The smart sounding verbiage in sell-side reports can lead to terrible investment outcomes

This is in response to Baird's moronic 'research piece' (Seeking Alpha synopsis here) letting investors know that they should wait for rents to bottom before buying apartment REITs because this is what worked last time.

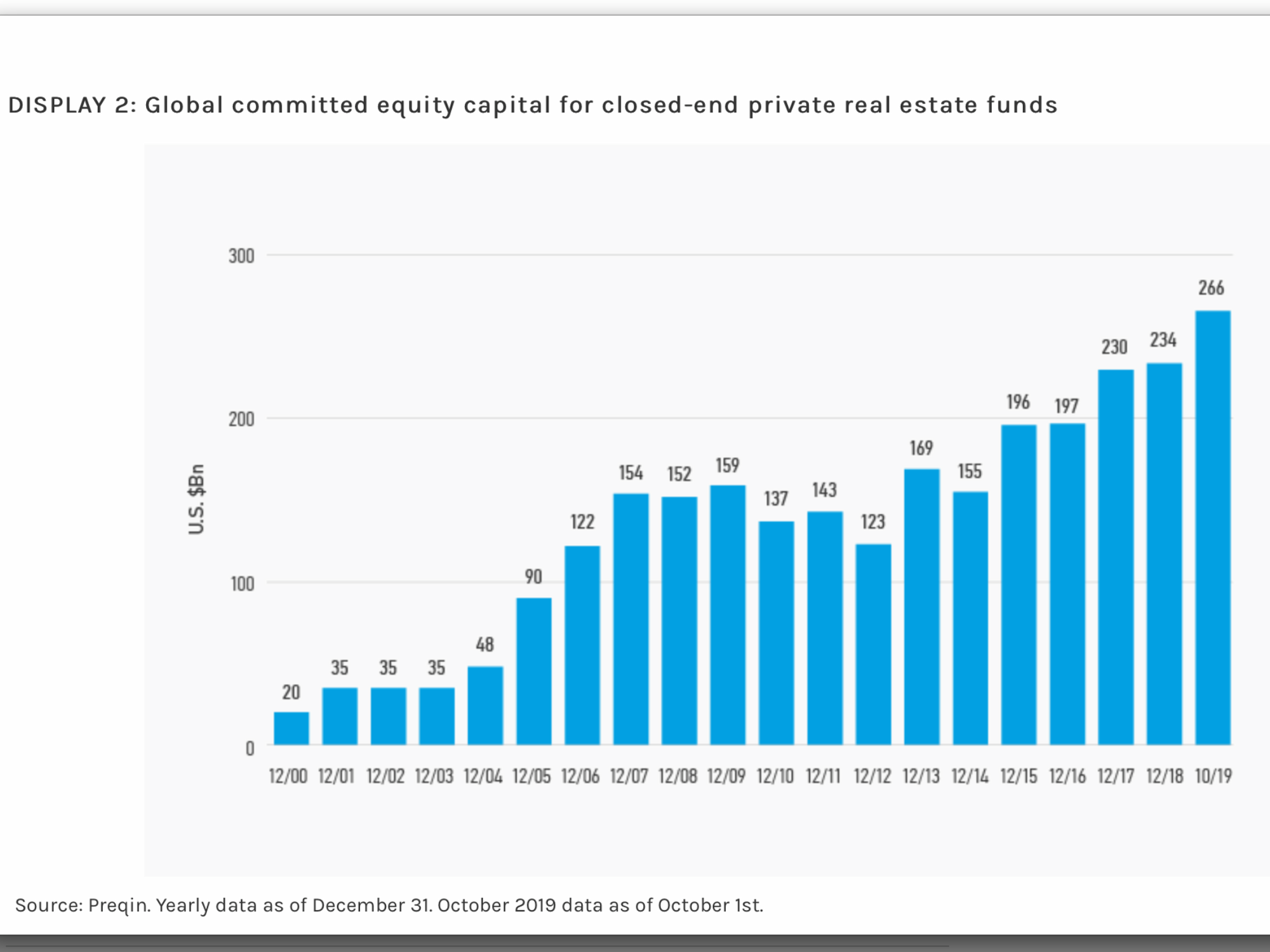

Why must we need to know when rent growth bottoms to buy the apartment REITs? Shares trade at a giant discount to private market values while the rest of the stock market trades at peak multiples. Apartment REITs are a private market game - only 5% of apartments trade publicly as REITs. The private market is THE market. As shown below, the private market has enough dry powder to buy every multifamily REIT multiple times.

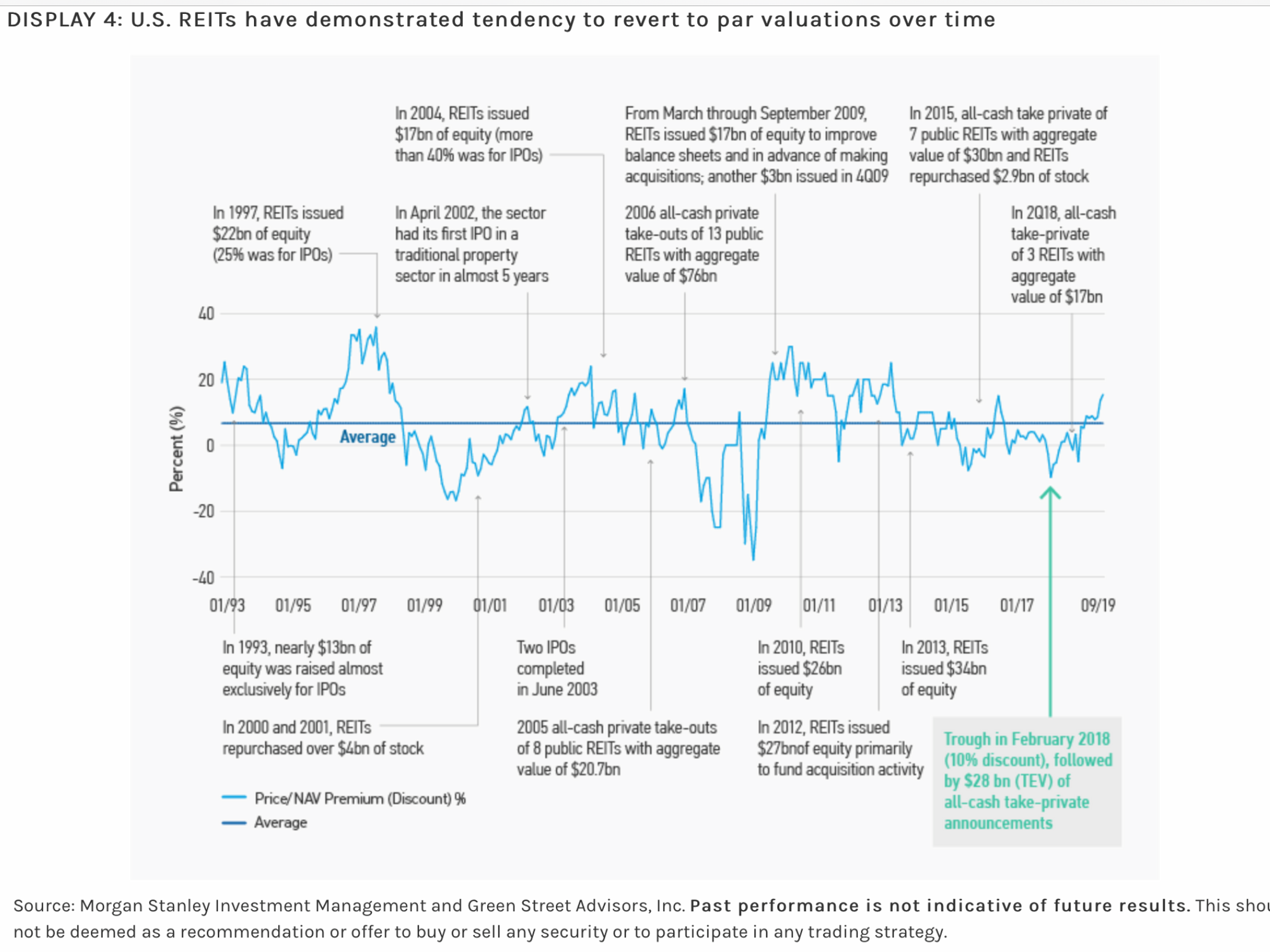

Long term investors (5 year horizon) are likely to earn great returns (14-20% estimated annualized total return on a 5 year hold) buying in today. REITs don't always trade at a big discount - frequently they trade at a premium:

If ESS reverted to NAV, it would have to rise ~75%. The wizards at Baird (and other Wall St firms) says wait. It might go down more. Baird's advice is as valid as its advice would be telling you to bet red or black on roulette. Baird is guessing what happens in the short term. Since the consensus is bearish, I suspect Baird figures giving a bearish explanation and a share price target in line with the current price is the 'safe route'. Maybe for the analyst's career. But long term investors will be rewarded for buying shares here IMO, supported by evidence - as you can see above, REITs tend to revert toward NAV over time.

NAV seems likely to go up given that long term interest rates are very low globally. Apartment REIT yield spreads (cap rate less 10 year treasury) are at 20 year highs - using long term average yield spreads sit around 2.8%. Adding 2.8% to the 10 year treasury yield of 0.7% suggests cap rates should be around 3.5%. This means ESS is trading at only 1/2 of NAV (EQR and AVB around 55% of NAV).

As for short term trading - I have no idea where these trade in the short term. Nobody does. But just because history suggests that share prices won't bottom until rents bottom there are many reasons why this time might be different, including:

A- more private equity money chasing real estate than ever before - look at this chart!

Beyond the insanely low valuations (huge discount to NAV) is a big reason why Baird's brilliant idea of 'waiting for rents to bottom' is so incredibly stupid! This dry powder, when levered could easily be $750 billion -$1 trillion. This money is chasing deals in the private market and will lead to either an outright acquisition of the large West Coast REITs or more JV transactions (at full value) like we saw Aimco do two weeks ago.

B- interest rates at all time lows - with capital flows more global than ever and Europeans having negative interest rates, it is entirely possible that foreign capital bids up real estate. Cap rate spreads (Cap rate less 10 year treasury) are at 25 year highs in the apartment space.

C- Ability of REIT management to engage in corporate transaction to realize value - Aimco did this on 9/14.

D- S&P 500/QQQ may be expensive - multiples are certainly more expensive than they have been at nearly all points in history. We are possibly in a bubble. It is fairly easy to make the case that an investor buying QQQ today will lose money (lots?) over a 5 year horizon. By contrast, West Coast/megacity apartment REITs are stupid cheap. It is very difficult to make a credible case that an investor with a 5 year horizon will not generate a positive absolute return. Even in a bad economic environment, I expect to do well in these REITs because I'm buying them at such a cheap price.

Even if Baird is right in the short term, there is ample evidence suggesting it will be wrong in the long term. At least that's what my $ says (I have skin in the game). I wonder what stocks the analyst at Baird owns (this person probably isn't allowed to own anything - compliance and 'objectivity').

Sell side analysts love to match the target price to the current share price. Some would be surprised that these experts are paid by 'sophisticated investors' to do provide such a service.

Waiting for rents to bottom is even less smart as guessing black in roulette. Maybe you win in the short term. Maybe not. But in the long run, the odds are stacked against you. Betting against California is a fools errand.

LONG ESS, EQR, AVB, CLPR

This is not investment advice. Do your own work.