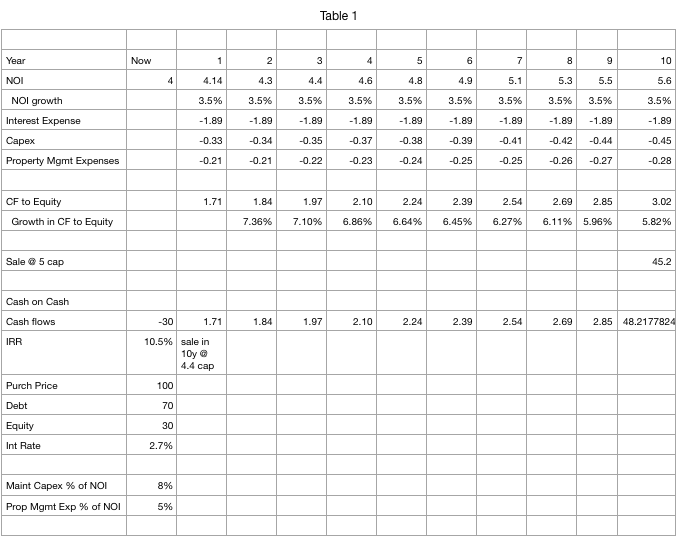

Are private buyers crazy? How buying at an apartment complex at a 4 cap can generate a 10% IRR

While publicly traded apartment REITs have fallen considerably YTD, the private market (the private market represents ~95% of US apartment assets; just 5% of US apartments trade publicly as REITs) for apartments has soared and in many markets is at or approaching new highs. With such a hot private market where assets are in many cases trading at 4% cap rates and below, I thought it would be instructive to provide a bit of color on what IRRs can be expected by the purchaser of the asset. Are these buyers being rational?

While I surely can't speak to every deal out there, below I should that purchasing at a 4 cap can indeed generate strong returns to long term investors. That said, I expect investors in public apartment REITs like ESS, EQR, AVB, CLPR, and AIV will do considerably better given the much higher cap rates (lower valuations) at which they trade. First a quick refresher on terminology:

NOI - Net Operating Income - Akin to Adjusted EBITDA

Capitalization (Cap) rate = NOI/Value of Asset (in this case the price paid). It may be easiest to think of the cap rate as the inverse of EV/EBITDA - in this case a 4% cap rate means the buyer is paying 25x EBITDA. To public market folks not versed in multifamily real estate, this probably sounds like a very high price.

LTV - Loan to Value - the percentage of debt used to finance the deal. Typically private market players use 60-80% LTVs to finance assets (so 20-40% financed with either straight equity or equity/prefs/mezzanine). In multifamily there are a large number of very attractive debt financing options. Currently there are many options offering non-recourse fixed rate debt at 2.2-2.6% in the 60-70% LTV range with terms of 5-10 years.

Here is a simplified IRR model showing how buying an asset at a 4 cap, financed with 70% LTV, 10 yr fixed rate debt at 2.6% produces nearly a 10% IRR.

Besides the initial cap rate and leverage mentioned above the other key drivers are:

-NOI CAGR of 3.5% throughout the forecast period. This is below the 4%+ CAGR seen in most markets over the past decade.

-Exit cap rate is 4.8% - I use a higher exit cap rate (lower EV/EBITDA multiple of 20.8x vs. 25x at purchase) to account for 1) conservatism given that cap rates today are at historical lows and (2) takes into account the aging of the property during the ownership period.

-Capex of 8% of NOI - this is non revenue generating capex that is required to maintain the property's condition

-2.7% Interest rate for 10 year fixed rate non-recourse financing at 70% LTV. While 2.7% sounds low, this is actually a reasonably conservative assumption (based on the current market). Consider that the 10y Treasury yields just 0.82% so multifamily mortgages offer 3x the return. Historically losses on multifamily mortgages have been very low. So while this is a low rate relative to history, I’d argue that a fixed income manager (for say a pension fund or an insurance company) is making a reasonable choice in allocating funds to multifamily debt versus owing treasuries.

-5% of NOI Property management expenses - most private players use 3rd party managers to service the assets (collect rents, leasing, co-ordinate repairs, etc).

-Note that there are no taxes as most, if not all, taxes will be shielded through depreciation & interest.

-2% commission on sale

No. Buyers aren't crazy. The astute reader will note that there is no tax paid above. Under most private structures there are ways for buyers to avoid not only the taxes on income generated during the period of ownership (again, shielded by interest and taxes) but also capital gains which can be avoided through 1031 exchange.

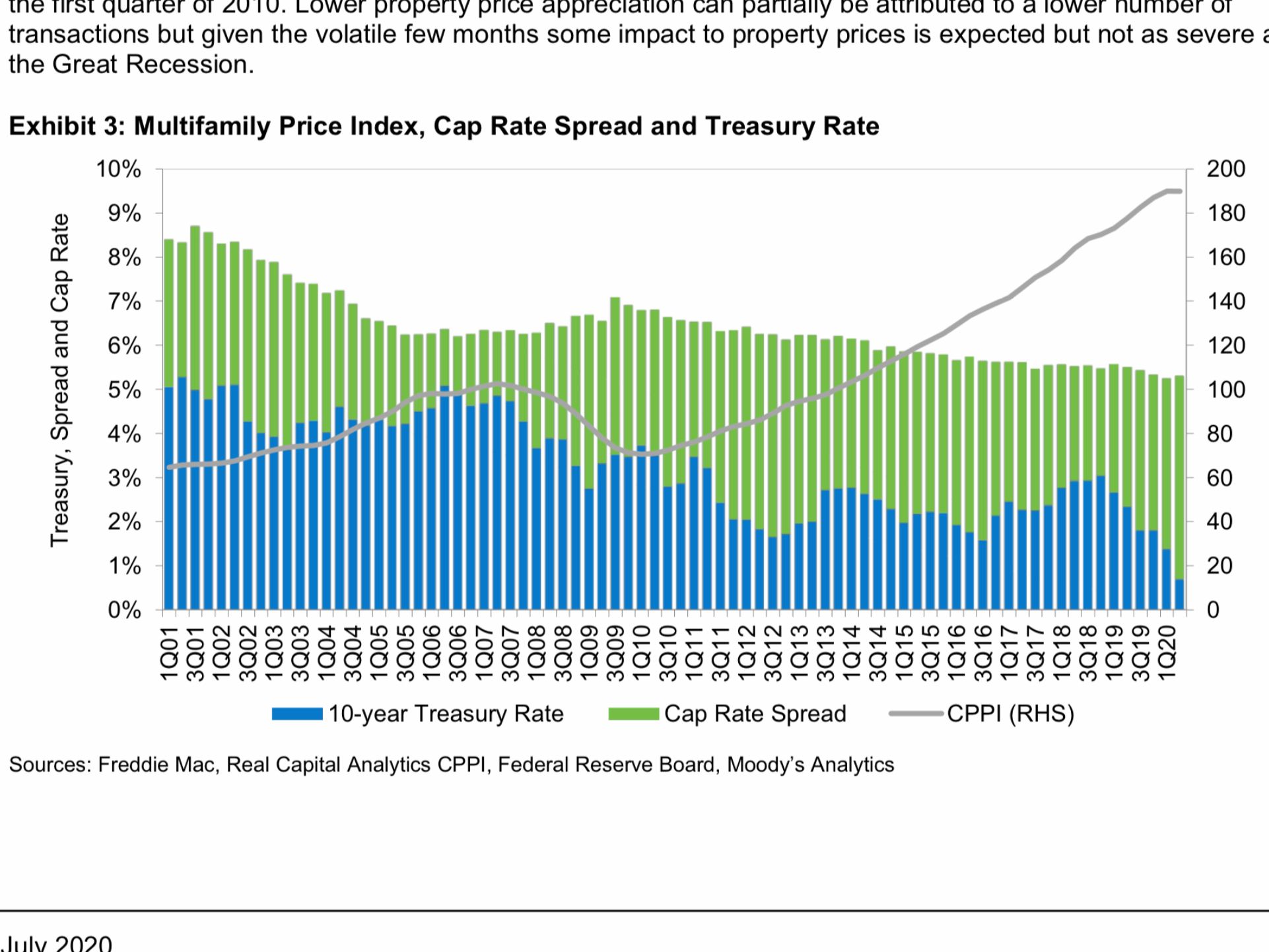

Here is a slightly different way of looking at the situation. While cap rates are compressing for apartment assets, cap rate spreads (cap rate spread = aggregate market cap rate - 10 year treasury), are high relative to the past 20 years (in private markets but especially the implied cap rate for public REITs). Note that the above graphic shows cap rate spreads for all US apartment markets, including secondary and tertiary markets which trade at higher implied cap rates. Said differently, cap rate spreads for the best markets (considering supply & demand fundamentals) tend to be lower. Accumulating assets in well positioned markets at greater than 300 basis points should provide attractive returns to the buyer.

In a low rate world, earning a 10%+ IRR investing in low risk multifamily assets is a fairly attractive option. That said it is baffling to me that the public apartment REITs have performed so poorly while the value of their assets has in many cases increased. Going forward, I expect that buyers of the apartment REITs like ESS, EQR, AVB, CLPR, and AIV are likely to do much better than 10% since the REITs sell at huge discounts to their private market value.

Eric Bokota is LONG ESS, EQR, AVB, CLPR, AIV. This is not investment advice. Do your own work.

Private Eye Capital Newsletter

Join the newsletter to receive FREE actionable investment ideas.