Calculating NAV per share

A REIT's NAV per share (Net Asset Value) is usually significantly higher than its stated accounting book value under US GAAP. I've received a few inquiries on how to calculate the estimated NAV for a REIT and have compiled this quick tutorial.

Materials required: Annual/Quarterly supplemental report found on nearly every REIT's investor relations page - this provides NOI, debt, preferred, share count/OP units, glossary of terms, etc

Key market inputs: Cap rate - this is based on comparable private market transactions. Common places to find these figures are: syndication/private fund deal pitches, transaction news flow (examples: here, here) , as well as being frequently discussed on quarterly earnings calls for REITs (here, here).

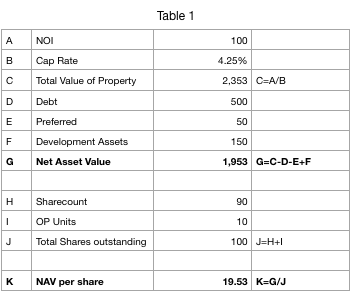

From here we can calculate NAV per share (see table 1):

We take NOI* and divide by the appropriate cap rate to determine the Total Value of Stabilized Properties owned by the REIT. We then deduct other claims on the value of the property - most notably claims from debt holders (imagine the value to a home owner being net of the mortgage holder's claim) and in some cases preferred stock holders (broadly similar to a debt holder's claim).

In many cases a REIT will have some development projects (Non Stabilized Property) in process which are generating minimal levels of NOI at present. However in coming quarters and years, these project will have tenants, collect rents, and produce NOI for shareholders. Thus we need to sort through the development section of the quarterly supplemental to find out how much has been spent on these development projects to give us a sense of how to value them. Unless I have decent visibility into the NOI produced by these projects, typically I will conservatively value these projects at cost. Note that successful completion will usually result in the value being higher than cost - illustrated here. In cases where we have substantial pre-leasing (best example being Kilroy which has pre-leased 90% of its in process development pipeline so we have a much better sense of future NOI), I'll add the expected NOI into total NOI (Item 'A' in table 1) and then include the cost required to complete the project as debt.

What is left is attributable to equity holders. All we have to do next is get the correct number of shares. There are often two categories of shares for REITs - the shares which are publicly traded and OP units which encompass a couple of things, notably un-traded (but convertible) shares held by management/insiders or un-traded (but convertible) shares which were issued in a transaction (for instance the purchase of a property). We add the publicly traded shares to the OP units to get the total number of shares. Lastly we divide the value attributable to equity holders by the total number of shares.

*NOI figure I use includes Proportionally consolidated JV NOI - to maintain consistency, the debt figure I use includes Proportionally Consolidated JV debt.

Private Eye Capital Newsletter

Join the newsletter to receive FREE actionable investment ideas.