Lots to like in Kilroy's 2Q conf call

While Kilroy shares have languished over the past few months, the business continues to make steady progress:

- As previously mentioned, during 2Q, development activity commenced for Kilroy Oyster Point Phase 2 (KOP2). Life sciences vacancy in South San Francisco is very low at sub 2% and rents continue to hit new highs. The company will have little trouble leasing this property and I expect it will announce signed leases in 2H. I continue to see KOP2 adding $5/share in NAV.

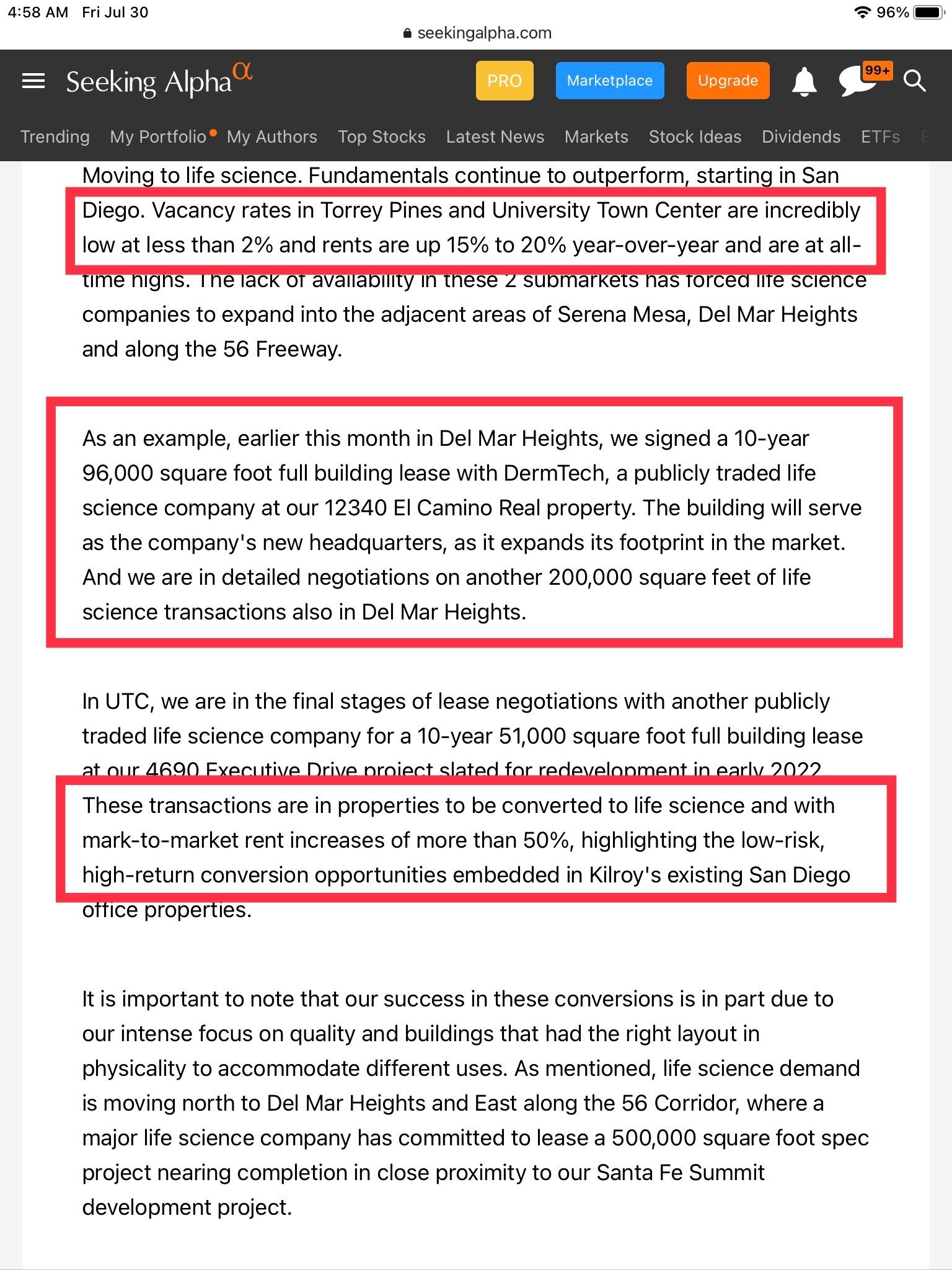

- Continuing with life sciences, Kilroy is in the process of converting some office space to life sciences space in the San Diego region. The economics of doing so are quite compelling considering the huge rent increase as well as lower cap rate (life sciences is trading in the 4-4.5% range both privately and publicly):

Source: Seeking Alpha Transcripts

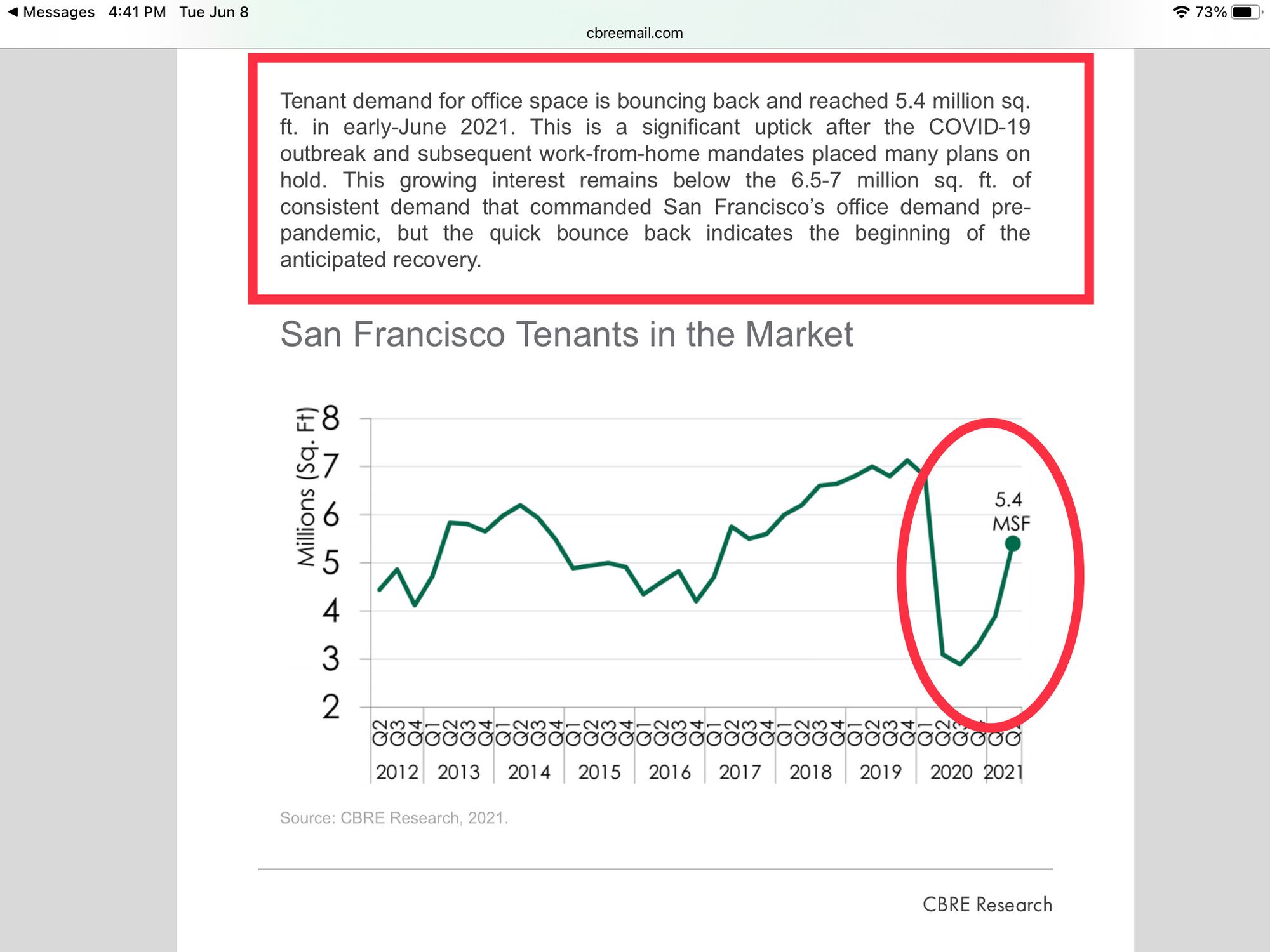

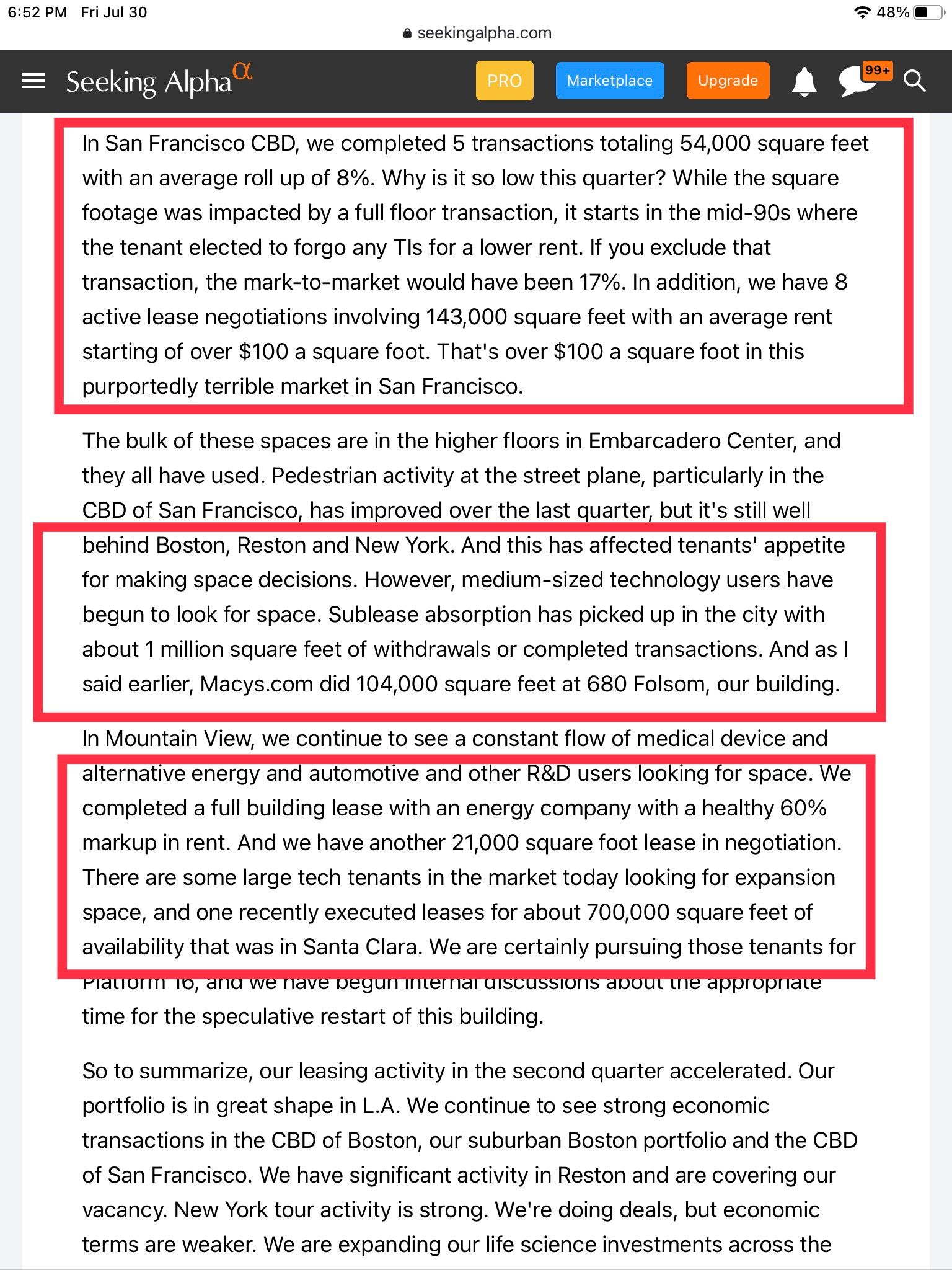

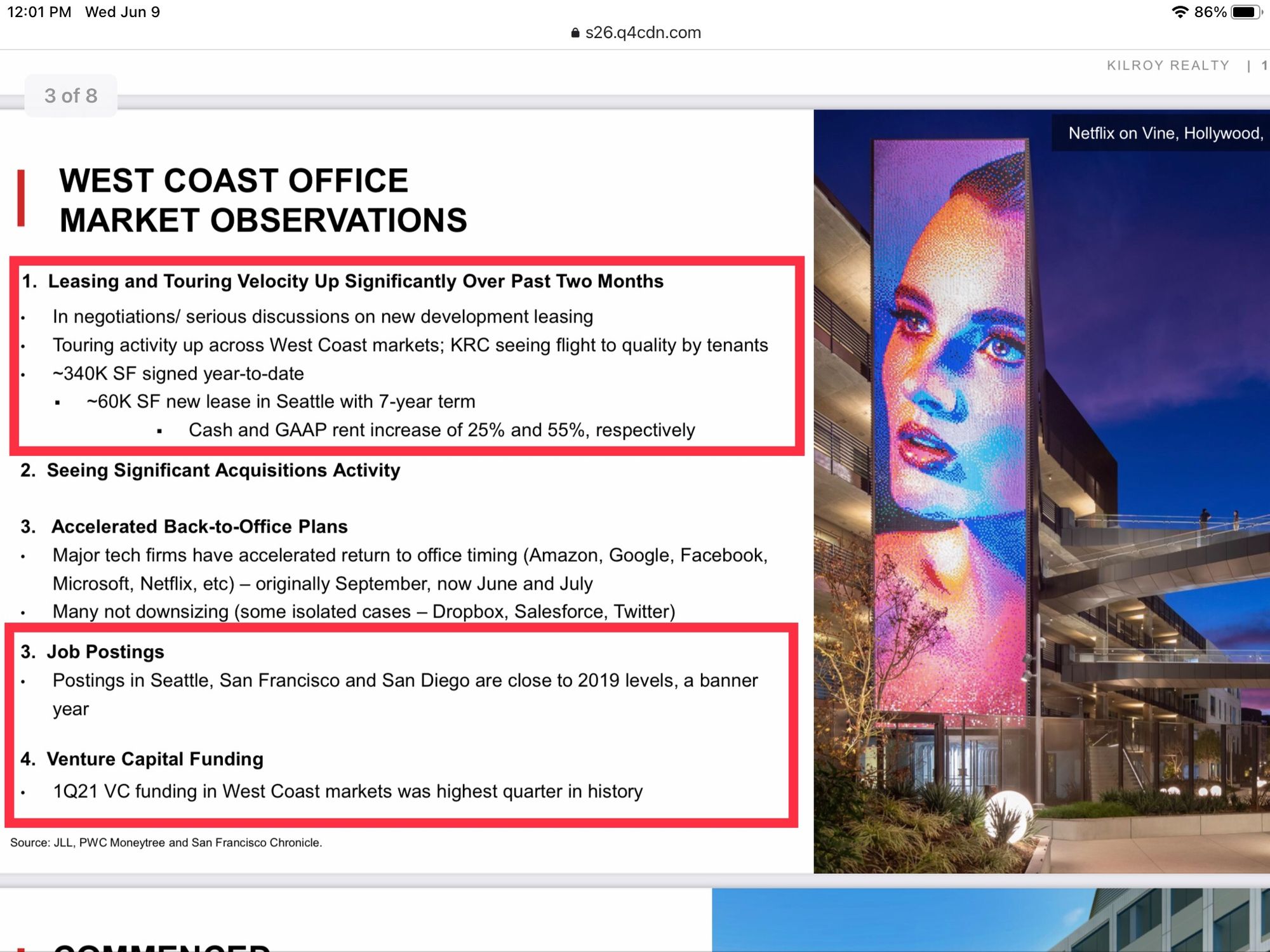

- KRC continues to see a pickup in office leasing interest. Seattle is very strong and activity is picking up in SF. Beyond large tech users (100K+ sq ft), Kilroy is also seeing increased interest from smaller (10-35k sq ft) users.

- Office peer Boston Properties management sounded positive earlier this week regarding how things are coming together in the SF Bay area:

- Prior to the pandemic, KRC believed that upcoming lease expiries were at a ~20% discount to prevailing market rents (see initial piece here). While Kilroy has few upcoming lease expiries in the near term, clearly the market has concerns about the rent levels post expiry. Concerns here are overblown IMO - as rent visibility has improved in recent months, management mentioned that it believes expiring rents are at a 15% discount to current market rents implying that rents have remained pretty stable despite the reporting of the office apocalypse. Job postings in key markets is near 2019 levels:

- Let's talk about the elephant in the room: Many employees want to work from home. Employers (Tenants) NEED to make offices an attractive place for employees to return-->Bifurcation between commodity and Cl A/Trophy continues. $KRC is incredibly well positioned to benefit from young portfolio (9-10yrs avg) of Class A, large floorplate, environmentally friendly buildings. Further real estate costs are a very small % of expenses for successful tech companies. Employees are their main cost and making/keeping them happy is key priority. I expect demand for top quality offices in SF Bay Area/LA/Seattle to remain strong despite Delta return to work hiccups.

- Management didn't provide a ton of color on Austin where KRC purchased the Indeed Tower during 2Q. Given mgmt's track record coupled with the similarity of the asset/tenant base, I expect that this deal will create value for shareholders. Over time, I expect we will see KRC do more acquisitions in Austin.

$KRC -frankly I was surprised to wake up and see Kilroy made an acquisition in Austin. However, I don't think this is a bad thing. Thematically consistent i.e. tech hub, strong growth, Class A (brand new). $VNQ $BXP #Austin #CRE 1/n pic.twitter.com/hGKLfC69B7

— Private Eye Capital (@PrivateEyeCap) June 17, 2021

Btw: I tend to be more active on Twitter than on the blog so you may wish to follow me there for updates on companies mentioned here.

CBRE management noted that investor demand for top quality office buildings w/ tech tenants remains strong:

Source: Seeking Alpha transcript of CBRE 2Q21 call

CONCLUSION

As life sciences goes from ~15->30% of NOI (as developments are completed) over the next 4-5 yrs, market will not be able to continue to ignore $KRC. Discount to life science peer Alexandria (ARE) will have to narrow/close.

ULTIMATELY, IF NAV DISCOUNT PERSISTS, I EXPECT KRC TO SPIN-OFF (2 years from now if I were to guess) ITS LIFE SCIENCES BUSINESS WHICH WILL: 1/ FORCE MARKET TO RECONSIDER THE VALUATION OF KRC AND 2/ PROVIDE AN ATTRACTIVE CAPITAL SOURCE FOR CONTINUED DEVELOPMENT OF THE LIFE SCIENCES BUSINESS.

I see today's NAV for KRC @ ~$95 growing ~5% p.a. as developments are completed. With the 10 year back down to ~1.3%, I expect we will see private market demand for top quality office assets pick up (4-5% cap rate vs. 5.5% I conservatively use in my valuation).

As always, this IS NOT INVESTMENT ADVICE.

Eric Bokota owns shares of KRC. It is entirely possible he is wrong about everything written here. Do your own work.

Private Eye Capital Newsletter

Join the newsletter to receive FREE actionable investment ideas.