$ESS

The private market for California apartments is Alive & Well

Paid

Members

Public

Quick N Dirty: On 9/14/20, Aimco announced a series of transactions including the formation of a $2.4 bn JV with a passive institutional partner whereby LA/SF apartment properties were sold at a 4.2% cap rate/$592k per unit valuation. This valuation is consistent with what

Essex (ESS): Following up

Paid

Members

Public

I received a few questions, via private message, regarding the our piece [https://www.privateeyecapital.com/why-would-any-long-term-investor/] on the Essex Property Trust (ESS) and I wanted to follow up (without attribution to the person/organization asking the question of course - we understand the value of anonymity). The main concerns

Why would any long term investor not own Essex Property Trust (ESS)?

Paid

Members

Public

Note: A very very rough draft was sent to our FREE Actionable Investment Idea Newsletter [https://www.privateeyecapital.com/signup/] subscribers on Friday. If you like being in the know and want FREE weekend reading, be sure to sign up NOW (note that you must confirm your email address within

California is not dead. Not even close!

Paid

Members

Public

California has some challenges - the government is big. Taxes are high. Covid related shutdowns have stopped film/tv production in LA. Nobody is traveling which has crippled LA's hotels, restaurants, theaters, retail, etc. Things are challenging right now in California. But...there are a few things that

Why Apartment REIT investors should care DEEPLY about the Private market

Paid

Members

Public

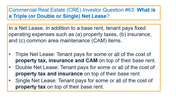

In the apartment business, just ~6% of assets (by value) trade in the public market as REITs. That means that the rest of multifamily assets are in private hands - these assets are owned by traditional institutional investors (large pensions & endowments), private REITs (such as Blackstone's B-REIT)