Contemplating BlueRock Residential REIT

Warning this is a half assed draft (moreso than all the other half assed drafts on my site).

Quick and dirty

-Sunbelt apartments are an incredibly hot asset. Rents are soaring and cap rates are compressing.

-BlueRock (BRG), an owner of sunbelt apartments, trades at a significant discount to NAV.

-The negative is that BlueRock (BRG) suffers from a flawed structure/incentive system which has allowed management to repeatedly transfer wealth from shareholders to themselves.

-However, the rapid appreciation in sunbelt apartment values could tempt management (which owns 30% of shares) to sell the company. Upside could be 100%+.

Sunbelt apartments are hotter than hot. Rents are soaring (rent on new leases +20% in many markets) and cap rates have fallen into the mid to high 3s.

Here are some recent updates from public sunbelt apartment REITs:

MAA leasing update:

Source: MAA 3Q21 supplemental

Source: MAA 3Q21 transcript

MAA on sunbelt cap rates:

Source: MAA 3Q21 transcript

NXRT leasing:

Source: NXRT transcript

NXRT on sunbelt cap rates:

Source: 3Q21 NXRT transcript

Leasing at Camden (CPT):

Source: 3Q21 Camden transcript

On to the (shit)show:

BlueRock (BRG) is one of the most flawed REITs I've seen. However, with a debt/pref heavy capital structure and soaring asset values, NAV here is almost certainly far in excess of the current share price. A couple of months ago, Bloomberg reported a rumor of a potential sale .

First the bad/very bad:

Management's Incentives differ MATERIALLY from shareholders

Beyond salaries/bonuses/stock grants, BRG 'management' transfers $40+ million (what is shown below refers to 2020 issuance - for 2021 they are guiding to $400 + million in issuance) per year FROM SHAREHOLDERS to THEMSELVES!

Moreover, 1/ BRG does NOT NEED THE CAPITAL AND 2/ these prefs are HIGH COST - nearly 7% after factoring in the egregious selling commissions outlined above.

THIS CREATES A POTENTIALLY TOXIC situation where the funds raised from pref offerings are allocated to risky deals ('management' has to try to find a way to earn greater than 7% on this money -not super easy in this market given how much capital is chasing apartment deals) to meet the dividend requirements associated with them.

FURTHER, it seems some of these proceeds are allocated to deals in which 'management' has an interest. This is a RECIPE for abuse where 'management' gets the nearly ALL THE upside while SHAREHOLDERS ARE BURDENED WITH ALL DOWNSIDE RISK. Thus far it hasn't been a big problem but that is likely due to the massive appreciation in sunbelt apartments over the past 3-4 years.

However, with so much money chasing sunbelt apartments, it is likely that deals being done today are riskier than those in the past. This could put shareholders on the hook for large losses should projects not work out.

Also, management has refused to engage with shareholders in the past - the Harbert Opportunity fund sought to acquire BRG in 2019 and was rebuffed by management.

WHY GET INVOLVED?

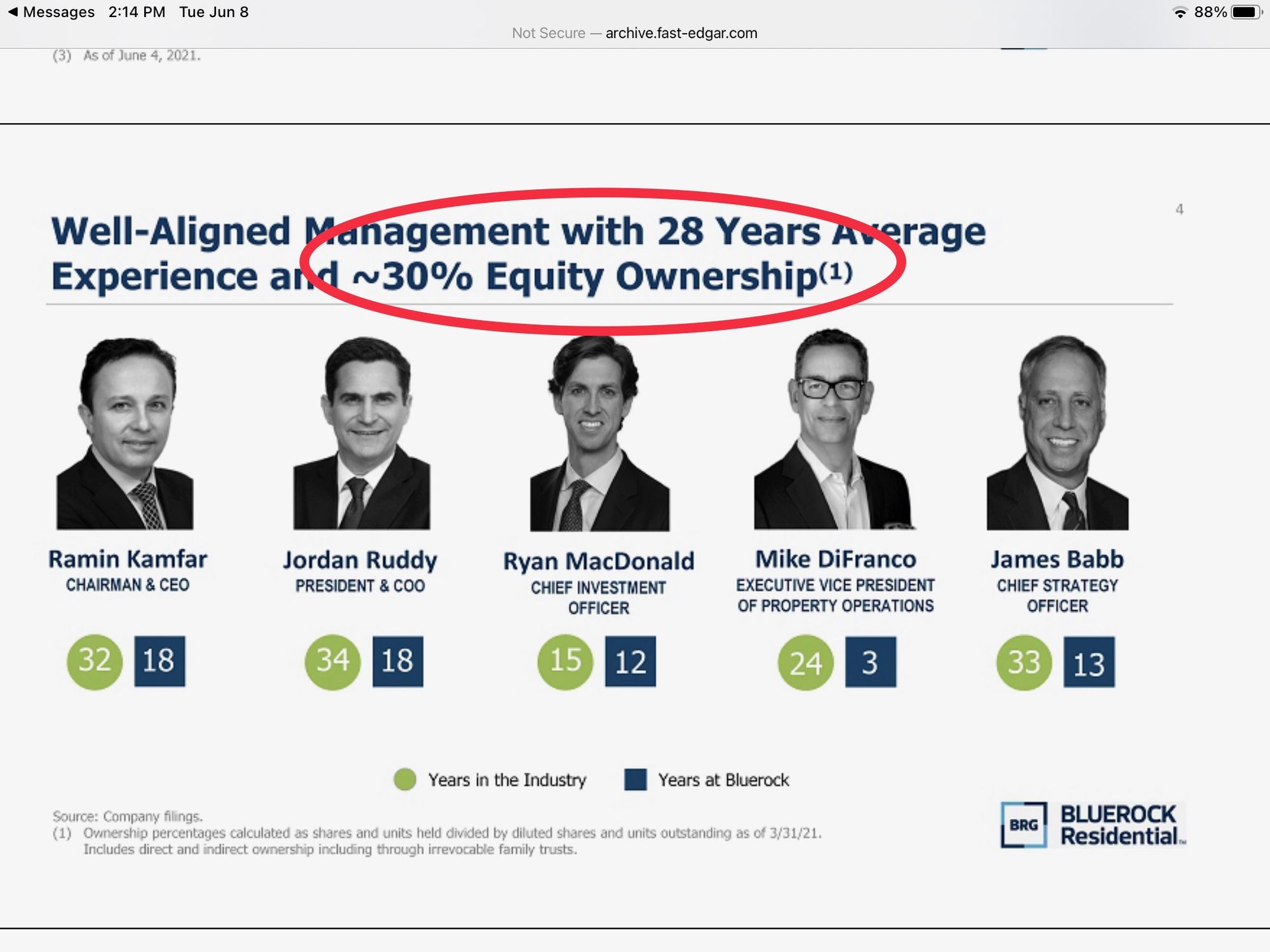

'Management' claims to own 30% of the equity:

Source: June Investor Presentation

However, this cannot be verified in regulatory filings as CEO Kamfar transferred his OP interests (convertible to Cl A shares) to a trust:

Source 2020 10-K

However, if we assume for a moment that 'management' does have a ~30% interest in the business, what might this be worth?

Quite a bit it turns out. Sunbelt apartments are on fire. Rents are soaring and cap rates have come down (in the mid-high 3s). Were BRG to sell off all of its properties, I estimate shares could be worth north of $30.

While the most recent quarter showed annualized NOI of roughly $120 mn, if we adjust for the massive increase in rents, NOI is closer to $130-135 mn. This is my estimate of NOI after factoring in current rents (eliminating loss to lease) as well as an increase in expenses (most notably property taxes). Because apartment leases are short term (1 year), this should be realized in the near term. This is the basis upon which apartment buildings are transacting in private markets.

Adjusting for debt (marked up 10% to account for yield maintenance - or penalty for early repayment of commercial mortgages), preferred, golden parachutes, other assets (pref/mezz outlined above - I mark down these values 20-35%) and applying a cap rate of 3.5-4.0% gets me to the following range;

4.0% cap rate: $26/share

3.75% cap rate: $32/share

3.5% cap rate: $40/share

This means that if 'management' does own 30% of BlueRock, they stand to gain $200-300 million from selling the company.

So 'management' is comparing the tradeoff of an instant payday of $200-300 mn vs. the $40++ million in annual plunder (+ salaries/bonuses/etc).

What will they do?

I don't know. As you can probably tell from what I've written, I'd own the shares if I thought there was a good chance the company would be sold. On the flipside, if there is no sale, I HAVE NO INTEREST IN BEING INVESTED WITH THIS MANAGEMENT TEAM despite the low price.

Was interesting to see:

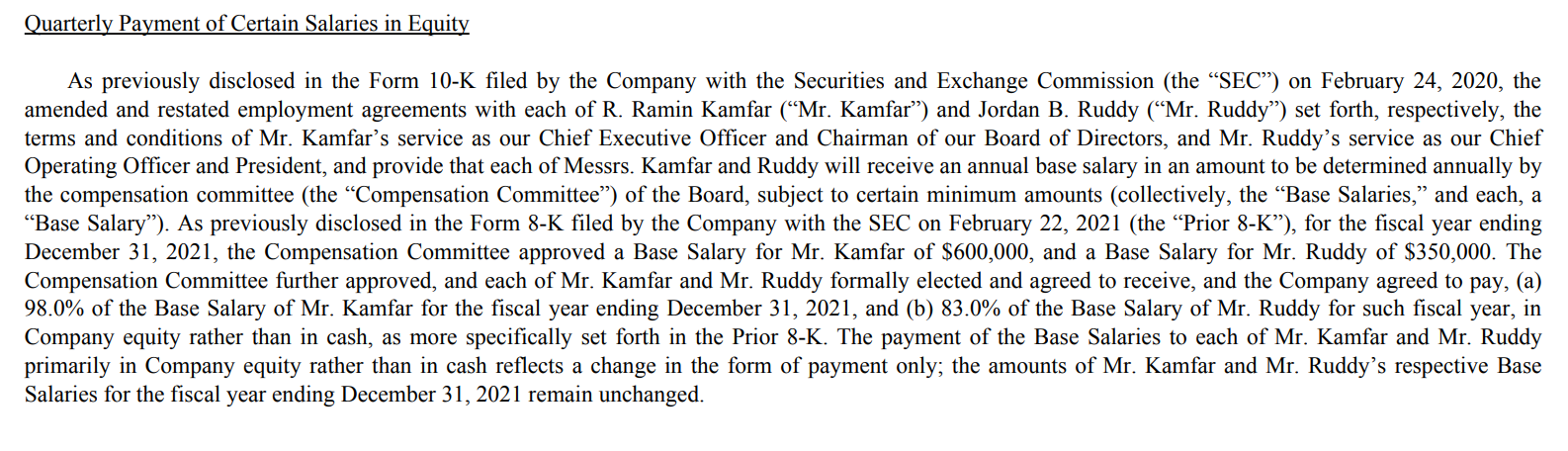

1/ mgmt take more comp in shares

2/ that they bought back ~7% of the share count in the most recent Q:

Other resources:

Song:

AS ALWAYS, THIS IS NOT INVESTMENT ADVICE. Do your own work. I have a tiny position in BRG. Can't really make up my mind.

Have thoughts on $BRG? Join the convo

Private Eye Capital Newsletter

Join the newsletter to receive FREE actionable investment ideas.