Don't believe everything that you read over and over again

Paid

Members

Public

Apartment REIT investors have heard two refrains throughout 2020: 1) California is dead (2) Urban areas are dead. To read the news, the death of CA seems a given -after all we lost not only Joe Rogan but Elon Musk and Oracle. Today after hours we have a sizable counterfactual.

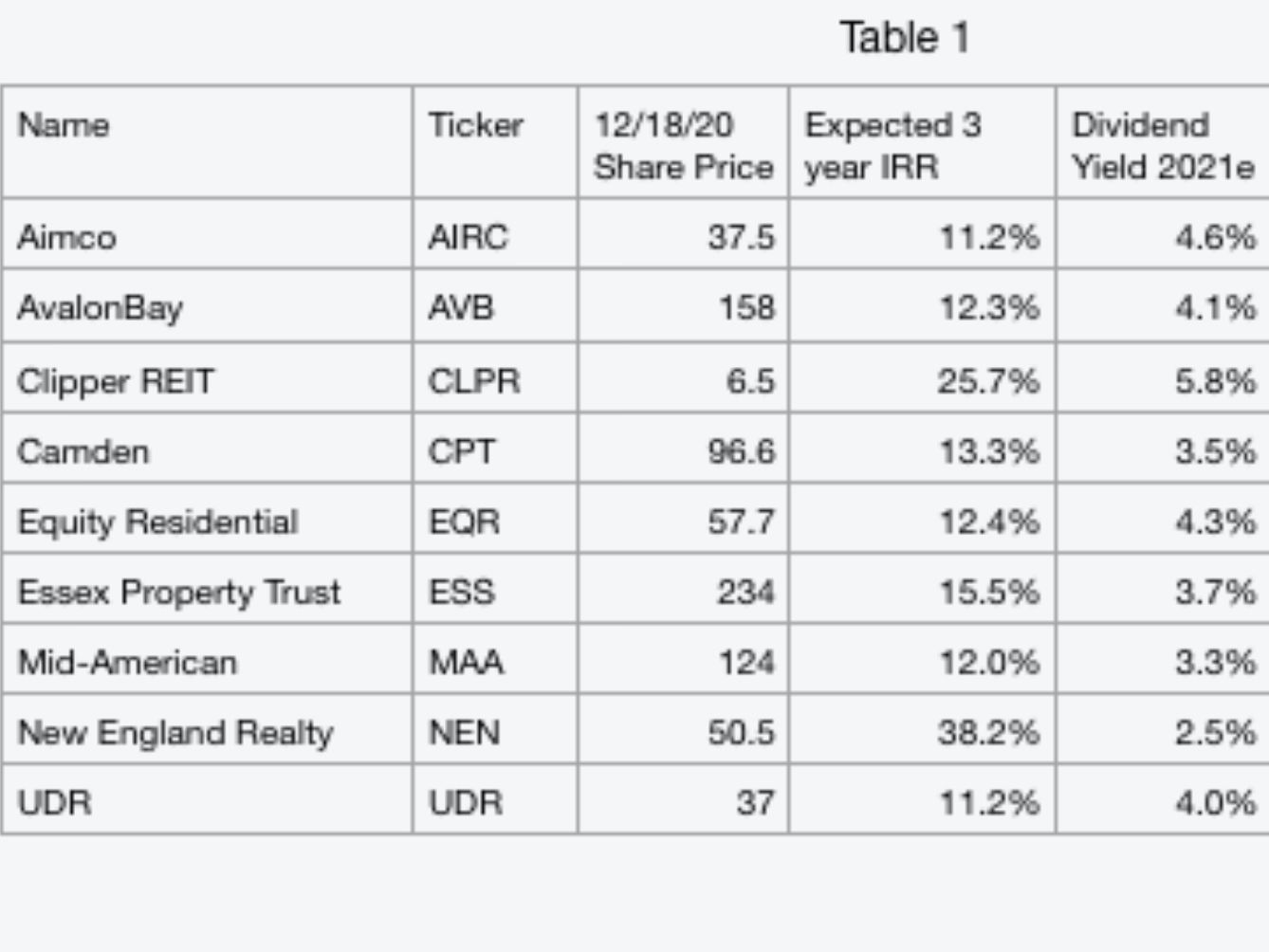

Estimated 4 yr IRRs for the Apartment REITs

Paid

Members

Public

As shown below, I've compiled a table showing estimated annualized returns to apartment REIT holders over a 4 year period. The purpose of providing a 4 year IRR guesstimate is to allow for comparison versus investing in private funds or syndication deals (which typically provide forecast IRRs). Key

Back to Basics/ Apartment REIT concepts

Paid

Members

Public

It has been brought to my attention that readers might benefit from a distilled version of the framework/concepts I use in evaluating apartment REITs. Here I discuss: 1. basic supply & demand for apartment markets and discuss how this impacts rents 2. the renter pool in gateway cities vs.

What might AIV be worth in a sale? What does this mean for other apartment REITs?

Paid

Members

Public

Yesterday it was announced that Aimco (AIV) a received buyout approach from privately held Westdale Partners. Frustratingly, price talk was not disclosed, leaving shareholders in the dark. Today I take a look at what Aimco might fetch in a sale and show NAV estimates for other apartment REITs. As I&

Glossary of Apartment REIT Terms

Paid

Members

Public

NOI (Net Operating Income) - Total property level operating revenue less total property operating expenses. If thinking about REITs versus other types of business, NOI is akin to adjusted EBITDA but adds back corporate overhead expenses. The rationale for doing so is that when apartment assets are bought and sold,

TJX - following up after 3Q

Paid

Members

Public

All in my thesis [https://privateeyecapital.us17.list-manage.com/track/click?u=9817d763c853faa67051e844f&id=8a8ecb776e&e=42944f6352] appears on track. 3Q results themselves were decent considering the reluctance consumers have to make non-essential shopping trips. Same store sales comps were -5% year over year. As we’ve seen

Sunbelt Apartment REITs: 20-25% Below Private Market Value

Paid

Members

Public

Note: A draft was sent to our FREE Actionable Investment Idea Newsletter [https://www.privateeyecapital.com/signup/] over the weekend. If you like being in the know and want FREE weekend reading, be sure to sign up NOW [https://www.privateeyecapital.com/signup/]. It's FREE!! Thus far I’

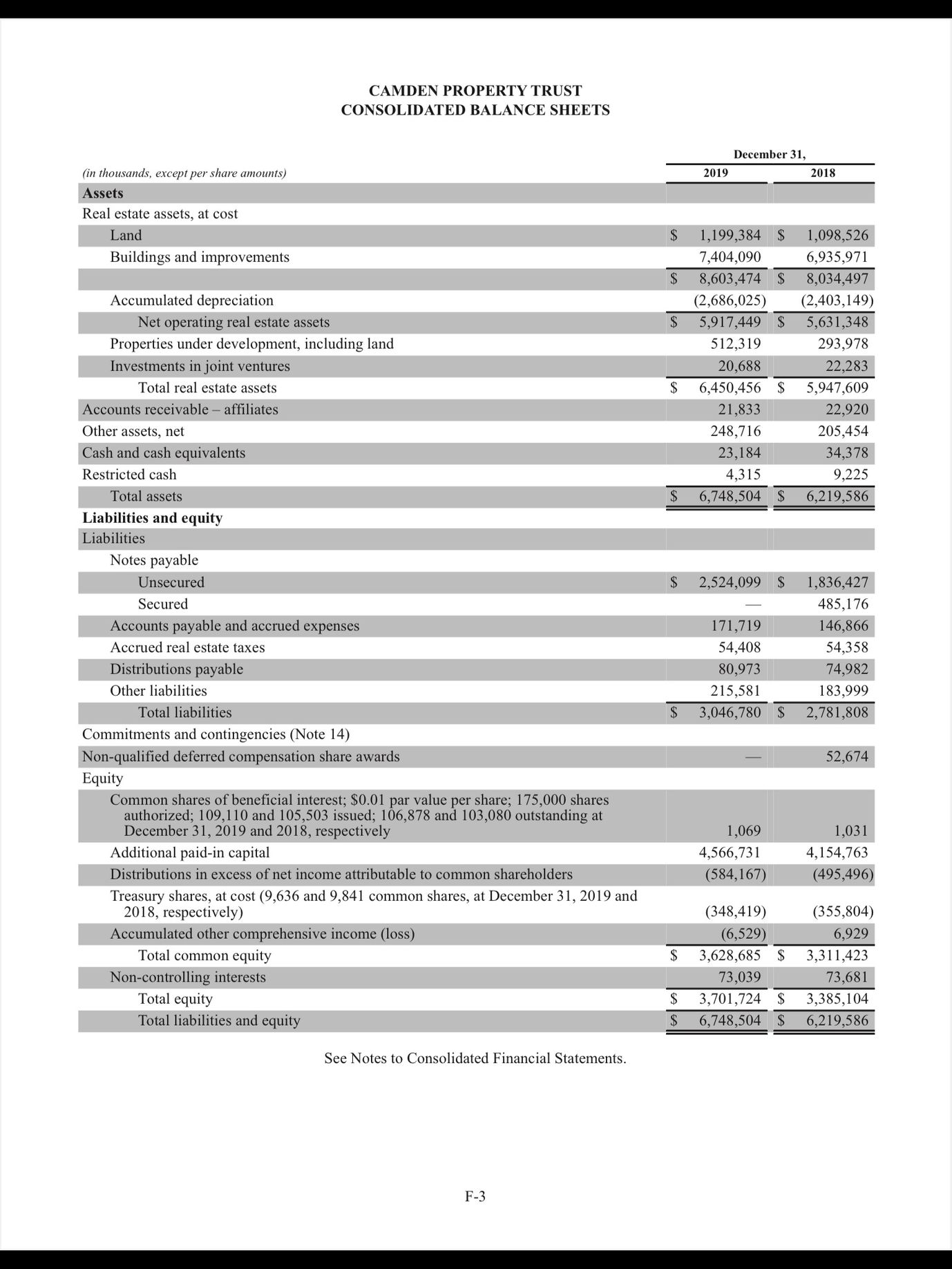

How I think about REIT balance sheets

Paid

Members

Public

To me, the most relevant factors are the following: 1) LTV or Loan to Value - this is the total amount of debt relative to the total value of the properties owned by the REIT. 2) Structure of debt - recourse vs. non recourse 3) Term to maturity & covenants