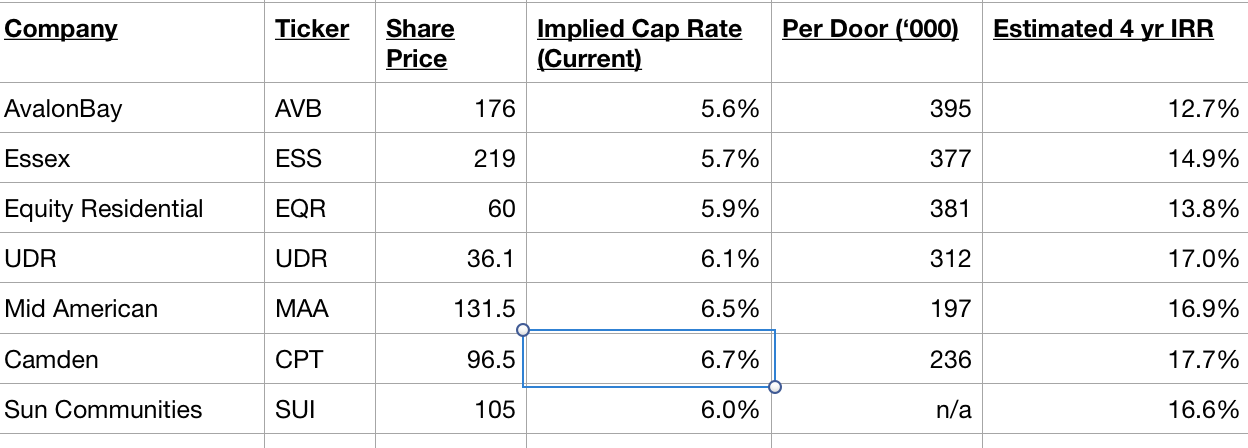

Multifamily REITs: Cap rates, Per Door, Expected 4 year IRR

Thought I'd throw this up here in case people are interested.

Methodology/Assumptions:

- Cap Rate uses current expected NOI and deducts 'Property Management Expenses'.

- Given the wall of supply hitting the sunbelt over the next 12-18 months, but relatively limited new supply in coastal markets, 2024 implied cap rates are likely higher than shown for coastal MF REITs (i.e. NOI should grow in 2024 for coastal markets) and lower for sunbelt REITs.

- Thinking longer term, I assume ~3% NOI growth over the forecast period for all the REITs shown above which is broadly consistent w/ LT historical averages/inflation. I expect that growth should be relatively steady for the coastal markets (again due to limited supply) whereas the sunbelt should see weakness in 2024-1H25 followed by a bounce in 2026 and 2027 (given my expectation of very low apartment starts in 2024 leading to scant deliveries in 2026-27 but continued population growth). Dramatically reduced supply expectations are a function of higher interest rates, higher construction costs, curtailment of CRE/development lending particularly on the part of regional banks.

- To determine IRRs, I use a 5% cap rate across the board for 2027e NOI and take into account dividends as well as expected cash build (dividend payout ratios generally sub 75% on AFFO). Historically coastal apartments have traded 75-125 bps tighter than sunbelt REITs due to limited supply/renter-by-necessity dynamic leading to more stable expected results. This changed during COVID which saw declines in coast NOI/FFO & a boom in the sunbelt which altered investor appetites (i.e. more capital flowing to sunbelt and out of coastal). For a brief period, sunbelt multifamily traded at lower cap rates than coastal. As you can see in the table above, cap rates have since reverted to something closer to their historical relationship (i.e. sunbelt now trades at a discount to coastal) as fears about sunbelt supply are front & center.

- There are puts and takes here re sunbelt vs. coast. As everyone knows, demand growth is stronger in the sunbelt (jobs/population) and regulatory risks are limited/nil. Coastal markets have flat/declining populations and regulatory/rent control risks (as well as implementation of onerous transfer taxes like we saw in LA) but benefit from very low supply growth in CA/NY/Boston, lower levels of property tax growth (Prop 13 in CA and something I forgot in MA) and very expensive housing (renters by necessity even at $200+k annual earnings).

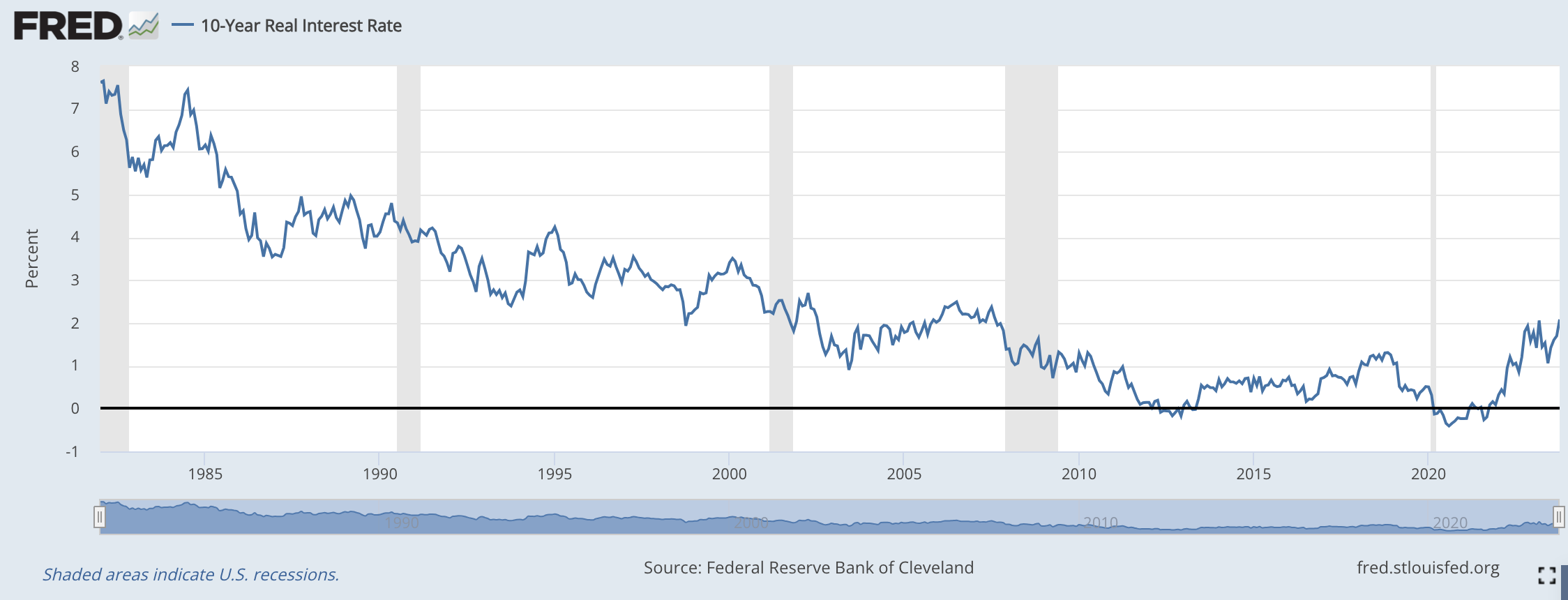

- Surely some of you think that 5% is an aggressive assumption. My thinking here is that a 5% cap rate should generate an un-levered, real (after inflation, assuming inflation is equivalent to NOI growth in the long-term) return of around 4.25% to the buyer. 4.25% is 85% of 5% with the 15% representing the difference between nominal and economic cap rates (i.e. G&A and maintenance capex). I see a 4.25% real return to be pretty fair for what I believe to be a diversified collection of low risk assets (10y Treasury real return shown below). If you assume a cap rate of 5.5% rather than 5%, 4 year expected IRR declines something like 3% (i.e. 17%->14%).

Disclaimer:

- I own shares of everything shown in the table above.

- Assume I am stupid/careless and everything above is wrong. Do your own work.

- This report should not be viewed .....by anyone

Song:

Private Eye Capital Newsletter

Join the newsletter to receive FREE actionable investment ideas.