Buying apartment buildings below pre-COVID prices

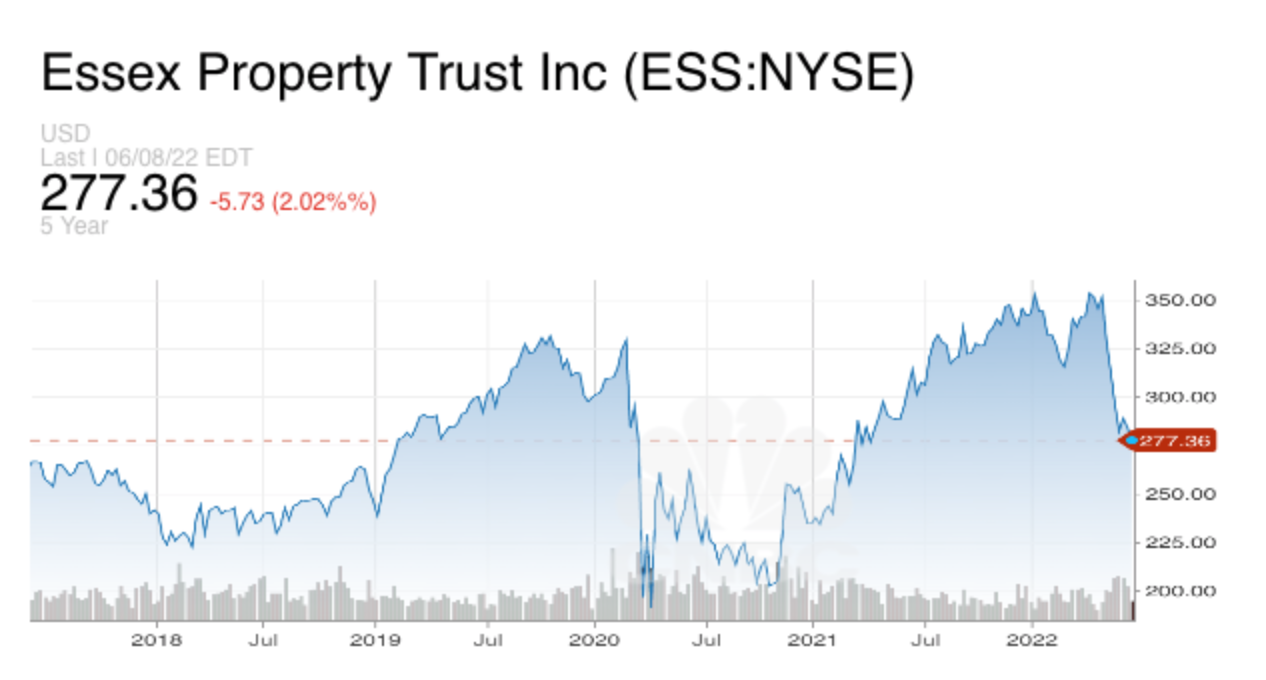

Back where we started nearly 2 years ago -> While rents have increased significantly and private apartment values have soared, the apartment REITs are again selling at a significant discount to the value of their assets. A combination of interest rate and recession fears have lead to a selloff across REITs and apartment REITs have declined 20-25% giving the enterprising investor another bite at the apple if you will.

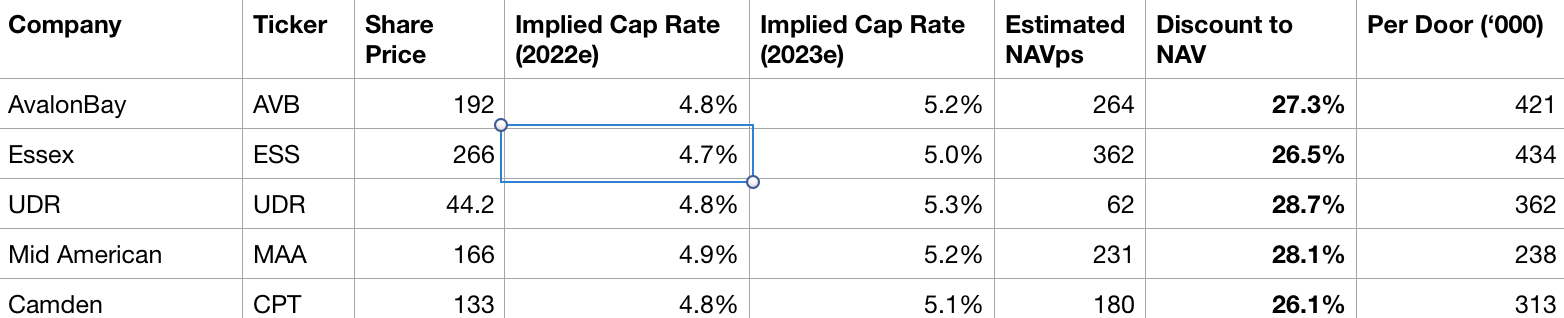

Today I will discuss investment opportunities highlighting 5 high quality, conservatively financed apartment REITs (LTVs sub 30%; fixed rate debt) which are selling at significant discounts to NAV.

Readers may be wondering why, in a market filled with inexpensive stocks, they should concern themselves with the apartment REITs?

1/ Apartment assets are inflation beneficiaries. Rents (which reprice annually) have soared over the past 12-15 months (shown later in this article). Home/condo ownership (competition for apartments) has gotten significantly more expensive over the past 4-12 months as both home prices (+20% YoY) and mortgage rates (from 3 to 5+% in just 4 months) have surged.

2/ Similarly, construction costs (both materials and labor) have soared which means that replacement cost has increased considerably, somewhere on the order of 25-35% over the past 2-3 years. Apartment REITs are trading at what I estimate to be a ~20% discount to replacement cost. Importantly zoning/lack of suitable locations (permanent constraint) + labor/const mean that not enough supply can come into the market (look at CA - supply just can't come in due to all the restrictions) to apartments should really trade at a premium to replacement cost.

3/ Private buyers remain active acquirers of apartment assets. The flow of capital into private funds targeting apartment assets has been nothing short of breathtaking. Should apartment REIT share prices continue to lag, I believe it is likely they could eventually be acquired at significant premiums to current prices.

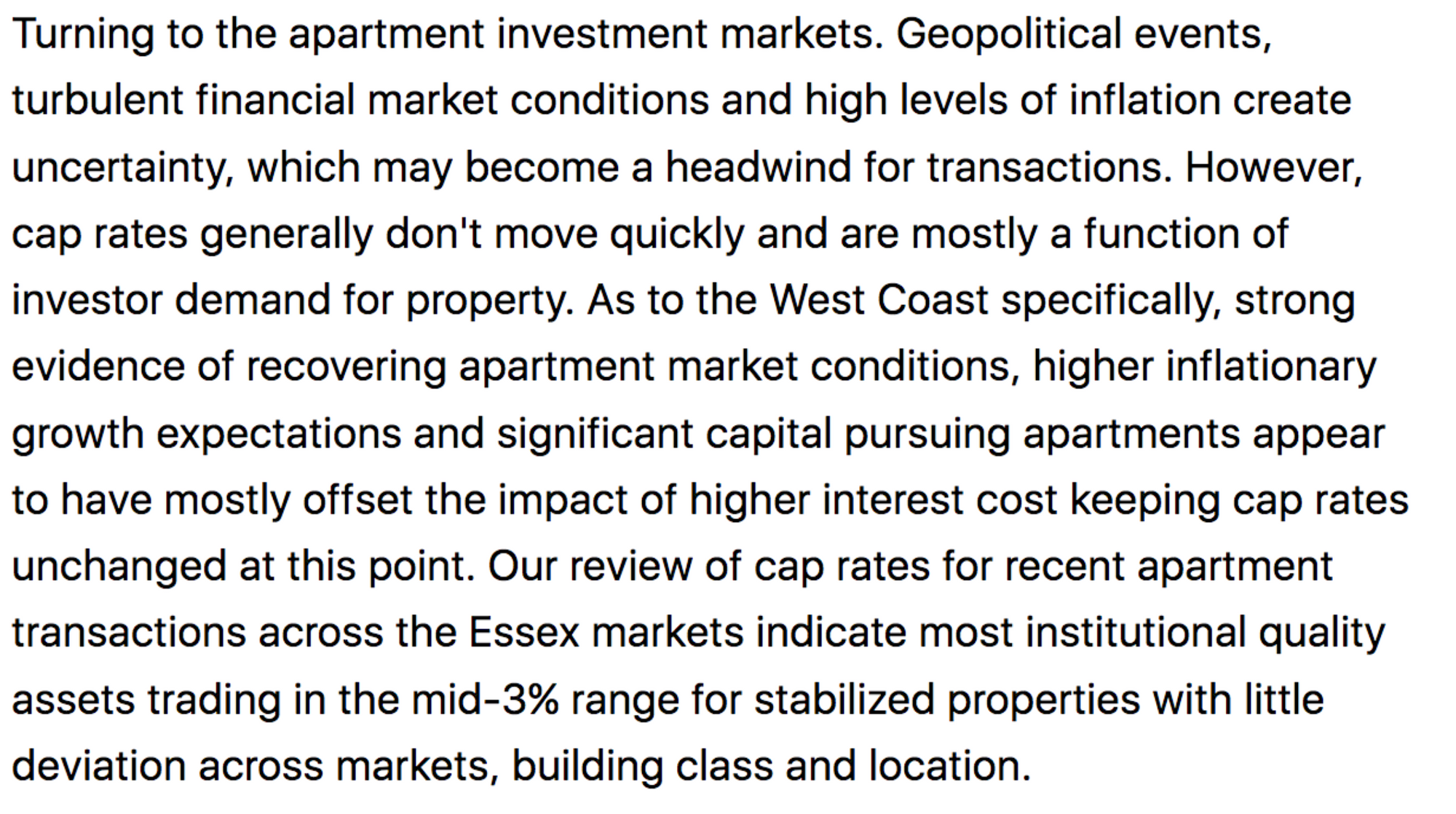

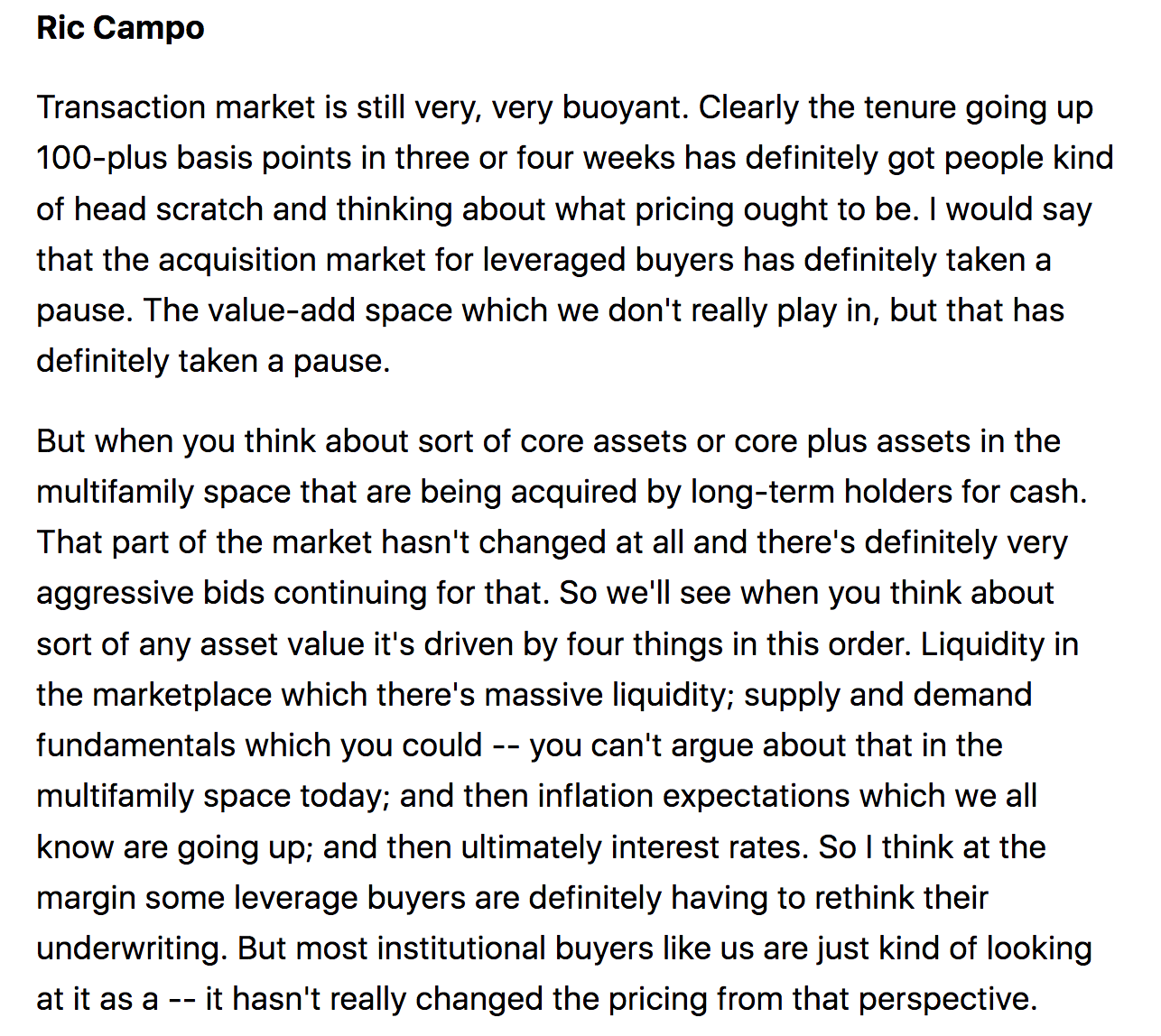

Recall apartment REITs own only about 5% of the apartments in the US. The other 95% of the market is owned privately by individuals, large institutional investors (like pension funds) and large private equity firms (like Blackstone which I will discuss below). This means that the private market is the REAL MARKET. There remains a tremendous amount of private capital chasing apartment deals, from small apartment syndicators to large private equity firms like Blackstone/Starwood/Brookfield. Private capital has been gobbling up apartment complexes at a furious pace over the past couple of years and cap rates have compressed significantly. In 2H21 and into 2022, institutional quality assets (both Class A &B both Gateway and sunbelt markets) saw cap rates compress into the low/mid 3s (versus low 4s when I first started writing about apartments in 2H20). Meanwhile apartment REITs trade at implied cap rates of 4.6-4.8% (using 2022e NOI). As we sit today, apartment REITs are trading at 25-30% discounts to NAV.

Why have apartment values increased over the past few years? Fantastic rental growth & cap rate compression driven by fund flows into private apartment funds. Let's start with the latter:

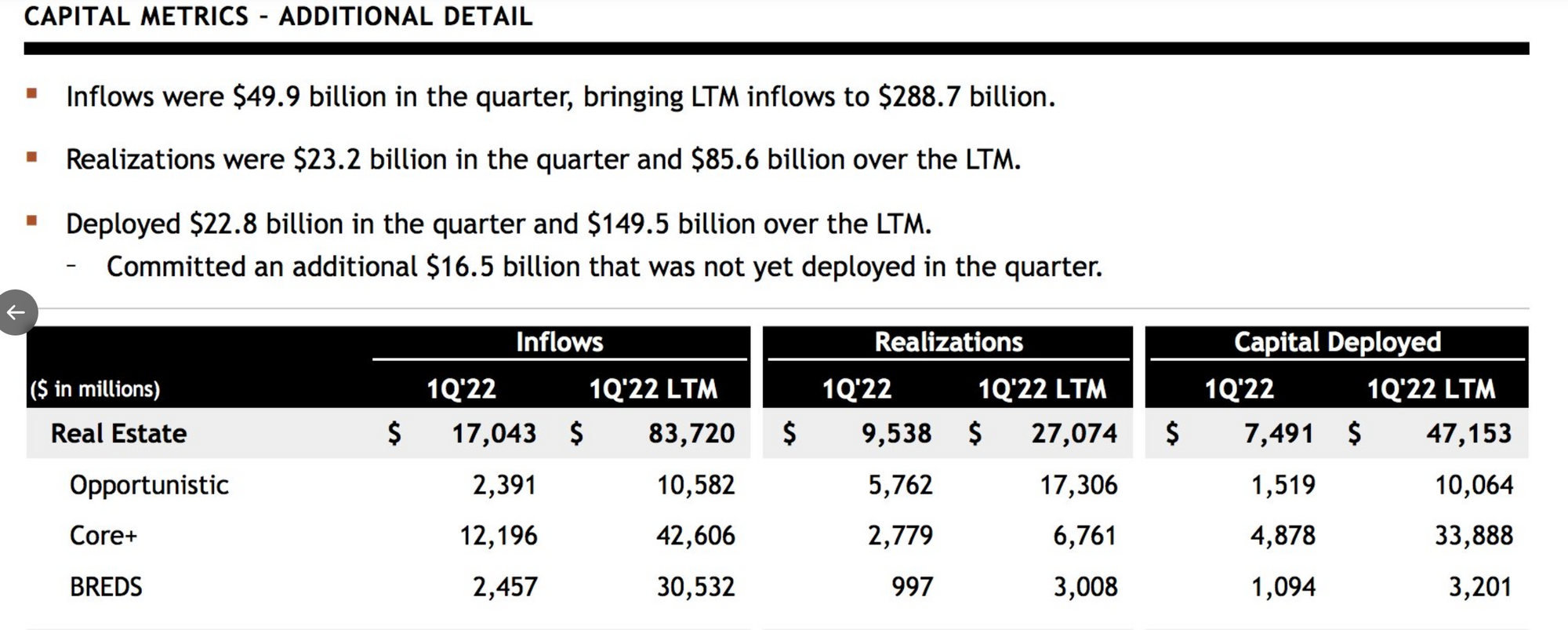

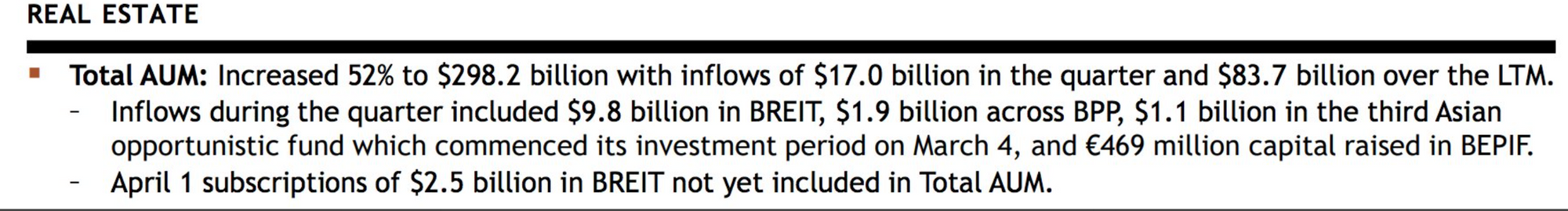

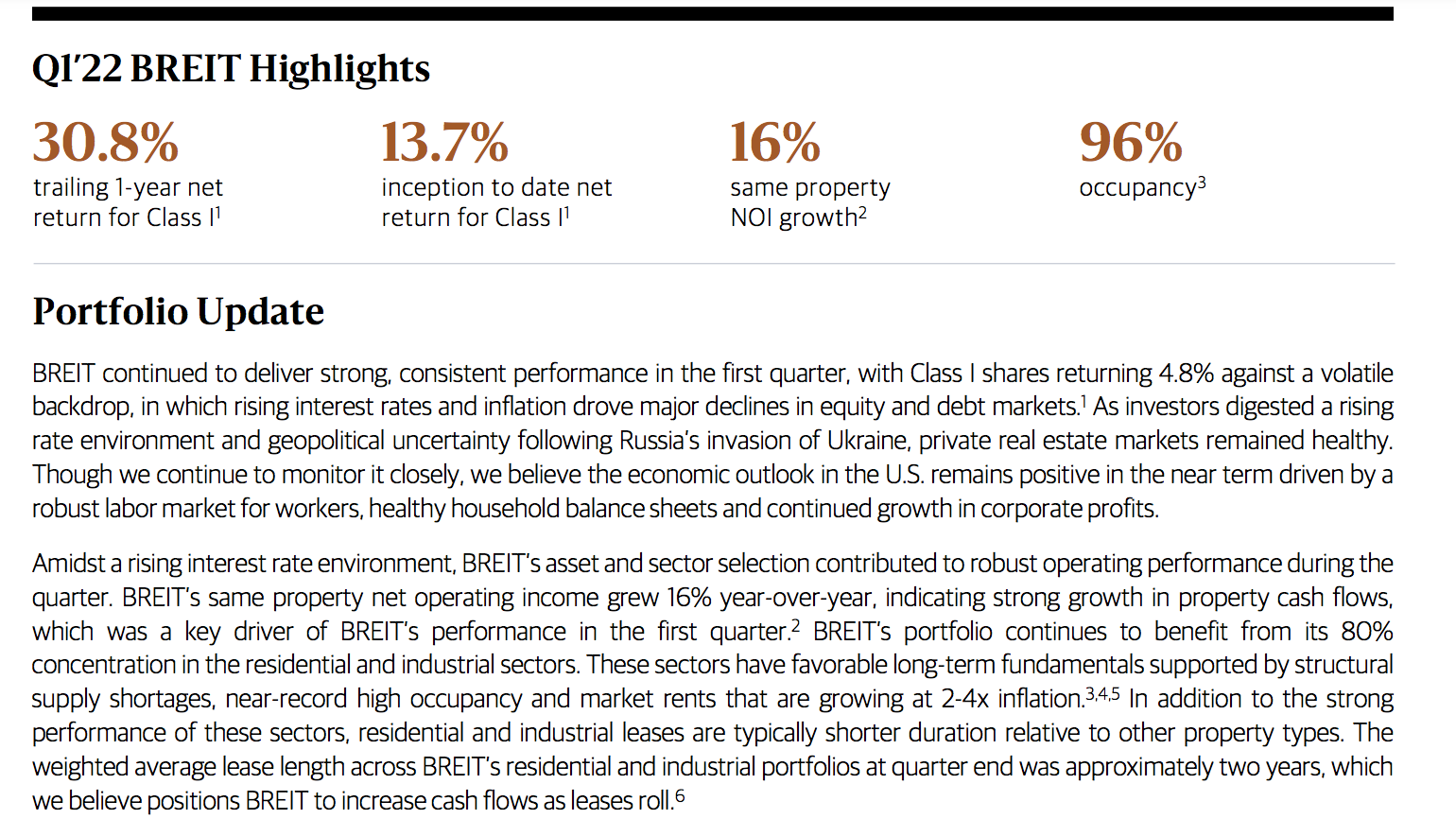

1/ There is a wall of capital chasing apartment assets. A great example of this is Blackstone's non-traded B-REIT. In the trailing 12 months, Blackstone's real estate funds raised over $80 billion in capital. In 1Q22 alone, Blackstone's private REIT (B-REIT) raised nearly $10 bn of equity.

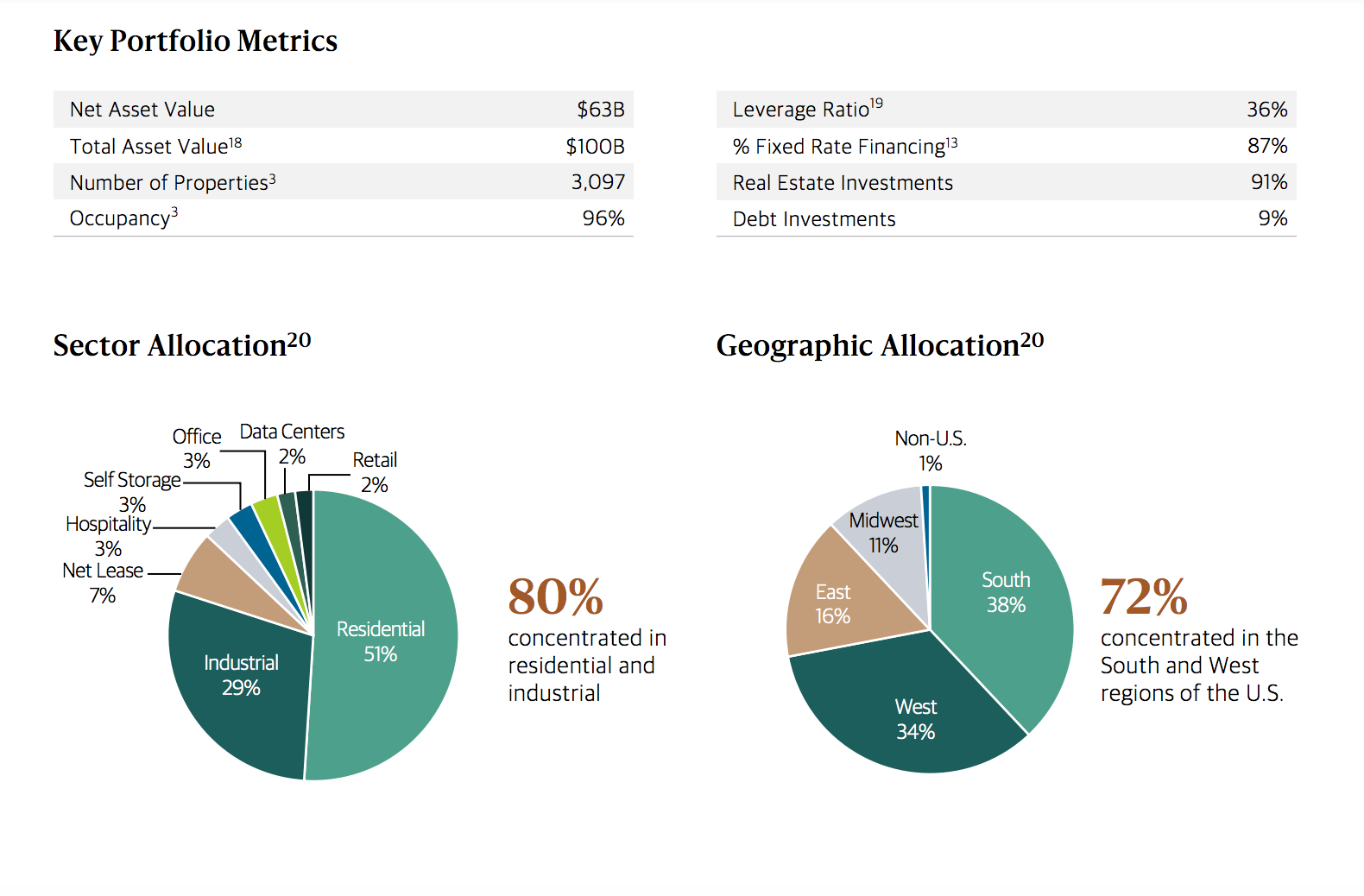

Here's more info on BREIT.

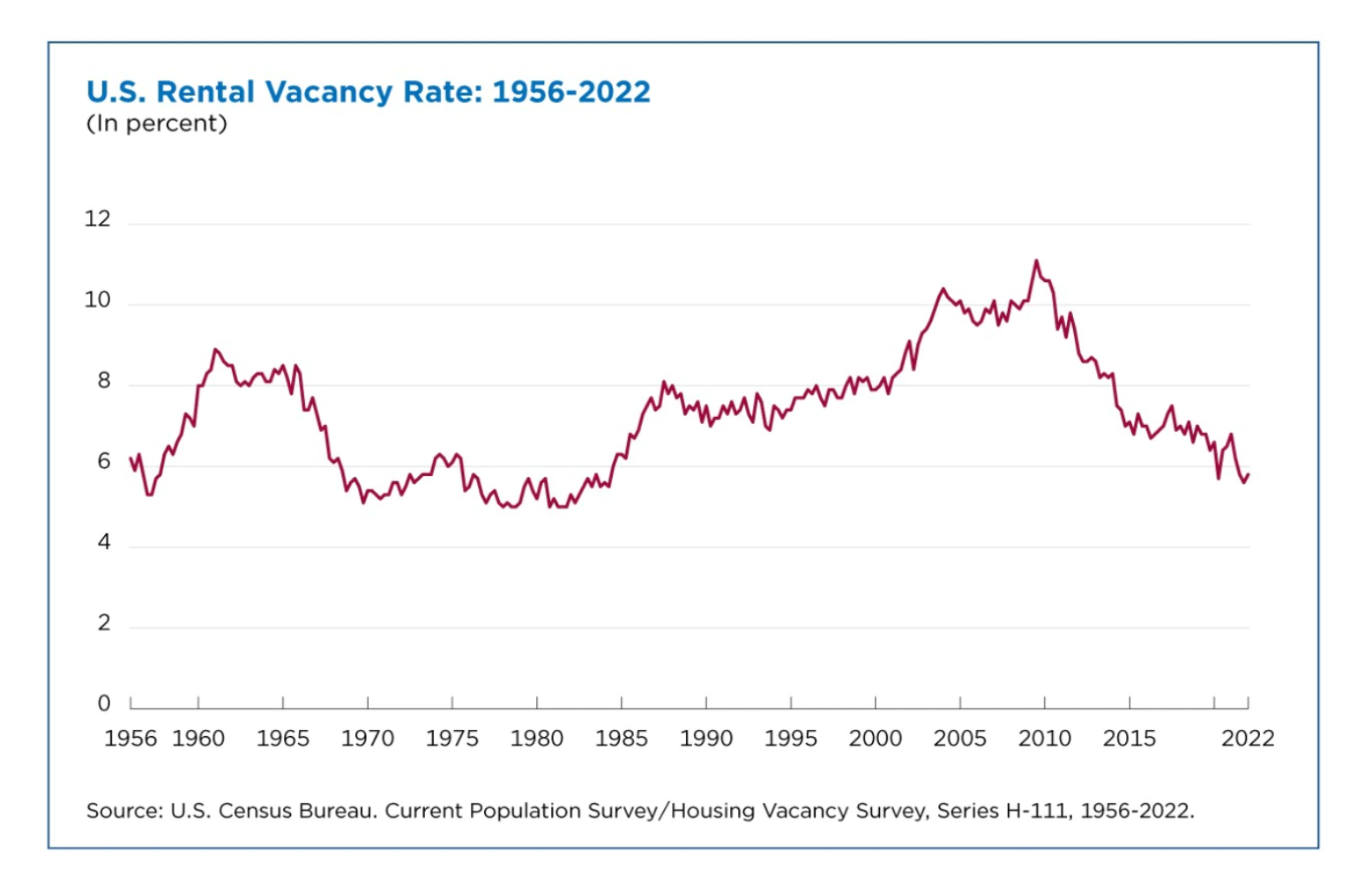

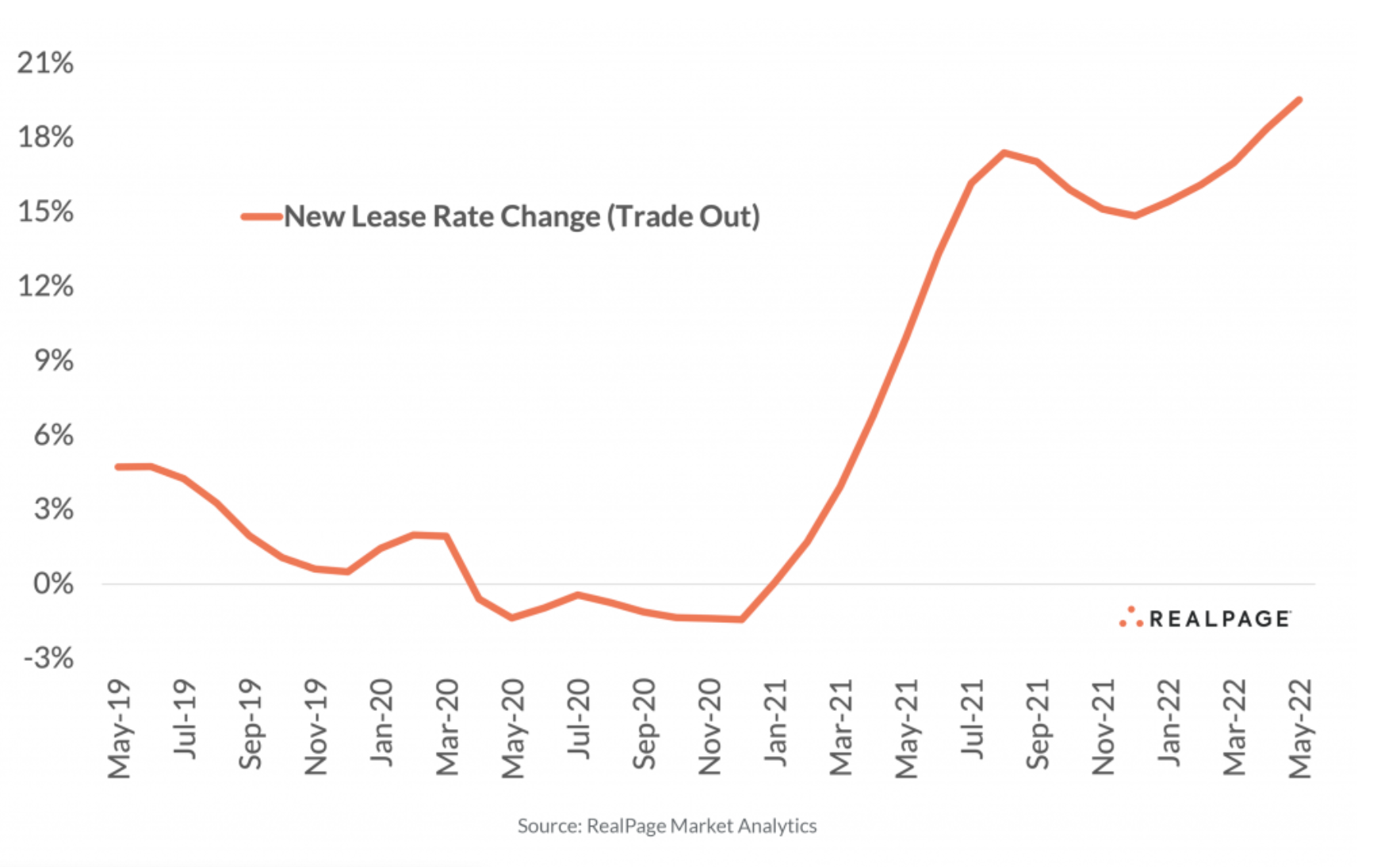

2/ Phenomenal rental rate growth - vacancy is near all time low (housing shortage) & apartment rents are ripping in nearly all markets. Apartment rents have increased at a torrid pace over the past 12-15 months. Here is a snapshot of US rental property vacancy & new lease rental growth over time:

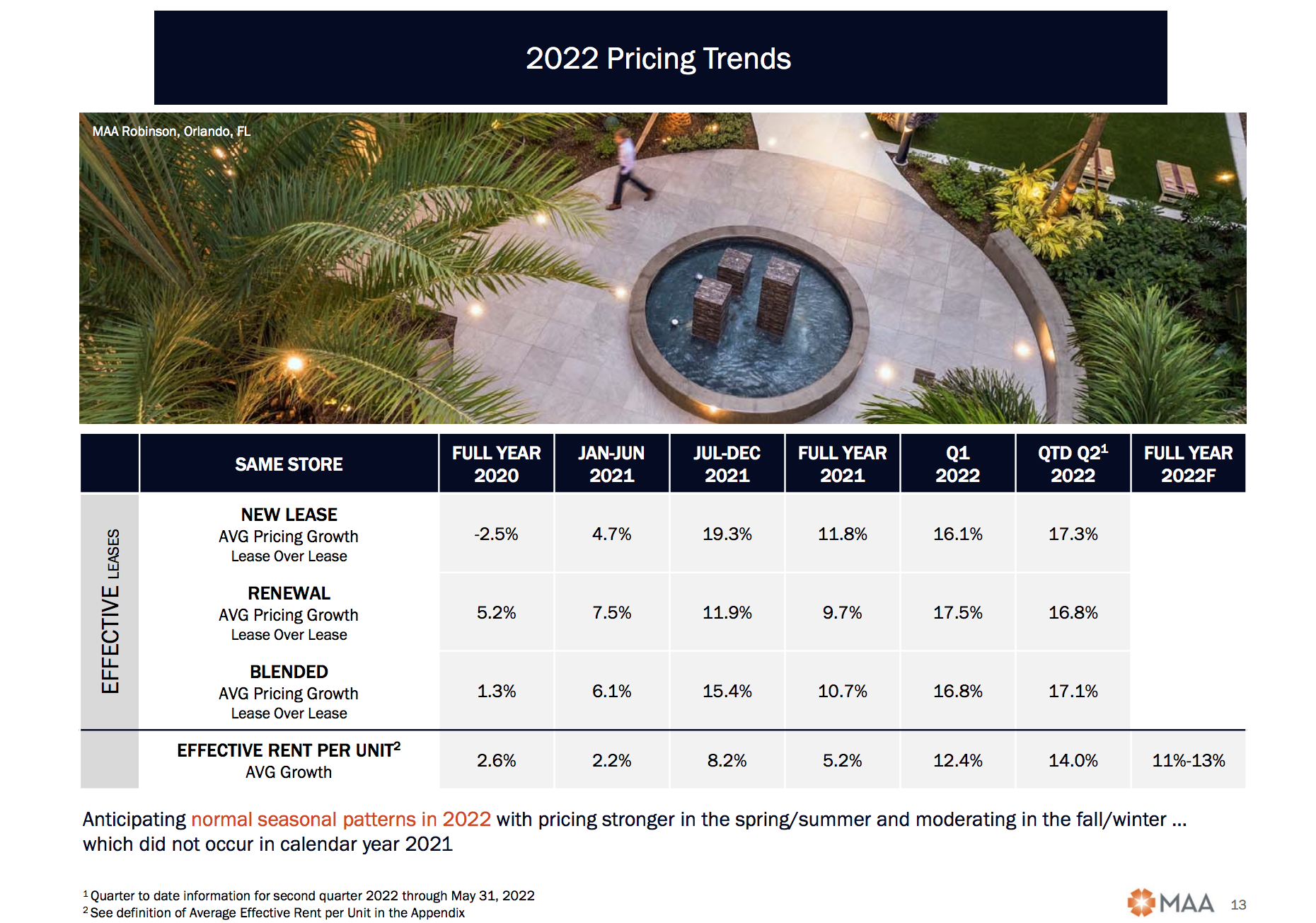

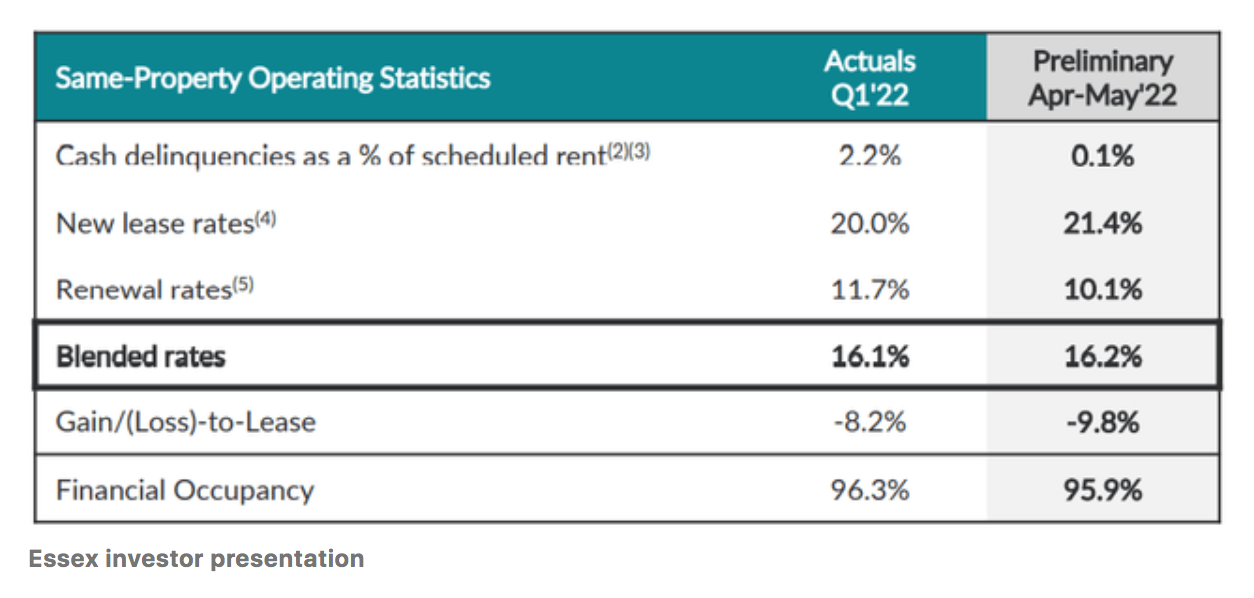

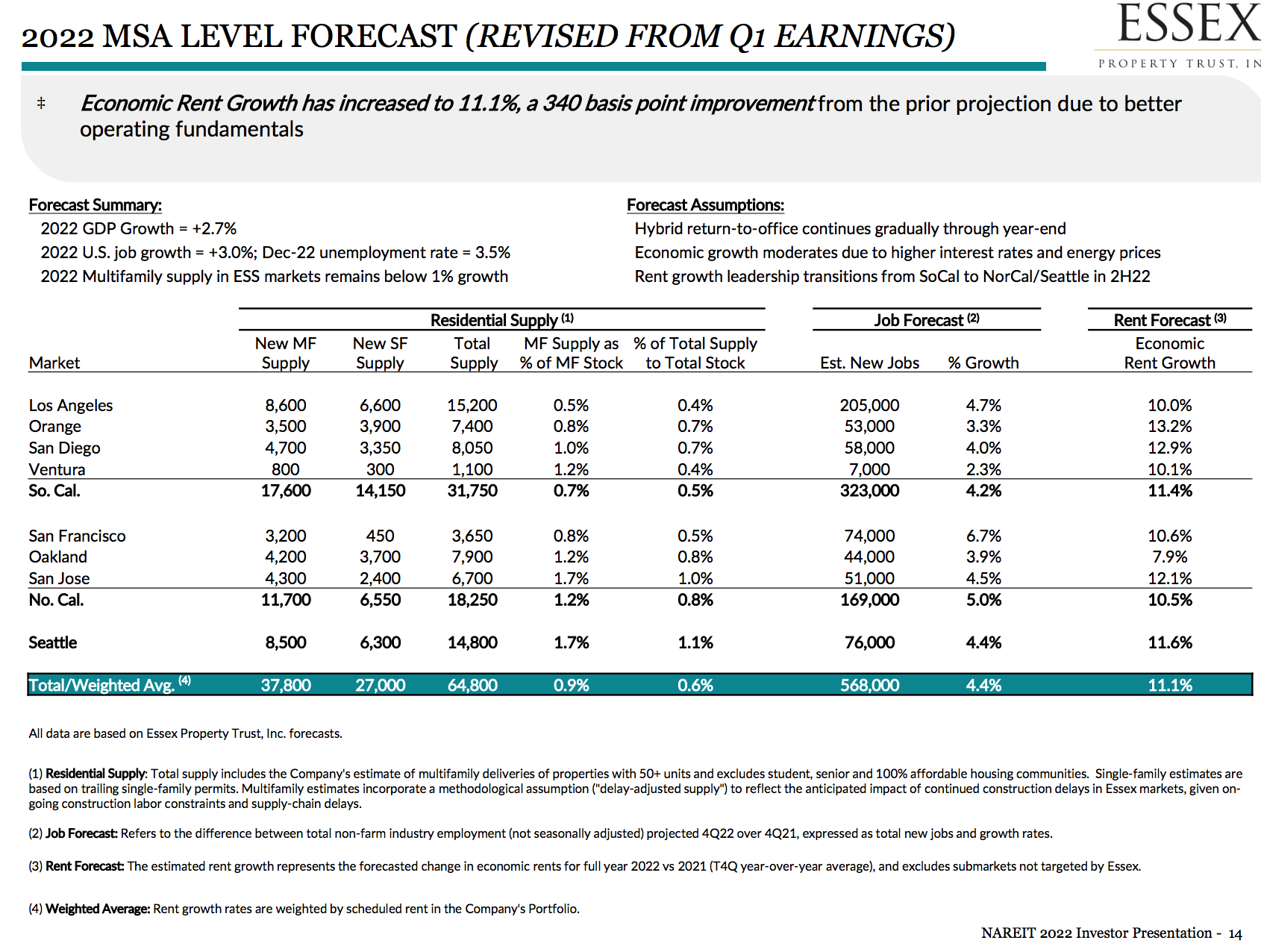

And MidAmerican (MAA) /Essex Property Trust's (ESS) recent rentals/ 2022 rent outlook:

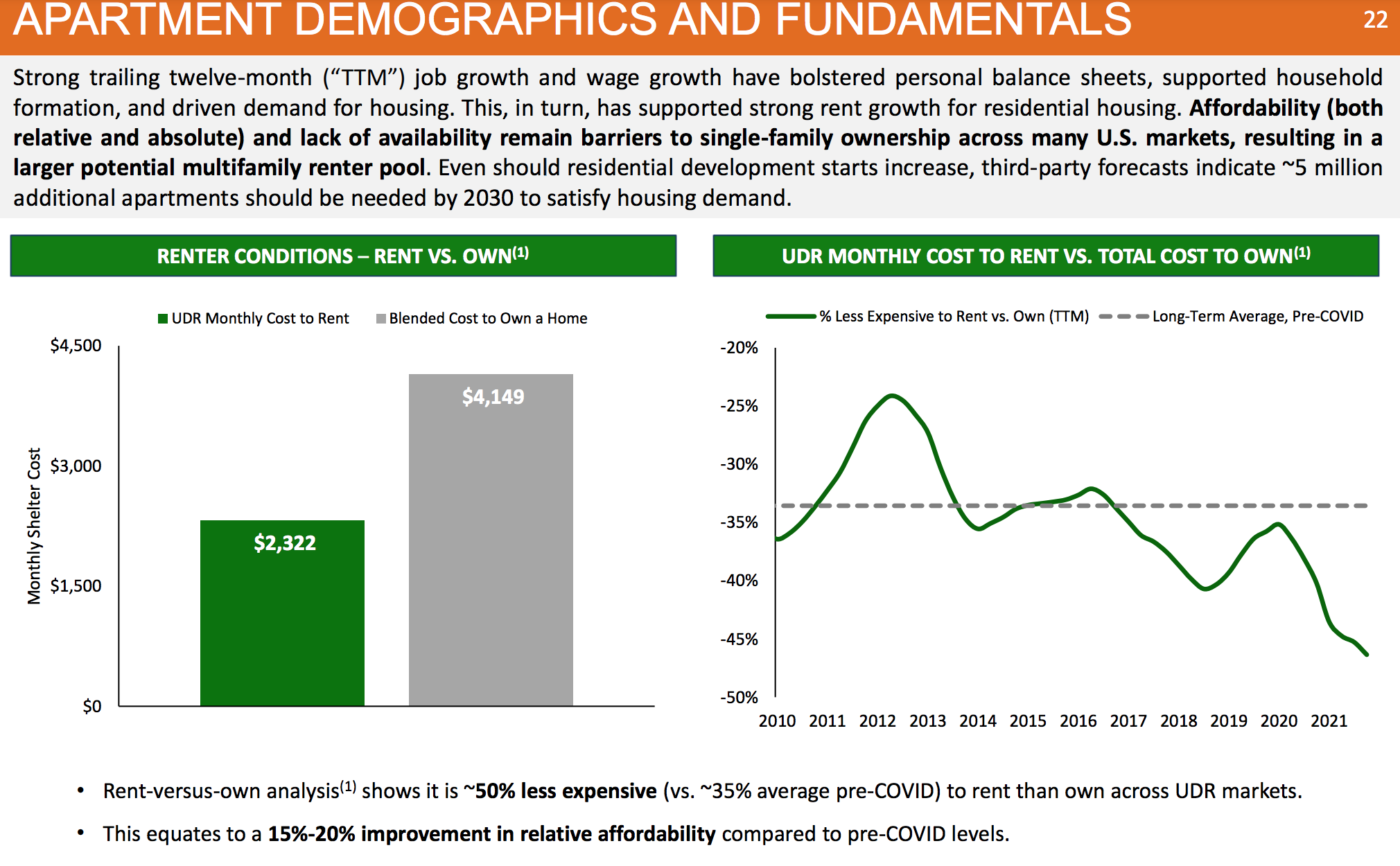

Despite increased rents, the economics of renting (vs. buying) have become MORE attractive to tenants as the cost of home ownership has soared due to home price appreciation AND rising mortgage rates. Many would-be home buyers are being sidelined by declining home affordability enlarging the pool of 'renters by necessity'. This ensures excellent demand for apartments for the foreseeable future.

Expectations for continued strength in rental rates have lead investors to bid up the price of apartment assets.

So we have a strong fundamental outlook for apartments as evidenced by strong rental growth AND a wall of capital flowing into apartment assets.

50% of BREIT's $$$ is allocated to residential real estate (mainly multifamily):

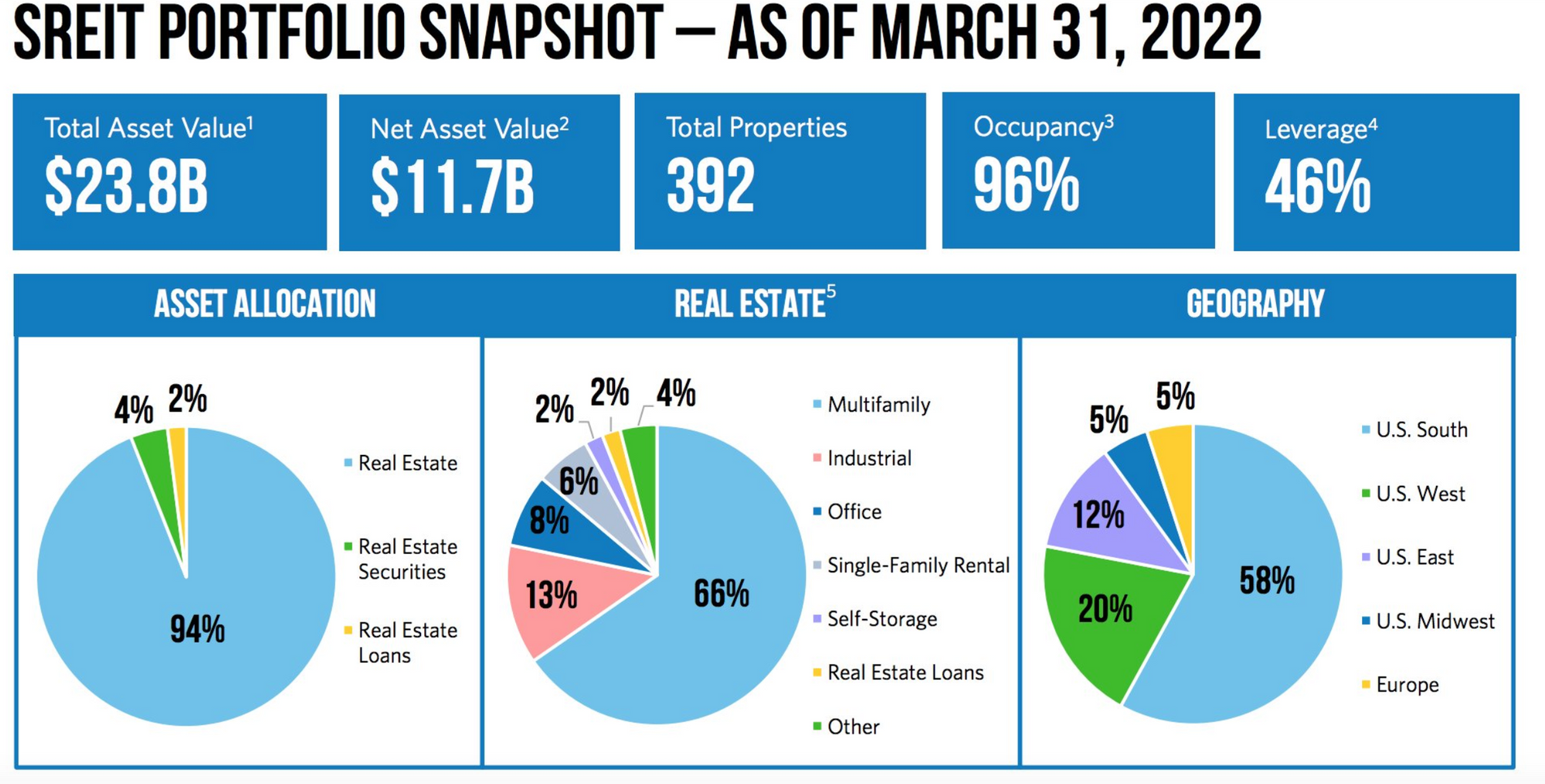

Similarly, Starwood's SREIT (which was created in 2017) has amassed nearly $24 billion in assets, with an EVEN greater share allocated to apartment assets:

Like BREIT, SREIT is raising capital rapidly, having raised over $20 bn in capital since 2017, and over $2 billion in 1Q22 alone.

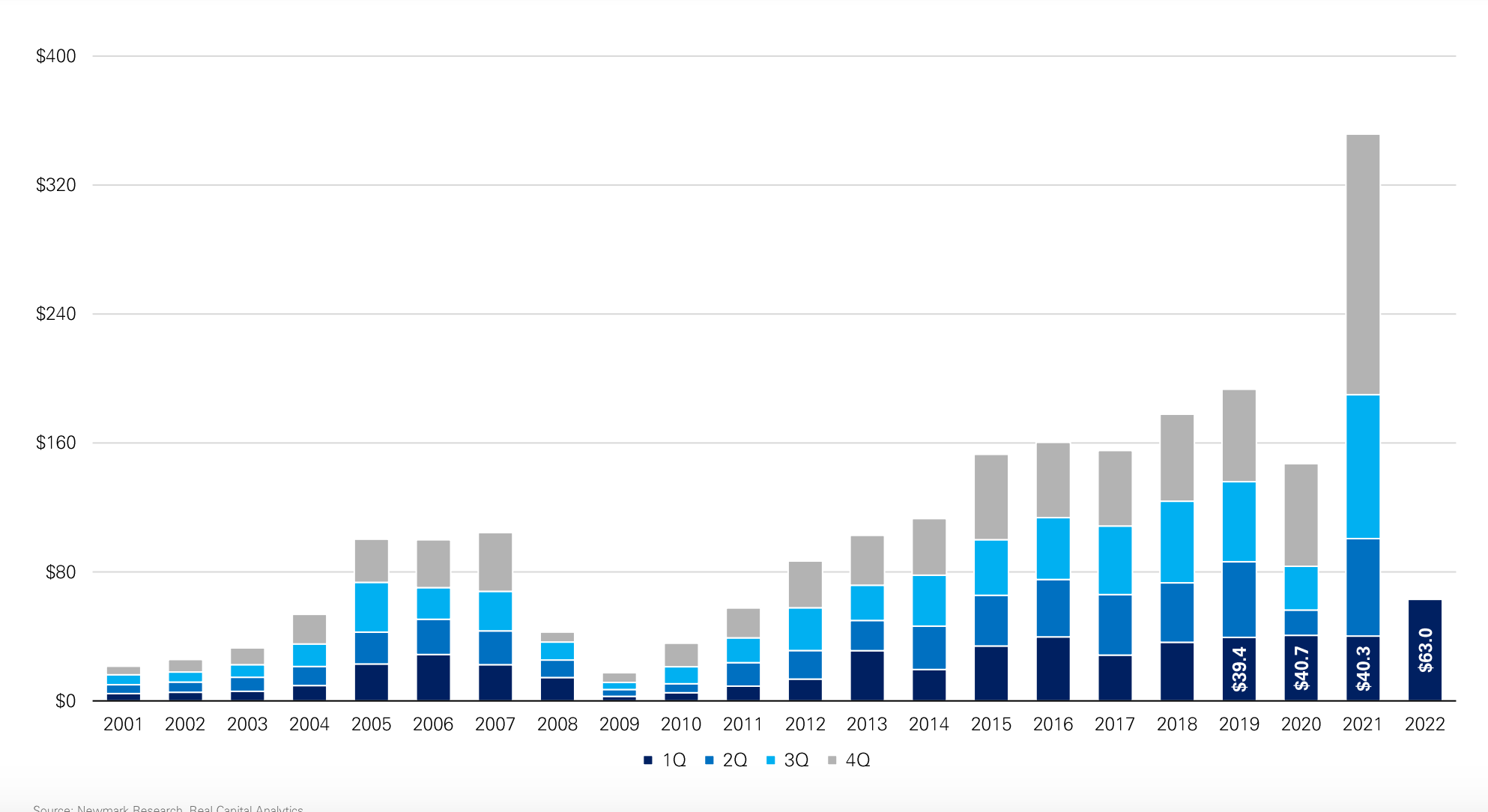

Assuming continued success in fundraising for these vehicles and employing modest leverage, I estimate that BREIT/SREIT will be buying a combined $40-50 billion in multifamily assets PER YEAR. As shown below, this represents a large % of the annual multifamily transaction volume and has driven cap rate compression:

In the past 7 months BREIT has announced the acquisition of nearly $20 billion in US residential REITs, including two multifamily REITs, BlueRock Residential (BRG written up here) and Preferred Apartment Communities (APTS) as well as student housing REIT American Campus Communities (ACC).

BREIT is taking in money at such a rapid pace that I believe it creates something I'll call the 'Blackstone put' for high quality apartment

While apartment REIT share prices have declined, the REAL value of the apartments they own has remained strong in the private market (REAL market). In its 1Q22 commentary, BREIT reports an increase in values:

Similarly, the apartment REITs note resilient private market apartment values for top quality institutional grade assets:

To recap, rents are on fire and the value of apartment assets has SOARED over the past few years. However, you almost certainly wouldn't know if by looking at 5 year share price charts of the apartment REITs:

This disconnect presents opportunity for the enterprising investor. Here's my estimated valuation snapshot of my five favorite apartment REITs:

NAV is calculated using a 3.75% cap rate on 2022 NOI (factoring in NOI growth works out to 4/4.1% on 2023). Strong rent spreads thus far in 2022/loss to lease (~10% for most at end of May) suggest 2023 NOI could be a bit better than I assume (I'm at like 5% overall). Note that my 2023 NOI number does not assume significant further rent growth in 2023, rather 2023 NOI benefits from rent growth already achieved thus far in 2022 (but the full effect hasn't hit the PnL yet) and the further curing of the loss to lease (i.e. marking rents to market as leases roll as we move through the remainder of the year).

RE Nerd notes: Cap rates consolidate JVs debt/ NOI on a proportional basis. NOI credited with in process development (and of course adds cost to complete to debt). I deduct 'prop management expenses' from NOI which differs (I'm more conservative) from supplemental disclosure/industry convention.

For more background on the individual REITs:

Avalon writeups

Essex writeups

Camden/ MidAmerican writeups

What do YOU think? Join the conversation: https://twitter.com/PrivateEyeCap/status/1534865681337839616

Song:

Legalese:

As ALWAYS THIS IS NOT INVESTMENT ADVICE. I could be WRONG.

Eric Bokota owns shares of AVB CPT ESS MAA UDR

Private Eye Capital Newsletter

Join the newsletter to receive FREE actionable investment ideas.