Creating value via Apartment Development

Paid

Members

Public

The reader may be wondering: with private market pricing at all time highs, other than share buybacks, how can the apartment REITs deploy capital at high rates of return? Development. Camden and other apartment REITs have demonstrated an ability to develop assets at attractive yields (NOI of development / cost of

You can have good news or cheap stocks; CLPR & NEN get No Love in apartment REIT rally

Paid

Members

Public

This past week saw news of a vaccine for COVID sent share prices of most apartment REITs soaring, with those having exposure to hard hit urban areas seeing the some of the greatest gains. Seemingly, an end to COVID and the expectation of a return to normality came as a

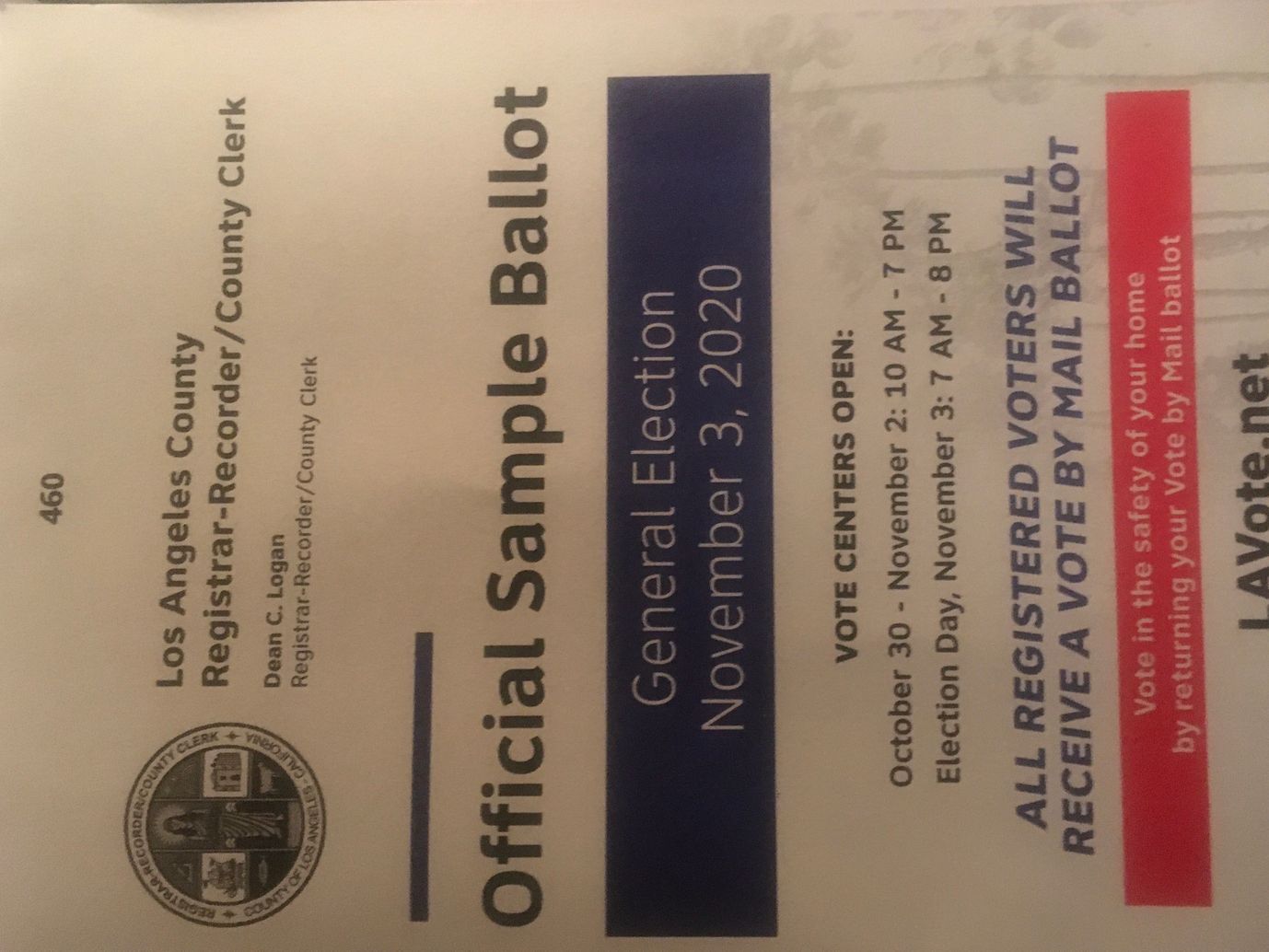

Great news from the ballot box in CA

Paid

Members

Public

Great news for apartment & other commercial real estate owners in CA: Prop 21 (rent control) FAILs with nearly 60% voting NO. Prop 15: 52% NO votes w/ 82% counted. Prop 15 sought to raise property taxes on most commercial real estate (Prop 15 DOES NOT include apartment buildings so

Are private buyers crazy? How buying at an apartment complex at a 4 cap can generate a 10% IRR

Paid

Members

Public

While publicly traded apartment REITs have fallen considerably YTD, the private market [https://www.privateeyecapital.com/why-public-investors-should-care-deeply-about-the-private-market/] (the private market represents ~95% of US apartment assets; just 5% of US apartments trade publicly as REITs) for apartments has soared and in many markets is at or approaching new highs. With

3Q20 updates for EQR/AVB

Paid

Members

Public

EQR and AVB reported weak results. The impact of the pandemic has hit urban areas hardest - causing increases in vacancy, declines in effective rents, and corresponding decreases in NOI. Occupancy @ EQR is ~94%. AVB saw occupancy as low as ~93% in Sept before rebounding to ~94% in October. Coupled

Essex Property Trust 3Q Results - pretty, pretty good.

Paid

Members

Public

Key observations: * Strong operational performance in occupancy, rent, NOI and cash collections. Trends at Essex improved heading from 3Q into October. While on a cash basis (allocation of free rent to period where free rent was borne by ESS), NOI was down a little over 10% but on GAAP/ straight

Another cheap publicly traded collection of apartment assets: NEN

Paid

Members

Public

New England Realty Associates LP (NEN) is a publicly traded limited partnership which owns apartment buildings in the greater Boston area. Through direct ownership and joint ventures, NEN has ownership interests in ~3,200 apartment units (just under 2,892 directly owned with the remainder being via 40-50% JV arrangements)

Tidbits: EQR follow up; New Actionable Investment Idea coming this week

Paid

Members

Public

While I have a new actionable investment idea in the hopper, it is not yet ready to send out (interested readers: keep your eyes out this week either in your Inbox or at www.privateeyecapital.com [https://privateeyecapital.us17.list-manage.com/track/click?u=9817d763c853faa67051e844f&id=bb15970f62&e=