TJX: Long Term Winner strengthened by COVID & selling at a discount

Note: A draft was sent to our FREE Actionable Investment Idea Newsletter subscribers on Friday. If you like being in the know and want FREE weekend reading, be sure to sign up NOW (note that you must confirm your email address within 8 minutes of signing up, otherwise you have to do it again..I know but thems are the breaks). It's FREE!!

My thesis for owning the company is as follows:

- TJX is the off price industry leader focused on apparel, footwear, and home goods primarily in the US and Canada under the TJ Maxx, Marshall’s, Homegoods and HomeSense banners across ~3800 locations totaling 80 million sq feet (and another 700 stores/14 mn sq feet in UK/Europe). TJX sells name brand merchandise for 20-60% below suggested retail prices. Stores are primarily located in outdoor shopping centers which have easier access, lower rents, and better traffic trends than malls.

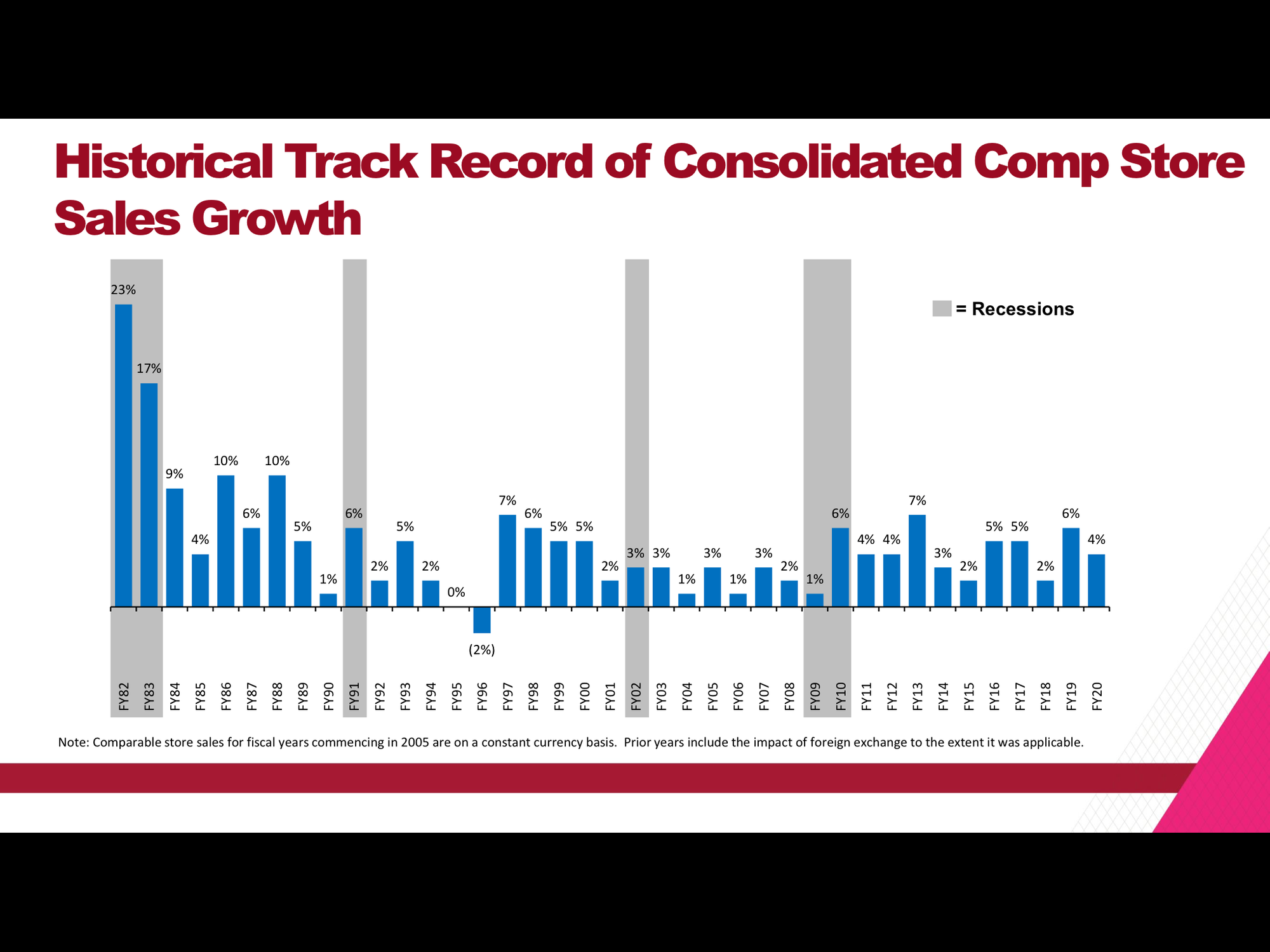

- While much has been made regarding online disruption in retail, on the apparel side, the reality is that the disruption has been driven by the tremendous success of bricks and mortar discounters - lead by TJ Maxx. Over the past decade, TJX has an EBITDA CAGR of 7.4% driven by expanding LfLs and growing its store count. TJX has a pristine balance sheet which will allow it to weather the storm and ultimately emerge in a much stronger competitive position looking out 5 years.

- The treasure hunt element (NEVER THE SAME PLACE TWICE) incents frequent visits by customers to see what TJX has today (assortment changes multiple times per week). Prices are low and shopping is easy and fun! Over decades TJX has created a 'Buy it now before it's gone!' mentality.

While the pace of disruption in retail has been dramatic over the past 20 years, the impact of Covid-19 will accelerate the failure of many, many retailers. TJX will be the main beneficiary of this in apparel retail. I expect it will also use this extreme disruption to aggressively expand into other categories.

- I expect that TJX will lower it's rent expense considerably over the next 5 years - shopping center landlords are beholden to TJX to drive traffic to their centers. Amid unprecedented retail failure, landlords ABSOLUTELY NEED TJX.

- TJX relative strength amidst a sea of weak competitors and suppliers will lead to strong growth in revenue and profitability over the next five years.

- With a strong balance sheet (no net debt) and leading competitive position, I see very little downside for investors with a 5 year time horizon.

While I’ve long been familiar with TJX I hadn’t purchased shares until March 2020. Simplistically the situation is that TJX is one of, if not the, most successful/consistent apparel/home goods retailer in the US. The company has consistently taken market share in all categories in which it operates. TJX came into the covid crisis with a very profitable/cash generative business, a net cash balance sheet, a history of benefitting from economic dislocation. COVID will accelerate TJX's growth and further it's competitive advantage.

By 2024, I expect TJX to produce EPS (and free cash flow per share) in excess of $4. At a 17-20x P/E multiple (in line w/ LT trading multiples), I get a fair value of $70-85 which implies an IRR of 11%-15% assuming a four year hold.

It appears certain we will see an unprecedented number of bankruptcies amongst retailers as the lockdown has exacerbated the problems of the retail sector and chronic problems have now become acute. Apparel & home retailers, given the discretionary nature of purchases, are likely to be among the hardest hit categories (home retailers are currently seeing a bump as people get used to being at home more often).

This extends throughout the supply chain to manufacturers of branded goods as well as shopping center REITs. TJX’s strengths include 1) strong brand synonymous with value (2) tremendous buying power (~$30 bn in inventory purchases pa) (3) very low cost structure - low lease costs @ 4.3% of revenue, no-service model (employees just stock & check customers out, very limited expenditure to fitout/maintain the store (4) significant clout with landlords (TJX paid over $1.7 bn in rent in 2019) - discussed below (5) a net cash BS (12/31)- discussed below.

RENT SAVINGS

I became increasingly interested in TJX as I was going back through and attempting to update my SITC/BRX (shopping center real estate investment trusts) models. While I consider both SITC and BRX to be very well run shopping center REITs, given the catastrophic impact of COVID on the retail/dining sector and the liklihood of significantly elevated bankruptcies for the foreseeable future, I realized I could not realistically underwrite a decline in NOI of less than 20% for these companies and that while I’d spent years understanding them, I could not buy them at 60-70% discounts to my estimates of NAV pre-Covid. Most publicly traded shopping centers have all pared back their portfolios significantly over the past 3-5 years and over 90% of shopping centers (by GLA) are in private hands. Private owners tend to carry significantly more leverage than their publicly traded competitors and will be in an even more desperate position.

~75% of TJX's leases roll-off within 5 years. If I'm a landlord and TJX represents 3-5% of my total rent (and within a given shopping center could easily be 10-25%, especially if there are multiple concepts i.e. Homegoods+TJ Maxx) and is a clear source of driving traffic to the center (my non-anchor tenants pay higher rents, 2-3x per sq/ft in many cases, to be in close proximity to TJX) what am I willing to do to retain them (and make deals to fill emptying space at other centers). Or really the question is, what am I not willing to do to retain them?

This all sums to something everybody already knows: there is going to be so much excess space in the wonderful world of US retail real estate that traffic driving retailers with strong credit ratings like TJX are going to be even more sought after as tenants than ever before. It seems inconceivable to me that rents for companies like TJX are going to meaningfully decline over a 3-5 year period (as leases roll but perhaps sooner). I project that TJX’s rent declines 10-20% (on a LFL basis, the company will certainly keep adding stores) looking out 3-5 years. I suspect rent cuts could be even larger.

Balance Sheet

TJX has a very strong balance sheet with a slight net cash position. Further, following a bond issuance earlier this year, TJX has in excess of $6 billion in available liquidity which gives it the ability to opportunistically source merchandise and as mentioned above remains one of the most sought after tenants for landlords looking for a traffic driving tenant with the ability to honor its leases.

The near term is guaranteed to be ugly as evidenced by the 11% fall this past week as 2Q results fell short of consensus guesstimates. I consider these results and the upcoming 3-6 months meaningless. My thinking is that as long as customers eventually return to physical stores, I fail to see how this idea doesn't work over a 4-5 year horizon. To a large extent, the worse the external environment is, the better TJX will do.

Historical Results & Estimates

$ mn | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | |

Total Revenue | 20,288 | 21,942 | 23,191 | 25,878 | 27,423 | 29,078 | 30,945 | 33,184 | 35,864 | 38,973 | 41,716 | 33,373 | 40,047 | 44,052 | 47,136 | 50,435 | |

Total Rev g | 8.2% | 5.7% | 11.6% | 6.0% | 6.0% | 6.4% | 7.2% | 8.1% | 8.7% | 7.0% | -20% | 20% | 10% | 7% | 7% | ||

Marmaxx Comp | 7% | 4% | 5% | 6% | 3% | 1% | 4% | 5% | 1% | 7% | 5% | ||||||

Home Comp | 9% | 6% | 6% | 7% | 7% | 7% | 8% | 6% | 4% | 4% | 2% | ||||||

OP | 1,991 | 2,300 | 2,447 | 3,106 | 3,351 | 3,606 | 3,704 | 3,849 | 3,987 | 4,218 | 4,416 | 2,000 | 4,416 | 4,998 | 5,637 | 6,342 | |

OPM | 9.8% | 10.5% | 10.6% | 12.0% | 12.2% | 12.4% | 12.0% | 11.6% | 11.1% | 10.8% | 10.6% | 6.0% | 11.0% | 11.3% | 12.0% | 12.6% | |

OPCF | 2,272 | 1,977 | 1,916 | 3,056 | 2,600 | 3,008 | 2,956 | 3,626 | 3,025 | 4,089 | 4,066 | 2,000 | 3,916 | 4,498 | 5,137 | 5,842 | |

Capex | 429 | 707 | 803 | 978 | 947 | 911 | 889 | 1,025 | 1,057 | 1,125 | 1,223 | 1,000 | 1,000 | 1,000 | 1,000 | 1,000 | |

FCF | 1,843 | 1,270 | 1,113 | 2,078 | 1,653 | 2,097 | 2,067 | 2,601 | 1,968 | 2,964 | 2,843 | 1,000 | 2,916 | 3,498 | 4,137 | 4,842 | |

Share Price | 52 | ||||||||||||||||

Shares o/s | 1,200 | 2024e | FCF | per sh | 4.61 | ||||||||||||

Market Cap | 62,400 | EV/OP | 14.0 | ttm | 2024e | FCFps | @18.5x | 83.00 | |||||||||

Net Cash | 500 | PE | 20 | ttm | |||||||||||||

EV | 61,900 | FCF yield | 4.6% | ttm |

TJX's shares have behaved in line with its operational performance with a total return in excess of 15% p.a. over 20 years.

Risks

1-TJX has almost no presence online. Online sales were ~3% of 2019 revenue. A transition of off-price retail from bricks to digital would be a clear negative as online profitability would be considerably lower than those achieved historically. There are numerous reasons I don't think we see much of an increase in penetration of digital off-price.

2-The next couple quarters could continue to be ugly given the unprecedented disruption wrought by Covid.

3-The economy could remain very weak for a prolonged period of time.

4-While lots and lots of retailers will be going bust over the next couple of years, TJX’s primary competitors ROSS/BURL are in similarly strong positions and are likely to aggressively grow their store bases over the next 5-10 years which could have a negative impact on TJX.

Except for points 1&4, I believe that in the long run, the worse 2&3 are, the better it is for the long term competitive positioning & profitability for TJX.

As you have no doubt guessed, Eric Bokota is LONG TJX. That doesn't mean you should be. Read our How We View Risk and as always...do your own work.

Wanna hear it first? (our FREE Actionable Investment Idea newsletter subscribers got a draft of this Friday and were able to read it over the weekend). Be sure to sign up if this is interesting to you (you will need to confirm your email within 8 minutes of signing up.)

Private Eye Capital Newsletter

Join the newsletter to receive FREE actionable investment ideas.