Tax Loss Selling/ The Most Wonderful time of the year

This is a work in progress which I'll be adding to over the next few days......Tell me if you've seen this: that stock which looked like a good deal sometime in November has continued to fall. And fall. And fall. Doesn't seem like anything has changed fundamentally. But the more it falls, the more it falls. This strange phenomena might be tax loss selling whereby 'investors' sell stocks precisely because they've gone down (selling before Jan 1, 2022 allows them to lock in the tax loss). While catching a falling knife doesn't feel great, tax loss selling can create interesting opportunities. Today I will highlight a few securities I think have been overly discounted. While I've taken a position in the securities discussed, I'd note that these are lower conviction ideas and I have weighted them accordingly (small).

Gap Inc (GPS) - Gap has persistently disappointed investors - the stock has been a terrible performer over almost any horizon. I don't really like this company. Gap is NOT a great business. It is certainly NOT a compounder. However the company has a solid balance sheet (basically net neutral i.e. net debt free) and while the Gap and Banana Republic aren't necessarily worth anything, Gap also owns Old Navy (~$8 bn in annual sales) and rapidly growing athleisure maker Athleta ($1.2 bn in annual sales) which is like a low rent Lululemon. As I mentioned, Gap & Banana probably aren't worth anything. However, as we sit today, it isn't hard to imagine the stock doubling. The overall enterprise value of GPS is ~$6 bn. It seems that Old Navy is worth more than this as it usually generates positive comp sales, double digit EBITDA margins, and has the opportunity to modestly grow its store count. The company seems to have found a niche in selling extremely inexpensive clothing for the whole family (low off-mall cost structure).

At 1x revenue Old Navy would be worth 33% more than the whole company. But wait, there's more: Athleta. Athleta has successfully ridden the trend of athleisure and now boasts over $1 bn in revenue across has the opportunity to significantly grow its store base (just 2oo stores today - should be able to easily double or triple the store base). I think Athleta could easily be worth $3 bn (2x 2022e revenue; probably equates to ~14x 2022e EBITDA) which would add another $7-8/share. Add up Old Navy and Athleta and you get $31-32/ share or about a double in share price.

While GPS traded above $32 earlier this year, it is also worth noting that GPS traded near my $31-32 estimate prior to COVID when it was announced that the company would split in two - dying concepts Gap & Banana would be spun off and healthy, growing Old Navy would remain. While the plan was cancelled in 2020, given the recent pressure on the share price (and continued differential in the long term outlook between Gap/Banana vs. ON/Athleta), I wouldn't be surprised were the plan to resurface which could serve as a catalyst for the stock.

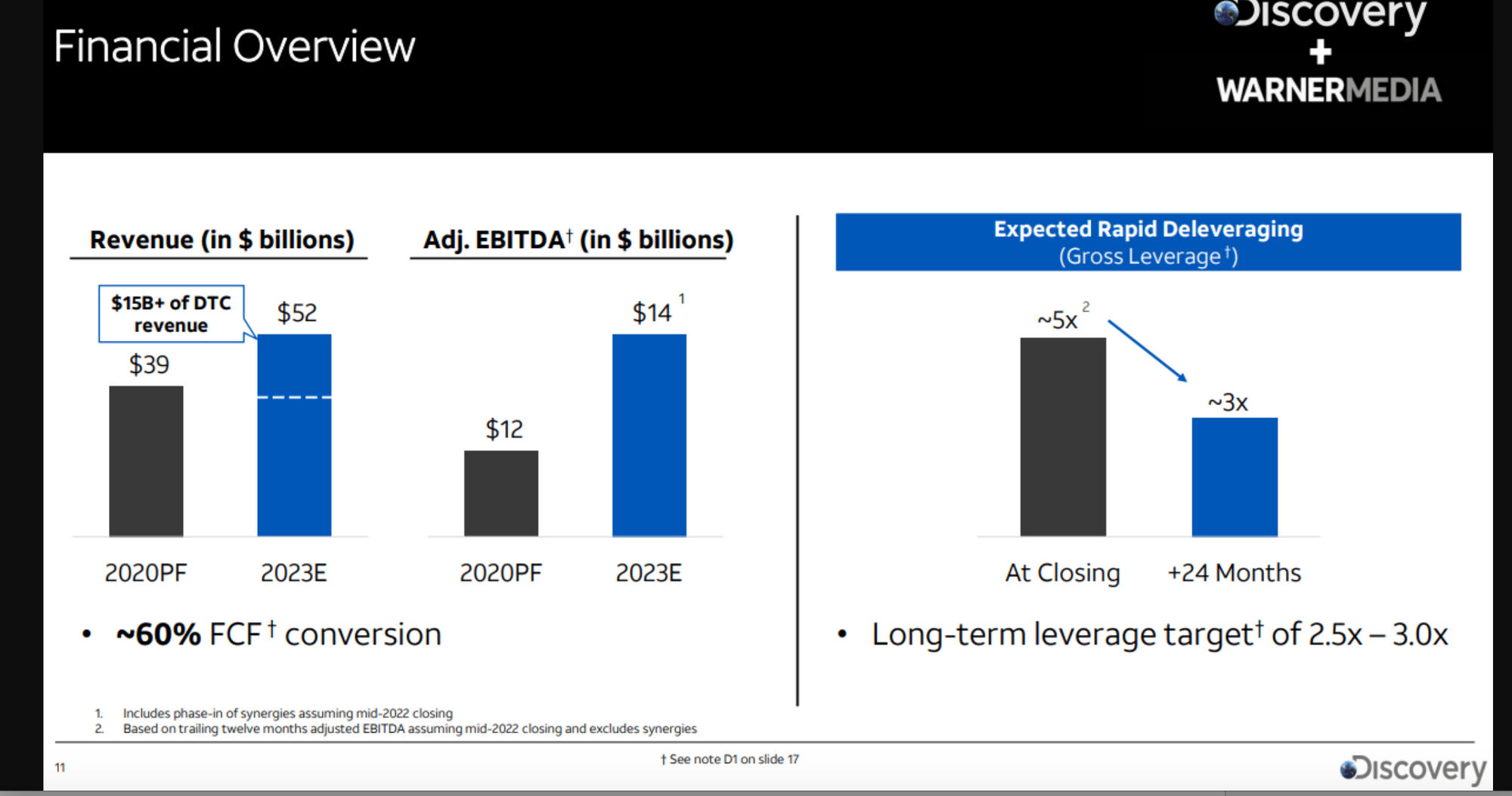

Discovery (DISCK) - Earlier this year, Discovery announced it would merge with AT&T's media assets, fka Time Warner. The new company will be named Warner Brothers Discovery and trade as WBD. This deal was greeted with enthusiasm for all of 12 hours - since then both stocks have tanked. Strategically the deal makes sense as

1/ Positions the new company to create a viable streaming competitor to Netflix as it broadens the library (marries Discovery's giant unscripted library of DIY/cooking/children's shows to HBO Max's lineup of edgy bingeable shows and movies)

2/ Should enhance the free cash flow of the linear television business through cost cutting (estimated at $3 bn) and better negotiating leverage with cable companies (combined company's channels represent a larger % of the bundle).

3/ There is little doubt that Warner's assets will be better run under Zaslav than under AT&T management.

However, investors dislike many things about the company including:

A/ Leverage of the combined company will be 4.5-5x ND/EBITDA. If the company can come close to hitting its EBITDA/FCF projections, it should de-lever fairly quickly.

B/ Bulk of EBITDA comes from the legacy bundle (cable TV subscriptions which is a dying business)

C/ Concerns about the Warner Brothers studio (making big budget movies) given monetization challenges. COVID has called the movie theater business into question which creates financial challenges for makers of big budget films.

D/ Slowdown in subscriber growth at Disney+ has made investors worry that the new streaming offering from HBO Max/Discovery may not scale. Scale is absolutely necessary in the streaming business to fund content purchases/development and still make a profit.

E/ Overhang of AT&T's dividend oriented shareholder base which may sell off the non-dividend paying WBD (this will be the ticker post closure) shares once they are spun off.

At the time the deal was announced the 2023 guidance was for $14 billion in EBITDA (flow through to FCF @ 60%) which works out about $3.50 in FCF per share. Notably while revenue is forecast to increase from $39 in 2020 (remember advertising and studio are hurt by pandemic in 2020) to 52 billion in 2023, EBITDA is expected to only increase +$2 billion (basically only the synergies realized by 2023) implying that virtually all incremental revenue will be invested in both content & marketing to continue to reposition the business for streaming.

At $21.75/share, the stock trades for ~6.2x 2023e FCF. I think the revenue/EBITDA/FCF targets are achievable given rebound we are seeing in advertising, ease of achieving synergies, growth in streaming. While linear tv is declining, price hikes should offset most of subscriber losses in the near term.

I don't know what this is worth but probably something well north of 6x. 10-15x seems much more reasonable, implying shares could easily double. There is an upside case where the company is eventually acquired by Apple. Apple TV has very little content and were it not free, I doubt it would have many subscribers. Apple is one of the few companies that can make a small bet (Time Warner Discovery's ent value is < 4% of Apple's market cap) and acquire a top 3 content library/streaming service. If Apple is really serious about having a streaming business, I suspect they would pay multiples of the current share price for Time Warner Discovery.

Further, I think the downside is covered making the following assumptions:

-While mgmt assumes streaming revenue of $15 billion in 2023, even if we assume only $12 bn (20% haircut) and value this at 5x revenue (vs. 8x for NFLX)

-Value studio at just 3x revenue (vs. 5.5x AMZN is proposing to pay for MGM which has an inferior library/ production capabilities).

-Value 2023e linear TV EBITDA at just ~4x.

Summing the above and deducting 2023 estimated year end debt (so allowing 18 months of pay down) gets me to ~$23 per share.

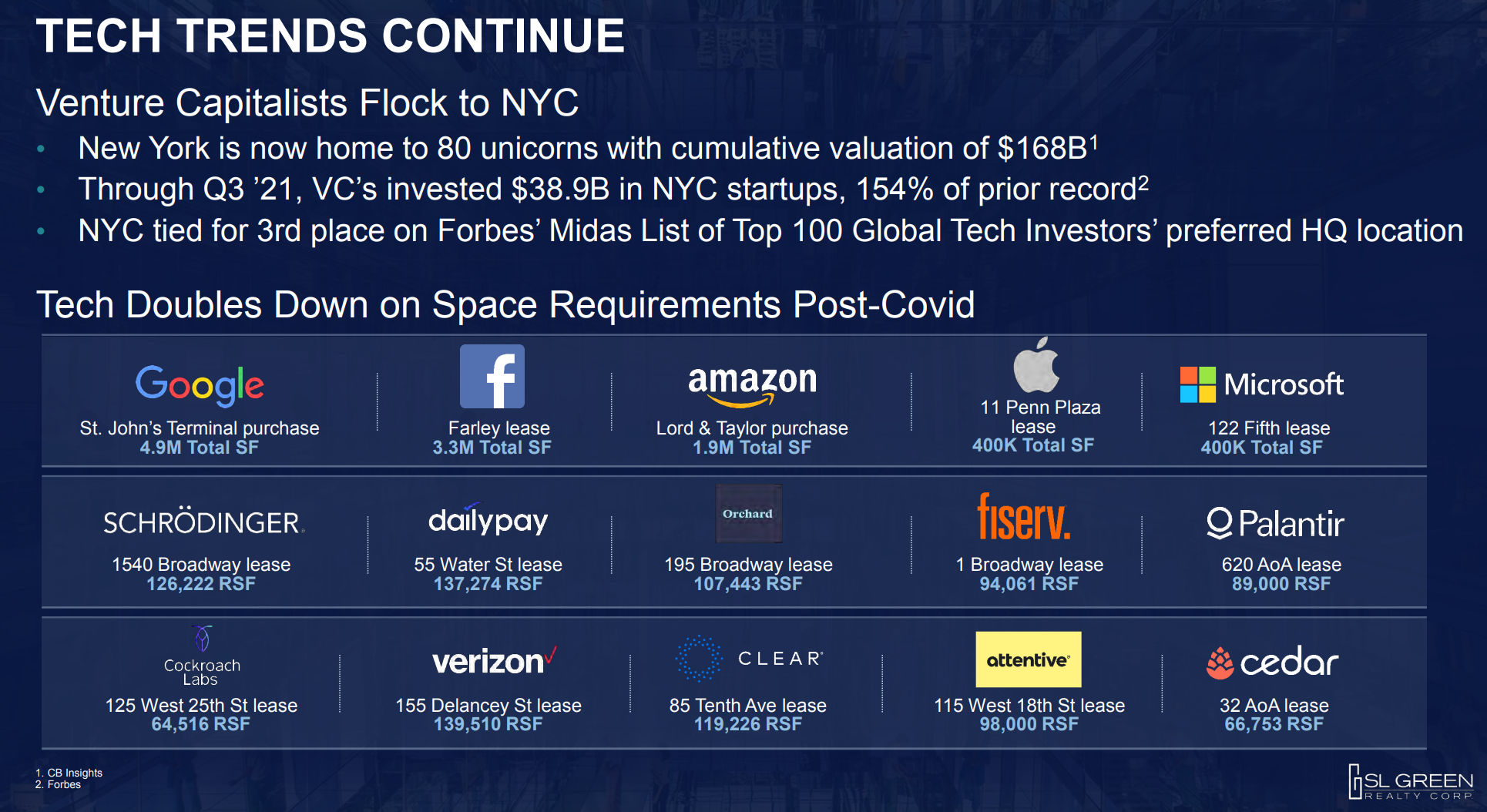

Vornado (VNO) - I don't like this very much. But this REIT seems too cheap here. VNO is a collection of Class A Manhattan office space plus a trophy asset (555 California St) in San Francisco and the Merchandise Mart in Chicago. As I've mentioned repeatedly, being an office landlord is generally a bad business and COVID/WFH is only making that harder. That said, Class A has and is expected to continue to fare much better than inferior grades of office space. As employers struggle to coax workers back to the office, they are taking up space in high end buildings which offer better amenities and provide a more attractive offering to employees.

NY also benefits from an ongoing influx of tech giants (GOOG, FB, MSFT, AMZN) have all gobbled up millions of square feet over the past few years:

At $41/share, I've got VNO trading at a 6.2% cap rate and about $670 per sq ft. As you can see below, this is a fairly significant discount to recent transactions:

Also there was very recent sale of the HSBC building (Older Cl A) was done north of $1,000 per foot (I heard 5.25% cap rate but haven't verified). Within VNO, there are some real gems, notably the recently completed Farley building (long term leased to Facebook) which would probably trade at a 4.5% or lower.

VNO has traded at a discount to NAV since ~2015 and the discount has only gotten wider. What might close the discount?

-End of COVID/Return to the office/Improving office sentiment/continued influx of tech companies.

-Enthusiasm over the Penn District (VNO is in the midst of a long term project to redevelop the Penn District but also seems intent on issuing a tracking stock which I think is a poor idea).

-Investors seeking strong cash on cash returns may become increasingly interested in office real estate. Cap rates on multifamily& industrial have been driven into the mid 3s and are pricing in optimistic outlooks for future rent growth. Private buyers/institutions purchasing office at a 5.0- 5.5% cap rate w/ 60% LTV (financed @ 3%) produces a fairly interesting 7-8% yield to equity (after accounting for capex) which is attractive in a low yield environment.

Ultimately I think VNO is probably worth $50-55 and one can collect 5% dividend yield while waiting.

Hudson Pacific Properties (HPP) - another office REIT w/ exposure to SF Bay area (not just in struggling downtown but in thriving Palo Alto, San Jose, etc), Seattle, and Los Angeles - 12+ mn square feet in all (at share), the vast majority of which is Class A.

Besides office, HPP also has a 51% stake in a studio real estate JV with Blackstone (BX). With global content production machine (NFLX, AMZN, HBO, DIS etc) charging full speed ahead, this business is well positioned for strong growth. This represents about 15-20% of the value of the company.

Within the office segment, HPP will soon complete One Westside (brochure), a brand new 584k sq foot project leased to Google in Los Angeles (GOOG is HPP's largest tenant). This asset alone is probably worth $700 million (at share assuming a low 4 cap rate - brand new, long term leased to a top credit tenant).

Stripping out the studio real estate and using a value of $925 million (+10% vs. the mark attributed to it when the JV with BX was created in June of 2020 when all studios were shut down), I have the office portfolio (inclusive of One Westside) trading at an implied cap rate of 8.1% which is too cheap. 5.2-5.8% is probably a more reasonable range. Conservatively using 5.8% gets me to an NAV of of $38 (5.2% would suggest $44 NAV) offering significant upside. In the meantime, shareholders can collect a 4.2% dividend.

I've sold some long dated put options on Dave & Busters (PLAY). I think the stock is cheap-ish as we sit today but there's a lot of juice in the options. Since the onset of the pandemic in 2020 (which sent shares down to $5), D&B's balance sheet has been repaired (ND/EBITDA ~1.5x) while the business is producing record results. I discuss this options trade opportunity in more detail here on Twitter.

As always this is most certainly not investment advice.

Eric Bokota has a long position in GPS, DISCK, VNO, HPP and PLAY

Private Eye Capital Newsletter

Join the newsletter to receive FREE actionable investment ideas.