Essex FY results & Private (REAL) market update

Paid

Members

Public

The results themselves are very much what I would expect based on what we saw in 2H20 and management's past commentary on trends.Importantly, ESS management provided 2021 earnings guidance (was previously suspended due to COVID related uncertainty), resumed the share buyback (had been paused due to uncertainty)

KRC results: Outlook Better than expected & Private Market Comps

Paid

Members

Public

More evidence that Kilroy Realty (KRC - here [https://www.privateeyecapital.com/kilroy-realty-the-price-is-wrong/] is my initial piece) is significantly undervalued came with 4Q results. While 4Q leasing activity remained subdued (just 61k sq feet signed in 4Q with 14% POSITIVE cash rent spread; signed another 75k sq feet in January

Have you ever wanted to own an MLB team?

Paid

Members

Public

Note: this article was sent out to subscribers in advance of web publication. Wanna hear it first? Sign up [https://privateeyecapital.us17.list-manage.com/subscribe/post?u=9817d763c853faa67051e844f&id=42a78a95e4] to receive Private Eye Capital's FREE Actionable Investment Idea Newsletter. It's FREE! If you are

Mobile Home Parks - the best business in real estate?

Paid

Members

Public

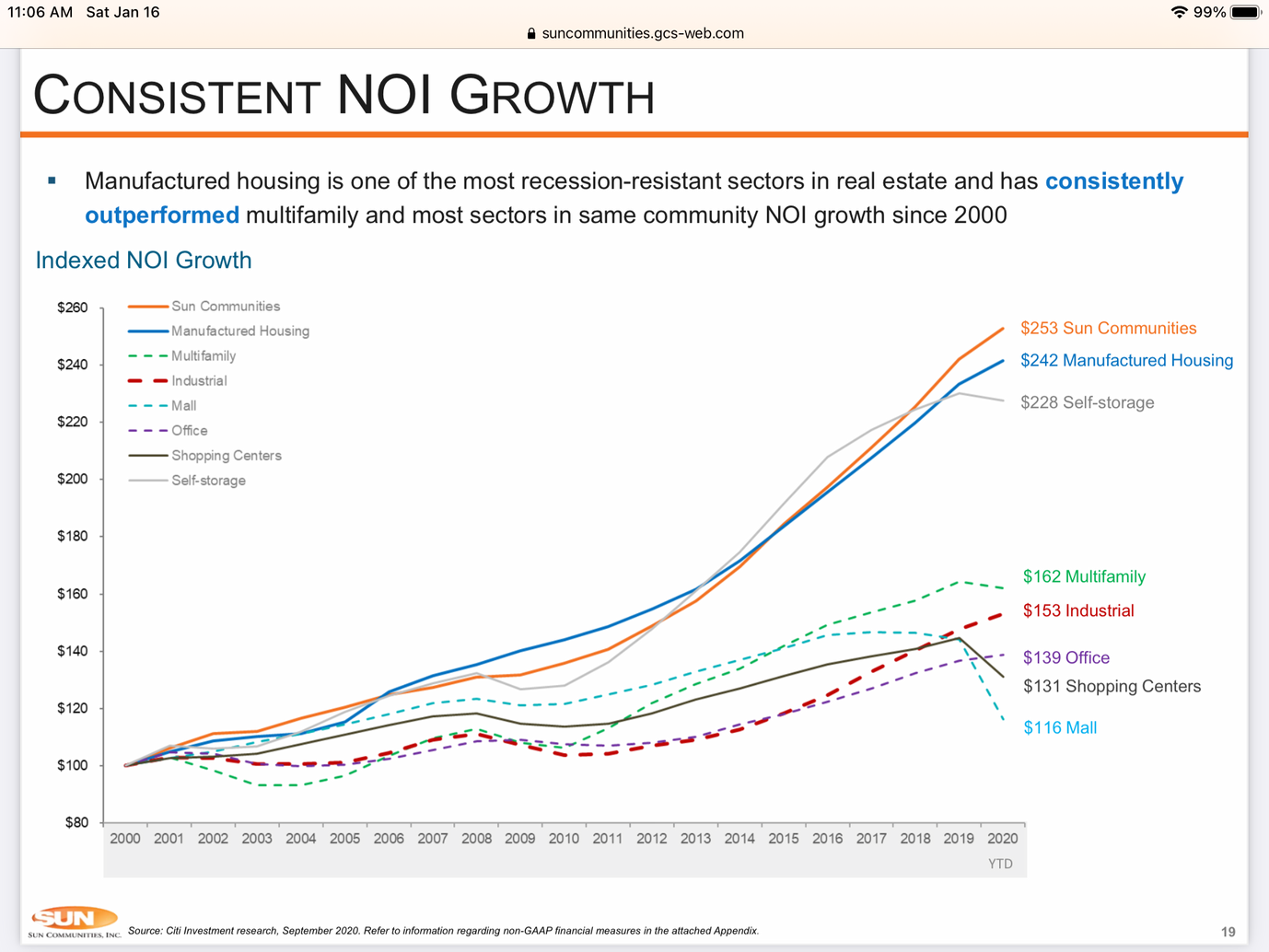

Having written extensively about the apartment business/REITs, today I write about another residential REIT sub-sector, the mobile home parks (MHPs). While shares are well off their 52 week highs (frankly I'm not sure why - operating results have been very strong, interest rates are low and prospects

Index Weightings Help Explain Why Many Bargains Abound in REIT-land

Paid

Members

Public

I’ve been writing quite a bit about apartment REITs lately. Any time I identify numerous bargains within one specific sector or sub-sector, I’m effectively saying that I am right and the market (stock price) is wrong. With billions of dollars invested and hundreds (if not thousands) of analysts/

Calculating NAV per share

Paid

Members

Public

A REIT's NAV per share (Net Asset Value) is usually significantly higher than its stated accounting book value under US GAAP. I've received a few inquiries on how to calculate the estimated NAV for a REIT and have compiled this quick tutorial. Materials required: Annual/Quarterly

LA is set to BOOM!

Paid

Members

Public

Happy new year - As I’ve mentioned previously, I believe that LA is on the precipice of a large, Hollywood-driven boom (I’m guessing 2H21) as: 1. Working through the backlog of un-produced film & TV from 2020 as COVID shut down production schedules for much of 2020. 2.

Kilroy Realty: The Price is Wrong

Paid

Members

Public

Note: A draft was sent to our FREE Actionable Investment Idea Newsletter [https://www.privateeyecapital.com/signup/] in advance of publication on this website. If you like being in the know and want FREE weekend reading, be sure to sign up NOW [https://www.privateeyecapital.com/signup/]. It's