Kilroy Realty: The Price is Wrong

Note: A draft was sent to our FREE Actionable Investment Idea Newsletter in advance of publication on this website. If you like being in the know and want FREE weekend reading, be sure to sign up NOW. It's FREE!!

Like many office REITs, Kilroy Realty (KRC) shares have been pummeled in 2020, falling over 30% from pre-pandemic levels despite:

1) Tenant base of financially strong tech companies - 98% collections. Weighted average lease duration is 7 years and the company has minimal upcoming maturities in 2021-2022.

2) having a relatively new, Class A portfolio with an average age of just 10 years.

3) meaningful increase in NOI over next two years from new pre-leased projects coming online

Despite these attractive characteristics, Kilroy's shares trade at a large discount to fair value as REITs and particularly office REITs are quite out of favor. When the market shifts from being a voting machine to a weighing machine, I expect KRC's shares could increase 55-75%. In the meantime shareholders collect a 3.5% dividend (just increased).

Interestingly, one of the most successful real estate investors in the world has been accumulating shares of Kilroy (KRC) throughout the year: As of 9/30/20, Blackstone owned nearly 6 million shares (up ~17% from the previous quarter).

Background

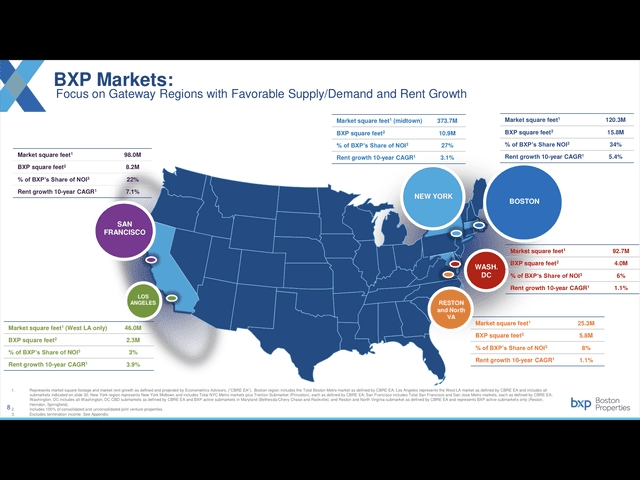

Kilroy is the only pure play West Coast office REIT. Until the Great Financial Crisis of 2008-09, Kilroy was focused only on Southern California but opportunistically expanded north to SF and Seattle. This has worked out quite well for shareholders as SF has been the best office market over the past decade with low vacancy and strong rental growth. This slide from Boston Properties (BXP) shows the long-term outperformance of SF versus other major US cities:

Source: Boston Properties Nov 2020 Investor Presentation

Kilroy has been an active developer, consistently completing projects with a Yield on Cost between 6.5-8% (12-15x NOI) which has created substantial value for shareholders as the private market (and until recently the public REIT market) has typically valued around a 5% cap rate (20x NOI). Projects completed over the past decade have created in excess of $20 per share in value for shareholders.

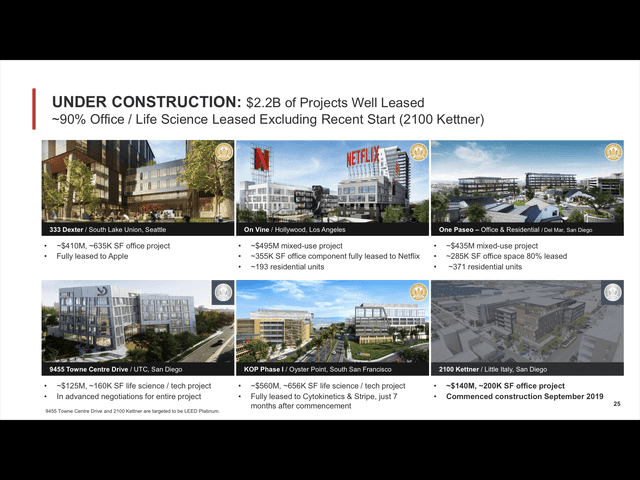

Recently Kilroy has been focused on large scale life sciences development projects, most notably Kilroy Oyster Point (Phase 1 to be delivered in 2021, Phase 2 may be started in 2021 with Phases 3/4 to begin later).

Source: Kilroy Investor Presentation

I expect that Kilroy will continue to opportunistically develop projects. Using its relationships, market knowledge, and project management expertise, it is reasonable to think that the company will continue to generate development returns for shareholders well in excess of its cost of capital.

West Coast Office Space - long term demand outlook is positive

There has been much concern over the future of the office and it is entirely possible that less office space is required in the future. However, Kilroy owns modern Class A facilities with an average age of just 10 years in supply-constrained West Coast markets like SF, LA, San Diego, and Seattle. Similar to what we see on the residential side, it is very difficult to bring new supply to market in the Los Angeles and SF Bay Area metros - one example specific to office realty is Prop M in SF which restricts new office supply.

Long term demand for this type of office space is bolstered by:

- Presence of nearly all large global tech companies in SF Bay area - technology companies have been strong performers throughout 2020 and are reinvesting earnings into growth projects which will necessitate additional hiring and office space going forward.

-Facebook, Google, and Amazon have all increased their physical presence throughout the pandemic - both purchasing and leasing large amounts of additional West Coast office space.

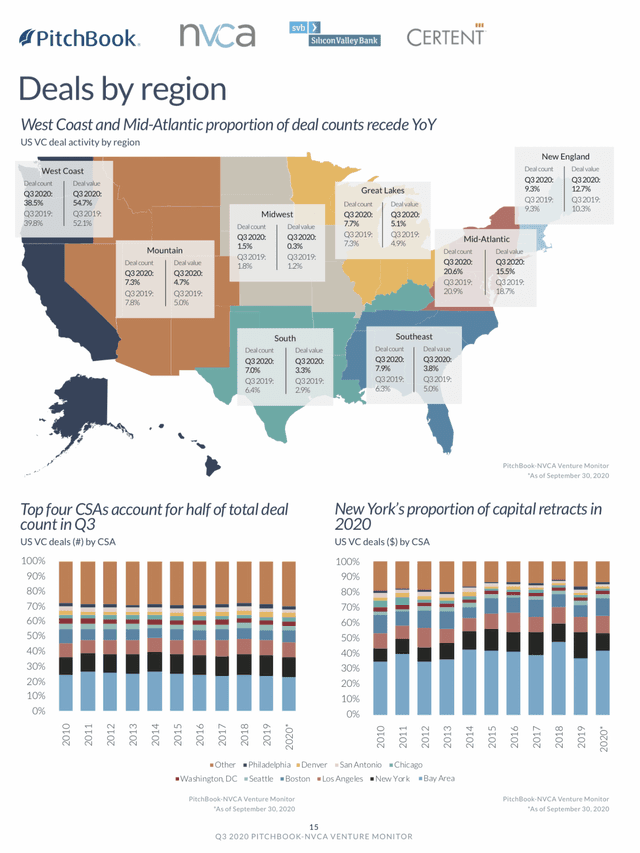

- Continued VC funding to West Coast startups - despite the 'death of California' narrative throughout 2020, West Coast startups continued to command over 50% of all VC funding through the first 3 quarters of 2020. This bodes well for future hiring and office space demand.

Source: Silicon Valley Bank presentation

- Los Angeles is well positioned for a Hollywood-driven boom. Not only is there is pent up demand to produce all the TV/Films which saw production delayed by the pandemic in 2020 but the competition amongst streaming services will lead to increased content production as Hulu, Disney+, HBO Max, Paramount+, in addition to Netflix and Amazon Prime. This is a structural increase in content production and LA will be the prime beneficiary of this expenditure. Earlier this year, one of the most successful real estate investors in the world, Blackstone (BX) entered into a JV with Hudson Properties (HPP) to acquire LA office/production assets. It is also interesting is that Blackstone has been buying shares of KRC throughout 2020 - during 3Q it increased its stake by 16% or $50 million (discussed in 'Valuation' section).

Strong Tenants, Well positioned with minimal 2021/2022 lease expiries

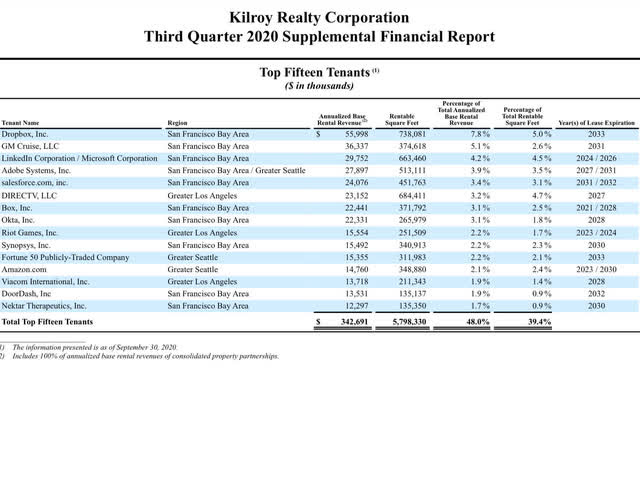

Source: Kilroy 3Q20 Supplemental report

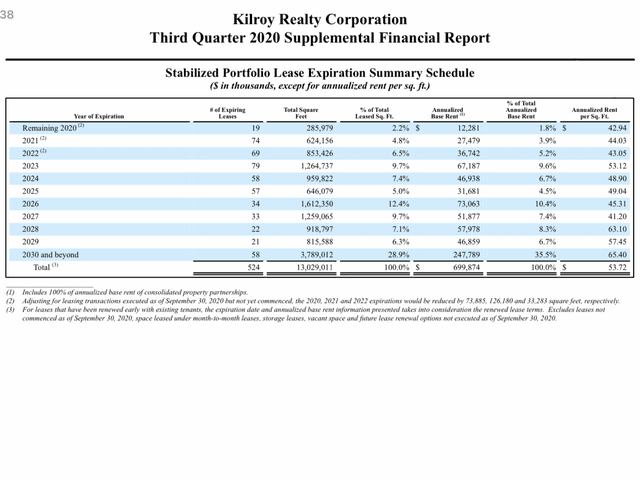

As shown above, KRC has a strong tenant base. Office/life sciences rent collections were 98% in the most recent quarter. While the near term outlook for new office leases in SF is murky as companies are slow to comeback to the office (most big tech workers aren't required to return until mid-late 2021), KRC is insulated against near term market weakness. As shown below, just 4%, 6%, and 10% of KRC's annual base rent has leases which expire in 2021, 2022, and 2023, respectively:

Source: Kilroy 3Q20 Supplemental report

As you can see below, coming into the pandemic, 2021, 2022, and 2023 lease expiries were 25, 13%, and 21% below market rents. While the market has surely softened since then, this gives KRC significant cushion. Even if rents for these years are down 30-35%, this will be offset by rent escalators (3-4%) in the remainder of its lease book. By 2024, it is likely that leasing conditions will have improved substantially as 1) large tech companies will continue to grow (2) startups will continue to get funded and expand and (3) weakness in current conditions will lead to less new space being developed. I expect KRC to be well positioned for improved market conditions with its modern, Class A office space.

Source: Kilroy November 2019 Investor Presentation

Valuation

Kilroy has strong visibility into its Net Operating Income (NOI) for the next several years. Taking into account development projects to be delivered over the next 12 months, KRC expects to have run rate NOI of ~$750 million (at share, stripping out NOI attributable to minority interests) by 4Q21. Using cap rates of 5.5% for office and 4.5% for life sciences, I estimate a 2022 NAV of $90-100 for KRC, indicating upside of 57-75% (and get paid a 3.5% dividend while you wait). The 4.5% cap rate for life sciences is in-line with recent comparable transactions.

As the global leader in private market real estate, Blackstone knows the true value of KRC's assets very well. While BX typically operates in the private market I suspect they found the incredible value in KRC to be compelling enough to buy shares in the public market.

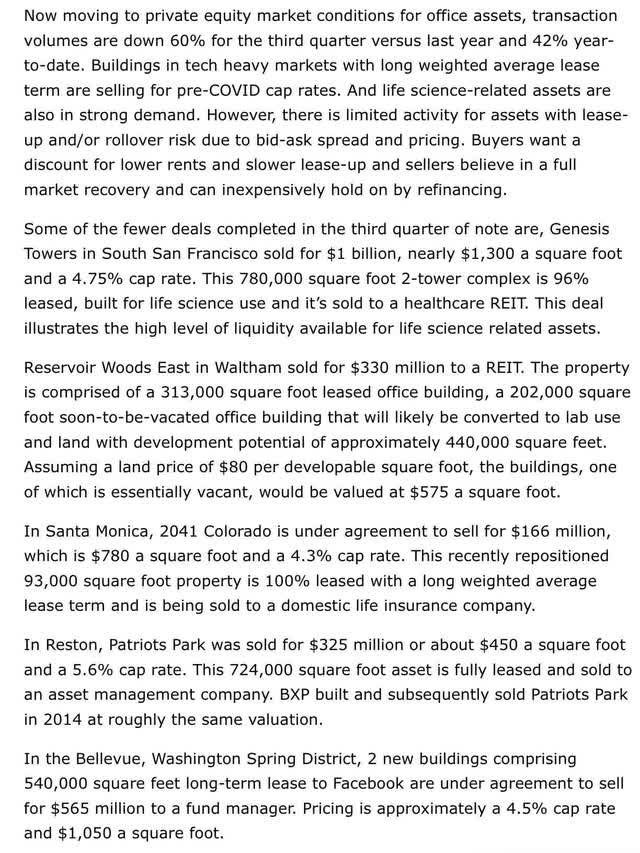

The 5.5% cap rate for office is 70-100 bps above pre-pandemic levels - note that with the 10 year having declined from 1.8% to sub 1% this implies a widening of the cap rate spread by 150 bps. While the pandemic has surely put a damper on office transactions thus far in 2020, on it's 3Q call, Boston Properties management noted that office properties with long duration leases to creditworthy tenants have seen deals at pre-covid cap rates (mid to high 4s):

Source: Boston Properties 3Q20 Earnings call transcript courtesy of SA

With a history of value-accretive development and strategy/platform for continued value creation, I believe that ultimately KRC shares should trade at a premium to NAV.

Balance Sheet

Kilroy has a strong balance sheet with no maturities until 2023, $1.4 billion of liquidity (more than enough to fund its development pipeline) and an LTV below 30% (using a 5.5% cap rate for office; 4.5% for life sciences).

Kilroy's strong balance sheet will not only allow it to weather the storm but to be opportunistic in both developing new properties as well as potentially acquiring properties from distressed sellers.

Conclusion

While KRC's share price has been battered by negative headlines surrounding office real estate and California, the company has a strong roster of creditworthy tenants, increasing life sciences exposure, a terrific development track record, coupled with long average lease duration with minimal near term expiries and a strong balance sheet. Despite having a limited risk profile, shares trade at a significant discount to private market value offering excellent upside potential to long-term shareholders.

Risks

- REITs remain out of favor

- Work from home trend is greater than expected and demand for office space is weaker than expected

-Everyone packs up and leaves CA

- Interest rates increase significantly

As always, this is not investment advice. Do your own work.

Eric Bokota owns shares of KRC.

Private Eye Capital Newsletter

Join the newsletter to receive FREE actionable investment ideas.