Invitation Homes ->Buy Rental Houses at a Big Discount

Note: this article was sent out to subscribers in advance of web publication. Wanna hear it first? Sign up to receive Private Eye Capital's FREE Actionable Investment Idea Newsletter. It's FREE! (brought to you by the Department of Redundancy Department).

Unless you’ve been living under a rock for the past year, you’ve probably read countless articles about the strength of the US housing market. The single family rental housing market is very strong as well. Not only was it strong during 2020 but it has been strong for the past several years with rents/NOI growing faster than for apartments. Strength in the US housing market (both home prices & rents) have been driven by:

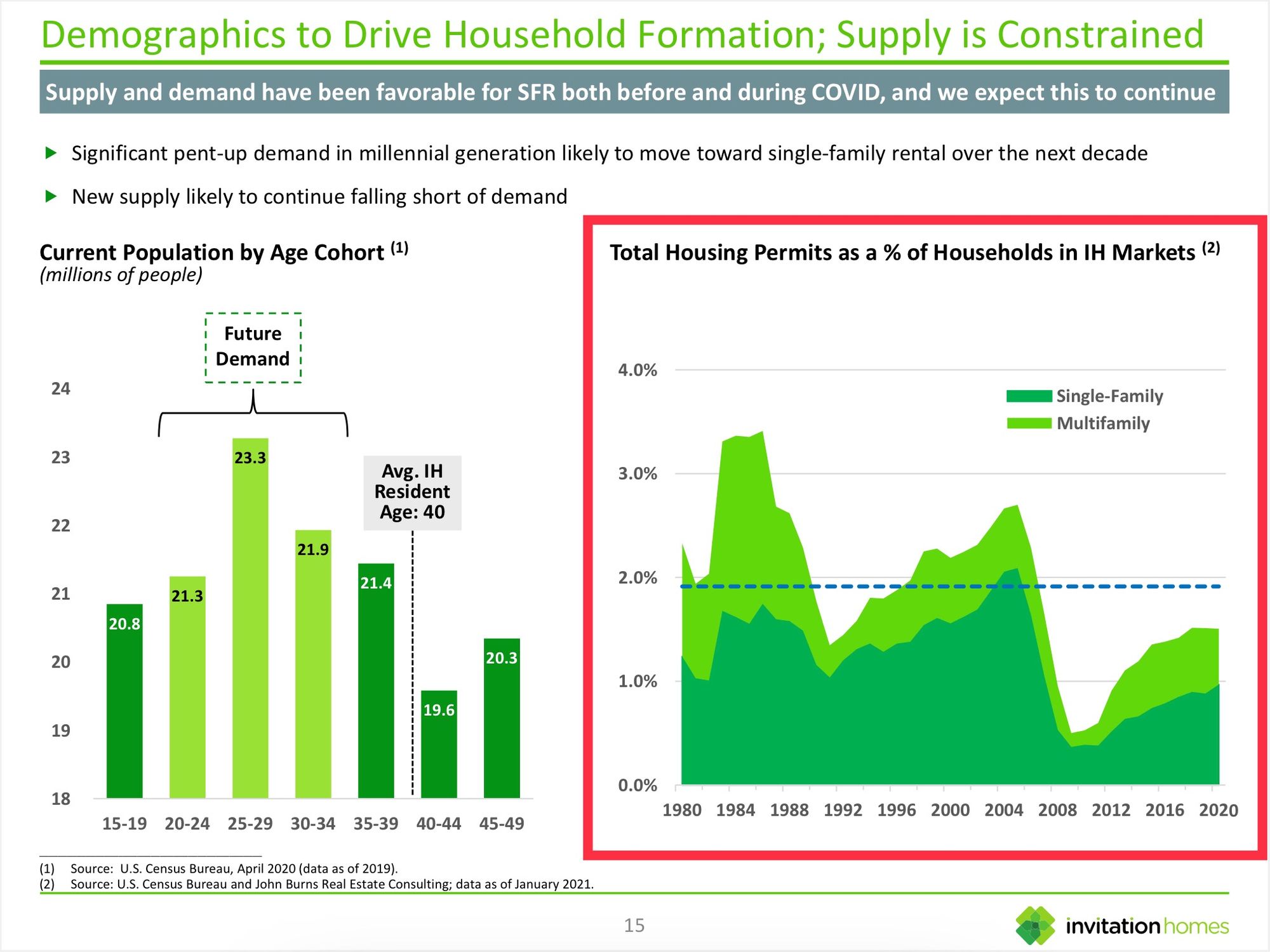

- Demand - demand has been very strong for two reasons (slide below, left of the red box): A) millennial generation is getting married, having kids, and moving to the suburbs (B) this has been hastened by the pandemic -> many buyers/tenants and not so many sellers/landlords.

2. Supply (red box in slide above)- After the housing bust of 2007-2009, too few houses were built in the US over the ensuing decade. Meanwhile construction costs have soared- the cost of buildable lots, construction materials, and labor have all risen much faster than the level of general inflation. Further regulatory constraints (stricter building codes) have exacerbated supply issues.

3. Low interest rates - While interest rates have risen over the past six months, mortgage rates are very low versus historical averages which has stimulated housing demand.

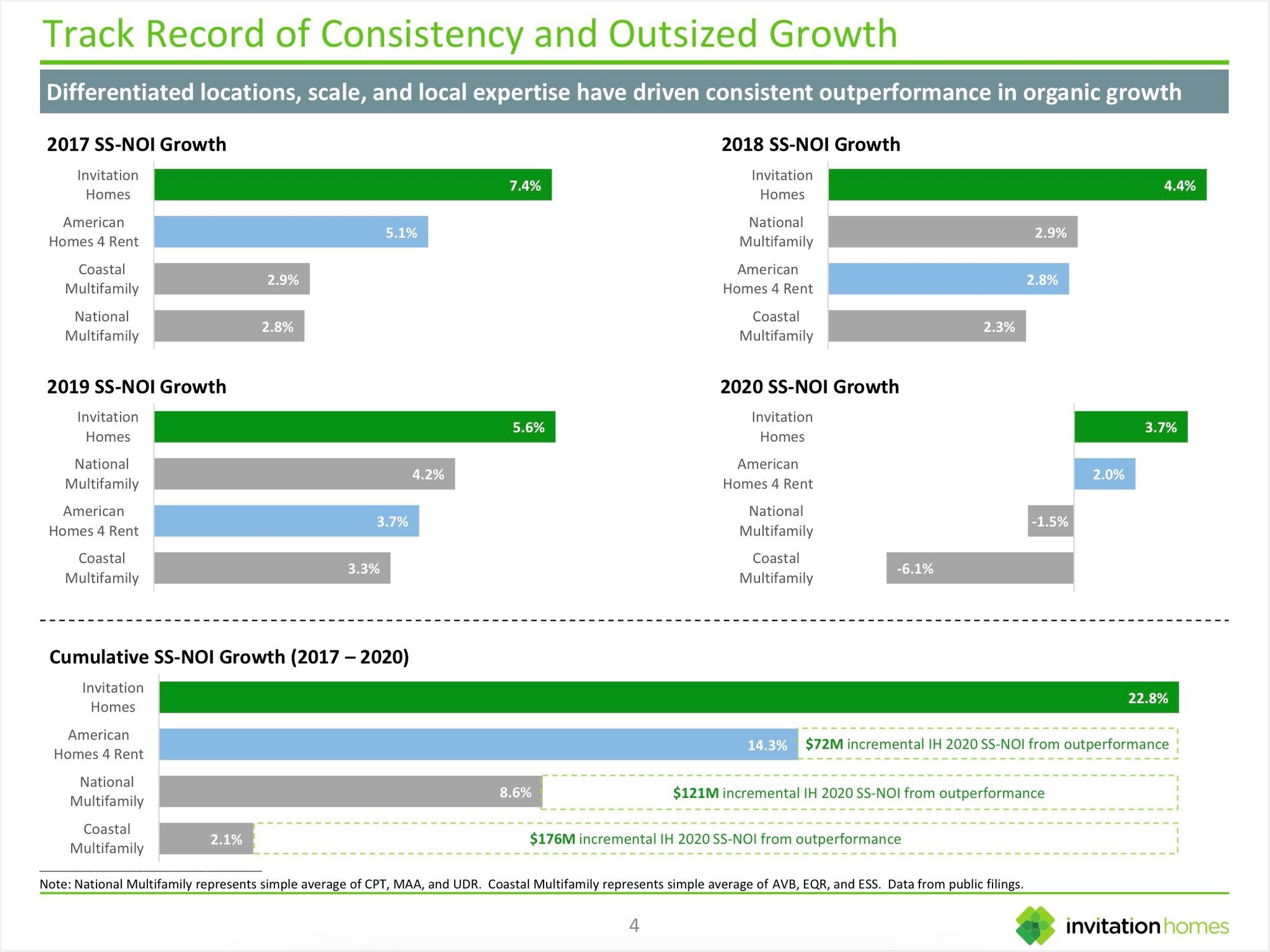

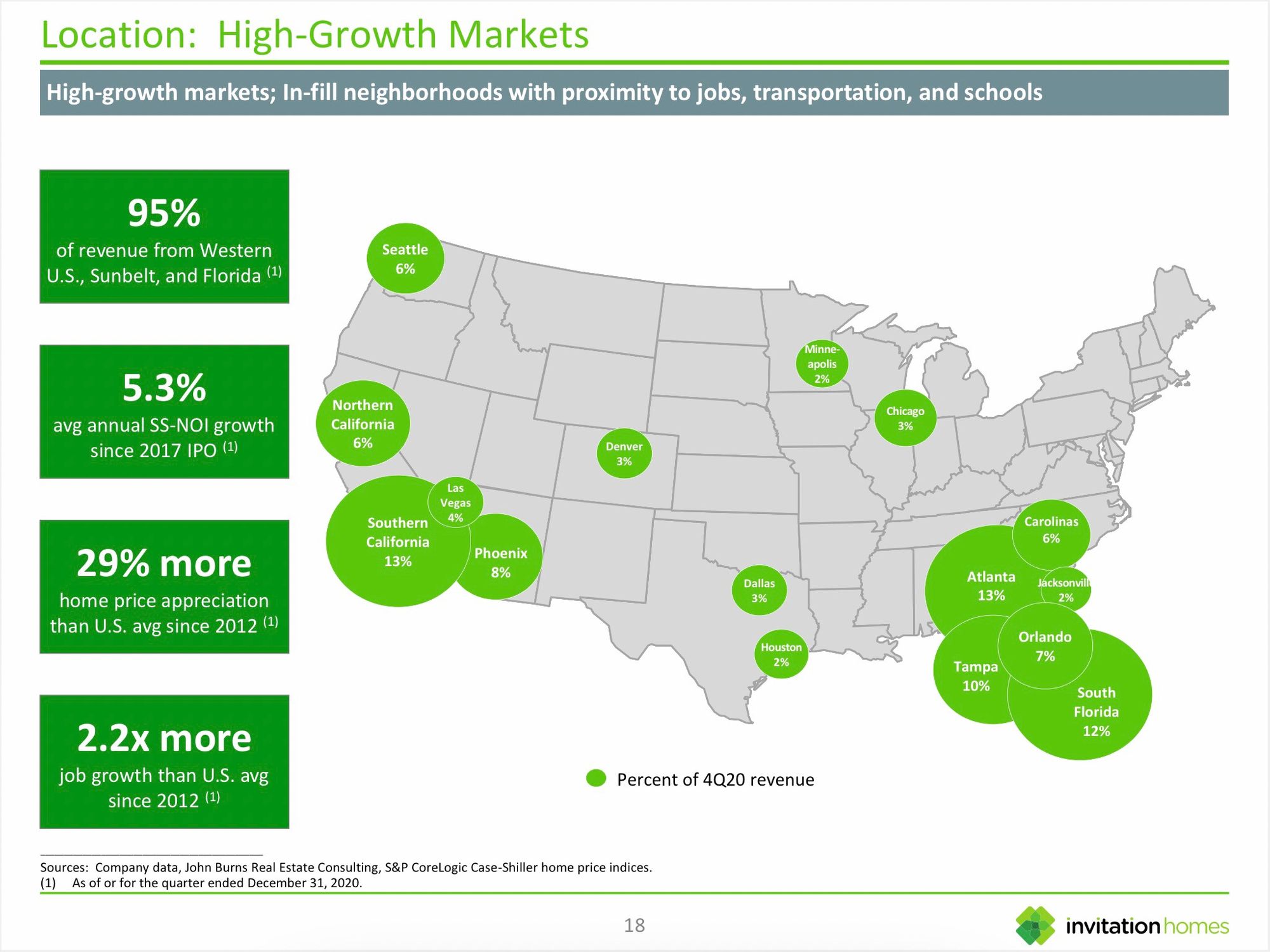

While this trend looks set to moderate a bit as the pandemic wanes, the maturing of the millennials is a powerful demographic tailwind which will propel demand for many years into the future. The outlook for supply is also favorable as constraints mentioned above persist. This supply/demand bodes well for owners/landlords of single family homes. Today I will discuss Invitation Homes (INVH) which owns over 80,000 homes in growing markets throughout the US. At $28/share, I believe shares are very interesting. My thesis is as follows:

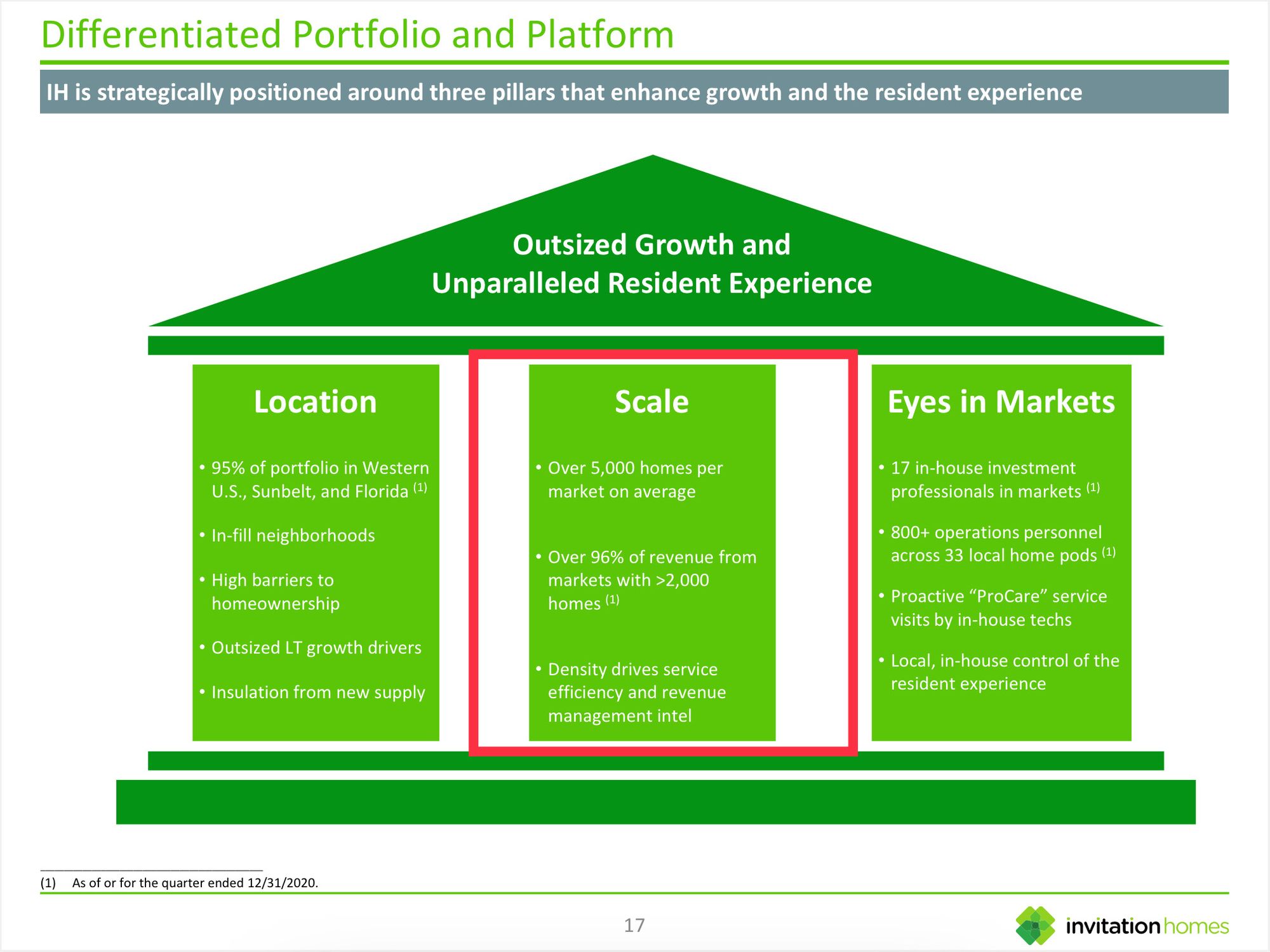

A/ While anyone can buy a home and become a landlord, this is a scale/density business. To effectively manage single family homes BIGGER IS MUCH BETTER. Scale allows for in-house provision of services at lower costs. For instance, INVH can hire plumbers, electricians, etc full time and spread the cost out across its vast portfolio of homes. The cost of repairs/maintenance for INVH is significantly lower than for landlords owning only a few houses.

B/ Route density is also critical. On average, INVH owns 5,000 homes per market. This allows INVH to cluster maintenance jobs (aforementioned plumber spends less time driving and can complete more repair jobs per day). These efficiencies have lead INVH to achieve NOI margins of ~67%. Put simply, with scale and density INVH retains more of each rental $ as profit than competitors.

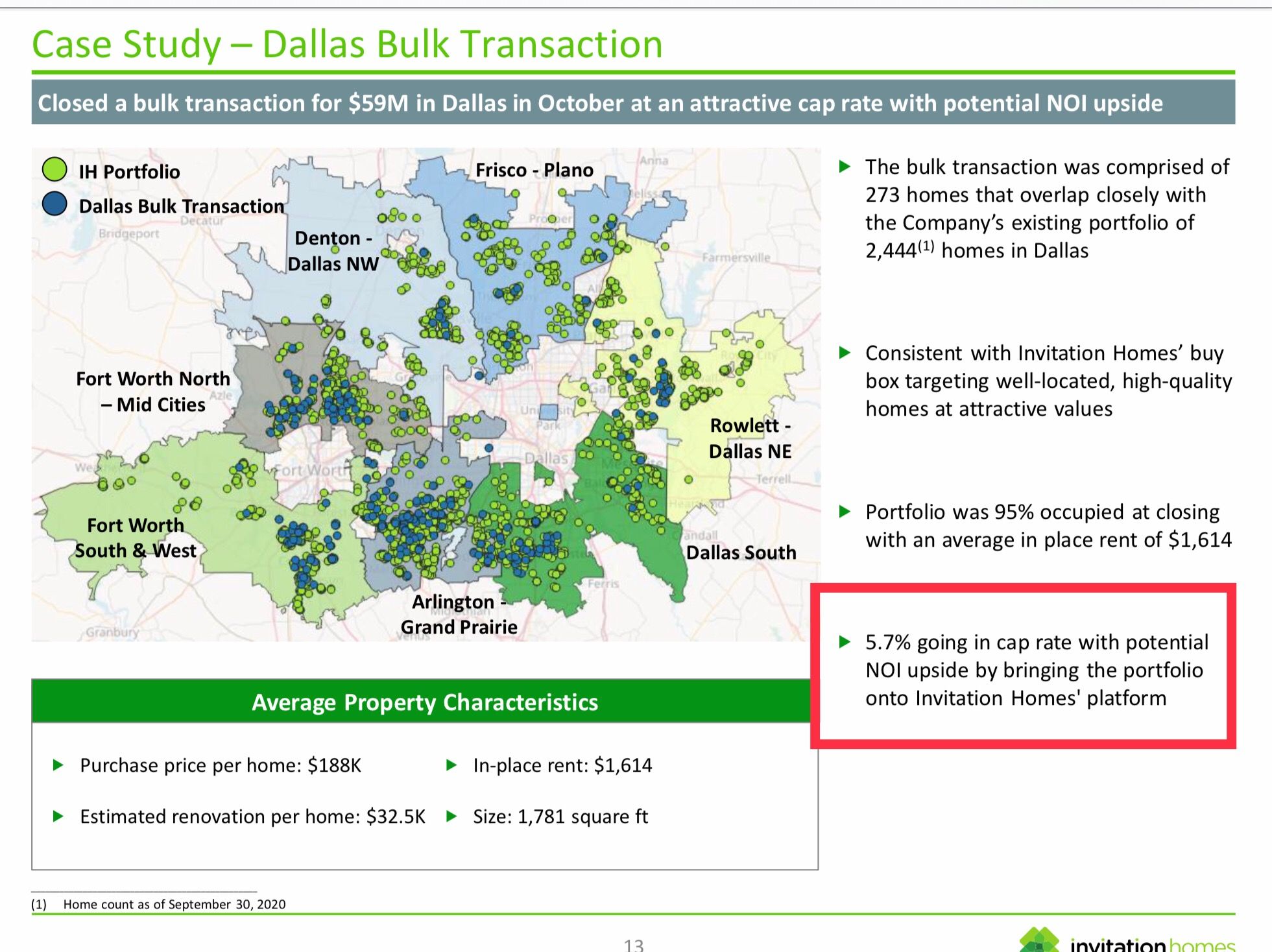

C/ Scale advantages = PLATFORM VALUE. Because INVH keeps more of each rental $ received, each home is worth more in the hands of INVH than to a less efficient small operator. Recipe for value accretive external growth (buying more homes). Recently INVH has been acquiring at 5.5%+ cap rates.

D/ Strong housing market coupled with housing market dynamics have allowed INVH to fund high return investments by selectively selling houses at high prices/very low cap rates. For instance in 4Q20, INVH sold nearly 300 homes for $295k each (2.3% cap rate); in 14 out of the last 16 quarters INVH the average selling price for INVH home sales have been sub 3.5% cap rates.

Play around on Zillow for and you will quickly realize that there are many homes which don’t make sense as rentals - the yield is just too low. Unlike apartment buildings which are owned exclusively as investments, single family homes are mainly owned as residences (duh Eric). What this means is that people own homes for non-economic reasons (or different economic reasons - tax deductions, etc) and sometimes the economics of buying/renting a home aren’t in sync. This gives INVH an ongoing opportunity to optimize its portfolio by recycling capital out of low yielding assets and into higher yielding homes.

In addition, a recent JV gives INVH additional buying power. Should investors take a liking to the company and give shares a premium rating, this would provide INVH with additional firepower for acquisitions.

E/ Occupancy at INVH is in excess of 98% today - well above even the best multifamily operators. This bodes well for rents. Historically, rent/NOI growth for INVH has exceeded that for the apartment REITs and I expect that rent growth will remain very strong for INVH due to the favorable supply/demand dynamics I discussed above.

F/ INVH operates in attractive markets with growing demand for single family rental units. Job/population growth exceed the national average. Again this is good for rents.

G/ INVH has a VERY STRONG BALANCE SHEET -loan to value (LTV) is only about 30% (think about that - most people only put 10-20% down when buying a house and have LTVs of 80-90%). I see INVH as a very low risk situation.

Valuation

For the apartment REITs, I estimate NAV by using private market valuations based on valuations at which similar assets are transacting in the real market (i.e. buying and selling actual apartment buildings). The best way to do this (I walk through how to do this here) has been using market cap rates and cross checking this with implied price per unit.

The best way to calculate INVH’s NAV would be to sum the estimated value (expected sales price) of its 80,000 homes, deduct the debt, divide by shares o/s and spit out the result. I can’t actually do that though because I don’t have A) the granularity of data (addresses) or B) the time - that would take a while.

So, similar to what I did with the apartments, I am using the cap rate method to estimate NAV here. Because of the dynamics of the single family home market I suspect this will result in something conservative versus the theoretical liquidation value (actual NAV).

For most of the apartment REITs, I’ve used cap rates of 4.25% (slightly conservative versus where assets have recently traded). I expect same store growth here to be 0.5-1% faster than for the apartments (probably around 4%). Capital recycling/external growth (w/o new equity) could add another 1% to NOI growth. As a negative, maintenance capex is higher for single family homes than apartments (closer to 15% vs. 9-10% for apartments). If I apply the same 4.25% cap rate to 2021e NOI (similar to the apartments I deduct property management expenses from NOI - this is a bit conservative), I arrive at an NAV of ~$33/share. At $28.50, INVH is trading at a 14% discount to NAV. At a 4% cap rate (same cap rate as used for the highest quality apartment REIT Essex), I get an NAV of $36 (putting INVH at a 20% discount to NAV).

As mentioned above, I think INVH has platform value due to its scale/density advantages (INVH keeps more of each $ of rent received) as well as opportunistic capital allocation. I believe INVH will create value for shareholders by growing the number of homes it owns. As such I think the company is worth 10% or so more than NAV. This suggests a fair value of $36-40 or 28-40% upside.

This level of upside is particularly interesting because:

-I consider INVH to be a very low risk investment for long term shareholders given its balance sheet strength and the very stable nature of the income it generates.

-Like the apartment REITs, there is positive optionality for a takeout or by increasing LTV, i.e. I believe INVH could payout a one-time special dividend equal 80% of its share price while still owning ALL 80k homes.

As always, THIS IS NOT INVESTMENT ADVICE. Do your own work.

Eric Bokota owns shares of INVH.

Private Eye Capital Newsletter

Join the newsletter to receive FREE actionable investment ideas.