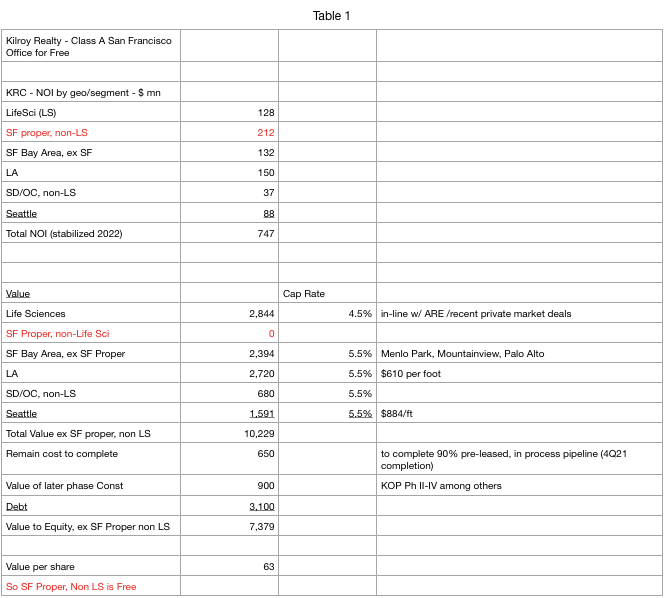

Kilroy Realty: $200+ million in NOI for FREE or... How bad is SF really?

Note: this article was sent out to subscribers in advance of web publication. Wanna hear it first? Sign up to receive Private Eye Capital's FREE Actionable Investment Idea Newsletter. It's FREE!

Headlines like this:

Create opportunities like this:

At $60 per share, the market is giving ZERO credit for Kilroy's downtown SF office properties. Properties which generate $200+ million under long term leases to tenants like Microsoft, GM, Salesforce, etc.

As goes KRC's SF Proper exposure, it is 98.2% leased - primarily to very strong/creditworthy tenants. Lease expiries are minimal over the next few years. Several of the properties could likely be sold at 5%ish cap rates given that they are relatively new properties long-term leased to credit tenants (GM, Microsoft, Salesforce, Adobe, Dropbox, DoorDash)

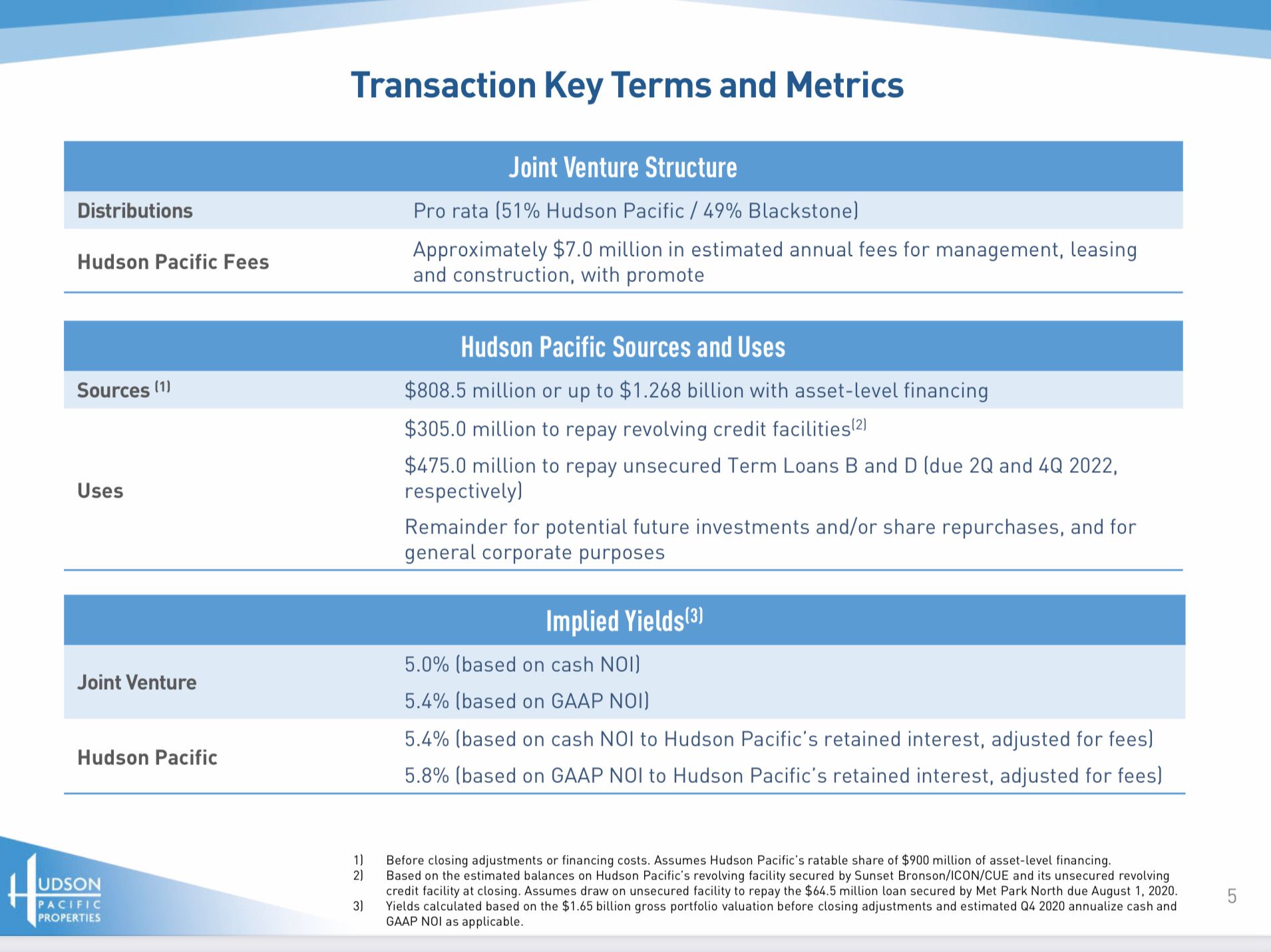

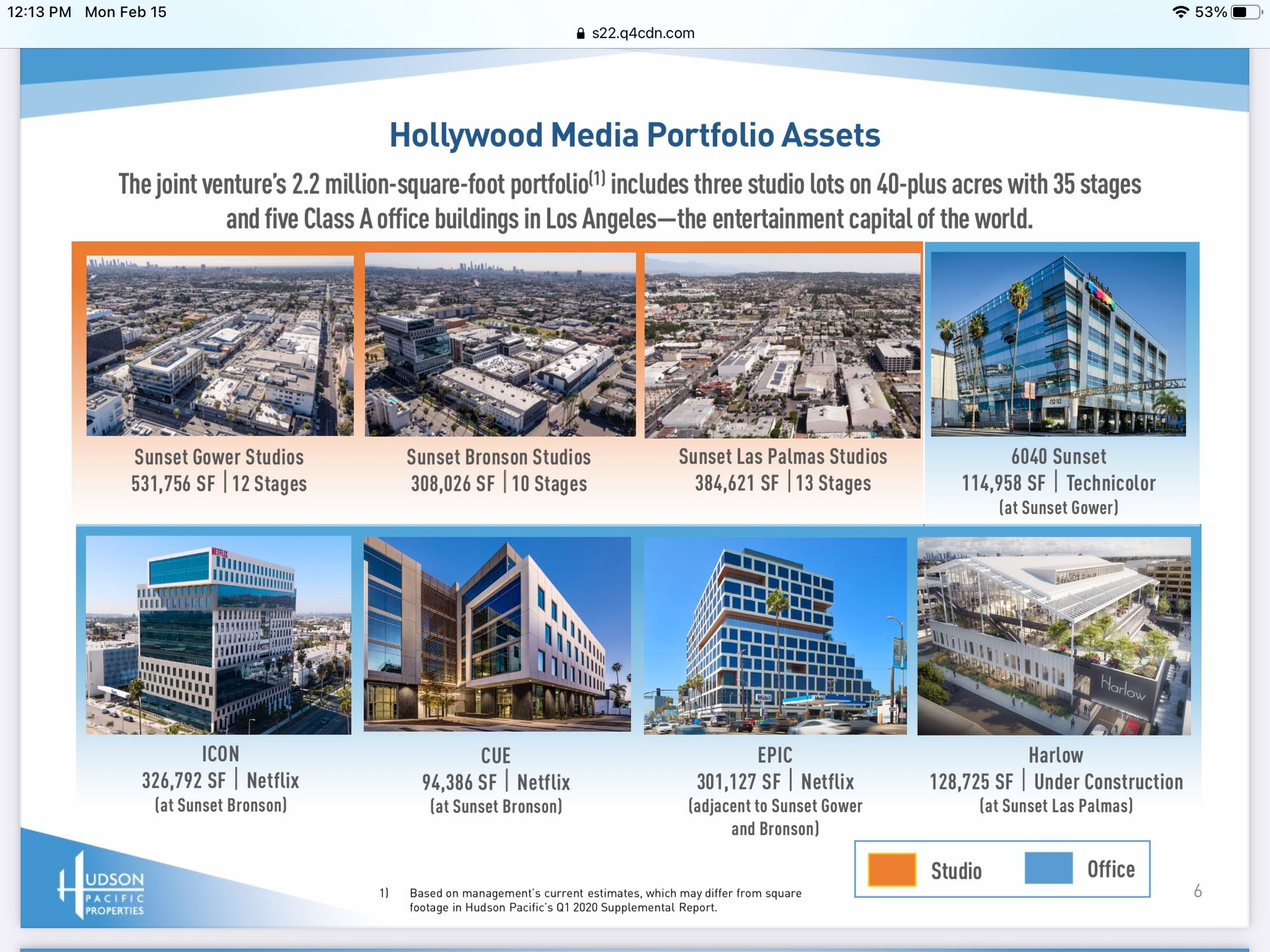

LA office space has seen some transactions post COVID. Most notably the one of the world's best real estate investors, Blackstone (BX), purchased a large interest in a JV with Hudson Pacific Properties (HPP) in June - the deal was done at a cap rate in the 5s. The properties in the JV contained a mix of studio and office assets (leased to entertainment industry tenants like Netflix). Several of Kilroy's offices are leased to the same type of tenants (Netflix, Tencent, Viacom).

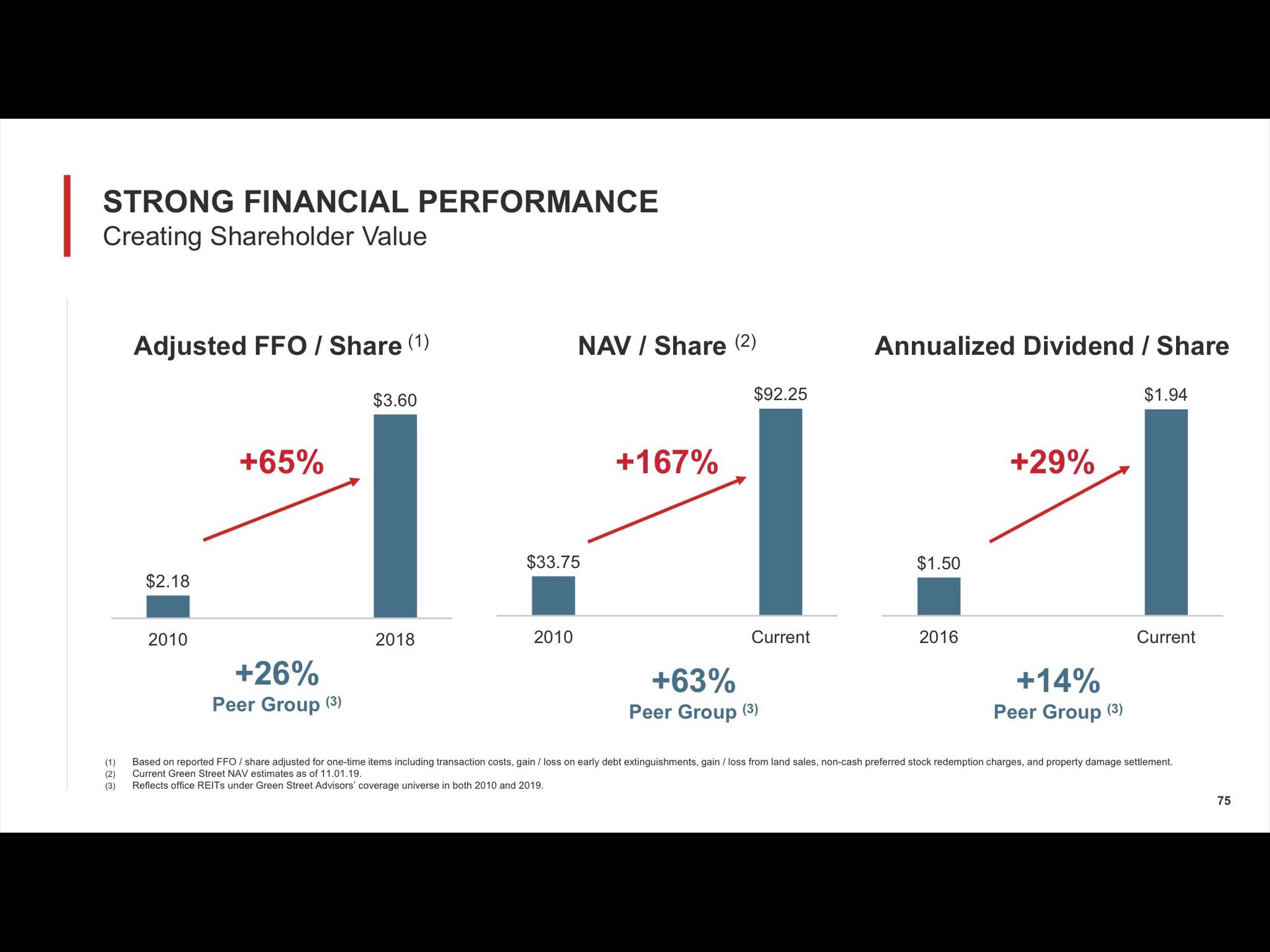

So you get a portfolio of Class A office in SF leased to credit tenants for FREE and a management team which has consistently created value for shareholders:

Source: KRC Nov 2019 Investor Day Presentation

Delivering new construction at a 7-8% yield (NOI/ cost) long term leased to credit tenants creates tremendous value for shareholders as these assets are generally salable at 5% cap rates or lower (so create at a 12-14x multiple and sell at 20x or higher).

Find this interesting? Check out my recent initiation /update on KRC. I think NAV is $90-100 and that given mgmt's track record of creating value for shareholders, shares could easily double over the next couple of years.

As always this is NOT INVESTMENT ADVICE. Do your own work.

Eric Bokota owns shares of KRC.

Song:

Private Eye Capital Newsletter

Join the newsletter to receive FREE actionable investment ideas.