Other things I've done (pt. 2) - Towers

Paid

Members

Public

Welcome to the wonderful work of economically resilient communications infrastructure assets. During the Jan/Feb selloff I was able to purchase shares of American Tower (AMT), a global operator of cellphone towers, at a reasonably attractive price. Cell towers house critical piece of the communications landscape and cell tower REITs

Things I don't much like that I've nibbled on

Paid

Members

Public

While 1Q22 allowed me many opportunities to buy high quality businesses at attractive prices, over the past week I've done a little bit of dumpster diving. In no particular order: KB Homes (KBH) & M/I Homes (MHO)- While I've owned many building products companies

Some other things I've done this Quarter (part 1)

Paid

Members

Public

In no particular order: * Significantly reduced exposure to Kilroy Realty (KRC) which I've written about repeatedly [https://www.privateeyecapital.com/tag/krc/]. The company continues to successfully execute life sciences development and is building NAV per share. I continue to think this is the best of the office

Offprice retail is on sale -TJX ROST BURL

Paid

Members

Public

First of all I apologize for the title. Seriously. I've made an investment into the three off-price retail leaders TJX, ROST, and BURL. While many (most?) apparel retailers have been disastrous long term investments, off price retailers TJX and ROST have been structural winners/disruptors (moreso than online

Buying the STORe

Paid

Members

Public

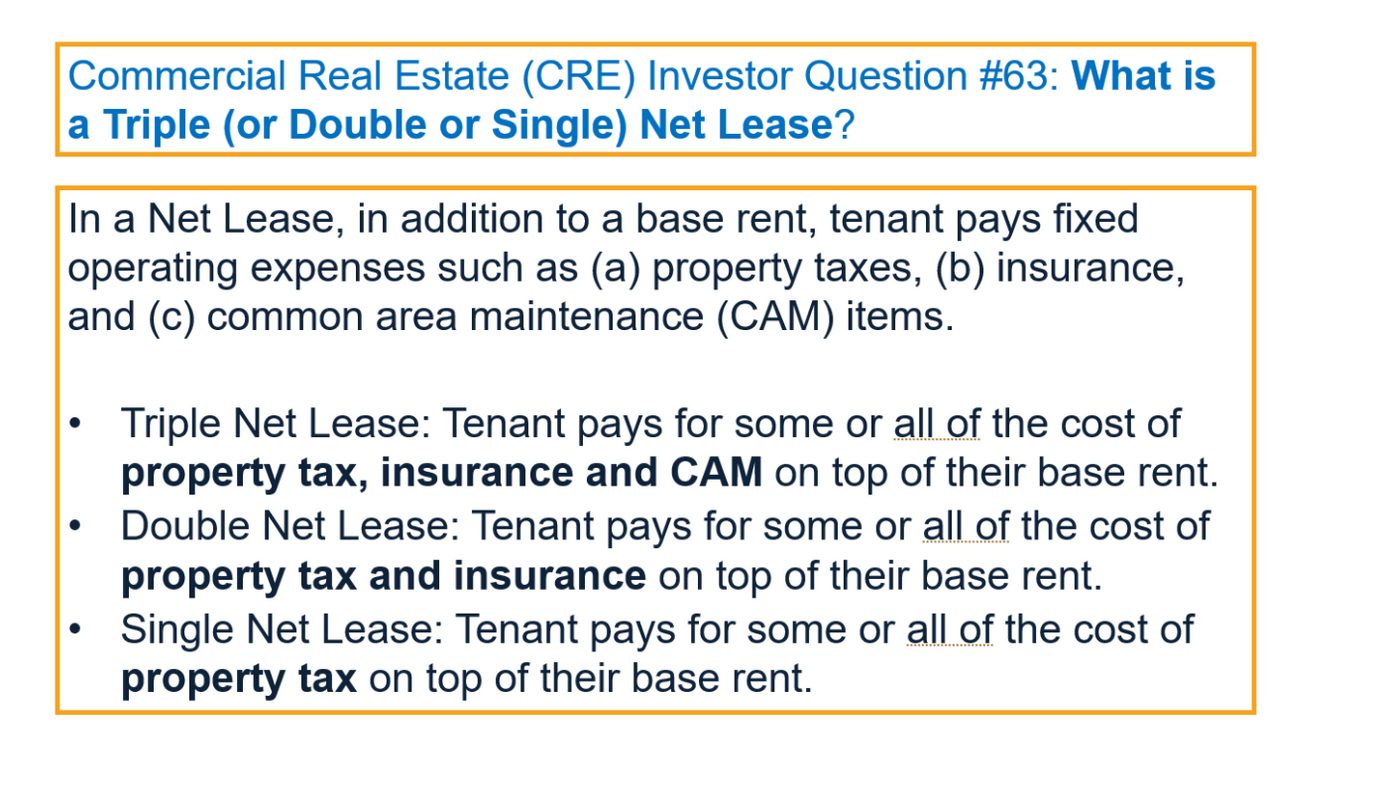

I've taken a position in Store Capital (STOR). I'd previously Tweeted about this position but figured I write a bit more about why I think this triple net lease REIT is an attractive opportunity for long term investors. STOR shares have been hit as: -Co-founder/Chairman

Tax Loss Selling/ The Most Wonderful time of the year

Paid

Members

Public

This is a work in progress which I'll be adding to over the next few days......Tell me if you've seen this: that stock which looked like a good deal sometime in November has continued to fall. And fall. And fall. Doesn't seem like

Contemplating BlueRock Residential REIT

Paid

Members

Public

Warning this is a half assed draft (moreso than all the other half assed drafts on my site). Quick and dirty -Sunbelt apartments are an incredibly hot asset. Rents are soaring and cap rates are compressing. -BlueRock (BRG), an owner of sunbelt apartments, trades at a significant discount to NAV.

Columbia Property Trust (CXP) go-private deal suggests significant upside for Kilroy

Paid

Members

Public

To follow me on Twitter (more timely updates), click here [https://twitter.com/PrivateEyeCap]. By my calculations, CXP is getting done at about a 6.3% cap rate. Some of the headline #s I saw don't appear to have ascribed value to the company's development portfolio.