10 year Treasury hits one year high

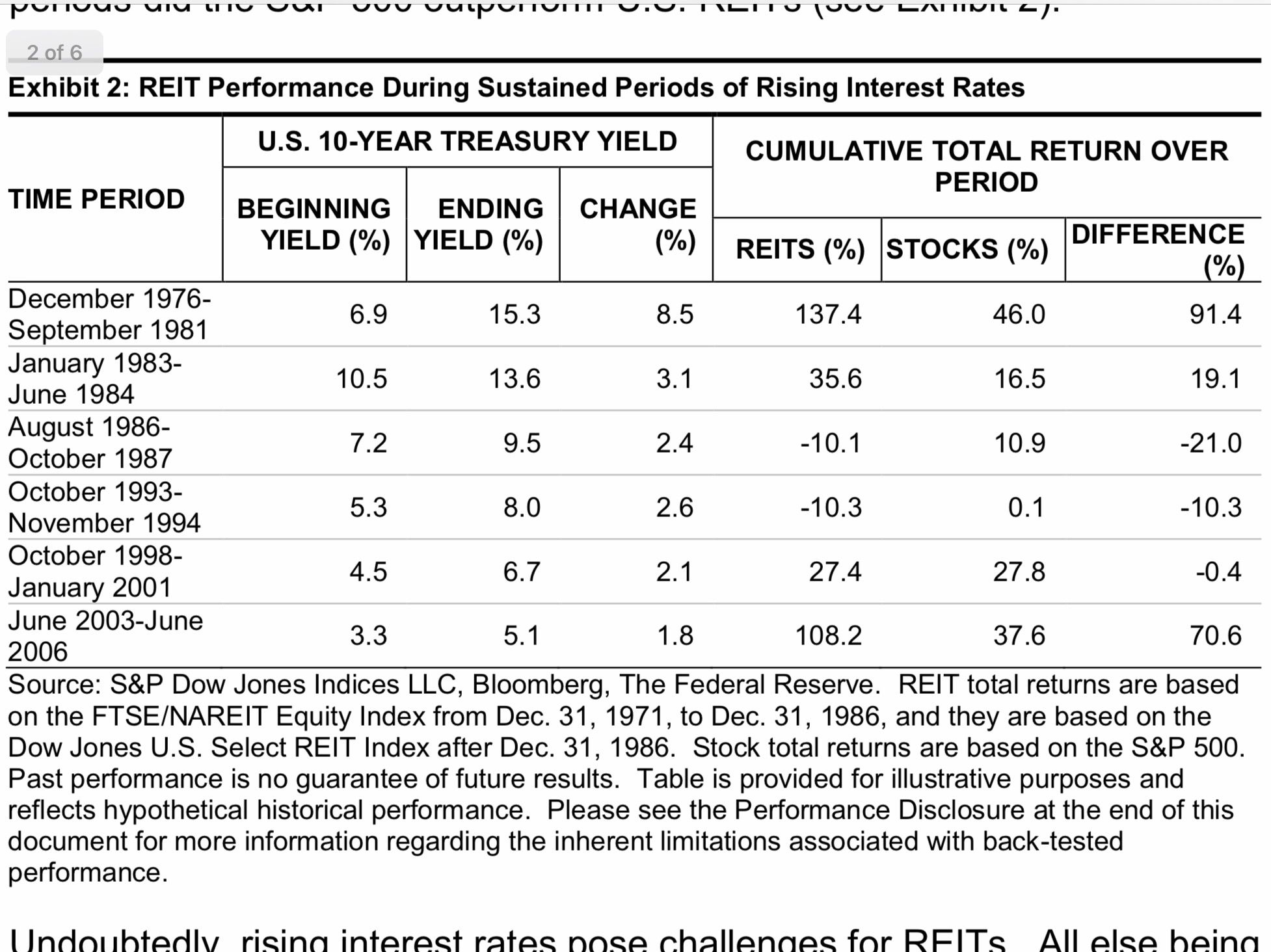

Last week, interest rates and inflation came back into focus as the 10 year treasury yield hit its highest levels in one year. The ten year treasury rate has doubled since I started this site a mere 6 or so months ago as inflation expectations have increased and market participants see an endless sea of treasury bond issuances ahead. While I don’t have a differentiated view on interest rates/inflation, it certainly seems plausible the massive fiscal/monetary stimulus could result in higher inflation and higher interest rates. The conventional wisdom is that rising rates are bad for REITs though history tells us this is not necessarily so:

As you can see above, returns were positive in 4 of 6 periods. As go apartment REITs, here is my thinking on the impacts of higher inflation/interest rates -The good:

- In an inflationary environment, pricing power is paramount. As mentioned in the 1/17 newsletter, apartments rents (and mobile home parks) re-price annually which makes them among the best positioned real estate subsegments. Many subsegments (office, retail, industrial) have longer term leases. While some of these have bumps linked to CPI, many have fixed escalators - if inflation is in excess of the rent escalator, purchasing power is not protected.

- Similarly, maintenance capital expenditures (which are subject to inflation) are much less burdensome for apartments at around 10% of NOI (even less so for mobile home parks) than for office and malls which are upward of 30%.

- Within the expense base, property taxes and insurance are the largest categories within operating expenses. While insurance costs are likely to increase at rates higher than the overall level of inflation (representing higher replacement costs due to building cost inflation), property tax changes vary widely. In this respect CA heavy apartment are best positioned because property taxes increase a maximum of 2% per year (thank you Prop 13). Massachusetts also has limits on property tax hikes. If rents increase faster than operating expenses, this positive operating leverage means that NOI will grow faster than rents.

- One place where inflation is evident is in building costs - both materials and labor. This makes it more expensive to build new new apartments (replacement cost is increasing-> if the cost to build new is higher, the value of the existing stock of apartments should increase which bodes well for apartment REITs). Similarly higher interest rates make financing new construction more difficult. Higher building costs/higher interest rates are likely to curtail new apartment supply which bodes well for rent/NOI growth at existing buildings. The apartment supply which does come on will require higher rents to achieve targeted returns - likely Class A+ or luxury product (not competing with class B apartments and still being priced above existing stock of class A).

- Home buying enthusiasm may wane as mortgage rates increase - Bigger factor in Sunbelt markets (where housing is relatively cheap and homes compete with apartments) than in CA/gateway markets (where homes are very expensive and most renters are considered ‘renters by necessity’ - generally not able to purchase a home).

The not so good

- At some point, higher interest rates will curb the enthusiasm of private market buyers. Private market buyers tend to use higher levels of leverage to purchase apartment buildings. Low interest rates positively impact deal economics leading buyers to be willing to pay higher prices. This could reverse the trend of cap rate compression we have been seeing in many markets. It is possible that the sea of capital which has flowed to private equity real estate means that deals will still be done at low cap rates (and returns to the levered private equity stub will be lower). With the 10 year Treasury at 1.5%, apartment REIT cap rate spreads remain reasonably attractive versus historical averages.

- If inflation rises significantly, this could lead government to enact price controls (rent control) as a populist appeasement measure - this would be a clear negative.

- Higher inflation may have a negative impact on the overall economy which could hurt demand for apartments - it could cause households to ‘double up’/stay doubled up.

With the apartment REITs have run up over the past several months, most still sell at a discount to private market value/replacement cost offering some protection to apartment REIT investors. If inflation picks up significantly, more highly leveraged ownership structures utilizing long-duration fixed mortgages could end up being the best performers (rents/asset values grow, debt cost is fixed at today’s low interest rates).

With regard to apartment Class (primer describing apartment classes here), Class A will benefit from having the low maintenance capex (newer buildings). That said, B buildings will benefit as replacement cost increases, the rent gap between new construction and existing rents on Class B buildings will remain large. This bodes well for value add returns, whereby owners opportunistically modernize units and boost rents.

As always, this is NOT INVESTMENT ADVICE. Do your own work.

Private Eye Capital Newsletter

Join the newsletter to receive FREE actionable investment ideas.