What might AIV be worth in a sale? What does this mean for other apartment REITs?

Yesterday it was announced that Aimco (AIV) a received buyout approach from privately held Westdale Partners. Frustratingly, price talk was not disclosed, leaving shareholders in the dark. Today I take a look at what Aimco might fetch in a sale and show NAV estimates for other apartment REITs. As I've highlighted repeatedly over the past several months, given the strong private market appetite for apartment assets, I believe that there is considerable upside for shareholders in apartment REITs.

An apartment REIT receiving a buyout overture at a premium should come as no surprise to those who have been following the space closely. There has been an obvious disconnect between public and private market valuations for some time now -the private market has been telling us (at times shouting at us) to buy the apartment REITs.

As a reminder, just 5-6% of apartments trade publicly as REITs with the remainder being owned privately. Being 20x the size of the REIT market, the private market is the real market when it comes to apartment assets and offers the best insights into the fair valuations of apartment assets and apartment REITs.

Given the disconnect between private and public valuations, I suspect we will see more takeover approaches in 2021. Despite the positive news, apartment REITs barely budged yesterday on the news. While public markets have been slow to react, the outlook for buyouts at a premium to current share prices remains strong. This is supported by:

- All-time low debt financing costs

- Record levels of private equity real estate dry powder

- An asset class which has favorable supply/demand characteristics and produces stable and growing cash flows

- Lack of controlling shareholders to block such transactions.

To the last point, with no controlling shareholder, activists could buy stakes in apartment REITs and advocate for either a sale at a premium or a recapitalization/special dividend.

Recapitalization transactions are an interesting alternative to going private transactions. Such recapitalizations could generate a sizable special dividend while allowing shareholders to continue to own all apartments/receive continued dividends. I illustrate this below.

Aimco/ Apartment REIT Valuations

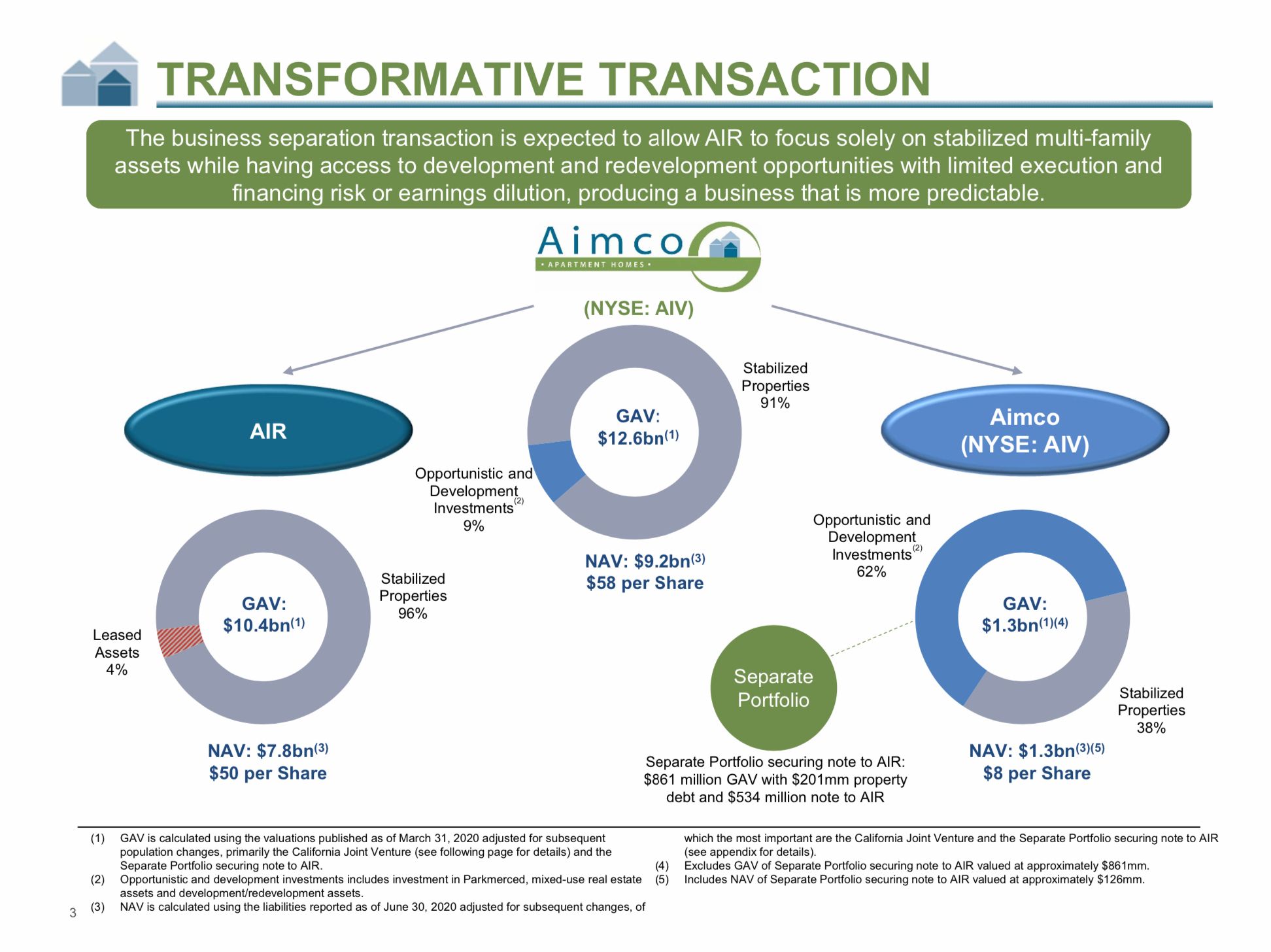

Following the announcement that it would be selling/JVing a a portion of it’s California portfolio & spinning off development assets in September, apartment REIT Aimco (AIV) had been pressured by an activist shareholder to consider alternatives to its plan including exploration of a sale. While management ignored shareholder pleas, on Wednesday (12/2), Bloomberg reported that the company received an offer at a premium. Shortly after, Aimco issued a statement saying that the approach ‘grossly undervalues’ the company and that it would move ahead with its planned spinoff.

With price talk undisclosed, shareholders are left in the dark. However, using AIV's public disclosures and comparable private market transactions data, we can estimate the value of AIV's assets and use this to speculate on what a fair price might be in a takeout.

Using a 4.5% cap rate, I estimate AIV’s fair value is somewhere in the ballpark of $50-51, implying 25-27% upside. Using a 4.25% cap rate, estimated NAV for AIV's is ~$55 which is similar to the $58 NAV shown by AIV in September when it announced its California asset sale/JV and intended spinoff:

With large amounts of private capital targeting the US apartment asset class, even if things don't work out with Westdale, I think a sale in the $50 range is achievable were the company to run an auction. A sale process could take several forms - either selling the company outright to a large private equity group or selling the assets piecemeal, which would take longer but could lead to a higher sales price by soliciting the highest bidder for each individual asset. While private market transaction value ground to a virtual halt at the onset of the COVID pandemic, activity has picked up meaningfully in the past several months.

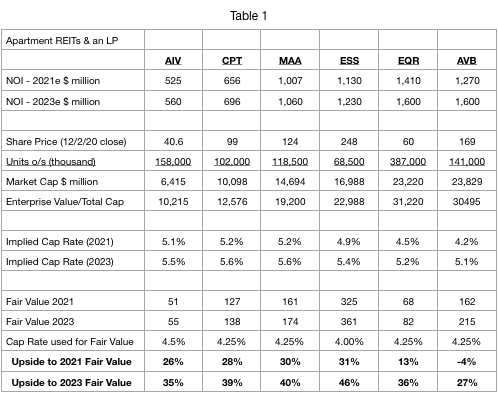

Similarly, even after the post 'vaccine news' run up in apartment REIT share prices, nearly all apartment REITs remain in the red for 2020 and trade at discounts to NAV/private market value. While REIT share prices have lagged, the private market for apartment assets has been very strong with apartment values in many parts of the US reaching all time highs. Private market activity reveals that cap rates (the cap rate is simply net operating income divided by the sales price of the property) have compressed into the high 3s -low 4s in most parts of the country. Here is a snapshot of several apartment REITs:

Note in the snapshot above that coastal/urban apartment REITs (which have been much harder hit than the sunbelt REITs) have larger differentials between estimated NOI for 2021 & 2023 as I expect California/NY to see meaningful recoveries as COVID fades. With a recovery expected, I'd expect that were a coastal REIT to be sold, it would fetch a price closer to the 2023 Fair Value estimates shown above.

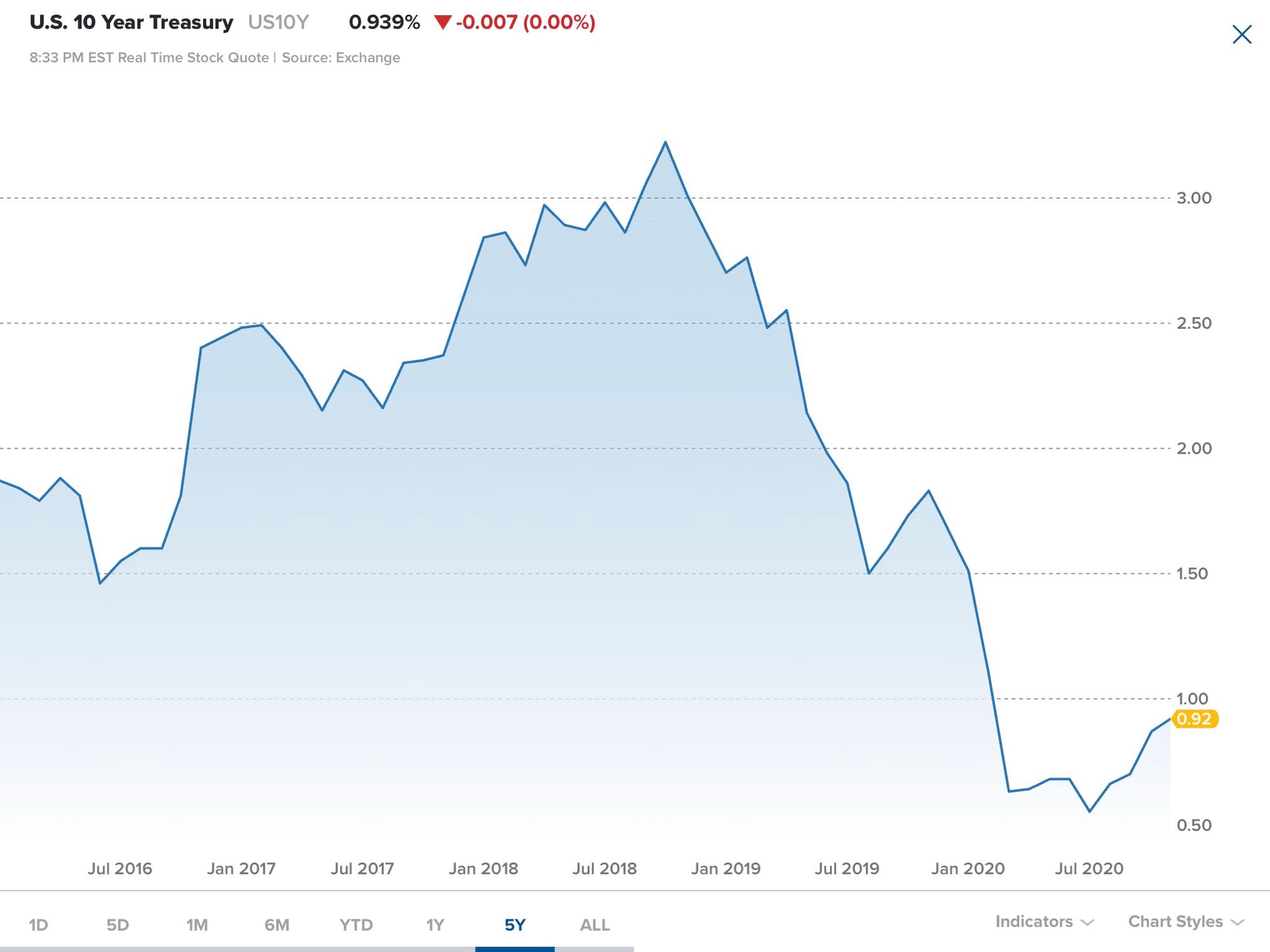

Private market apartment values have increased largely due to the stable income profile of apartments coupled with the significant decline in long-term interest rates since the onset of COVID. Because private operators use higher levels of leverage, with low financing costs (2.4-2.7% interest rates for 10 year non-recourse loans with 65-70% loan to values), operators are still able to generate ~10% returns for equity investors despite low cap rates.

Source: CNBC

With interest rates near all time lows, even at high 3s/ low 4s cap rates apartments are transacting at the high end of their 20 year range for cap rate spreads, which tend to range between 2-3%. With a sub 1% 10 year Treasury rate, cap spreads are over 3% today in the private market despite the increase in apartment values. As a refresher, the cap rate spread measures the difference between apartment cap rates and the 10 year treasury. Cap rate spreads for apartment REITs are considerably wider - spreads were north of 5% recently (October) and today still sit between 4-4.5% for most apartment REITs. This is yet another metric which illustrates the attractiveness of the apartment REITs.

In addition to very low interest rates, there is another factor which makes it likely that we will see more takeover approaches for the apartment REITs - there is a gigantic wall of private equity real estate money looking for deals. The chart below shows that there is in excess of $250 billion in real estate private equity. Private operators use higher levels of debt financing to purchase real estate- usually 60-75% of the purchase price. When leveraged, the $250 billion in private equity could fund the purchase of up to $1 trillion in real estate. This dwarfs the entire capitalization of the apartment REIT space by a factor of 6-7x.

RECAPITALIZATION - an alternative to going private

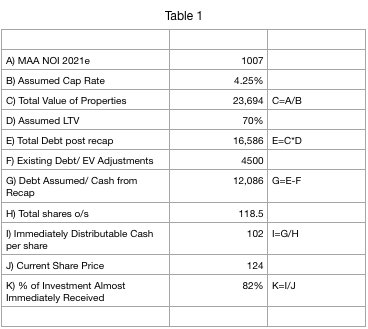

While going private could provide a quick payoff to shareholders, a recapitalization is an alternative which could provide a large special dividend while allowing shareholders to continue to own all of the apartment assets (albeit in a more leveraged structure). For demonstration purposes, I will use Mid American Apartments (MAA) as an example though this would be applicable to most of the apartment REITs.

In a recapitalization, the apartment REITs would take on additional debt to fund the special dividend to shareholders. The objective would be to take advantage of the low interest rates to secure long term, low cost financing - allowing shareholders to have their cake and eat it too. In the example below, after concluding the recapitalization, MAA would have a loan-to-value or LTV of 70% which is consistent with the capital structure seen in many private funds and private syndication deals.

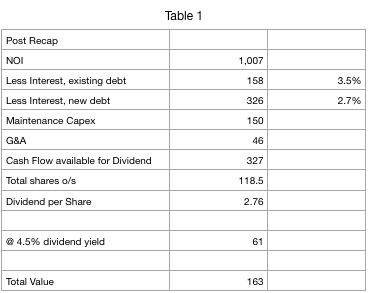

As shown above, to get to a 70% LTV, MAA would take on ~$12 billion worth of new debt. This debt would be used to pay a one time special dividend to shareholders of $102 per share, representing over 80% of the current share price.

Importantly, MAA would not have to sell any of it’s existing properties to fund the special dividend. It would, however, be required to pay interest expense on the incremental $12 billion in debt - in addition to the $4.5 billion in existing debt already on the balance sheet. Below, I show the pro-forma free cash flow calculation assuming a 2.7% interest rate for the $12 billion in incremental debt. Note that this interest rate is 50% higher than the 1.8% rate at which MAA issued 10 year debt within the last month. The interest rate assumed for the recapitalization is consistent with secured (non-recourse) financing available for 65-70% LTV apartment assets.

After paying interest expense, maintenance capital expenditures and covering overhead, I estimate that MAA would have $2.76 per share to pay out annually as a dividend to shareholders (vs. $4 per share it currently pays). Assuming the more highly leveraged company would trade at a 4.5% dividend yield (vs. 3.3% currently), this implies the post re-cap shares would be worth $61 each. Adding $61 to the $102/share special dividend shows a total value or MAA of $163 which ties neatly to a 4.25% cap rate.

Summary

With stable income, readily financeable assets, low interest rates and large amounts of real estate private equity capital searching for deals, I expect we will see more private equity overtures made to apartment REITs should the valuation discrepancy remain. Trading at a discount to private market value, I continue to see upside for apartment REIT shareholders. Stay tuned.

As always this is NOT INVESTMENT ADVICE. Do your own work.

Eric Bokota is LONG AIV, AVB, CPT, EQR, ESS, MAA, NEN

Private Eye Capital Newsletter

Join the newsletter to receive FREE actionable investment ideas.