Other things I've done (pt. 2) - Towers

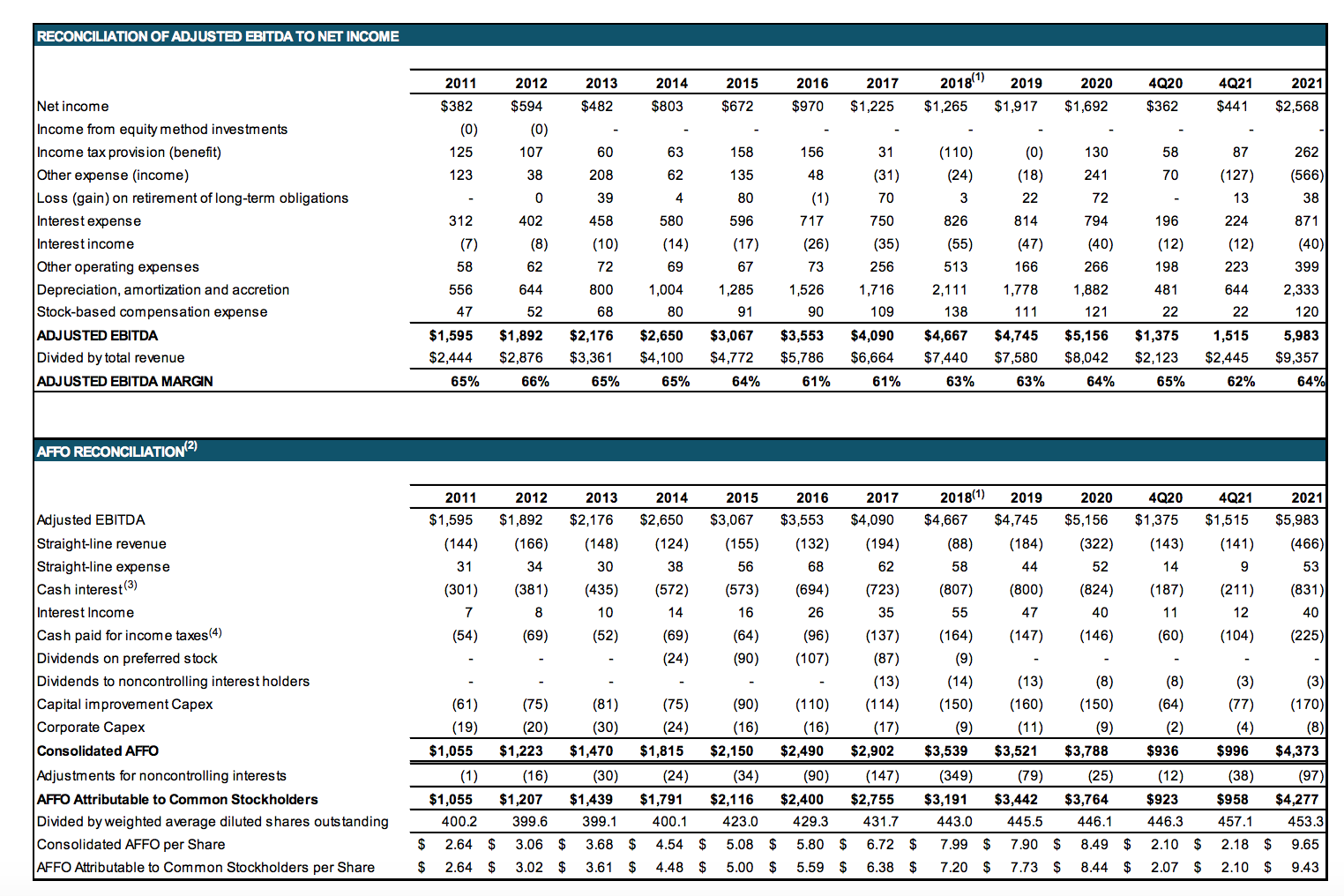

Welcome to the wonderful work of economically resilient communications infrastructure assets. During the Jan/Feb selloff I was able to purchase shares of American Tower (AMT), a global operator of cellphone towers, at a reasonably attractive price. Cell towers house critical piece of the communications landscape and cell tower REITs have been fantastic performers over the past 20 years through both organic growth and accretive acquisitions which have driven tremendous growth in NOI/EBITDA and AFFO/share. Here's a snapshot of the company's financial performance over the past decade:

The business model of cell towers is fairly straightforward:

-Tower operators like AMT acquire (or lease) the land under the tower from property owners.

-AMT then signs long term leases with telecom tenants (Verizon/ AT&T/ T-Mobile, etc) to locate antennas/communications/HVAC (and in some case back up power) equipment.

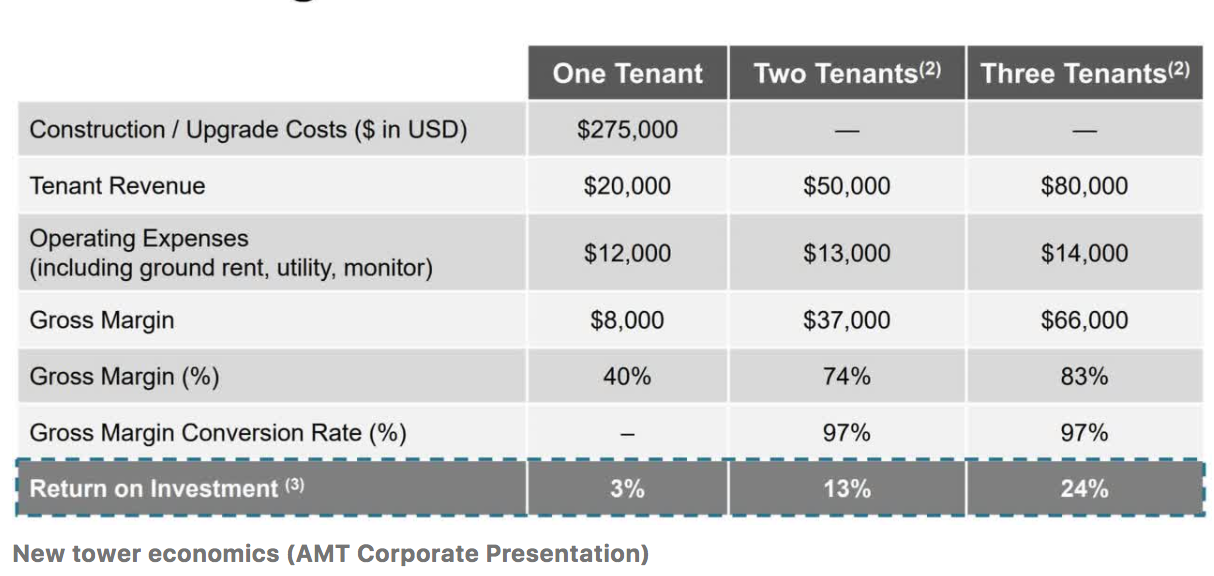

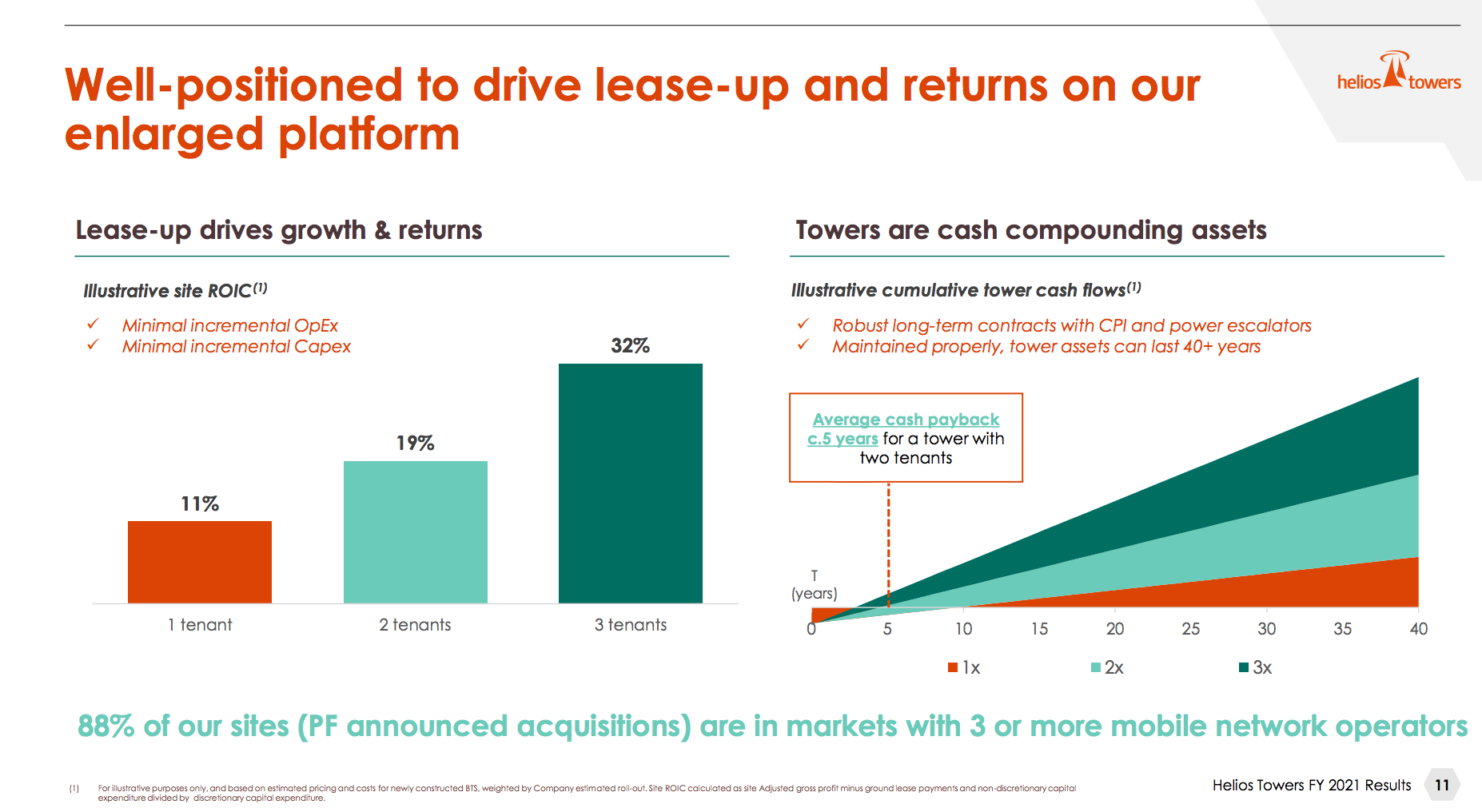

Financial performance is driven through co-location of tenant equipment at sites. As shown below, site economics/returns are driven by the number of tenants which co-locate at each location.

Increasing demand for mobile data has increased both the number of sites and the number of tenants at each site.

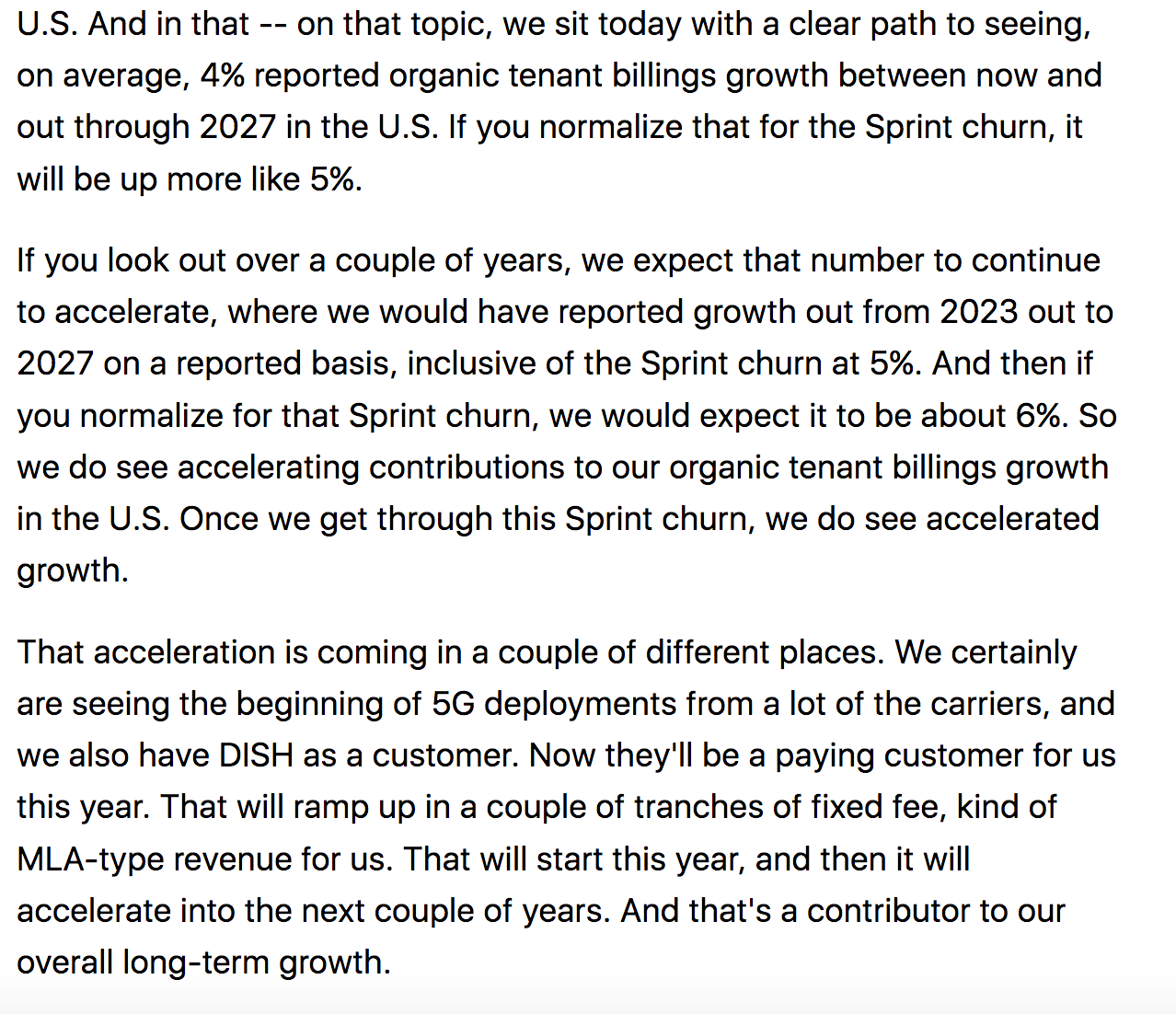

The 5G rollout provides a pathway for above average organic growth over the next 5+ years as telecom operators install new equipment to provide 5G coverage throughout their networks:

While shares of AMT have bounced back sharply, there are a couple of small cap operators in the tower food chain that I think are interesting to investors with a long term time horizon.

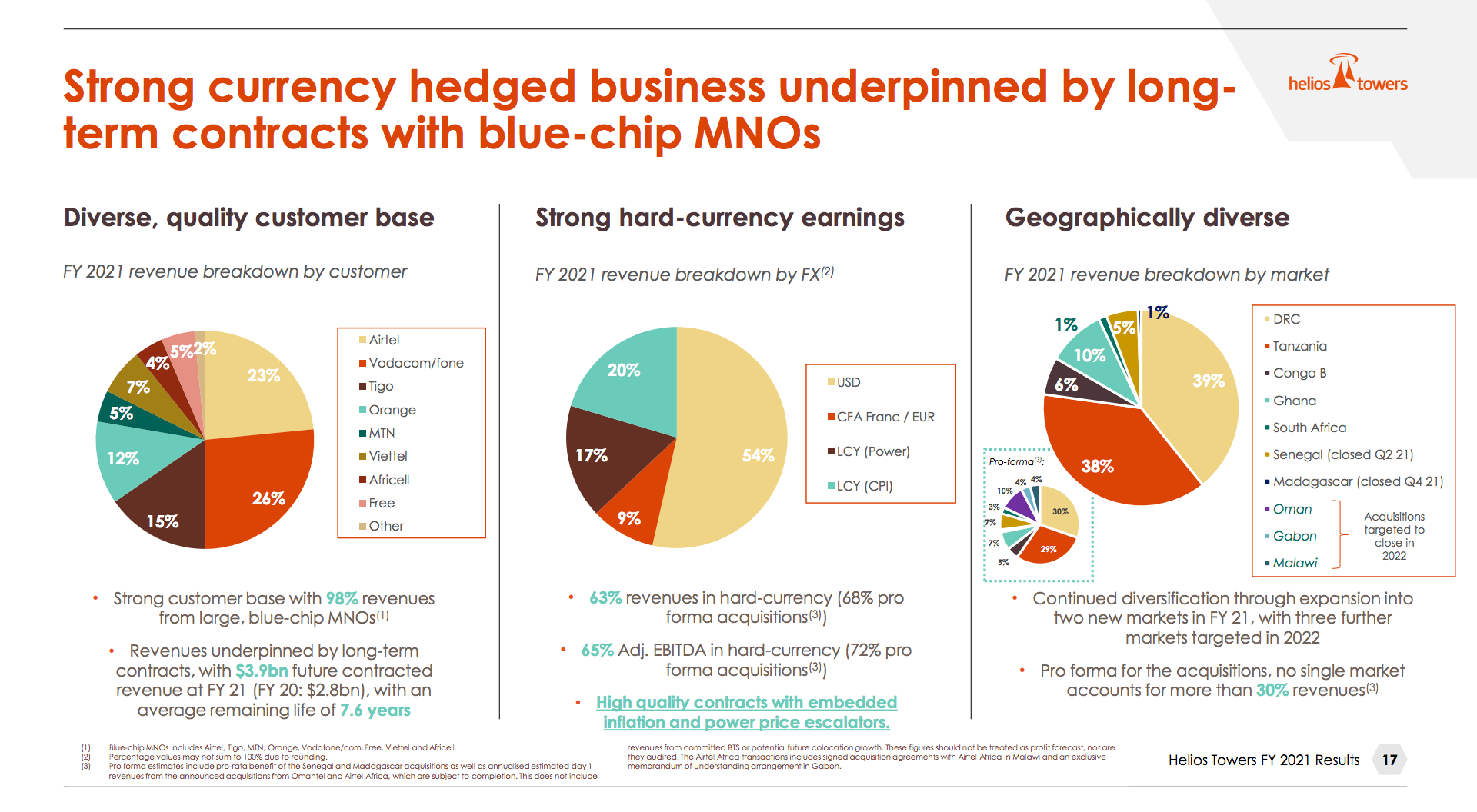

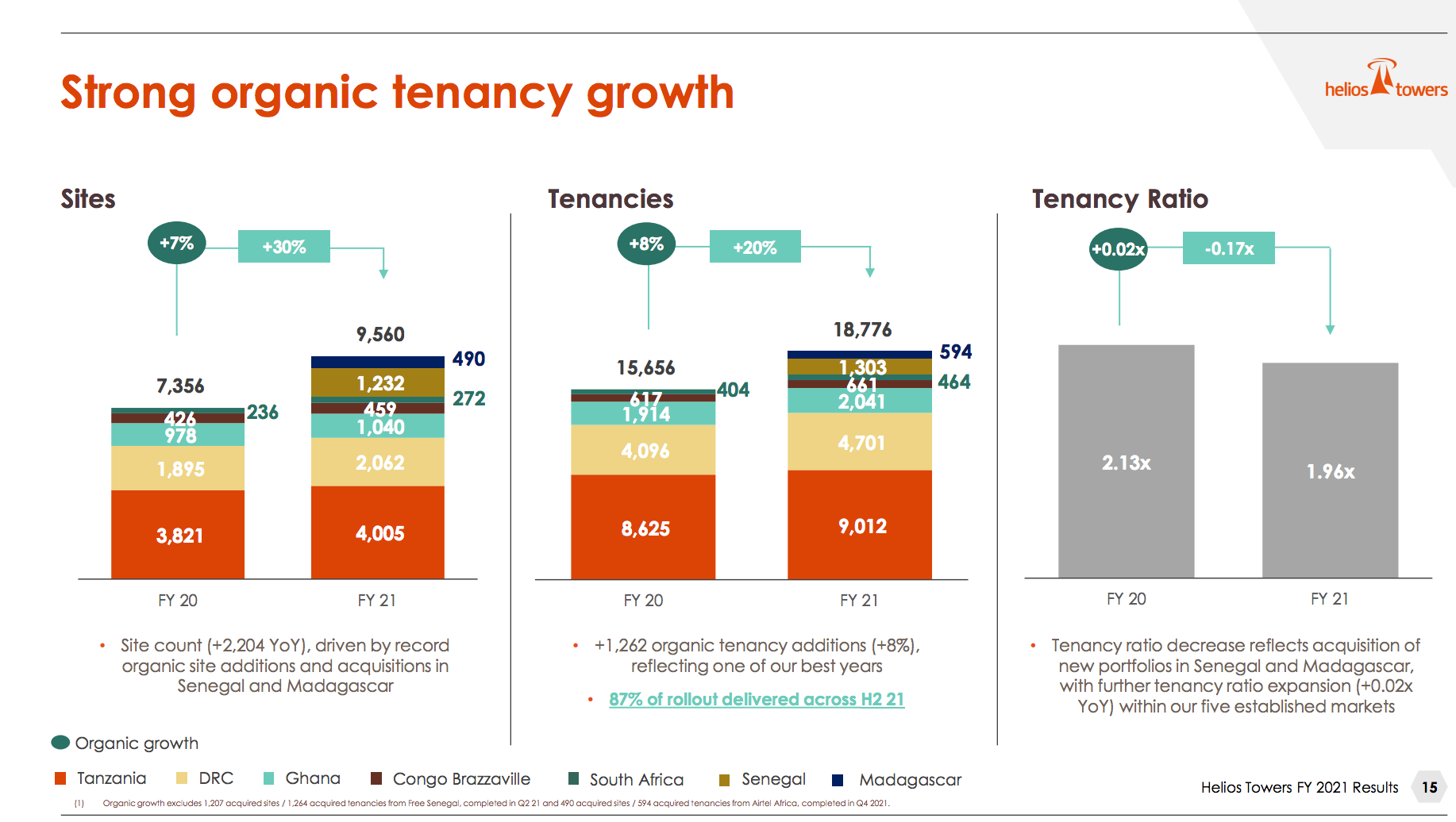

Helios Towers (HTWS LN) trades in London and operates a network of towers in Africa. Cell towers are an even more critical piece of infrastructure in Africa than developed markets given that much (most?) of the African continent is without fixed line (copper, cable, fiber) infrastructure. While there are obviously greater risks (political, regulator, currency) to doing business in Africa, many of these risks appear mitigated as Helios tenants tend to be creditworthy multinational operators (Airtel, Vodafone, Tigo, MTN, Orange) operating under long-term contracts in hard currency (dollar$/ Euros):

Meanwhile there is a significant long-term opportunity for Helios as mobile communications infrastructure in Africa continues to develop. Similar to AMT I expect to see organic growth in sites, # of operators per site, and accretive growth via acquisition.

Also, similar to AMT, unit economics are driven by the number of telco tenants at each site:

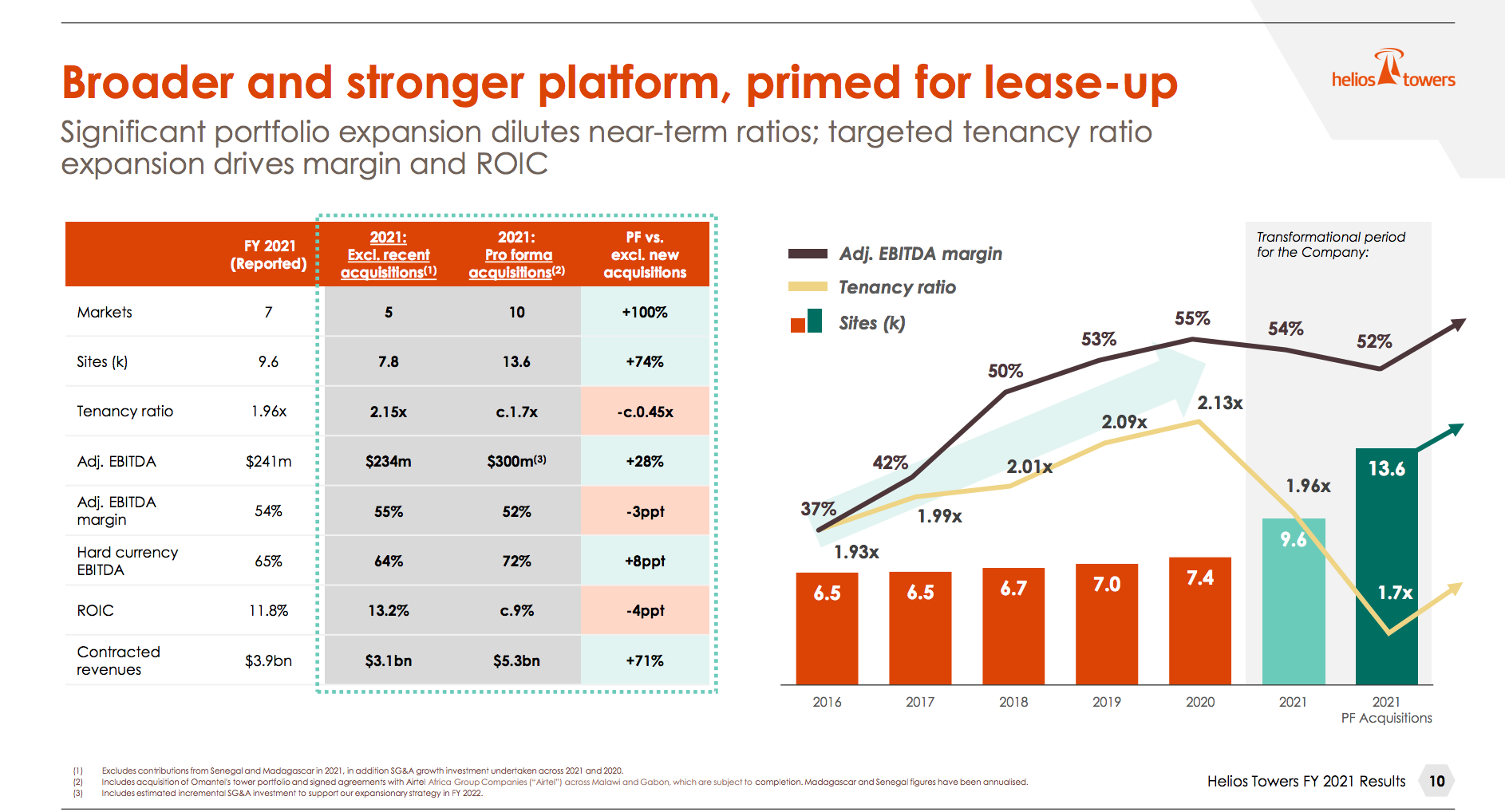

During 2021, Helios acquired tower operators in Senegal & Madagascar. The acquired operations had a lower number of telco operating at each site - creating a high return, multiyear opportunity for Helios:

The company will likely continue to acquire underutilized assets and use its relationship with telcos to increase occupancy & boost returns.

In terms of valuation, Helios trades at an EV/EBITDA (2022e PF for acquisitions) multiple of ~8x. By comparison, AMT trades at a 24x 2022e EBITDA multiple. AMT trades at a high valuation due to the security and growth of its cash flow. Economic fluctuations have little to no impact on the business due to the contractual nature of its leases. While I'm not suggesting that Helios should trade at the same multiple, I think the gap is too wide given that Helios is primarily hard currency, long-term contracts with creditworthy tenants which should also prove to be economically resilient. It is worth noting that Helios has a strong balance sheet with a net debt/EBITDA ratio of just 3.6x (vs. ~5.5 for AMT).

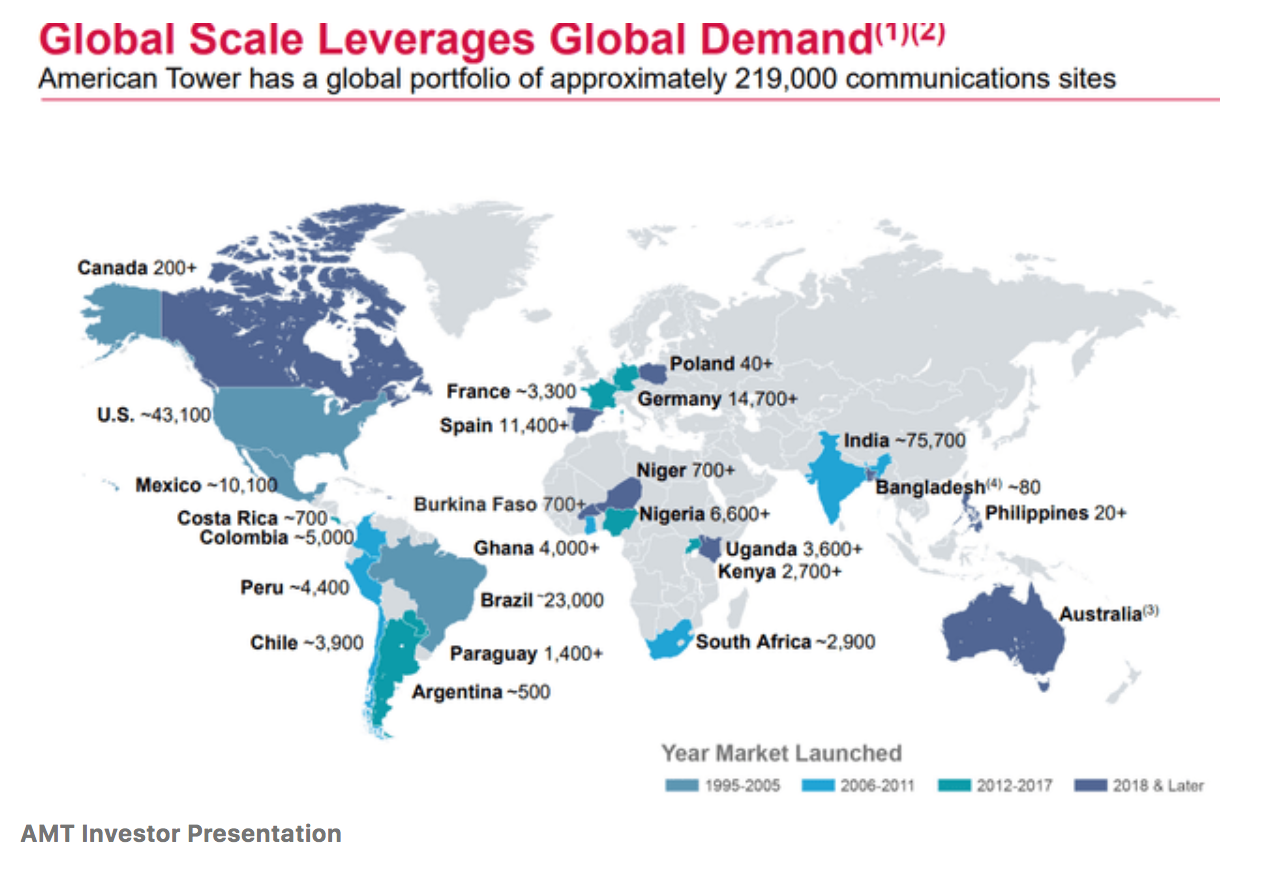

I think there is a decent possibility that Helios is eventually acquired, possibly by AMT. As I mentioned above, AMT operates globally and has been quite acquisitive - spending tens of billion$ to consolidate the tower market. Here is a snapshot of AMT's global footprint:

As you can see, AMT has nearly 20k sites in Africa and presumably would be interesting in adding to that footprint.

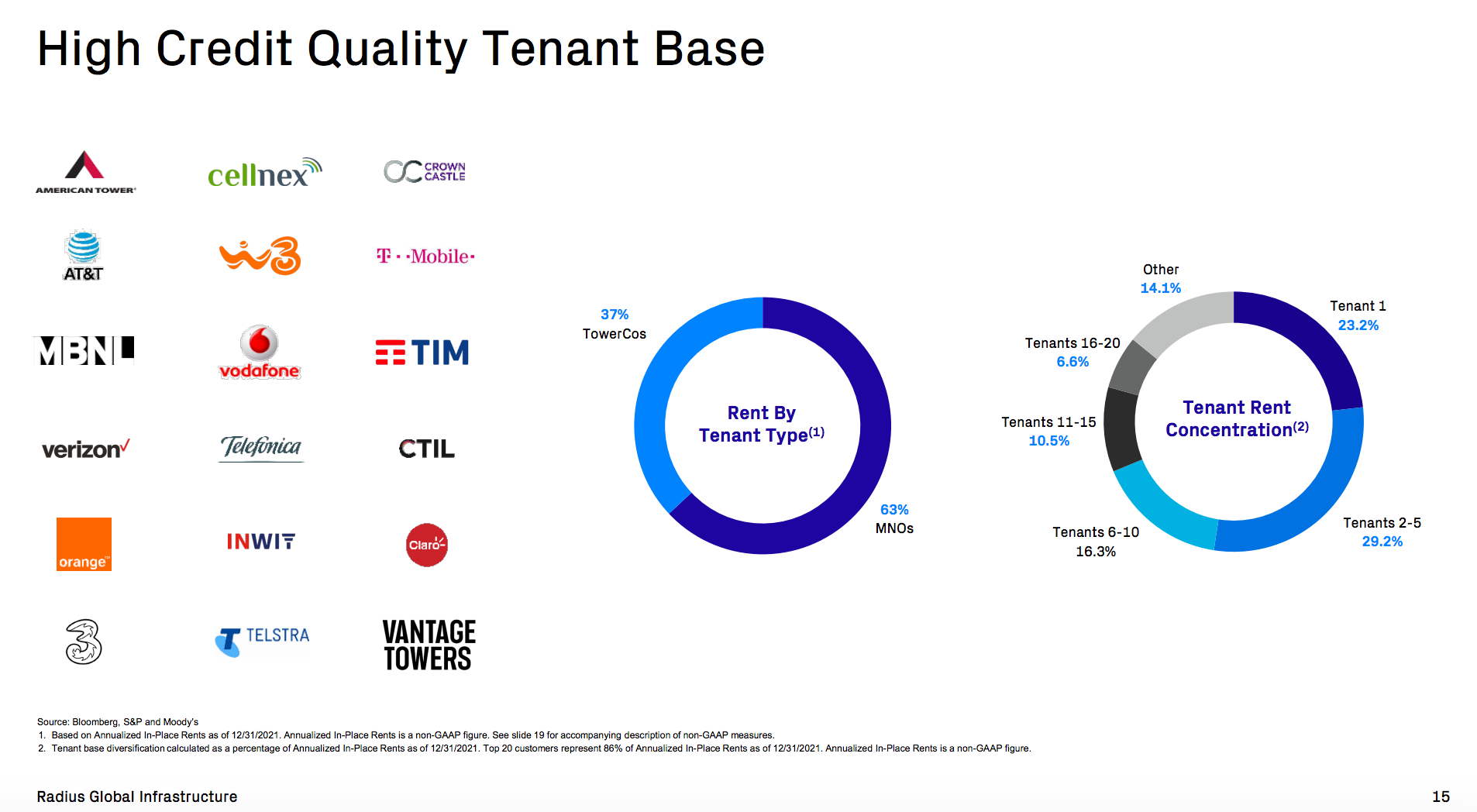

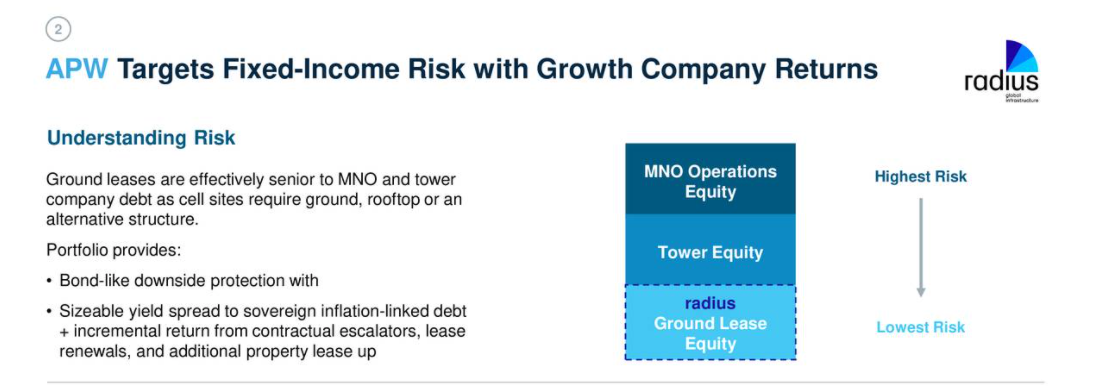

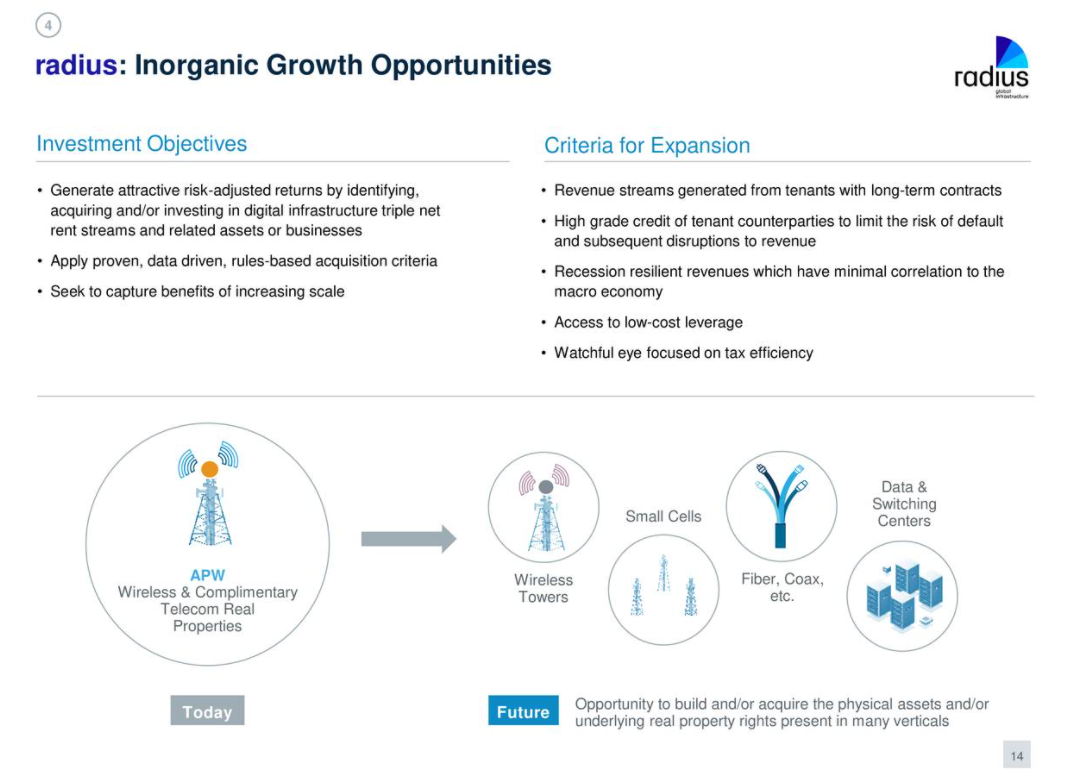

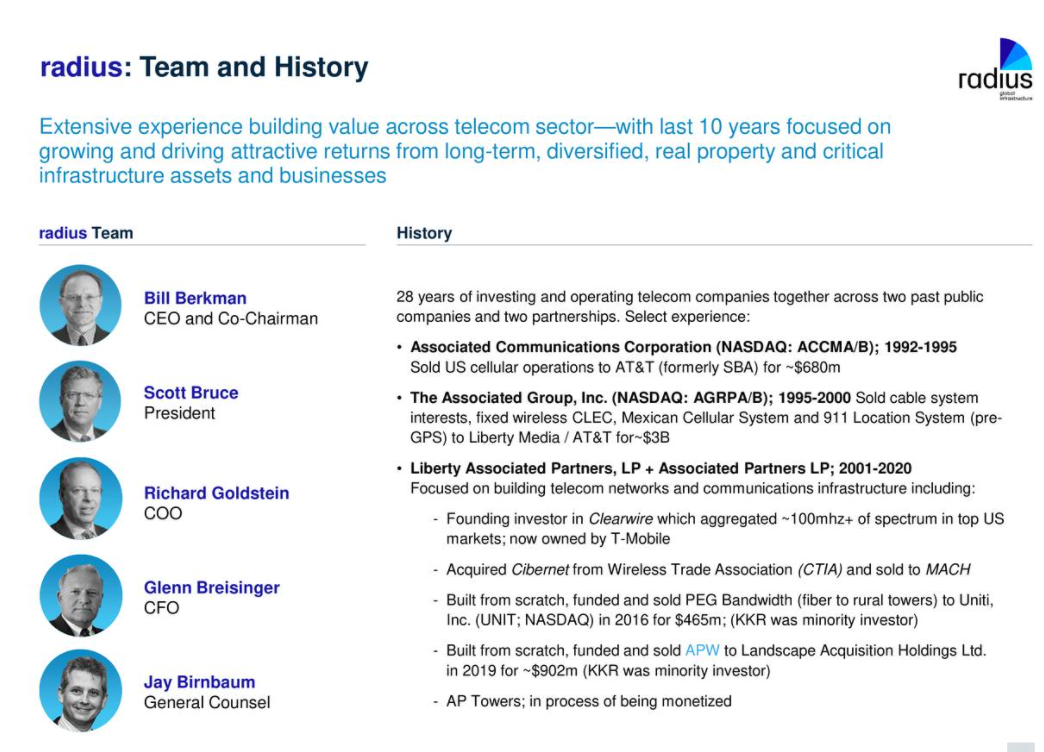

Another intriguing opportunity in the tower infrastructure space is Radius Global Infrastructure (RADI). RADI came public via a SPAC in 2020 and is a leading lessor of sites to tower companies like AMT (in fact AMT is one of their largest tenants). As noted above, in some cases AMT purchases the site under the tower and in other instances it leases the site - mainly from mom & pop land owners. Since 2011, RADI has been acquiring these sites from mom and pops.

RADI's business model is somewhat different than AMT/Helios - it is simply leasing the land under the tower on a triple net basis. It does not install infrastructure at the site (as shown in the New Tower Economics slide near the top of the article) and does not incur the ongoing operating costs of the site (almost all on a triple net basis - tenant is responsible for operating expenses, property taxes, insurance) - RADI just collects rent.

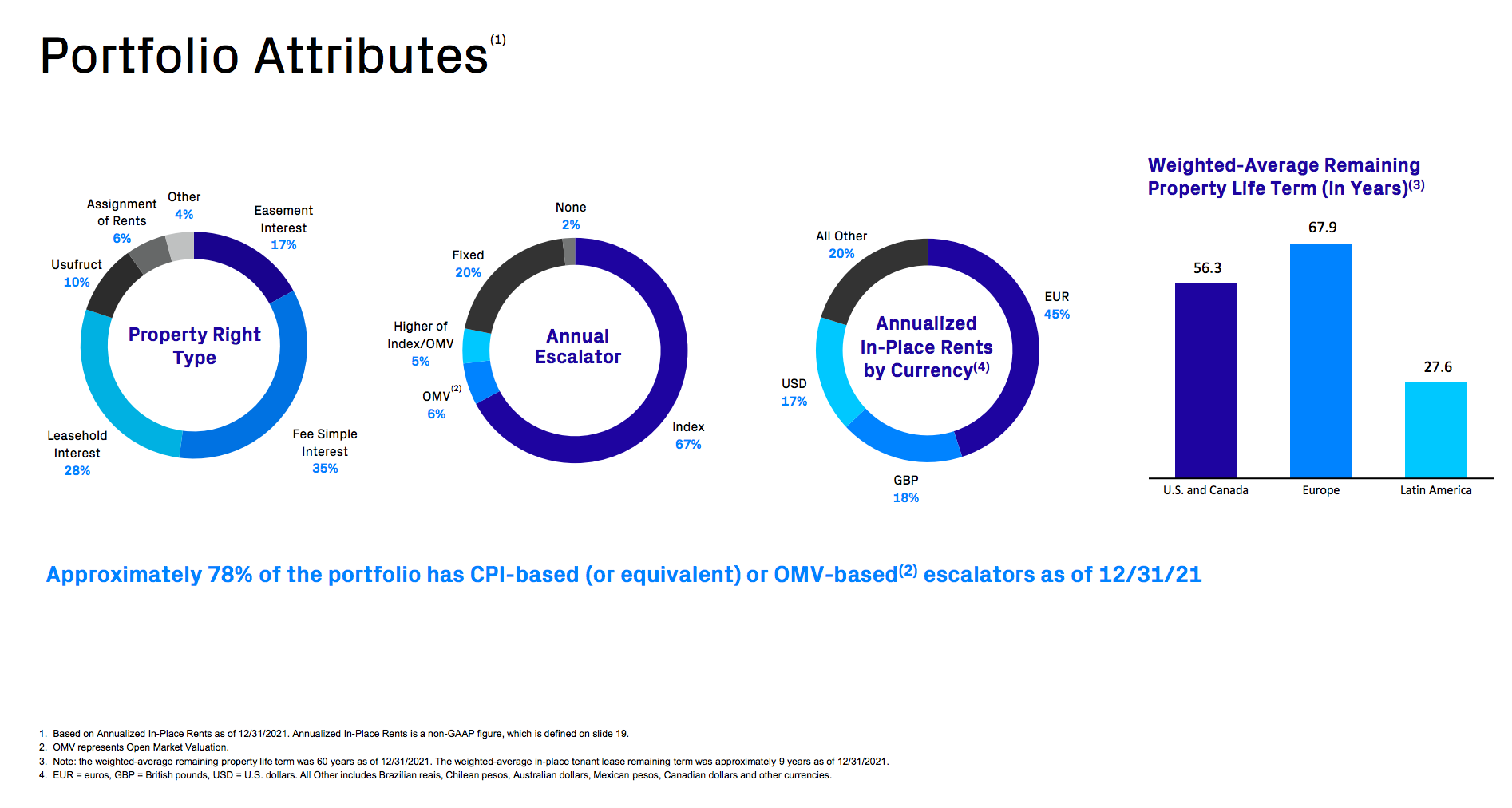

Like AMT/Helios, RADI's tenants are highly credit worthy and operate under long term leases. Better yet (particularly in the current environment), the majority of RADI's leases are linked to inflation.

By coming public, RADI has gained increased access to capital (both equity and debt) and has significantly stepped up its pace of acquisitions. Because RADI is mainly acquiring the rights to these properties (one by one - RADI has a staff of over 100 people tasked with doing deals) from relatively unsophisticated small land owners, it is able to do so on attractive terms. Over the past year cash cap rates have been ~7% (after allowing for acquisitions costs, on a GAAP basis cap rates are 6.5%).

Acquiring inflation protected long term leases with credit worthy tenants at a 7% cash cap rate is an incredibly attractive proposition in my view. Consider that tower operator AMT recently placed 10 year debt at 4.1%. There is zero inflation protection fro the investors purchasing that debt. Moreover, RADI's leases rank senior to the debt. So in effect, RADI is acquiring a senior claim with inflation protection at a higher yield!

As we sit today, at $14, RADI trades at an implied cap rate of 5.5%. Similar to STOR, the market puts a higher valuation on RADI's assets than it is paying to acquire assets. This means that the company can create value for shareholders by making acquisitions (ceteris paribus - if stock price declines materially or acquisition cap rates fall significantly this would not necessarily be the case). Today the company only owns 8k or so sites but there is an opportunity to double or triple that over the next 5 year - the company expects to deploy $400+ mn per year to acquire sites.

While RADI is trading at an apparent premium to NAV, I believe that the company would fetch far more than its current share price were it to be auctioned today. Though RADI is able to acquire sites at 7% cash cap rates, this is largely done one by one (paying $600-700k or so per location) and it is a slow process that takes time to put real money to work. It is most likely that there would be a significant aggregation premium. Rather than looking at what RADI is paying for assets I think it makes more sense to look at tenant debt yields (which are an inferior claim & have ZERO inflation protection). Doing so suggests RADI should be valued at 4 cap or lower. This implies a fair value (today) of $21-22. Importantly this is a conservative figure gives no credit to RADI's origination platform (the army of people doing these lease deals). Originating $400+ mn per year at 7% cash cap rates will create over $2/share of value per year (assuming 4% is the correct cap rate). Thus I think the real fair value of this business today is $25+. And I expect that value to compound over time as RADI executes its acquisition strategy.

In my mind there are numerous potential acquirers of RADI - not just AMT or private equity but possibly NNN lease REITs like O or ADC which seek just these types of assets - long term leases to investment grade tenants with an origination platform to provide continued accretive growth.

While I believe in the long term opportunity for RADI and see a value much higher than where it trades today, it is entirely possible that the company will trade poorly for awhile given:

1/ SPAC history - frankly I'm not quite sure why they came public via SPAC (if you know DM me on Twitter). The management team, lead by Bill Berkman had been very successful in previous ventures. Management owns ~20% of the company.

2/ Not structured as a REIT. Looking out 2 years, I think that RADI will convert to a REIT once it starts to generate taxable income. Given the success of AMT, CCI, SBAC in public markets, I expect REIT investors will award RADI an appropriate multiple of NOI. Eventual index inclusion (VNQ) would also be a significant positive.

3/ Screens poorly due to high leverage and income statement expenditures for acquisition costs. Does not generate AFFO (EPS ~equivalent for REITs) because of the high operating cost of RADI's origination army as well as interest expense burden

4/ High financial leverage vs. REITs: net debt to EBITDA is ~6x and likely headed higher as the company continues to make debt funded acquisitions. These guys are more comfortable w/ debt than the hyper conservative folks that run REITs - will will probably see ND/EBITDA approach 8x which could turn some folks off. Note that I am not worried about this level of leverage given the incredibly stable, inflation protected cash flows. Management issued lots of low rate fixed interest debt last year which provides plenty of capital for growth.

5/ No dividend - ultimately I think this becomes a REIT and upon becoming a REIT we should see dividends. However at this stage the company isn't really generating any excess cash to distribute to investors (not paying taxes because it has an interest expense shield and an amortization shield).

Song:

As always this is NOT investment advice. Do your own work.

Eric Bokota owns shares of AMT, HTWS, RADI, STOR

Private Eye Capital Newsletter

Join the newsletter to receive FREE actionable investment ideas.