Another cheap publicly traded collection of apartment assets: NEN

New England Realty Associates LP (NEN) is a publicly traded limited partnership which owns apartment buildings in the greater Boston area. Through direct ownership and joint ventures, NEN has ownership interests in ~3,200 apartment units (just under 2,892 directly owned with the remainder being via 40-50% JV arrangements).

Greater Boston has been a very good market for apartment owners over the past several decades - it has resilient apartment demand bolstered by:

- Knowledge economy/high average household income

- Strong educational hub with leading universities

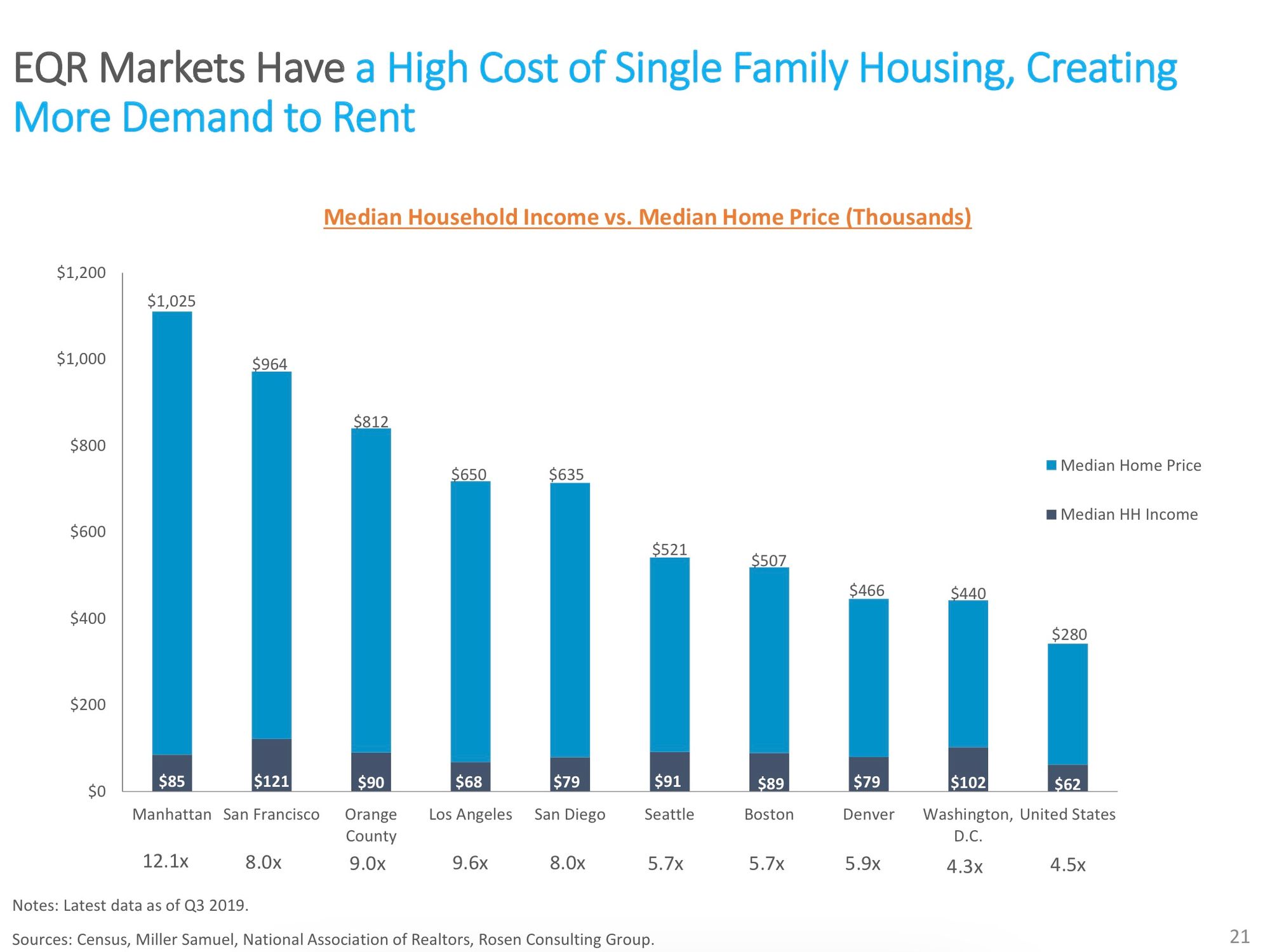

- High housing prices which make many residents renters by necessity (5.7x median home price vs. media HH income). While apartment rents have recently declined due to weak urban demand, the surge in housing prices brought about by the move to the suburbs/low interest rates will actually increase multiple of HH income at which housing trades - it is likely that this will lead to more renters by necessity in the future. In addition to having favorable.

Source: Equity Residential Investor Presentation

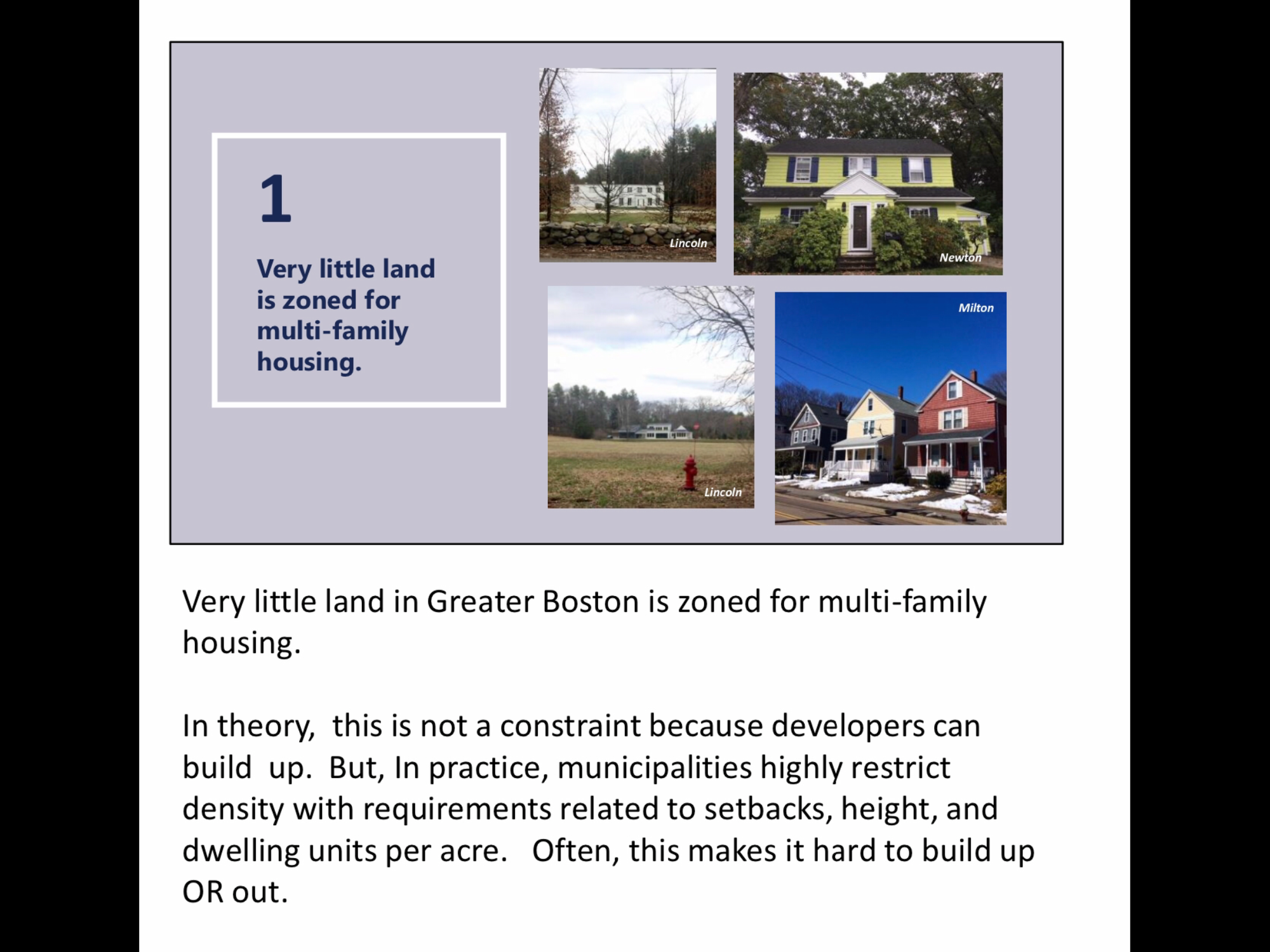

In addition to having favorable demand dynamics, the supply of apartment units in the Boston area is limited by:

- strict building codes - here is a report describing the complexity/challenges of posed to multifamily development greater Boston. Similar to LA/SF, in Greater Boston, municipal (over 100 municipalities each with their own codes/permitting processes) building codes are designed to: 1) protect single family home values by limiting supply (2) limit density/traffic. This creates a very favorable dynamic for owners of existing multi-housing assets. Here is a summary slide:

- high construction costs

- lack of available land/ relatively high population density

It is also worth noting that like California's Prop 13, Massachusetts has a favorable property tax regime (Prop 2 1/2) which provides property owners strong visibility into property taxes/ property tax increases (for those new to apartment investing, property taxes are the largest operating expense item for multifamily owners).

NEN is focused on Class B apartment buildings. Apartment buildings are typically broken into three categories:

A - relatively new (less than 15 years old), priced near the top end of the market and offer the full range of amenities; Class A apartments tend to be the most economically sensitive as renters trade up to nicer apartments in strong economies but may trade down in weaker economies

B - generally 15-30 years old, priced at a 15-25% discount to A units of comparable size. Because Class B units are less expensive than Class A, rents/occupancy tends to hold up better in economic downturns as these units offer less expensive rents than Class A. Class B &C is not subject to competition from new construction as development is ALWAYS focused on Class A (Class B would never pencil out and new Class B is NEVER BUILT).

C - typically 30 years or older; less desirable locations/few, if any, amenities. Priced at a 25% or greater discount to A units.

While the pandemic has negatively impacted urban areas in gateway cities like Boston, Class B apartments have been better insulated from its effects given the more affordable price point.

Ownership & Related Party Transactions

NEN is controlled by the Brown Family which owns nearly a 50% economic interest in the company. NEN co-owns properties with entities affiliated with the Brown family. In addition, NEN also procures management services from The Hamilton Company, an entity owned by the Brown family (external management arrangement - NEN does not have its own employees managing the properties).

Thus an ownership interest in NEN is an investment with the Brown family and trust that they will continue to treat unit holders fairly. Thus far, I have not seen any transactions which indicate otherwise.

Balance Sheet

NEN maintains a strong balance sheet. If I proportionally consolidate the NOI and the associated debt of the JVs and use a 4.5% cap rate, I get to a loan to value (LTV) of 38%.

NEN uses a mix of both recourse (parent level) and non-recourse (property/entity level) debt. Many of NEN's properties carry non recourse mortgages. The company also uses a corporate line of credit (recourse) and in some cases has given a corporate guarantee of the property level debt. Given the low LTV (about 50-60% of what we'd expect to see in the private market) and ample cash resources ($15 million at 6/30), I am not worried about NEN's balance sheet. The company has minimal upcoming maturities - I'd prefer than more debt was maturing soon as nearly all of the NEN's mortgage debt could be refinanced at more attractive rates.

NEN has the financial strength to resume share repurchases and am hopeful that it will do so soon!

Corporate Structure

Unlike the other publicly traded apartment investments I have written about, NEN is organized as a Limited Partnership as opposed to a REIT (real estate investment trust). Simplistically the partnership structure will generally shield current income from taxation for most investors but will increase filing burdens (K1).

Valuation

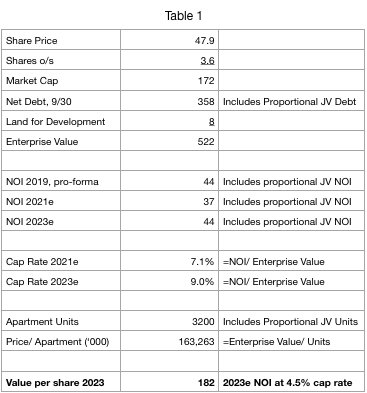

At $47.9 per unit, NEN trades at a 7.1% cap rate on estimated 2021 net operating income (NOI) and an 9.0% cap rate on 2023 #s assuming a recovery (back to basically 2019 #s adjusted for the December acquisition) and taking into account debt paydown/cash build in the interim. Today's EV equates to just ~$163,000 per apartment unit - far, far below private market comparables which are north of $300,000 per unit.

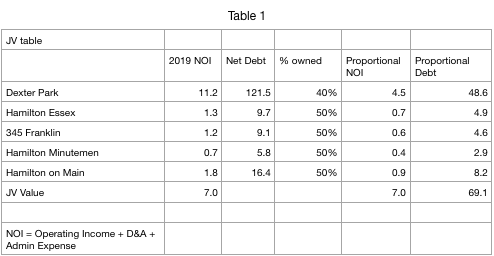

To arrive at the cap rate and EV/ per I use consolidated NOI and proportionally consolidate the NOI & Net Debt from the Joint Ventures (see table below, from Note 14 in the 2019 10-K for those following along at home):

Conservatively using a 4.5% cap rate, slightly higher than the 4-4.25% cap rates the private market has placed on assets in supply constrained markets with long-term favorable demand prospects, gets me to a value of over $180 per share for NEN in 2023. This represents well over 200% upside from today's price.

Some of you are probably wondering: What does the buyer get assuming a purchase at a 4.5% cap rate? Assuming NOI growth of 3.3% (in line with history), 70% LTV @ 2.7% fixed rate (do-able for stabilized assets in today's market), capex of $1,700-1,800 per door and a refi back to 70% at the end of year 7, the buyer would receive ~110% of her equity capital back (within 7 years) and still own the property. Assuming a sale after a 10 year hold at a 5 cap (higher cap rate to account for building age), the IRR would be 12%.

The cash on cash return (to equity) is 7.8% in year 3. Moreover, the cash flows to equity are growing at ~6% per year. Note that this is faster than the 3.3% assumed NOI growth rate because of the fixed debt service payment (interest only payment assumed in this example). In a world of 86 bp 10 year treasuries, this is a very attractive return. Thus the private market is being quite rational in purchasing these assets at a 4.5% cap rate.

Positives

- Trades at a larger discount to NAV relative to the large cap apartment REITs like Essex, Equity Residential, and AvalonBay.

- Stable property tax regime courtesy of Prop 2 1/2. Overall increases in property taxes for a municipality are capped at 2.5% (individual properties can see variations around 2.5% but 2.5% is a reasonable annual expectation for a portfolio of MA properties).

- Partnership structure reduces tax burden on income received.

- Given the giant discount to NAV at which NEN trades, NEN management has the opportunity to increase NAV/share through share repurchases. In fact, NEN does have a history of modest share repurchases. However, given the limited liquidity in the stock, I do not expect to see a meaningful amount of capital deployed here. Also NEN halted its share repurchase program in May in response to COVID and the associated economic uncertainty.

Negatives

- Lower payout ratio/ Lower yield - NEN retains more cash flow than . To the extent that the company is able to deploy this retained cash flow at attractive IRRs, this could end up being a positive. However, while publicly traded apartments investment vehicles trade at low prices, there has been little change in the price of private assets. Outside of special situations (development/lease up) where debt financing has all but evaporated, there is not much distress - thus the investment opportunity set appears fairly limited for NEN.

- Like CA, Massachusetts is subject to ill conceived rent control initiatives.

- While I generally view high levels of inside ownership as a positive, the company is run by a Jameson Brown who is son of founder Harold Brown (who died in early 2019). Jameson’s actions thus far have been sensible but it is worth noting that he has less than 2 years at the helm and is just 34 years of age. Given family control, NEN is unlikely to draw an activist involvement to unlock value through a sale or greater payouts to shareholders.

- Additional tax filing burden due to partnership.

- Illiquid - some days the shares don’t even trade. This isn’t a huge concern for most long term owners, but those looking to build a position of any size must exercise patience and will inhibit institutional interest.

Song:

Private Eye Capital Newsletter

Join the newsletter to receive FREE actionable investment ideas.