Mobile Home Parks - the best business in real estate?

Having written extensively about the apartment business/REITs, today I write about another residential REIT sub-sector, the mobile home parks (MHPs). While shares are well off their 52 week highs (frankly I'm not sure why - operating results have been very strong, interest rates are low and prospects are strong), these REITs aren't insanely cheap like the apartment REITs.

However I believe Equity Lifestyles (ELS) offers investors the opportunity to earn a solid inflation-protected return (like apartments, rents re-price annually) with minimal risk of capital impairment. Further, with so much of the world owning negative yielding instruments (and the US 10 year at 1.1% or so) I expect we will see cap rate compression. Should cap rates compress to 3% (look at Germany which has cap rates in the 2.5-3% range for apartments -despite NOI growth limited by rent control), we could see meaningful upside in the names. As such, I see this as an asymmetric situation - low risk and reasonable expected 'base case' return with the potential for significant upside.

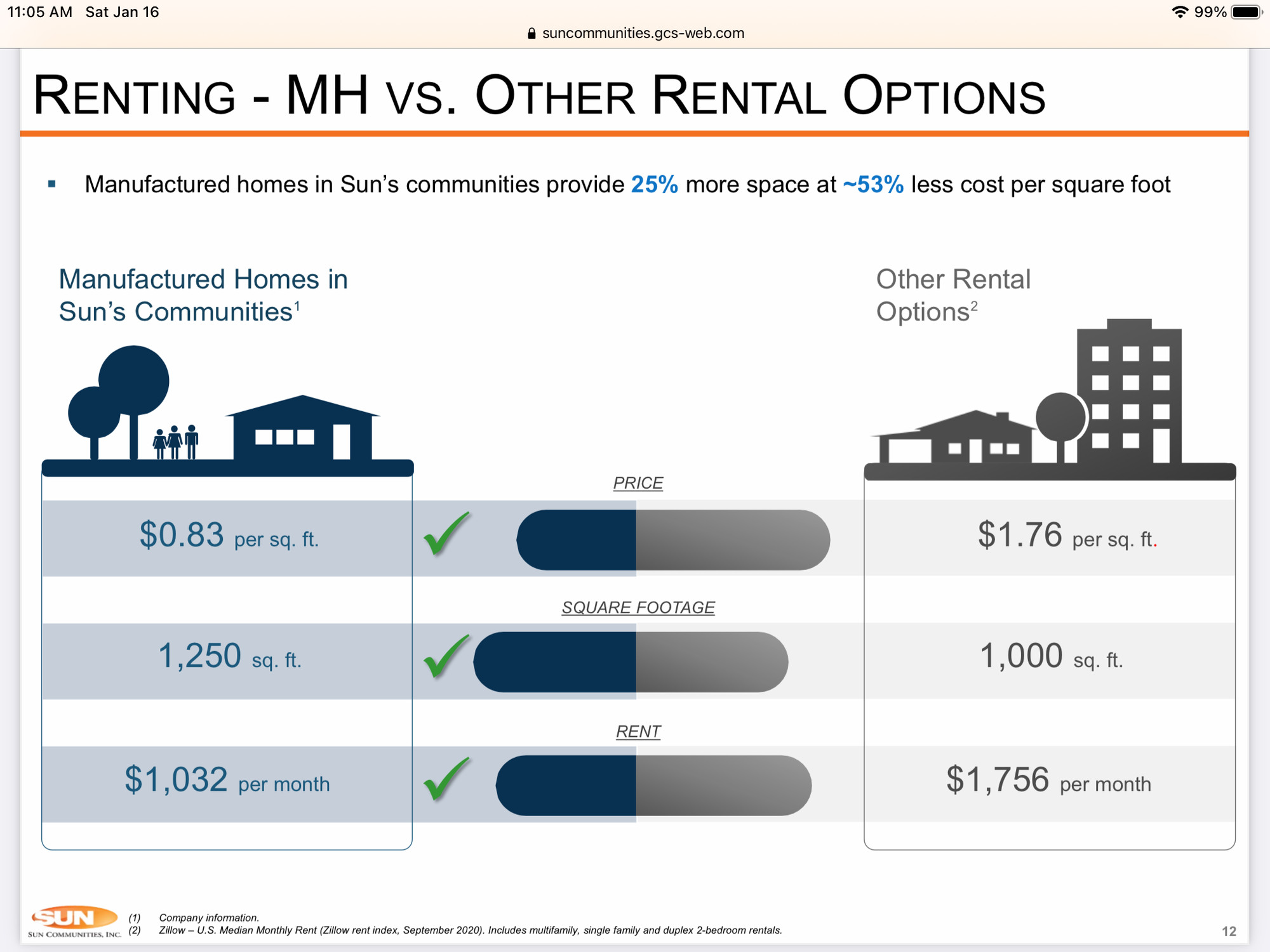

- No supply concerns - supply is flat over time. Many parks converted to higher & better use while NIMBYism and high land costs prevent meaningful new supply from being added.

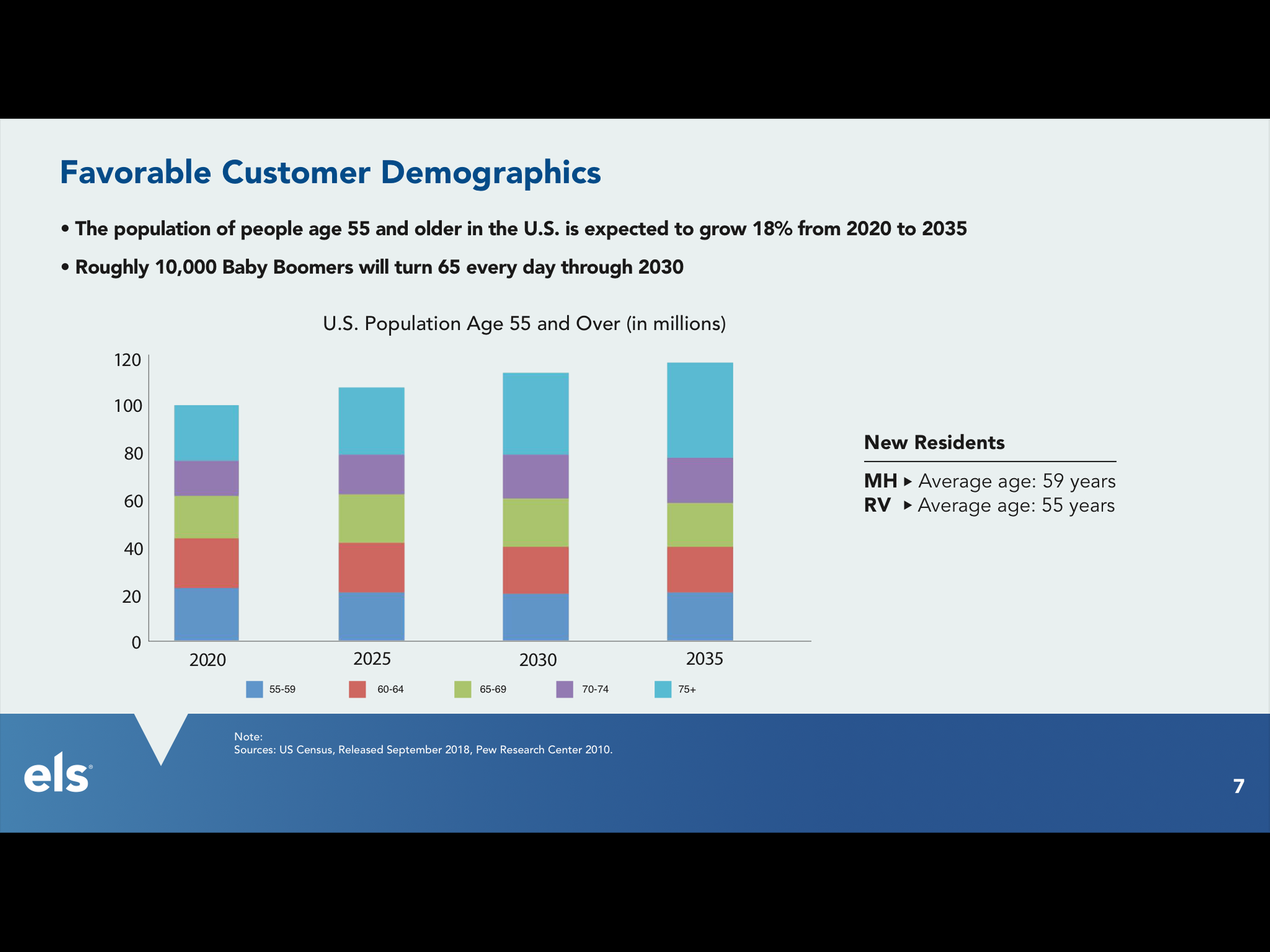

- Growing demand - cheapest housing option in the US which has a shortage of affordable housing. MHPs are very popular with baby boomers (growing demographic).

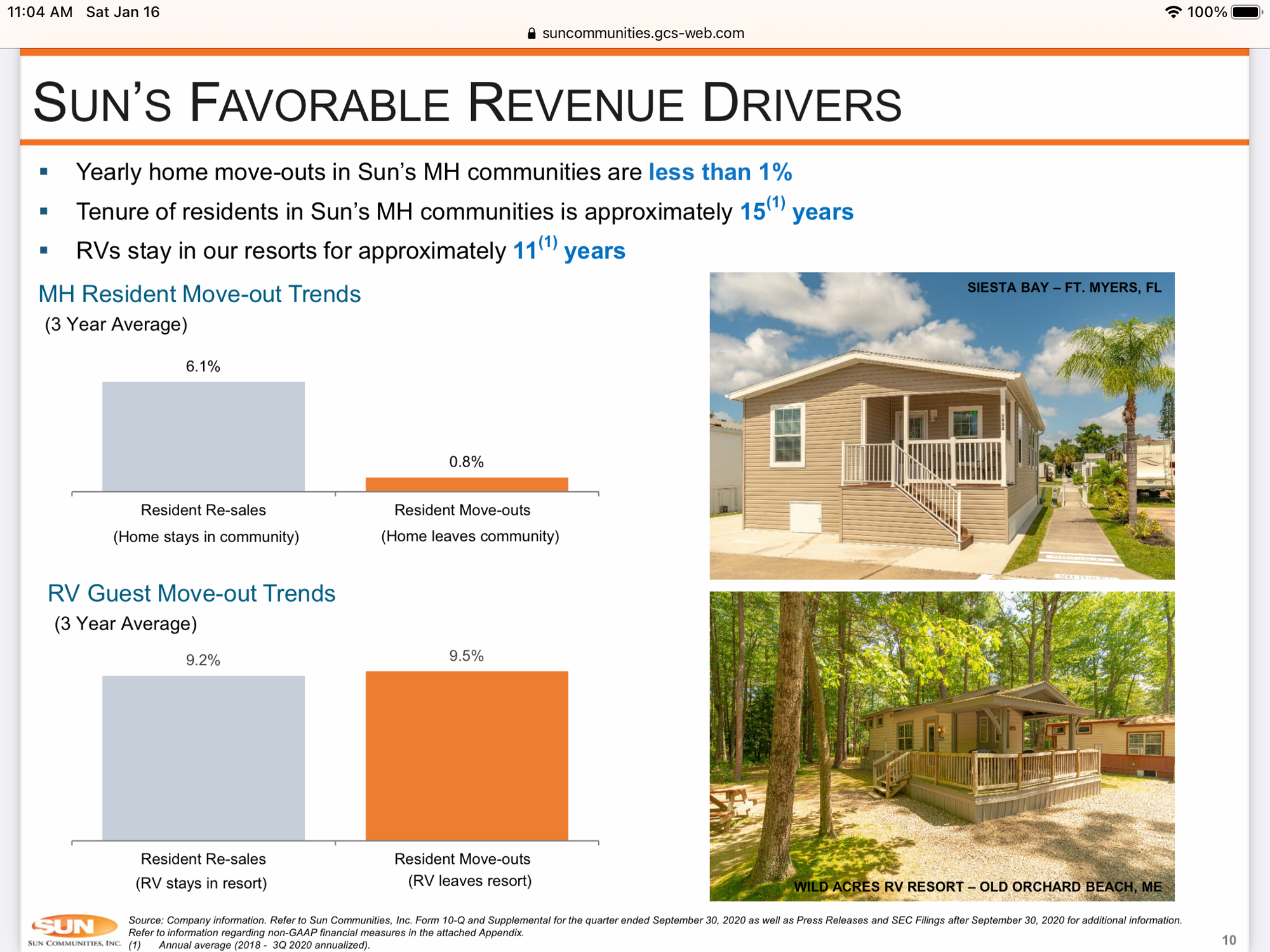

3. Strong price power -move outs are few due to high switching costs. Tenant (rents site, owns home) is faced with the dilemma of either selling home (resale value isn’t great on MH) or having to incur cost of moving home (removing, moving, and reinstalling home typically costs $5k+) to another site.

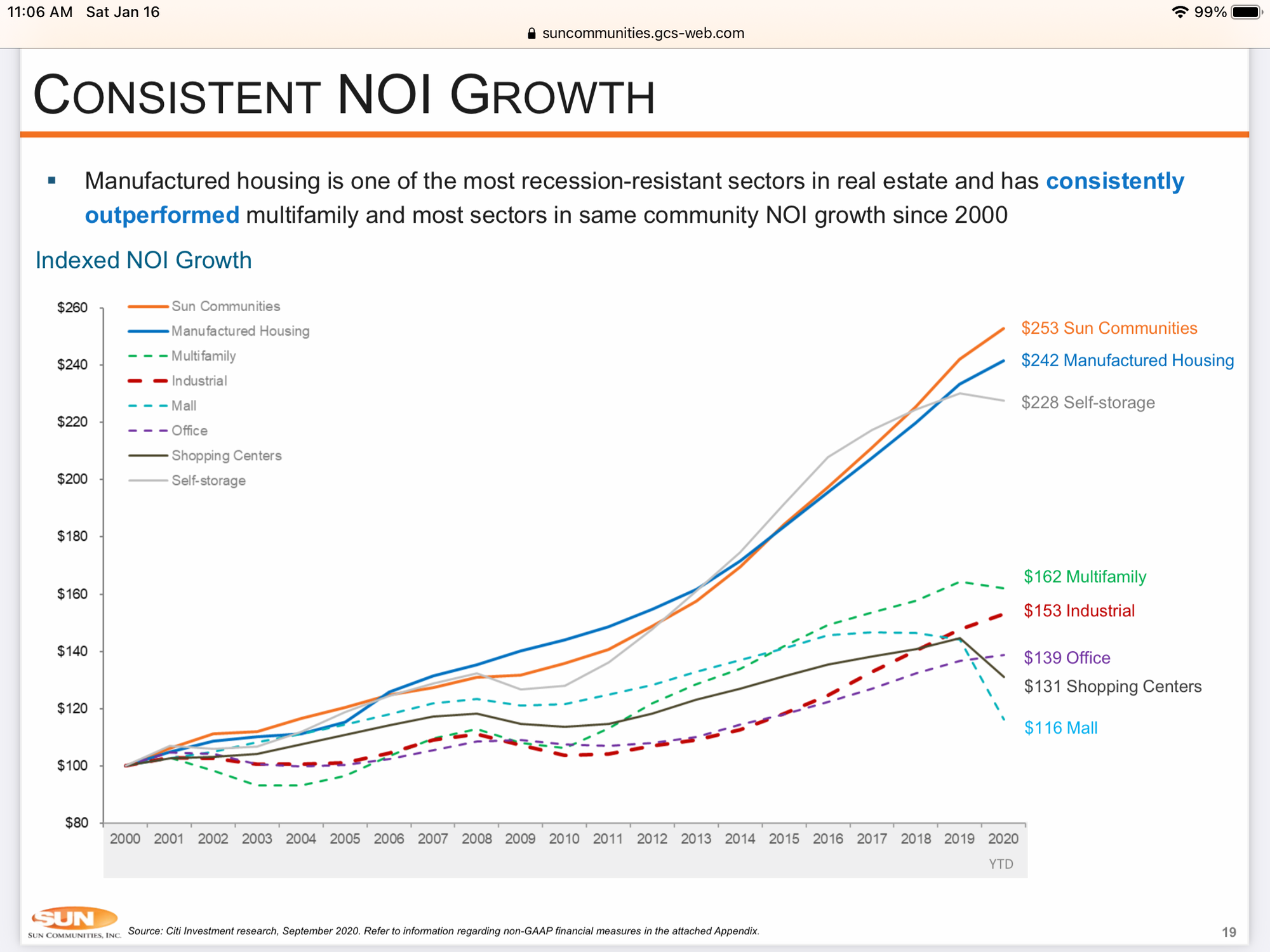

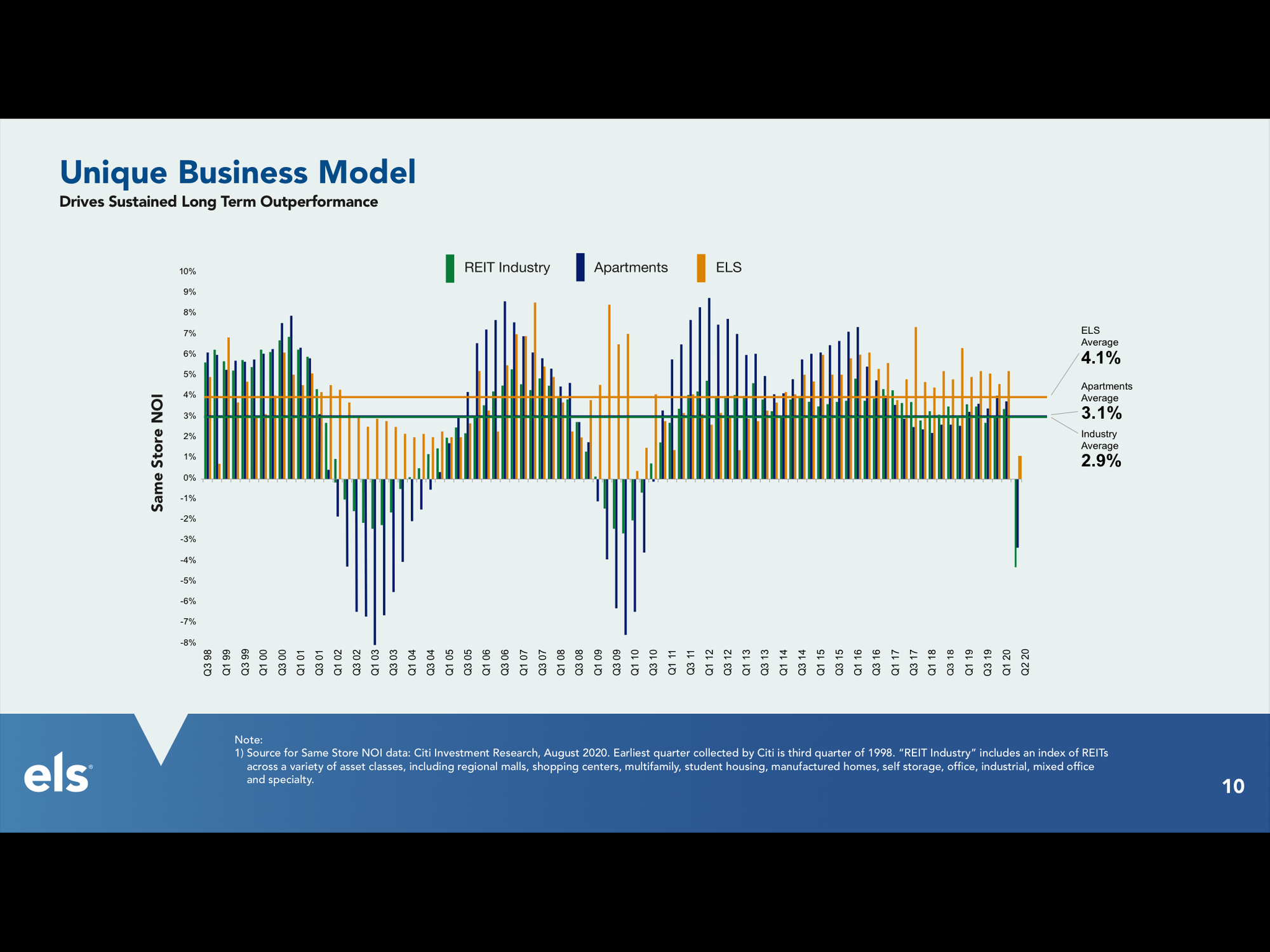

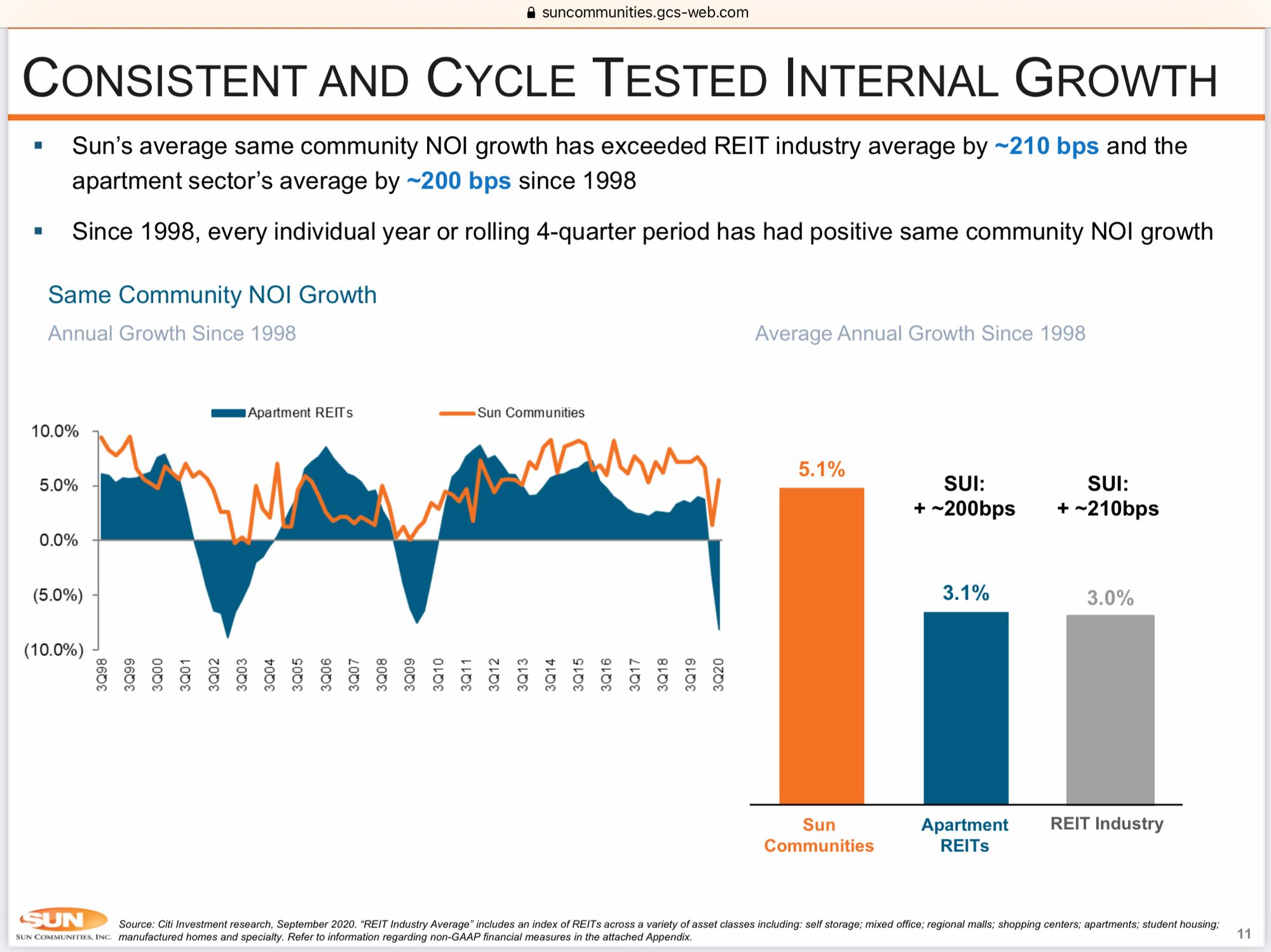

4. Lack of competitive supply + Growing demand + Pricing power have lead to incredibly resilient results -> 4.2% same store NOI CAGR over 20 years w/ ZERO DOWN YEARs. Likely to be better going forward given higher US housing costs/demo tailwind.

5. Minimal ongoing capital expenditure requirements as maintenance encompasses land and amenities/infrastructure but few buildings.

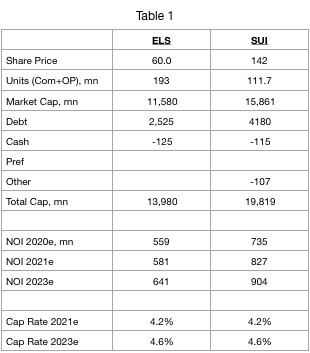

6. As we sit today, Equity LifeStyle and Sun Communities trade around 4-4.2% cap rates on 2021 NOI. While this isn’t expensive, it doesn’t scream cheap. With strong balance sheets and a growing, inflation protected, recession proof business these should produce 7-10% annualized returns.

In valuing the apartment REITs, the lowest cap rate I’ve used in my base case valuation is a 4% cap rate based on private market transactions. This is what I used for The Essex Property Trust (ESS) which has the greatest supply barriers (zoning make residential development in SF/LA very, very difficult and the cost of new supply is prohibitive), favorable long term demand drivers, and highly predictable operating expenses (largely due to Prop 13 which limits property tax hikes to 2% pa).

By comparison, MHPs like ELS have (A) even more restricted supply and (B) a more stable base of demand due to growing 55+ population and affordability. As such, I think these should trade at something lower than a 4% cap rate. As we sit today, ELS trades at a 4.2% cap rate implying modest undervaluation.

So what type of return can an investor expect in purchasing a slightly undervalued security like ELS? In total I think it is reasonable to expect 7-10% per year which breaks down as follows:

2.3% dividend

+ 4-6% same-store NOI growth

+ 1-2% external growth - community expansion (adding new mobile home sites to existing parks), debt paydown, acquisitions/new development

This works out to an expected annualized return of 7.3-10.3% (~9% at the midpoint). This seems more than fair given the low risk profile. With the 10 year treasury at just 1.1%, it is possible that we see cap rate compression which could produce further upside (cap rate compression to 3.5% for instance would suggest 25-30% appreciation potential).

Note that SUI recently acquired a marina business named Safe Harbor which management believes shares many of the same characteristics of the mobile parks business. While this may be true, at this stage I have less knowledge/confidence in the marina business. Thus in the MHP space I own ELS but not SUI.

Song:

This is NOT INVESTING ADVICE. Do your own work.

Eric Bokota owns shares in ESS, ELS

Private Eye Capital Newsletter

Join the newsletter to receive FREE actionable investment ideas.