Altice USA- Yes 2Q net adds disappointed but...I think ATUS could triple in 3-4 years

Quick and dirty: Since reporting 2Q results a couple weeks ago, cable broadband provider Altice USA (ATUS) shares have fallen -17% to $28 and now trade at very low valuation multiples. While 2Q net subscriber additions were modestly disappointing, as shown below, I believe the resurgence of NYC explains this weakness. I do NOT believe anything has fundamentally deteriorated in the business. As such, I see weakness in the shares as an opportunity for long term shareholders as I believe the stock could rise 200% over the next 3-4 years as ATUS's ample free cash flow grows and is used to buy back lots and lots of stock.

Broadband represents the vast majority of ATUS's EBITDA/Free cash flow. I view broadband as a fantastic business with huge barriers to entry, limited competition, and strong pricing power.

It is rare to find a very stable/non cyclical business trading at just 8x 2022e EV/EBITDA and 8x free cash flow to equity. What are they doing with ALL the free cash flow? Buying back stock.

This Actionable Investment Idea is NOT for the faint of heart. This situation is riskier than other investment ideas written up on this site - please see the disclaimer section. Not only do levered companies tend to have highly volatile share prices but leverage increases the risk of permanent capital impairment to equity holders. In addition, there are other risks to consider with this investment, some of which I walk through near the end of this report.

Today I explore what the market doesn't like about ATUS and why I think the market is wrong using insights from last year's apartment REIT project.

What crushed the stock? 2Q Results. Here is my take:

1) With regard to the most recent quarter, the obvious area of disappointment is ATUS reporting zero net broadband subscriber additions (to be referred to as net adds) during the second quarter. Not only did it report poor net add #s for 2Q but ATUS backtracked on the its full year guidance of net broadband adds being inline with 2018/2019.

This is in contrast to John Malone's Charter (CHTR) which reported a strong quarter of net adds just two days later. Comcast (CMCSA) also reported solid net subscriber adds for 2Q. So what gives?

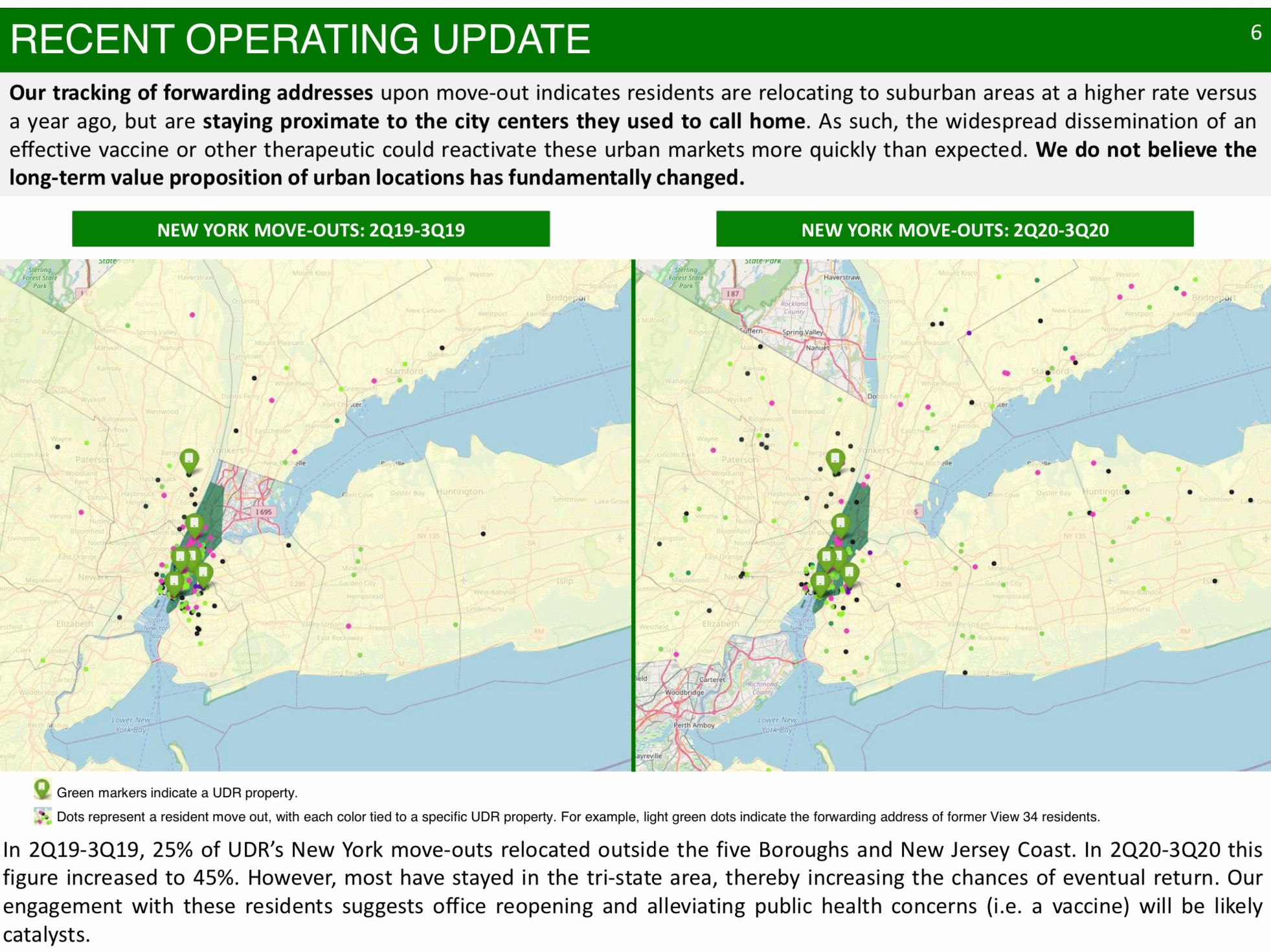

As pertains to the second quarter specifically, ATUS suffered a partial reversal of some of the pandemic induced NYC mass outmigration experienced in 2020. Unlike Charter, which is considerably larger than ATUS and geographically diversified, ~65% of ATUS's business (Optimum brand-> formerly the Cablevision assets) is concentrated in the areas surrounding NYC. While the 'Death of NYC' said everyone was moving to the sunbelt, having done considerable work on apartment REITs with exposure to the NY area, the reality was that:

A) many people fled NYC - for evidence, go back and look at how bad the apartment REITs #s were last year.

B) The COVID induced exodus of NYC was to ATUS's benefit in 2020- the company does not operate in NYC but has a strong market position in surrounding areas. ATUS reported record broadband subscriber additions in 2020, with 2Q20 being its best quarter as most of those fleeing NYC moved to surrounding areas. Recall the decline in apartment occupancy NYC focused apartment REITs experienced last year. It was truly unprecedented. Here is a slide from apartment REIT UDR last year showing NYC COVID refugees stayed close to home after fleeing the city in 2-3Q20:

ATUS management acknowledged this benefit on last year's 2Q call:

Source: ATUS 2Q20 conference call transcript from Seeking Alpha

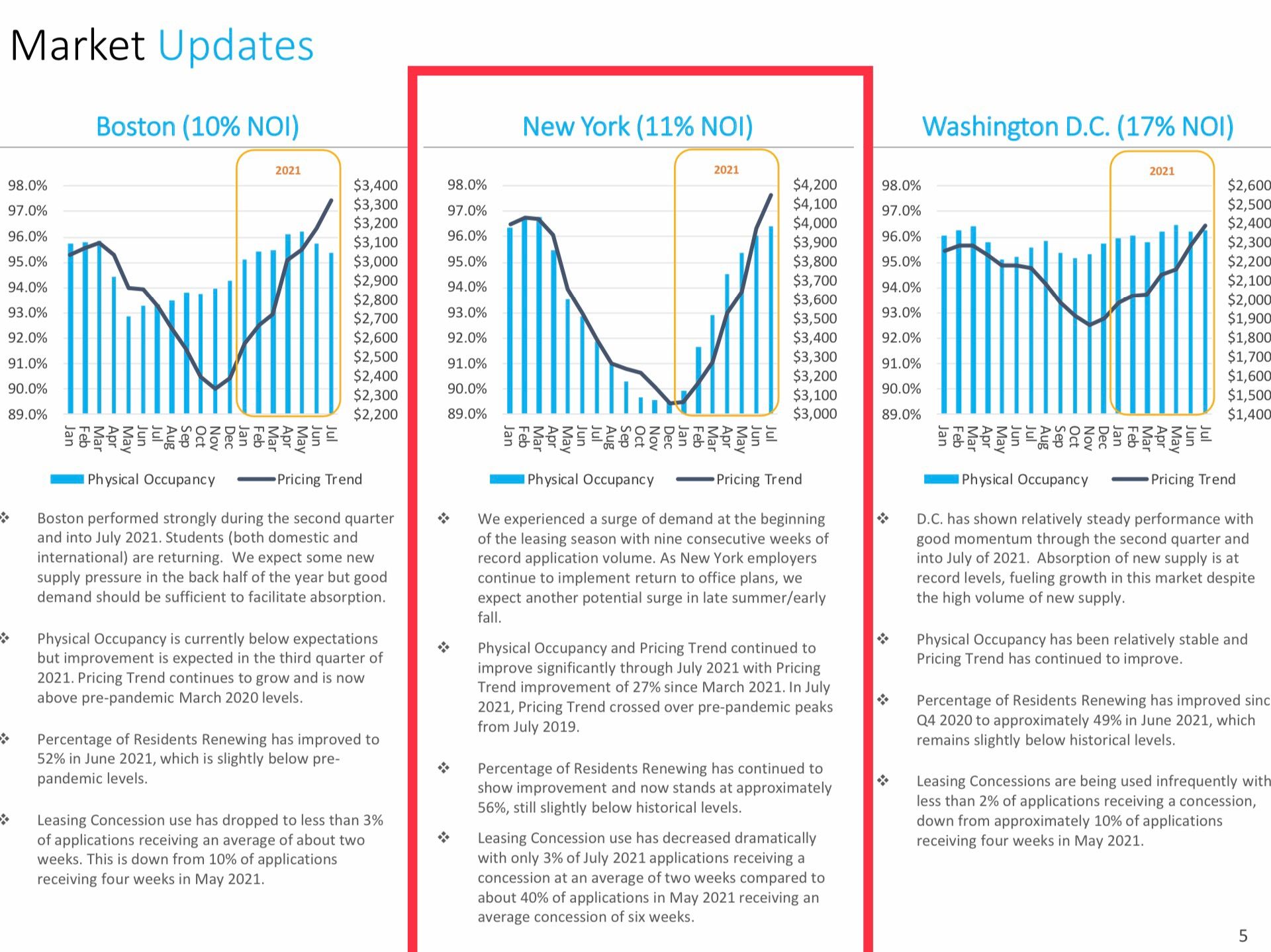

C) This year we've seen people moving back to NYC en masse:

Source: Equity Residential 2Q presentation

Those moving back to NYC are coming from somewhere and I believe that many are coming from areas served by ATUS which is temporarily increasing churn/stifling net adds. So to me this isn't super surprising - COVID created has created innumerable distortions in the supply and demand for various services.

Previously ATUS had guided 2021 to have net broadband subscriber additions ('net adds') as being on par with 2018-19. Having 2Q net adds of zero (and seeing a weak start to 3Q), management walked back prior 2021 net adds guidance but has kept other financial guidance in tact. It is entirely possible that we see another weak quarter or two of net subscriber additions in 3-4Q. IMO this is more than priced into the stock.

Why I like ATUS and the broadband business

- Cable broadband is a very good business - Altice generates non-cyclical monthly recurring revenue and faces relatively limited competition (fiber competition in about ~45% of their footprint). Broadband is pretty much a necessity. Providing a necessity with relatively limited competition translates to pricing power for ATUS.

- There are significant barriers to entry in the broadband/fiber business including: high cost of building out connections to the home. Similarly this endeavor takes a very long time. After building a network, an operator must then attract new subscribers to its network. Lots of time & billions of expenditure for an uncertain payoff.

- ATUS trades at a low valuation - 8x EV/EBITDA (2022) and a P/FCF of just 8x (and 2022 free cash flow is penalized by elevated capital expenditures which should begin to decline in 2024). These are very low multiples for a competitively insulated, non-cyclical business that is growing.

- While ATUS employs significant financial leverage (ND/EBITDA of 5.6x), the company has ample liquidity, manageable upcoming debt maturities and has limited covenants. Further, the business is not cyclical and is highly cash generative. ATUS was able to access the capital markets during 2020 and push out debt maturities while lowering interest costs. While debt levels are higher than typically seen at publicly traded companies, I believe that this is a sustainable capital structure given the consistency of cash flow.

- ATUS is likely to dramatically reduce the number of shares outstanding by allocating all free cash flow to share repurchases. Since its 2017 IPO, Altice has reduced its shares outstanding by over 35%!! Share repurchases at very low valuation multiples are accretive to per share value. Further, I believe the sheer size of the repurchase will make it hard for the market to ignore the value of ATUS.

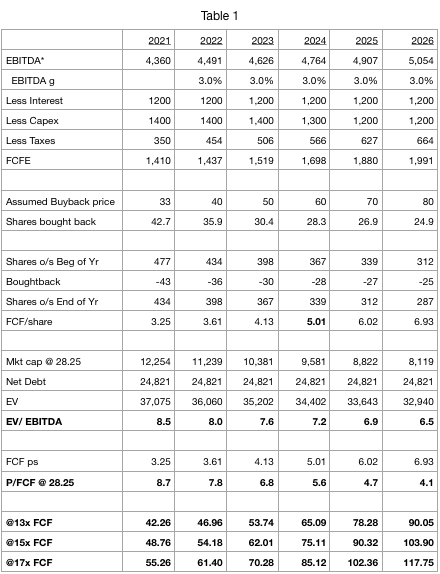

Valuation - what might ATUS be worth in 3-5 years?

*My #s differ slightly from reported b/c I use estimated Proportional EBITDA which strips out the 49.9% of Lightpath EBITDA attributable to MSIP

I expect that the broadband business will grow 6-8% per year due to additional subscribers (1-2% per year) with the remainder coming from price/mix (mix being people upgrading to faster packages, i.e. 1GB). However, I assume EBITDA growth of 3% per year for ATUS because some of broadband growth will be offset as ATUS sheds video/fixed-line telephony subscribers. It is important to note that ATUS has been shedding video/telephony subscribers for the better part of a decade while still growing EBITDA. Overall I think the contribution of video/telephony to group EBITDA is fairly limited (prob <15%).

I assume all FCF is used to buy back shares which is consistent with what the company has done since coming public. Paradoxically, the longer Altice's share price stays depressed, the better it is for long term shareholders (as each $billion spent on repurchases buys a greater # of shares). Over the forecast period, I expect ATUS to shrink its share count by another 35%.

Growing FCF coupled with a shrinking share count lead to dramatically higher free cash flow per share looking out a few years - growing from an estimated ~$3.25 per share in 2021 to ~$5 per share in 2024. Ultimately I think the market will be forced to award the company a significantly higher multiple as cash is generated and shares are repurchased. My base case is a 15x FCF multiple in 2024, resulting in a $75 share price, nearly triple from today's price. Today cable peer Charter trades at ~16x next year's (2022) FCF, 10.6x EV/EBITDA and a similar EV/ homes passed. To be fair Charter is a superior company - it has better assets and has executed better on growing net adds. I believe Charter is undervalued today -I think fair value is closer to ~20x FCF and that this gap is closed over the next few years as the company executes so I'm assuming Altice trades at a 25% discount (P/FCF multiple) versus the 50% discount at which it trades today.

RISKS

An investment in ATUS shares are not without risk. Risks include:

-Financial Leverage - as mentioned, ATUS carries significant financial leverage with net debt to EBITDA of 5.6x (vs. ~4.2x for Charter). Given the structure of the debt (long term, few upcoming maturities, credit facility w/ ~$2 bn capacity in place) low interest rates, and stable cash flows I believe the debt levels are manageable/sustainable.

-ATUS is effectively controlled by controversial Franco-Israeli billionaire Patrick Drahi. While ATUS has been reasonably well run under Drahi's ownership since coming public, Drahi's track record in Europe is poor. Drahi took on too much debt to buy lower quality assets (mobile operators -more competitive environment/basically no price power). Then after the market puked out Altice Europe shares, Drahi bought them out on the cheap. The reason I'm willing to own ATUS despite Drahi's track record is that a) it isn't likely that he can buy a major US wireless asset - they are too expensive (b) it is likely that he learned something from his experience and will not repeat the same mistakes in the US (c) he is effectively trying to take ATUS out on the cheap by buying back shares rapidly. This should serve long term shareholders in ATUS as well.

-Acquisitions - Since coming public, ATUS has generally been very sensible in its acquisition strategy - typically buying small broadband operations to expand its area of operation. Recently it has been rumored that Altice USA is contemplating the acquisition of Mint Mobile, an MVNO which I view as being somewhat outside its core business. While it is possible that such an acquisition would be value accretive for shareholders, I'd prefer the company buy other broadband operators or simply continue to just buyback stock.

-Increased competition from fiber - this is a virtual certainty but most likely will occur incrementally/at the margin as telcos like T/VZ gradually expand their footprint. As we sit today, I estimate that ATUS competes with telco fiber in ~45% of its footprint (primarily in the Northeast). ATUS has competed fairly well with VZ Fios in the Northeast.

-5G/wireless broadband risk - broadband services are being provided through wireless providers. To give some context, wireless providers have talked up their ability to provide 'broadband' with the emergence of 3G and 4G as well. While 5G will allow for faster download/upload speeds than 3/4G, from what I've seen it meaningfully lags the cable broadband speeds provided by Altice, Charter, etc. Further, over time our need for speed increases (video streaming services, 4k video, Zoom/video calls, gaming, virtual reality, new digital things we can't yet imagine but won't want to live without). This is magnified by the number of people using the service within a given household. Also it is unclear whether 5G broadband will be provided outside of very dense areas (CBDs). Given the importance of broadband as an essential service, saving $10-30 per household per month to buy what is likely to be an inferior service seems a poor value proposition.

-Regulation? As mentioned there is relatively limited competition (and sometimes no real competition) which sometimes leads to talk of regulation.

Other resources:

Here's a good podcast where Francisco Olivera explains the Altice investment case from December 2020: https://podcasts.apple.com/us/podcast/francisco-olivera-altice-usa-atus/id1437766060?i=1000501575784

IMO, Librarian Capital on Seeking Alpha has done a good job covering the ATUS investment case - find his work here.

The stock/sector is also well covered on https://yetanothervalueblog.substack.com/

Clip:

AS ALWAYS THIS IS NOT INVESTMENT ADVICE - DO YOUR OWN WORK.

Eric Bokota owns shares of ATUS.

Private Eye Capital Newsletter

Join the newsletter to receive FREE actionable investment ideas.