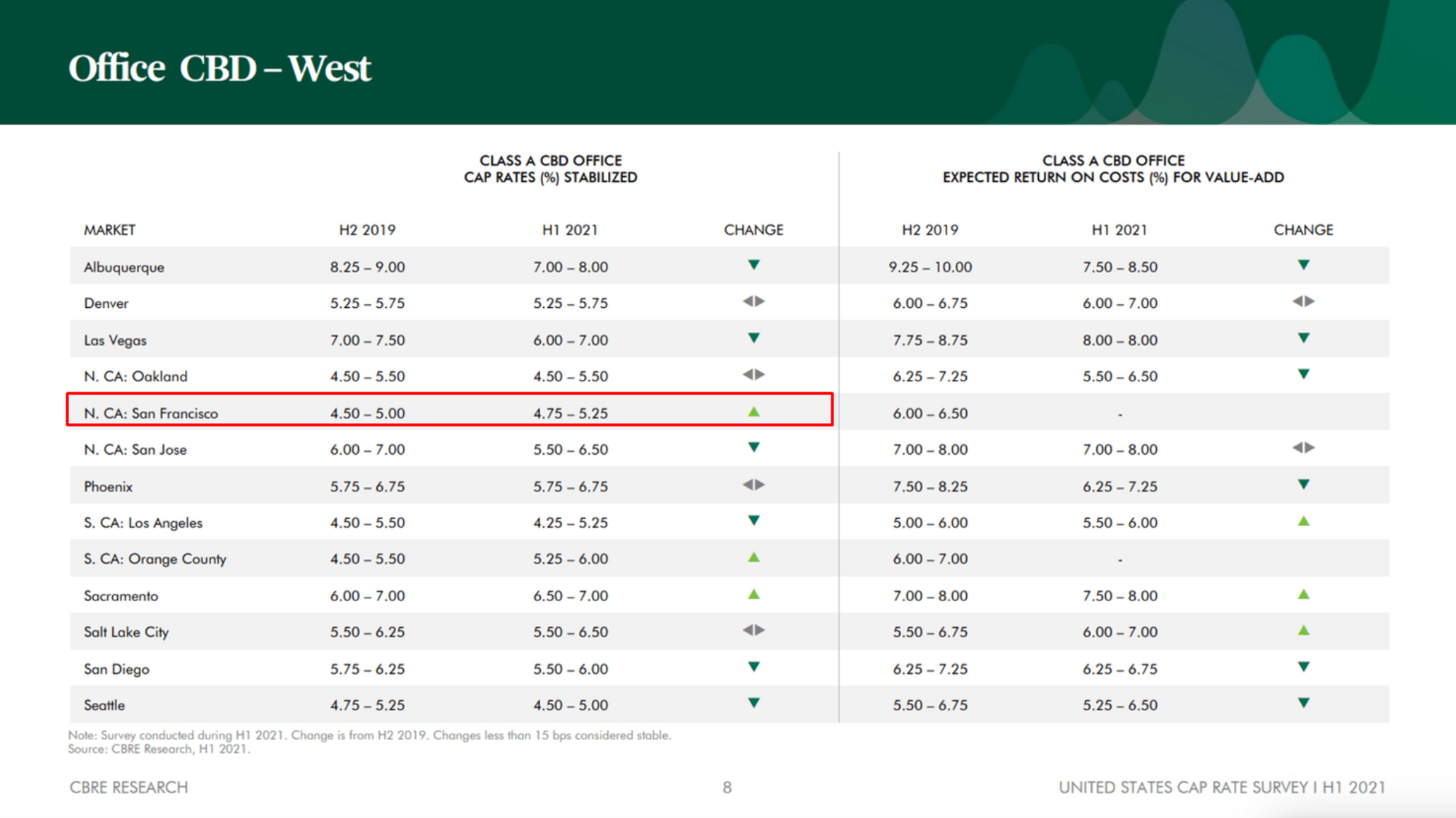

Using 5.5% for Kilroy's office assets (80 bps lower than CXP transaction - given KRC is all West Coast/ big tech tenant base/ newer assets - 5.5% is still more conservative than recent CBRE cap rate survey -see slide below) and 4.5% for life sciences (in line w/ ARE, private markets) I get to $95 a share. Even if I used a draconian 6% cap rate for KRC's office portfolio, I still get to $88/share in NAV (+33% from today's ~$66).

Song:

As always this is not investment advice. Eric Bokota owns shares in KRC.

Private Eye Capital Newsletter

Join the newsletter to receive FREE actionable investment ideas.