Things I don't much like that I've nibbled on

While 1Q22 allowed me many opportunities to buy high quality businesses at attractive prices, over the past week I've done a little bit of dumpster diving. In no particular order:

KB Homes (KBH) & M/I Homes (MHO)- While I've owned many building products companies over the years, I don't care for the homebuilding business itself as primarily due to its capital intensity - cash flows tend to be plowed back into inventory (read: land bank).

Homebuilders had a tremendous run since the onset of COVID as millennial buyers flocked to the burbs to raise families spurred by all time low mortgage rates & WFH policies increasing mobility. With existing homeowners loathe to move, and supply of new homes constrained by labor & material shortages homebuilders have produced fantastic results as home prices soared causing sales & margins to soar.

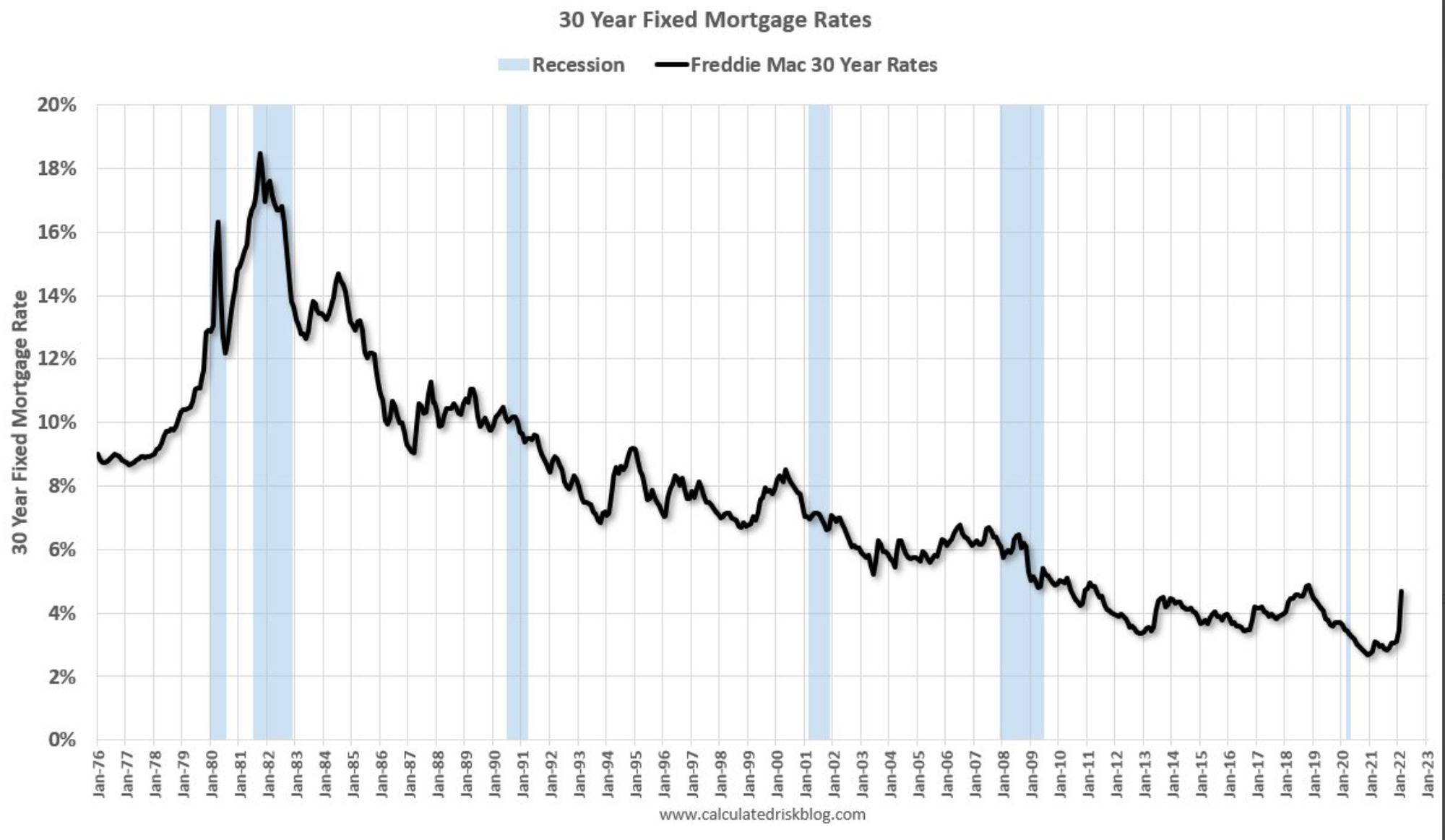

Over the past few months, mortgage rates have surged (mortgage rates have outpaced the rise in 10y treasury):

Coupled with the dramatic rise in home prices, housing affordability has declined substantially. This all points to a slowdown in home prices/homebuilding activity.

With that said, existing home for sale inventory remains very low - I believe it may remain low as prospective sellers face much higher borrowing rate (selling house and buying a new home likely requires paying off a ~3% mortgage to take out a 4.5%+ mortgage) or soaring rents. This suggests that the homebuilding market could have legs.

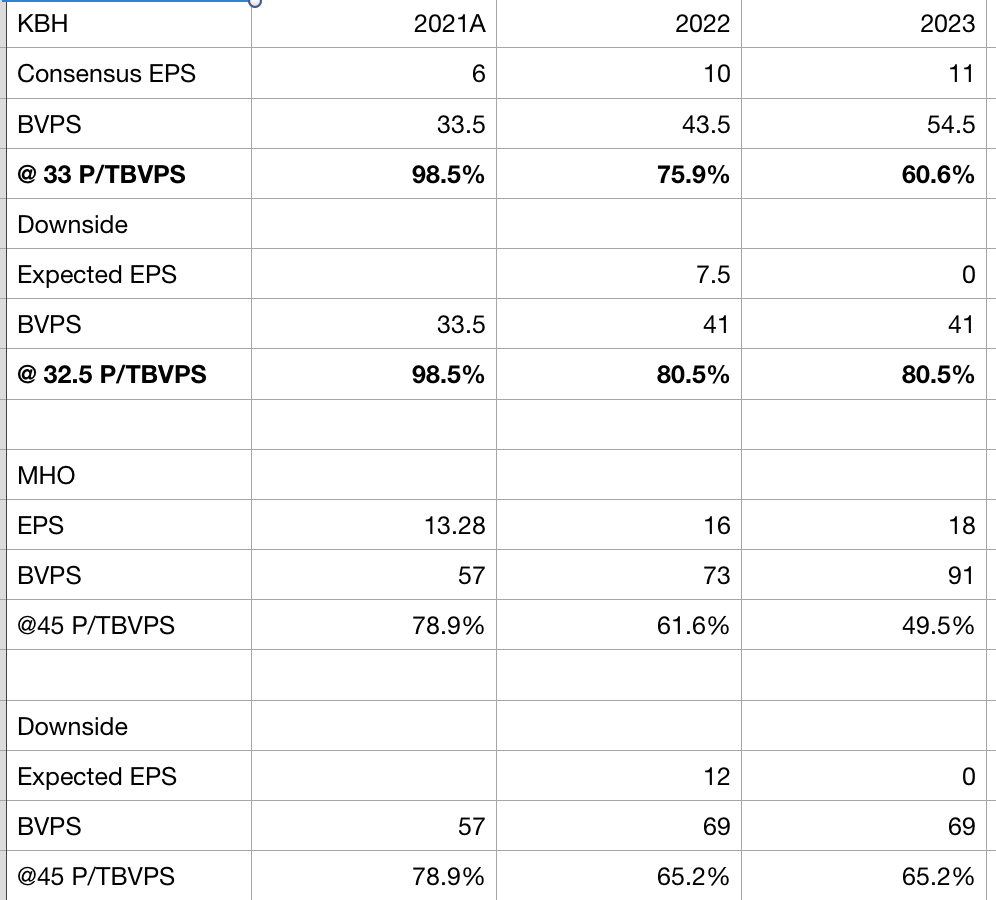

While I'm not super confident in the above assessment, I took small positions in KBH and MHO. My thesis is that as these companies work through their backlogs, book value will build quickly (forward P/E of 3) putting these stocks at significant discounts to tangible book value looking out 18-24 months (MHO already trades at a big discount to book.

Of course 1/it is not assured that book value growth comes to fruition - we could see a massive uptick in cancellations/decline in orders or writedowns to book value (all homebuilders have significantly increased their landbank spend - this may have to be written down should the music stop). 2/ there is no guarantee that the stocks don't trade at a discount to tangible book value as forward prospects decline.

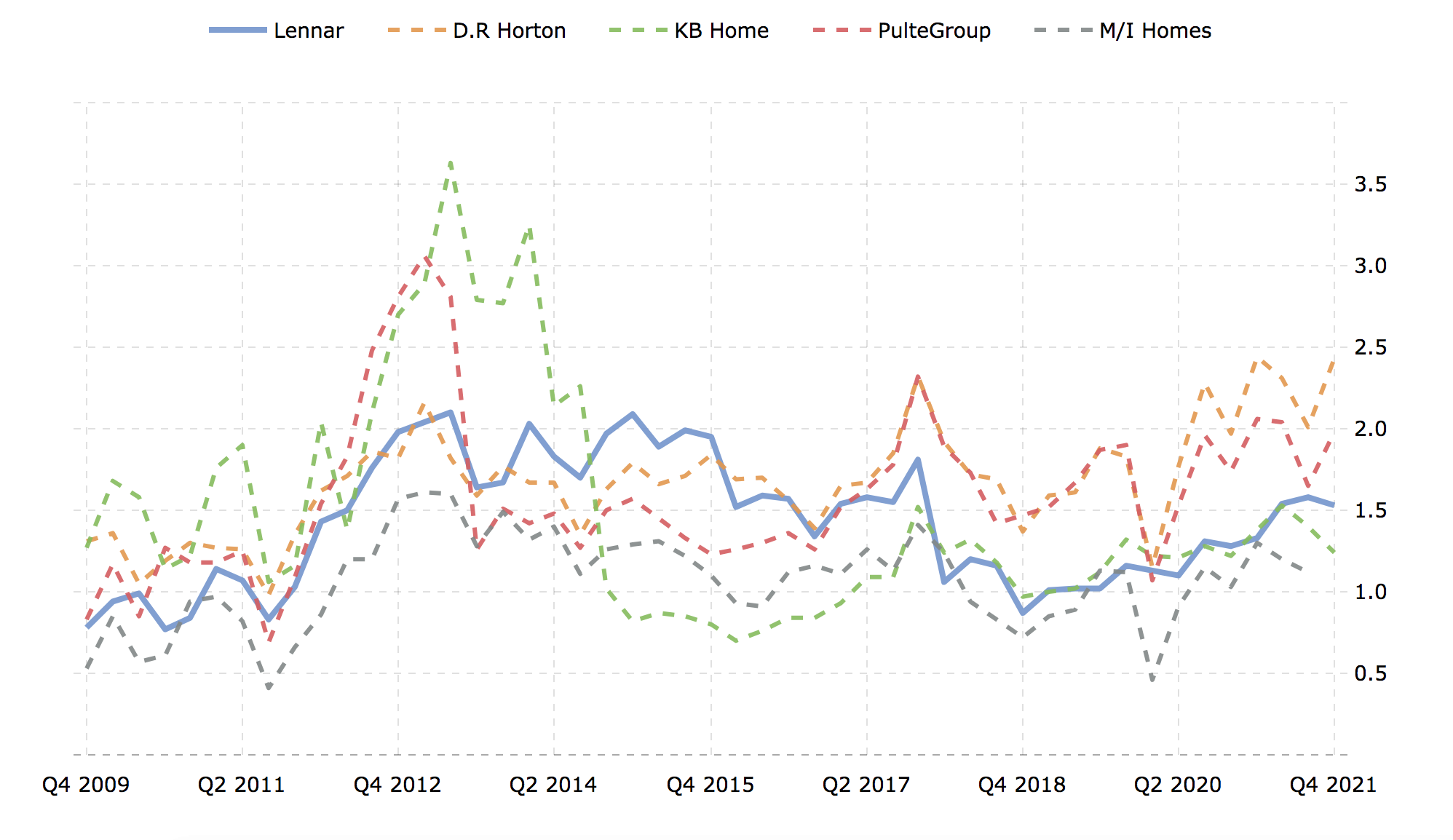

With regard to point 1, because homebuilders have had to limit sales due to supply constraints, I suspect the backlog will hold up better than it otherwise might. As goes point 2:

Source: Macrotrends, note this is P/B not P/TBV

As you can see, homebuilding shares have been quite volatile - should results hold up better than feared, shares could easily rise 50% or so. As to the downside, it seems covered on a fundamental basis though sentiment has shown to dominate these names and it is entirely possible that shares trade below my purchase price.

Added on 4/10: Homebuilders may also be able to make sensible JVs with single family rental REITs Invitation Homes (INVH) and American Homes for Rent (AMH) or private equity players in the single family rental space. INVH and AMH now trade at implied cap rates right around 4% and have 97-98% occupancy. The soaring mortgage rates which will prohibit many from becoming homeowners will almost certainly increase the demand for single family home rentals. While homebuilding stocks are all bumping along their 52 week lows, capital is flooding into the single family rental space. Given this discrepancy in sentiment, it seems there is a deal to be done either via JVs whereby homebuilders partners w/ public or private capital to construct single family rental homes. It is also possible that a private equity group acquires a homebuilder with the intention of converting a large portion of its landbank into single family rentals.

Citigroup (C) has been a value trap's value trap - underperforming every index and pretty much all US banks over the past decade. The stock has plummeted thus far in 2022 as 1/ concerns about Russian exposure 2/ investors are underwhelmed by management's plans outlined at a recent investor day.

I generally steer clear of banks due to their high leverage and black box nature. As we sit today, C trades at ~65% of tangible book value which is the low end of its historical range (has traded as high as 1-1.1x over the past 5 years). With interest rates headed upward, most banks - including C- should see higher net interest income in 2022/2023 which may allow the company to earn a reasonable (say 10%) return on tangible equity. A re-appraisal to 1x tangible book would suggest significant upside.

I also picked up a few shares of Ally Financial (ALLY) which primarily makes vehicle loans in the US (also does credit cards and some mortgages). New and used car prices have surged over the past 12-18 months due to supply chain shortages/inflation. Ally has seen its earnings soar due to lower loan loss provisions plummet due to the surge in used vehicle values - if a customer defaults and Ally is forced to repossess/auction the vehicle, any loss would be smaller than in normal times. Vehicle pricing remains high, bolstering the near term outlook for ALLY (expected to earn in excess of $7/share in 2022 & 2023).

Beyond favorable current conditions, ALLY has a somewhat differentiated business model from traditional banks - it does not have branches - instead it solicits auto loans through relationships with car dealers and attracts retail deposits online. The lower cost model (no branches) allow ALLY to pay depositors higher rates of interest than competitors. While this is a positive, the flipside is that ALLY's deposit customers are more interest rate sensitive which means it might benefit less (or not at all) from interest rate hikes. Overall I have a positive bias to their business model and think the company might be able to sustainably earn a return on equity slightly in excess of 10%.

Shares currently trade at ~1.1x current TBVPS/6x forward EPS. Looking out to the end of 2023, assuming ALLY achieves current earnings forecasts of $7 in 2022 & 2023, ALL would have a TBVPS of ~$50. Should the market take a liking to its online business model the stock could trade at 1.4-1.5x TBVPS (traded there as recently as 2Q21) implying a stock price of $70-75/share.

I'm not going to go through the litany of risks associated with investing in banks/financial institutions. The list is long. When a financial institution reports earnings I'm not hoping for something great to happen - I'm hoping it doesn't report a disaster. These are small positions.

Song:

As always this is NOT investment advice. Do your own work.

Eric Bokota owns shares of KBH, MHO, C, ALLY, INVH, AMH

Private Eye Capital Newsletter

Join the newsletter to receive FREE actionable investment ideas.