Invitation Homes ->Buy Rental Houses at a Big Discount

Paid

Members

Public

Note: this article was sent out to subscribers in advance of web publication. Wanna hear it first? Sign up [https://privateeyecapital.us17.list-manage.com/subscribe/post?u=9817d763c853faa67051e844f&id=42a78a95e4] to receive Private Eye Capital's FREE Actionable Investment Idea Newsletter. It's FREE! (brought to you

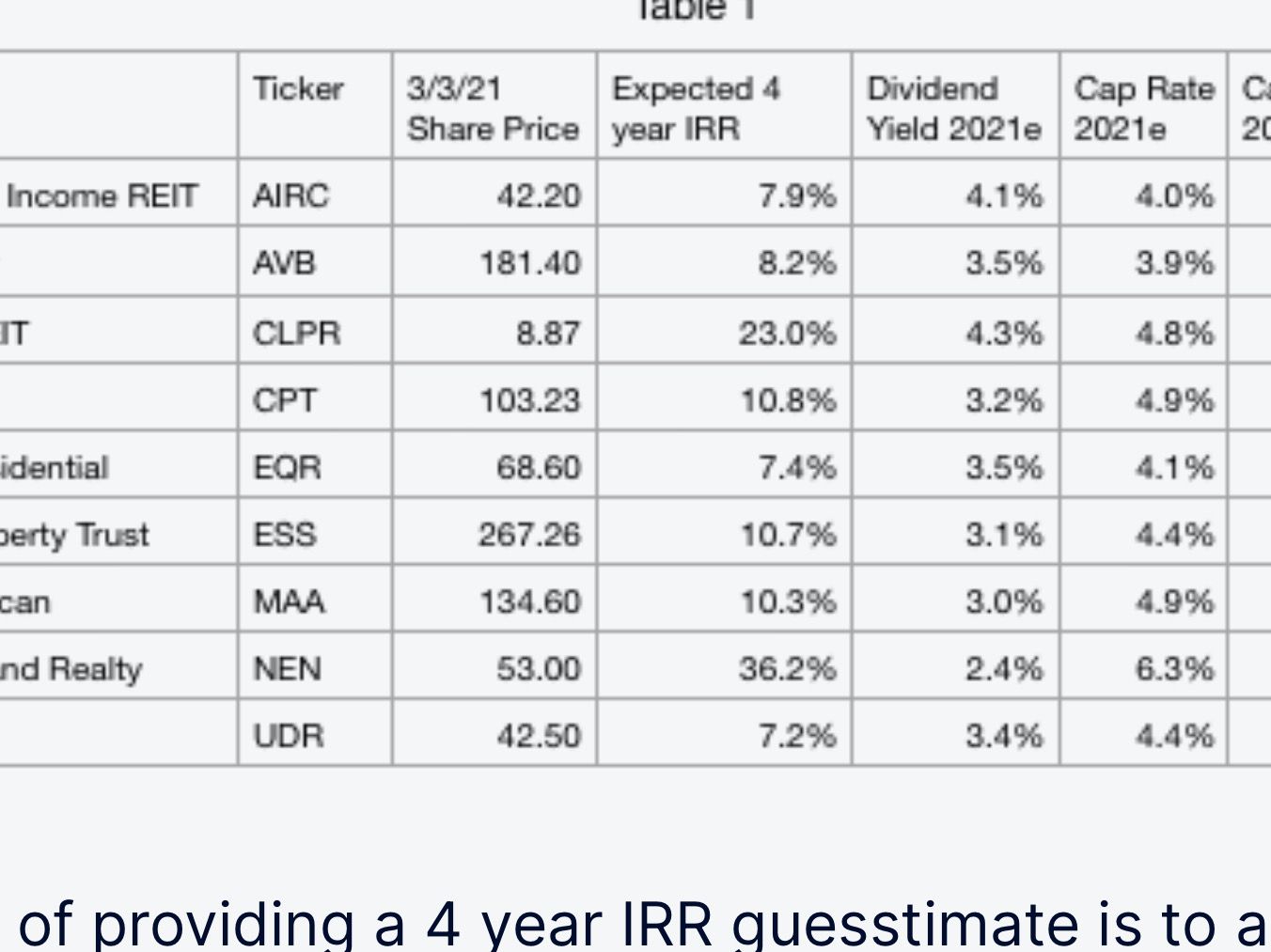

UPDATED: Cap rates, 4 yr expected IRRs for Apartment REITs

Paid

Members

Public

Thought it was time for a quick update here as companies have reported and share prices have moved up a bit. Broadly speaking, the coastal/urban apartment REIT share prices have moved up. Unlike the wizards on the sellside who like to keep their price targets closely in-line with the

TJX results

Paid

Members

Public

TJ Maxx reported 4Q/FY results. While TJX shares have done well since I first wrote [https://www.privateeyecapital.com/tjx-the-maxx-for-the-minimum/] about the company, this is the market starting to look forward to brighter days in 2022 and beyond. Current results remain weak due: -store closures overall stores were closed

10 year Treasury hits one year high

Paid

Members

Public

Last week, interest rates and inflation came back into focus as the 10 year treasury yield hit its highest levels in one year.The ten year treasury rate has doubled since I started this site a mere 6 or so months ago as inflation expectations have increased and market participants

More office results/Musings on Office/ Margin of safety

Paid

Members

Public

I have been thinking about office real estate and office REITs more over the past couple of weeks. As noted in my piece [https://www.privateeyecapital.com/index-weightings-and-other-factors-explain-why-many-bargains-abound-in-reit-land/] highlighting the severe underweighting of apartment REITs in real estate indices/ETFs, office REITs are also significantly underweight (versus real commercial property

Kilroy Realty: $200+ million in NOI for FREE or... How bad is SF really?

Paid

Members

Public

Note: this article was sent out to subscribers in advance of web publication. Wanna hear it first? Sign up [https://privateeyecapital.us17.list-manage.com/subscribe/post?u=9817d763c853faa67051e844f&id=42a78a95e4] to receive Private Eye Capital's FREE Actionable Investment Idea Newsletter. It's FREE! Headlines like this:

EQR Results; Expectations/Moods/Share Prices

Paid

Members

Public

Equity Residential (EQR) reported results last week showing improved quarter over quarter occupancy. While rents declined year over year, concessions/incentives have declined and rents have stabilized versus last quarter. LA, Boston, Orange Country and San Diego rank are expected to show relative strength for 2021. Of course, SF and

MAA/CPT -Quick sunbelt update

Paid

Members

Public

Mid American and Camden both reported results last week. For 4Q20/FY2020 MAA's results were a bit better as it has less exposure to the soft Houston market and no exposure to Los Angeles. Similarly, MAA has a slightly better outlook for 2021. MAA mgmt expects slightly positive