Germany's Vonovia & the Case for Cap Rate Compression at Essex

Paid

Members

Public

A rough draft of this article was sent to subscribers to our FREE Actionable Investment Idea Newsletter [https://www.privateeyecapital.com/signup/] in advance of publication on privateeyecapital.com . If you like being in the know and want FREE weekend reading, be sure to sign up NOW. It's

Essex Property Trust (ESS): What Goldman Sachs says vs. What Goldman Sachs does

Paid

Members

Public

This past week again saw the West Coast Apartment REITs in the red despite continued positive apartment operating data points and private market commentary. This provides long term investors with what I believe to be an excellent opportunity. Today I will touch upon: 1) Update on September apartment rental collections

The prudent sounding verbiage in sell-side reports can lead to terrible investment outcomes

Paid

Members

Public

This is in response to Baird's enlightening research piece (Seeking Alpha synopsis here [https://seekingalpha.com/news/3614408-wait-for-rent-growth-to-bottom-on-apartment-reits-baird] ) earlier this month letting us all know to wait for rents to bottom before buying apartment REITs. The wizards at Baird think this is what worked last time. Let me

Equity Residential (EQR): Recap transaction could give shareholders ALL their money back while still owning ALL the apartments

Paid

Members

Public

The 9/14 $2.4 billion California apartment [https://www.privateeyecapital.com/the-private-market-for-california-apartments-is-alive-well/] transaction lends credibility to the notion of being able to recapitalize Equity Residential (full writeup here [https://www.privateeyecapital.com/equity-residential-the-megacity-will-thrive-and-the-private-market-screams-buy/] ), pay shareholders back 94-103% of their money invested (pretty much right away) and then still owning

The private market for California apartments is Alive & Well

Paid

Members

Public

Quick N Dirty: On 9/14/20, Aimco announced a series of transactions including the formation of a $2.4 bn JV with a passive institutional partner whereby LA/SF apartment properties were sold at a 4.2% cap rate/$592k per unit valuation. This valuation is consistent with what

Essex (ESS): Following up

Paid

Members

Public

I received a few questions, via private message, regarding the our piece [https://www.privateeyecapital.com/why-would-any-long-term-investor/] on the Essex Property Trust (ESS) and I wanted to follow up (without attribution to the person/organization asking the question of course - we understand the value of anonymity). The main concerns

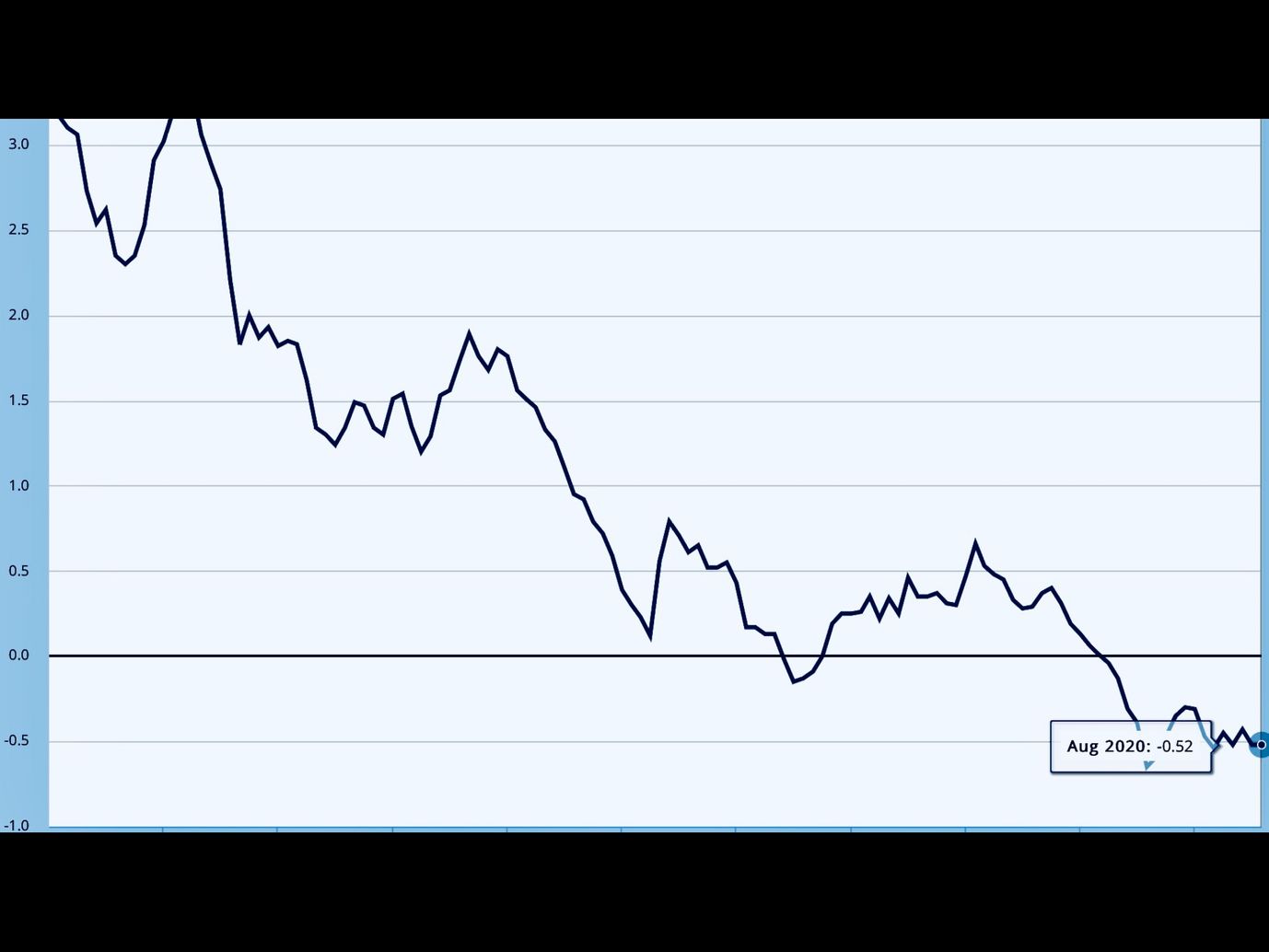

Why would any long term investor not own Essex Property Trust (ESS)?

Paid

Members

Public

Note: A very very rough draft was sent to our FREE Actionable Investment Idea Newsletter [https://www.privateeyecapital.com/signup/] subscribers on Friday. If you like being in the know and want FREE weekend reading, be sure to sign up NOW (note that you must confirm your email address within

Why Trump's 'Eviction Moratorium' is a Nothing Burger for the megacity apartment REITs

Paid

Members

Public

BIG Headline -->Minimal Impact