Index Weightings Help Explain Why Many Bargains Abound in REIT-land

I’ve been writing quite a bit about apartment REITs lately. Any time I identify numerous bargains within one specific sector or sub-sector, I’m effectively saying that I am right and the market (stock price) is wrong. With billions of dollars invested and hundreds (if not thousands) of analysts/portfolio managers also evaluating the REIT space, a fair question I’ve received is ’What makes you think you are right?’. Today I highlight 6 reasons why I believe there are tremendous inefficiencies in the pricing of REITs and the reasons why I believe REITs will be reprice higher:

1 -REITs are ~25-30% of owned by ETFs. ETFs have no interest in the valuation/fundamentals of the various assets held/purchased. ETFs simply look to match the index they follow - there is no conscious thought given to the pricing of assets.

2 -The largest ETF, VNQ -Vanguard’s Real Estate Index Fund is market cap weighted & VERY concentrated - when an investor buys VNQ ~46% of the investment is put into just 10 holdings (adjusting for VNQ’s holding of Vanguard RE 2 - which appears to be invested similarly to VNQ). The S&P Real Estate Select index/ETF (XLRE) is even more concentrated with the top 10 holdings making up nearly 70% of total assets.

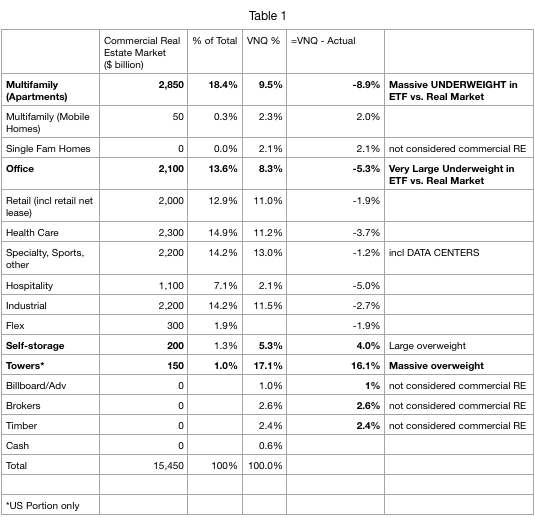

3 -The largest ETF, VNQ DOES NOT CLOSELY RESEMBLE THE US REAL COMMERCIAL PROPERTY SECTOR. This point CANNOT BE OVERSTATED - two of the largest sub-sectors of the real commercial property sector, apartments and offices, represent a small fraction of the largest REIT index/ETF. Conversely, non traditional/specialty sub-sectors cell towers, data centers, and self storage are significantly over represented in the indices. This creates tremendous opportunity for astute investors to select individual REITs at large discounts to readily ascertainable private market value - this is most apparent in the apartment REITs.

Note: Single Family Homes, Billboards, Brokers, and Timber show up as zero weight in Commercial Real Estate Column because they are not commercial property.

In July 2019, NAREIT released a piece entitled ‘Estimating the Size of the Commercial Real Estate Market’ which included estimates of the real property value for each of the main sub-sectors within CRE. Since this time, values (private & public) for some of the asset classes has certainly changed (most obviously industrial has gone up, retail/office/hotel valuations have come down to varying extent). In the comparison table above, I’ve made some adjustments to attempt to account for these change. As you can see above, relative to the actual weight of the asset class in the real estate market apartments are massively under-represented in the largest REIT ETF, VNQ.

4 -This is further exacerbated by:

A) Sell side analysts at big brokers/banks (i.e. GS, MS, C, etc) who devote most of their time to data centers and cell tower companies (which represent large index weightings) and spend comparatively little time in staying apprised of developments in the private market for real estate sub-sectors with low index weightings like apartments despite the fact that 95% of the market is private. As I've said before, for apartments the PRIVATE MARKET IS THE MARKET (this holds true for offices/ shopping centers, etc). Hence the private market comparable transaction data is of immense value in determining the true fair value of the REITs. However, sell-side/broker research underweights the importance of private market value, neglecting the most relevant comparison base for apartment REITs.

B) Most REIT fund managers tend to have sub-sector weightings similar to the index. This is the perverse behavior of active fund management whereby fund managers adopt ‘closet indexing’ strategies to avoid getting fired (for underperforming) while still collecting active management fees. Active share in actively managed REIT funds tends to be relatively low.

5 -Institutional Equity managers (Mutual funds/ Hedge Funds) tend to shun REITs, in part because they don’t screen cleanly - i.e. book value is understated due to annual depreciation charges (though economically most properties appreciate over time) leading to P/B ratios much higher than P/NAV. Similarly Net Income is minimal due to Depreciation charges. On the site, I have included a simple tutorial which shows how to estimate NAV per share for a REIT.

6 -Retail investors tend to be dividend yield seeking. Retail investors are generally unaware of private market metrics used to determine transactional real estate pricing. This is evidenced repeatedly on Seeking Alpha (which draws millions of retail investor visitors). Looking through the hundreds of REIT articles published per month on SA, many highlight the REITs dividend yield in the title. Very few have any mention (or understanding) of cap rates/price per unit (which are the metrics on which commercial real estate tends to trade in the private market).

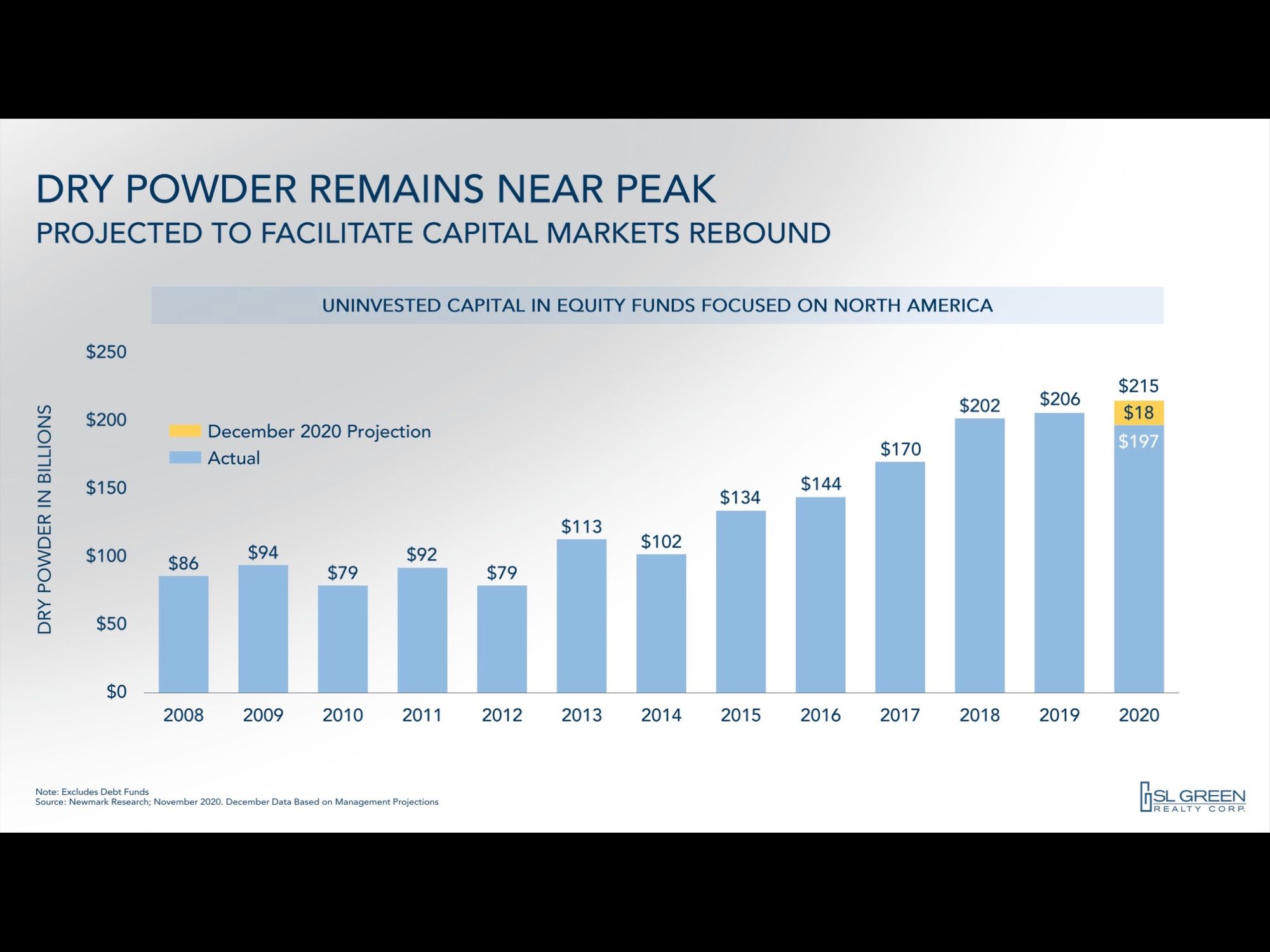

While the aforementioned factors may explain the conditions by which apartment real estate securities have become undervalued, there are unlikely to be significant changes in the factors noted above. So how does this work itself out? There is a notable self correcting mechanism: the private market/M&A (as we are seeing with BPM/BPY) and the massive piles of private equity capital dry powder allocated to real estate:

Real Estate Private Equity dry powder allocated to North America sits north of $200 billion (potentially $800 billion when leveraged). As this capital is deployed, possibly involving the purchase of one or more of the REITs, I expect share prices to revert to NAV. Alternatively REIT management teams can build NAV per share via asset sales and share repurchases at a discount to NAV. Several of the apartment REITs have repurchased shares in 2020 and have current buyback authorizations.

In the meantime the market has offered us the opportunity to purchase a collection of quality assets which are building value over time at a significant discount which tends be a good recipe for solid long term investment returns.

Song:

As always, this is NOT INVESTMENT ADVICE. Do your own work.

Private Eye Capital Newsletter

Join the newsletter to receive FREE actionable investment ideas.