You can have good news or cheap stocks; CLPR & NEN get No Love in apartment REIT rally

This past week saw news of a vaccine for COVID sent share prices of most apartment REITs soaring, with those having exposure to hard hit urban areas seeing the some of the greatest gains. Seemingly, an end to COVID and the expectation of a return to normality came as a great surprise to the publicly traded apartment REIT market and the wizards of Wall St followed with some sell siders upping their price targets and ratings on this ‘news’.

Though I’ve been investing in public markets for over 20 years, share price reactions to headlines never cease to amaze me. For the past several weeks, the apartment REITs headed lower daily as headlines of urban flight, increases in vacancy, and lower rents circulated and recirculated before recirculating some more. ‘News’ of a vaccine, perhaps three months earlier than had been previously expected sent shares upward 20-30% overnight.

It almost goes without saying that the difference in cash flows received by apartment owners/REITs over that 3-6 months does not come anywhere close to justifying such a move. Yet some brokers upgraded apartment REIT shares and increased target prices (after the giant move of course). The change in cash flows/asset value is relatively miniscule. The change in sentiment has been massive. You can have good news or you can have cheap stocks.

While most of the apartment REITs soared on news of Pfizer’s COVID vaccine, small cap NY REIT Clipper (CLPR) & New England Real Estate Associates LP (NEN) have gotten No Love. Like EQR/AVB, both NEN & CLPR reported tough 3Q results with steep drops in urban occupancy and declining rents. To be sure, CLPR is wholly exposed to Manhattan/Brooklyn and has no suburban exposure (NEN has exposure to both urban & suburban Boston). However, the sharp move in EQR/AVB shares appears driven by the idea of cities not being dead and being poised for a rebound - possibly somewhat sooner than expected. This rebound has barely been reflected in CLPR’s share price (and not at all for the even more thinly traded NEN).

Make no mistake about it - urban life has been rendered undesirable by the pandemic. Most of the appeal - restaurants/bars, museums, sporting events, theater/concerts, shopping, etc have been closed or dramatically altered in response to COVID. Unless human nature has permanently changed, the appeal of living in close proximity to these places/activities will return. This spells upside - particularly for the small cap apartment securities.

Delving into CLPR/NEN results:

Clipper’s primary point of weakness was seen in its luxury Manhattan property Tribecca House. Results here were ugly - occupancy plummeted from 91.3% at 6/30/20 to just 80.1% at 9/30 with rent/sq ft down 7% (on the call mgmt said occupancy has since recovered to 83% at Tribecca House but requiring further rent concessions). This caused NOI at the Tribecca Property to decline 40%. Other Manhattan properties, namely Aspen & Clover House saw occupancy decline from 95-98% to 89-90% (have since seen a 3-600 bp improvement according to the 3Q call). Brooklyn properties, lead by rent stabilized Flatbush Gardens showed a much more modest decline (from 99% at 6/30 to 96% at 9/30).

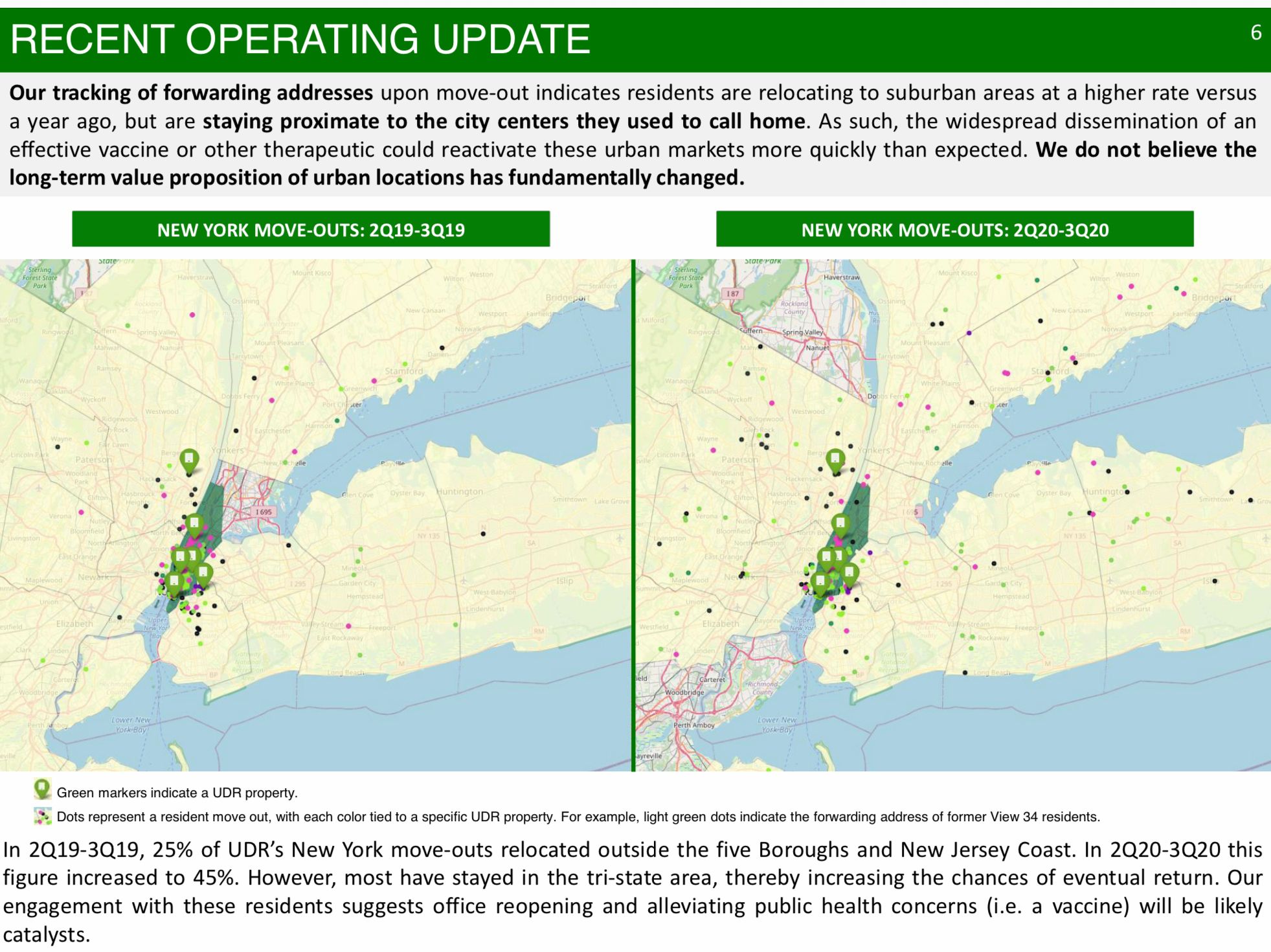

A recent presentation from apartment REIT UDR shows most NY move-outs have remained in the greater NY area - suggesting a return to the city as COVID ends:

Source: UDR November Investor Presentation

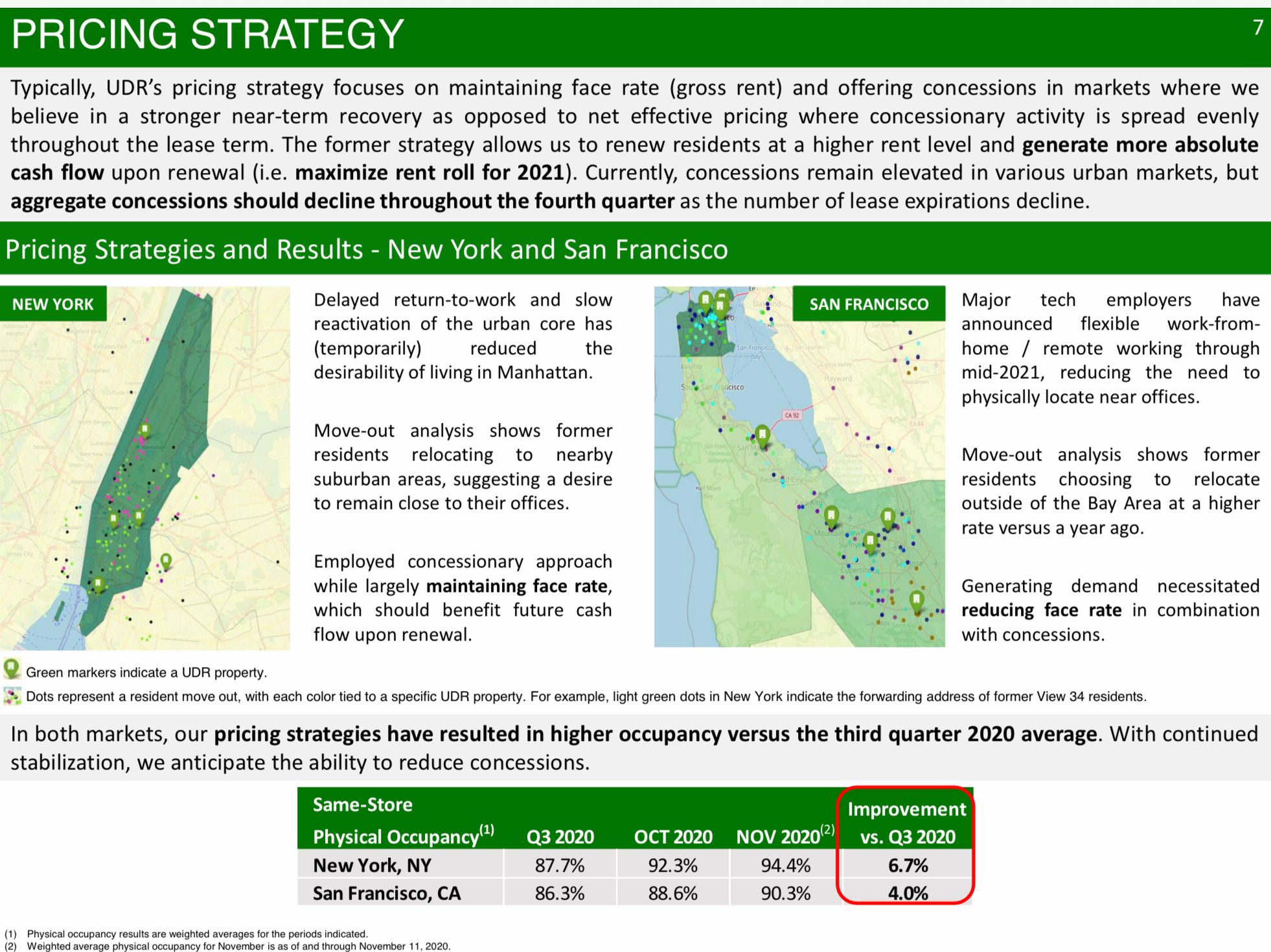

Similarly, like CLPR/AVB/EQR, UDR has seen a pickup in NY occupancy since quarter end:

Source: UDR November Investor Presentation

While the near term outlook is ugly- the downside to long term shareholders is limited. While CLPR carries more debt than other apartment REITs, the debt is well structured - all debt is non-recourse (no cross collateralization) and the company has no maturities until 2027 (here is a quickie on how I look at REIT balance sheets). Further, there is nearly $2 per share in unencumbered cash (~1/3 of market cap) at the holding company facilitating investment opportunities and share repurchases.

2021 will not be a great year for Clipper. Clipper will be lucky to hold NOI flat in 2021 vs. 2020 as its recently commenced/soon to commence long term office renewals with the city of NY, which see rent bumps adding $7 mm to NOI, are offset by the flow through of lower occupancy/lease rates in its Manhattan properties. Looking ahead, 2022/23 should be considerably better years. While I expect NOI for 2021 will trough in the low $60 mn range, ultimately NOI should move back up to $70-75 million in 2022/23 (excluding 1010 development/ any Flatbush densification). I see a base case NAV of $12-15 per share looking to 2022/23 ($70-75 mn in NOI @ 4.5% cap rate) - the patient investor collects a 6.5% divvy while waiting.

Additional upside for CLPR shareholders could come in the form of:

- Flatbush densification (~$2/share)

- Despite the disclocation we’ve seen in the market thus far, there appears significant upside from a Tribecca House condo conversion which looks to be $1400-1800 per foot in a sale vs. ~$900-$1000 per sq ft value implied in my valuation above. That said, while ESS has a clear path to condo conversion for about 16% of its portfolio (if it chose to do so), I’m not entirely sure about the path to conversion for this property.

- CLPR has some desirable street retail properties which had well below market rents (in some cases 70% below market rent) coming into COVID and aren’t collecting much in 2020. There is upside here.

Similar to CLPR, NEN saw occupancy at its urban properties dip into the 70s in the most affected locations (Dexter Park, its largest a JV asset). While its suburban locations are holding up better, NEN’s 2021 NOI will be down versus 2020 (does not have the office rent bump benefit at CLPR). As discussed in my initial note, NEN has a strong balance sheet and as an LP retains more capital (lower payout ratio) than the REITs - I have no doubt NEN will weather the storm. As COVID recedes, I expect a full recovery in NOI. Looking to 2022/2023, I continue to see a fair value per share of $150+.

It is worth noting that I estimate NEN accretes value to shareholders at about $12 per share annually (25% of current price) which breaks out as follows:

-Dividend of $1.28 or 2.7%

-Approximate $4 per share annually year through retained cash/debt paydown (so 8% versus the current share price).

-Further, with NOI moving up ~3% in a normal year, this accretes a further $7-8 per share in annual value (capping incremental NOI @ 4.5%). So value is building while we wait.

While there is no identifiable catalyst for shares to move toward fair value, the beauty of an investment in NEN is that NAV per share continues to grow nicely and I believe this will prevent units from being a ‘value trap’, even if shares continue to trade at a discount to NAV.

To summarize, though small cap apartment securities are currently getting No Love, I see considerable upside for long term shareholders. Song:

As always, this is not investment advice. Assume I know nothing and always do your own work.

Eric Bokota owns shares of CLPR, NEN, ESS, EQR, AVB and AIV

Private Eye Capital Newsletter

Join the newsletter to receive FREE actionable investment ideas.