UPDATED: Cap rates, 4 yr expected IRRs for Apartment REITs

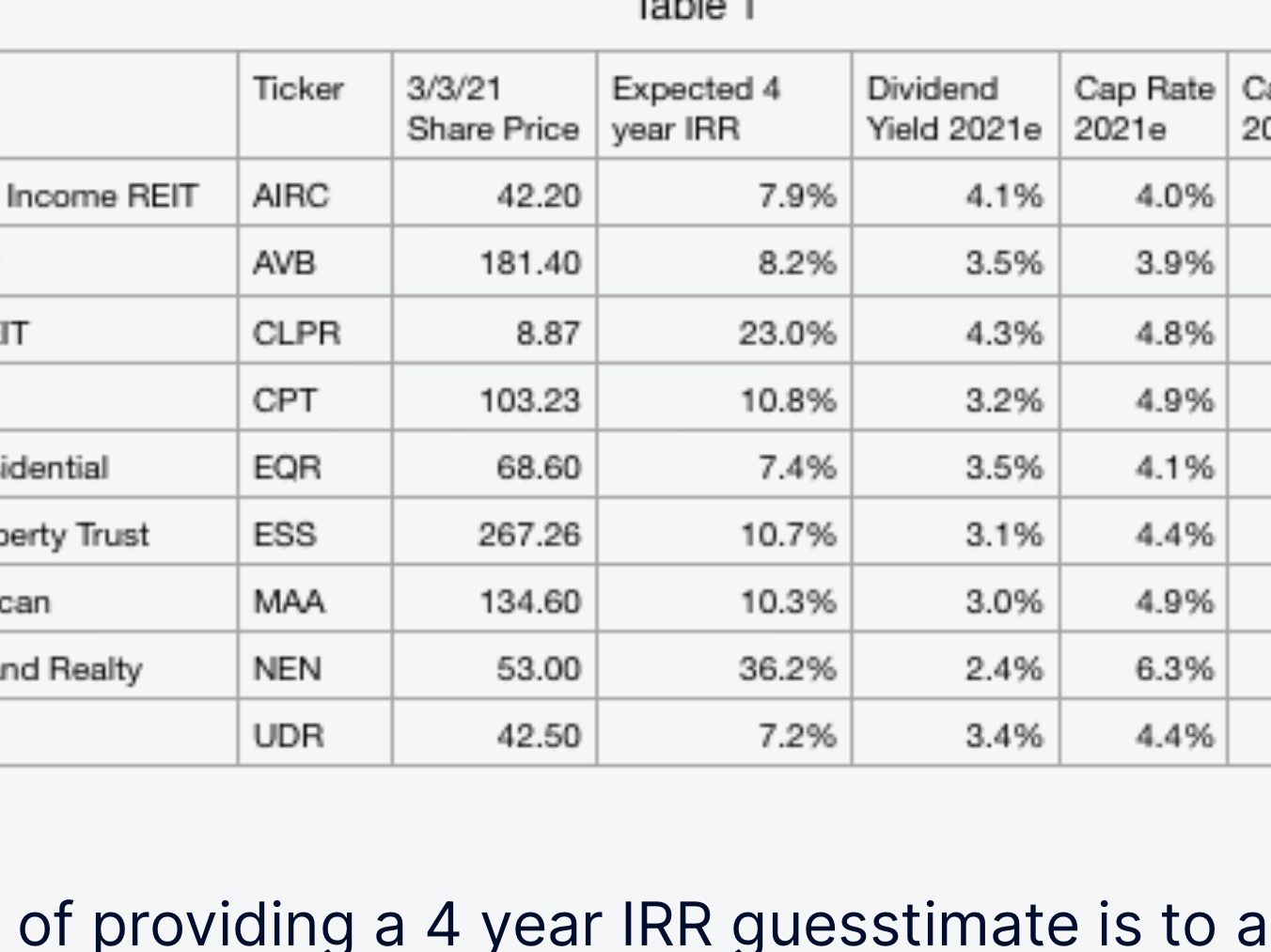

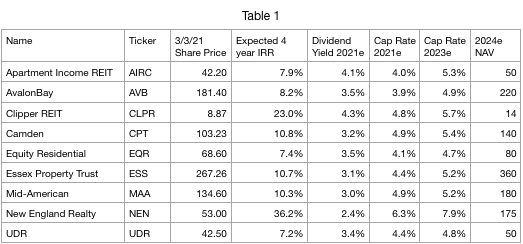

Thought it was time for a quick update here as companies have reported and share prices have moved up a bit. Broadly speaking, the coastal/urban apartment REIT share prices have moved up. Unlike the wizards on the sellside who like to keep their price targets closely in-line with the current share price (leads to comically gesticulating price targets and insane commentary from these 'experts'), my NAV estimates have not moved much. As regular readers already know, my NAV estimates are derived using actual apartment values (private market cap rates, price unit estimates, replacement cost, etc). With share prices having moved up and NAV estimates relatively flat, expected 4 year IRR has come down. That's just the math. Within the large cap multifamily space, ESS, CPT, and MAA are the only apartment REITs which I expect to produce double digit returns over the next 4 years.

The purpose of providing a 4 year IRR guesstimate is to allow for comparison versus investing in private funds or syndication deals (which typically provide forecast IRRs). Key assumptions include:

- Apartment REITs trade at NAV by end of 2024. Historically apartment REIT valuations (and REITs in general) have reverted toward NAV. The estimated NAVs are based on my best estimate of current private market values.

- 2024 NAV assumes a recovery in NOI for gateway coastal markets (2021 NOI will be depressed as higher vacancy/ lower rents flow through). For sunbelt markets which have seen only modestly negative impacts from COVID, I assume 2021 NOI is basically equal to 2019 and then 3% growth per year to 2024.

- Modest growth in dividends for most apartment REITs

- Modest benefit from deliveries of newly developed units over the next several years (this has a relatively small impact on the NAV growth over the forecast period)

Of course, should the apartment REITs trade to NAV sooner than 2024, IRRs would be higher than those shown above. If it takes longer than 4 years to revert to NAV, IRRs would be lower. Historically share prices have traded in a band (sometimes at a premium, other times at a discount) around NAV. There is a reasonable argument that REITs should trade at a premium to NAV which is as follows:

- Daily liquidity - REITs can be converted to cash daily via a brokerage account whereas syndication deals and private funds are typically locked up for 5+ years (though liquidity events such as a refinancing can provide sizable interim distributions).

- Greater transparency via quarterly supplementals, quarterly conference calls, audited financing statements

- Lower expenses - private investment vehicles charge fees. Fee structures vary widely but in nearly all cases fees are significantly higher than the central overhead expense incurred by apartment REITs.

- Access to more sources of capital/ opportunistic share issuances/buybacks - large apartment REITs can access not only the secured financing markets (mortgages on properties) but also issue unsecured debt at the holding company level, typically at lower interest rates than available on mortgage debt. Publicly traded equity allows for issuances at a premium to NAV and buybacks at a discount to NAV, both of which are accretive to NAV per share. All else equal, opportunistic asset sales and share buybacks will increase NAV per share.

Song:

As always, this is not investment advice. Eric Bokota owns shares in the securities discussed in this post.

Do your own work.

Private Eye Capital Newsletter

Join the newsletter to receive FREE actionable investment ideas.