3Q20 updates for EQR/AVB

EQR and AVB reported weak results. The impact of the pandemic has hit urban areas hardest - causing increases in vacancy, declines in effective rents, and corresponding decreases in NOI. Occupancy @ EQR is ~94%. AVB saw occupancy as low as ~93% in Sept before rebounding to ~94% in October. Coupled with incentives/rent declines, same store residential NOI declined 8.4% at EQR with total NOI declining 12.2% (some apartments have ground level apartments in urban areas have retail tenants as well - EQR took a receivable writeoff in the retail portfolio in 3Q. Excluding this writeoff, total NOI for residential & retail was -10%). AVB reported NOI -10%.

Residential rent collections at EQR were relatively unchanged at 97% and 96% at AVB which saw modest softening.

For both AVB/EQR, rents continued to weaken into October meaning that NOI declines are likely to be greater in 4Q20-2Q21 than experienced in 4Q. This is modestly offset by the ~100 bp increase in occupancy.

Suburban portfolios held up better than urban ones - vacancy rates in some urban areas are as low as 88% whereas suburban properties at EQR/AVB are 95-96%. I continue to believe in the long term appeal of megacities but right now most renters lack interest as the current appeal of city living is low: most folks are working from home an don’t benefit from a short commute, many of the attractions (restaurants/entertainment/etc) are shut down completely or have greatly curtailed offerings. Things will be ugly until they are not.

On the capital allocation side, AVB repurchased shares during the quarter and is looking to sell properties to fund both share repurchases at attractive discounts to NAV and new developments. Given my belief that shares of multihousing REITs are significantly undervalued coupled with their very conservative balance sheets, I am enthused by AVB buying back shares. New developments can also be an attractive investment opportunity at this point in the cycle as while most asset classes are being chased by too much money, there is a dearth of capital (both debt & equity -noted by UDR on their call as well) available to developers which can allow for development yields well in excess of where stabilized assets are trading. We’ll see what comes into the pipeline but possibly if AVB is able to deploy capital into attractive markets at development yields (cap rates) near where AVB itself trades this can be as or more attractive than buybacks (because the company would have a brand new asset rather than an older asset).

EQR is not buying back stock and does not seem interested in buying back stock. Frankly I don’t really understand why not. All in, this makes me prefer AVB to EQR though I continue to own both.

Impact on Value/Time

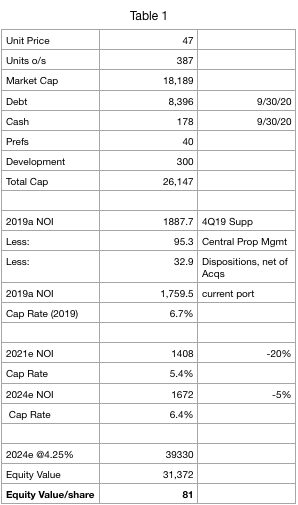

Urban markets have been hit harder than I’d thought. While I’m not adjusting my fair value targets ($80 for EQR/ $225 for AVB), I guesstimate that it will take a year or so longer to reach my normalized NOI number than I’d originally anticipated (so I’m thinking 2024 vs. 2023 FWIW).

I assumed that conditions remain difficult based on current rents/occupancy. This flows through to NOI - I now model a 2021 same store NOI decline of 20% which recovers to 95% of the 2019 level by 2024. Using a 4.25% cap rate, EQR's expected fair value is $81 in 2024.

Looking ahead, there are some positives:

-Polling indicates that ill conceived CA Prop 21 is likely to fail

-Apartment applications are up in hard hit urban markets

-On its call, Camden (CPT) reiterated the strength of private markets with deals pricing at sub 4 cap rates. CPT mgmt suggested that it may sell some assets here and also noted that its markets (South/ Southeast) are prone to new supply (building codes are not nearly as restrictive in these markets, land is more abundant).

-strong exposure to recovery in the urban core - once occupancy picks up, rents will pick up and NOI can move up at a pretty good clip

-LA poised for strong recovery as filming resumes and structural demand content for streaming services picks.

-Venture Capital Fund Raising for 2020 has already exceeded 2019 levels - this disproportionately goes into tech/media which benefits LA/SF/Seattle and even NY. Not surprising given the NASDAQ/IPO market but this money is yet to be spent, will be spent to hire workers and many of those workers will rent apartments in ESS/EQR/AVB markets.

-Price of housing in these areas (Seattle/LA/SF) is INCREASING. This makes apartment rentals a relatively more attractive option.

-Apartment REIT UDR noted on their 3Q call that they believe Seattle/LA/DC have bottomed

-Prospect of more relaxed immigration policy under Biden which would benefit coastal cities

-Absence of capital for development - both debt and equity capital have retreated. Reduced new supply coming to market. Noted by multiple companies on quarterly calls.

-pent up demand largest # of 18-34 year olds living with parents in several decades.

-Positive commentary on leasing interest by West Coast office REIT Hudson Pacific (HPP).

Here are a few more private market transactions (first 4 are in markets where the REITs discussed own assets; the last I include because it is an example of an urban asset trade:

New construction Inland Empire (Los Angeles) at $375k per unit. https://commercialobserver.com/2020/10/southern-california-apartment-trades-130-million/

-KKR buys 81 units in Brooklyn @ $571k/unit https://www.multihousingnews.com/post/brooklyn-asset-trades-for-46m/

-NY Financing https://therealdeal.com/2020/10/29/all-year-snags-650m-financing-for-bushwick-luxury-rentals/

-UDR sold an Alexandria, VA (metro DC) property for $437k per apartment

-Chicago @ $400k/unit https://www.multihousingnews.com/post/luxury-chicago-apartments-sell-for-33m/

Eric Bokota owns ESS, EQR, AVB, AIV. As always, this is not investment advice. It's entirely possible there is a factual error somewhere above. Do your own work.

Song:

Private Eye Capital Newsletter

Join the newsletter to receive FREE actionable investment ideas.