Why I'm buying the Software Massacre

Software stocks got destroyed last week. It could very well get worse before it gets better. There are many negative headlines proclaiming the death of software at the hands of AI native upstarts like Anthropic's Claude and Salesforce's own internal difficulties deploying AI. Scary sounding stuff. Here's why I'm buying leading enterprise SAAS players Workday (WDAY) & Salesforce (CRM):

- Customers aren't going anywhere. Technology changes much, much faster than organizational behavior, particularly large organizations. It isn't about the latest technical capabilities of the software/application. It is almost never about the lowest cost option. It's about the client organization & the incentives of the top decision makers within. There have always been naysayers for companies like Salesforce (and Oracle / Microsoft - see below in Risk section) who have cited the existence of cheaper alternatives with similar/better performance. The implementation of a large enterprise system like Salesforce or Workday is a major decision for a client and is a C-Suite (CEO/CFO/COO)/BOD level decision - a decision which likely took 6-18 months. Going with an established vendor is the safe route - an executive is unlikely to be fired for adopting & implementing a leading platform. Once adopted, an enterprise spends significant amounts of time & money modifying its internal processes & training employees on the software. Enterprises & the people running them are incented to stay the course as the decision to 'rip & replace' an established/functioning system could very well get an executive fired if it doesn't go well. Within a large organization it is harder to replace Salesforce or Workday politically than it is technically. Rip & replace is an asymmetrically negative decision for a management team/BOD. This has always been the case in enterprise software and remains the case today - which is why customer retention rates have always been incredibly high. And of course, mission critical/high switch costs = pricing power.

- Companies like Salesforce & Workday have been around for a couple of decades and clients trust that they will be around decades from now and continue to support them going forward. Choosing a new system, even if the implementation goes well enough, carries the risk of 'who will maintain/update/improve/customize this thing 5 years from now?'.

- Platform / Ecosystem - these companies have thousands of 'partners' - software integrations/APIs/3rd party consultants, all of whom have a vested interest in the survival & success of the ecosystem. Salesforce and Workday have become so successful because they let other companies build apps on top of them. Through partnerships/integrations/APIs, these large enterprise software systems have their tentacles in nearly every part of a large organization making rip & replace a messy and risky move. Customers don't have to be super happy with the software system. They will only consider changing if they are super (probably even super duper) unhappy with it.

- Widely circulated studies/reports from McKinsey /MIT labs/ etc show that enterprise AI adoption is going slowly, is non-linear, and in most cases hasn't produced meaningfully positive financial outcomes - yet. While it is inevitable that AI performs many enterprise tasks which are currently performed by humans in 5-10 years doing so will require careful planning, testing, and iteration before mass adoption occurs. Given their central role in the business processes, organization and delivery of information within organizations, incumbent software companies like Workday and Salesforce are in prime position to be the vendor of choice to shepherd enterprises along in carefully implementing, measuring, and adjusting AI tools/agents. This journey will be long & winding with fits and starts. But it is my expectation that incumbent enterprise software companies will have every opportunity to continue to serve & grow with their existing customers on their AI journey even though there will be bumps along the way. Paradoxically, Salesforce's own internal snafus using AI agents and customer hiccups with Agentforce make it even less likely that customers will consider a rip and replace for the new, new thing.

- CRM & WDAY will make the transition from selling seats to selling agents/work performed via token sales. There is an inevitable loss of seats as AI replaces workers. This is real. That said, my understanding is that there are some provisions which protect revenue should seats decline. As to selling agents/AI, the initial sales of tokens may have a negative impact on margins given the incremental cost (buying AI compute) and the incentive to initially underprice it to spur adoption (and preempt competition). It will complicate the journey and make financial results messy. Brace for ugly quarters and potentially dramatic stock sell-offs along the way. We saw this a decade or so ago as legacy software companies moved from selling on-prem to subscription and that generally worked out quite well. Ultimately I expect the business/revenue model will transform from seats-based to work-performed and that over the medium/long-term this will not be dilutive to profitability.

- Balance sheets are strong (no net debt) and valuations are low at 12-13x FCF (calendar 2027) which is pretty exciting for businesses with recurring revenue streams that are likely to continue to grow 8-12%. No heroic assumptions are required to get a 5 year IRR of 15-20%.

Risks & How this probably won't be super fun for the next couple years:

- Narrative of SAAS death could get louder & these could get (much) cheaper. As an example, recall that Microsoft traded down to 6-7x OP/9x FCF toward the end of Ballmer's reign (2011-14). Despite HSD revenue growth, narrative surrounding MSFT at the time was death of the PC / MSFT (Bing) failed at search and bid for Yahoo / MSFT missed the smartphone / MSFT culturally broken / free worktools from Google / Microsoft not a player in the cloud / fear of bad acquisitions (acq of Skype). While CRM / WDAY are attractive they are nowhere near 2011-13 MSFT level of 'stupid cheap'.

- I expect a messy transition to AI (Agentforce). This has almost certainly been overhyped (in the short run) and will likely lead to disappointment (for customers & Wall St). Enterprise oftware companies are lead by master salesmen who overpromise (in the short term). I expect it may go something like Oracle/Larry Ellison's proclamations regarding Oracle Fusion/Exadata (2010-13 IIRC) when it publicly targeted 10-15% revenue growth and missed by a wide margin. This eventually came to fruition but gave investors many opportunities to second guess themselves. Oracle was trading in the 10-14x FCF range during most of this time.

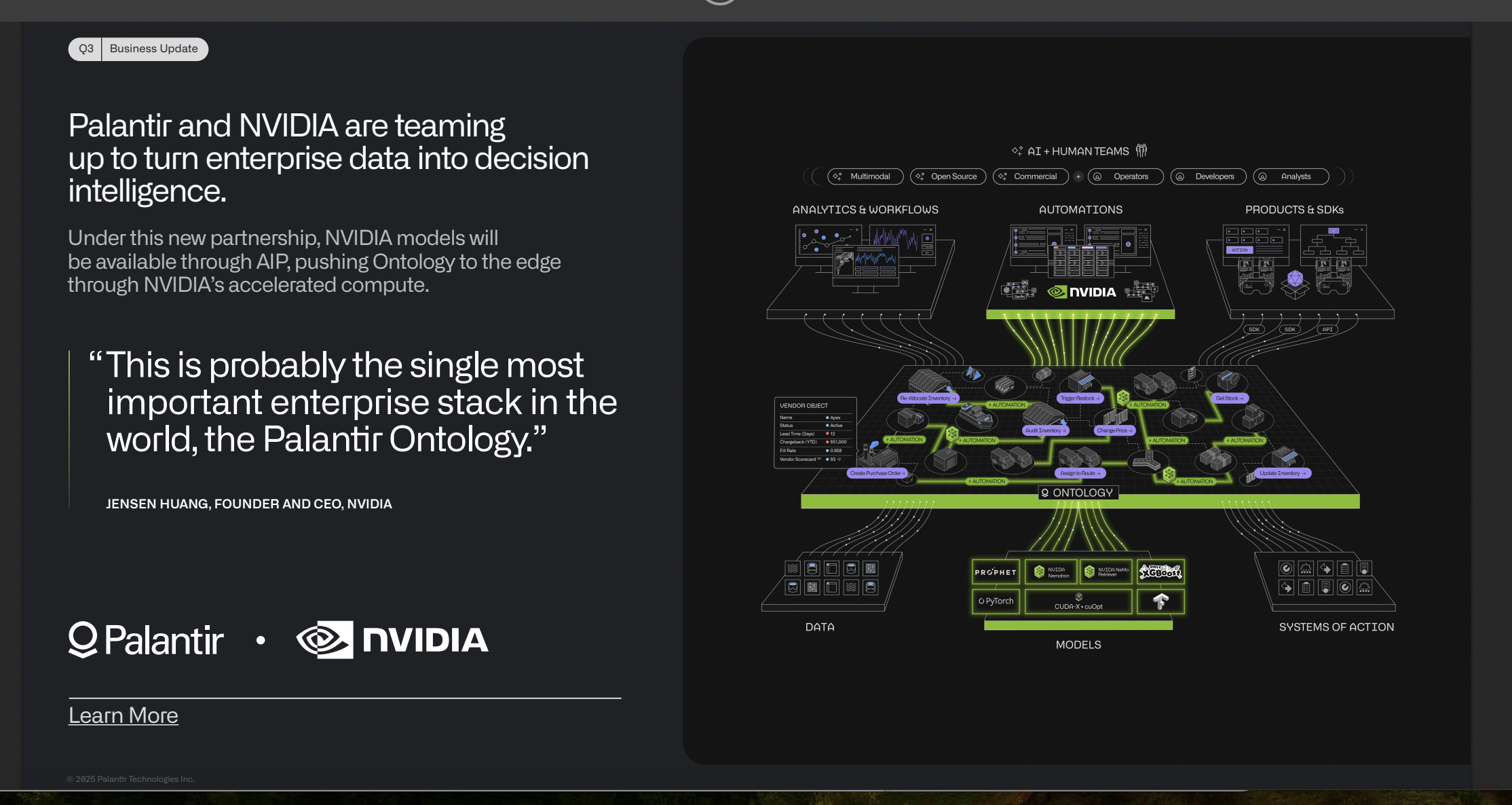

- Palantir (PLTR) eats the biggest slice of the Agentic enterprise AI cake. This is the closest thing to AI enterprise 'magic' we've seen thus far. With its software sitting top multiple systems (SAP/WDAY/CRM), Palantir is able to deploy effective enterprise AI solutions in 3 days. Some of the case studies are quite impressive. CRM & WDAY can't catch up - they are relegated to the monetization of agentic automation of a list of boring/unspectacular tasks. While this mitigates some seat loss, revenue stalls.

- There will likely be large acquisitions done by CRM / WDAY at eye popping multiples that will breathe fear into all of us. Prepare to see a few years of FCF used on an AI acquisition done at 40x forward revenue. We saw something like this with ORCL SAP MSFT, etc as on-prem transitioned to cloud (though multiples rarely exceeded 12x rev) and I expect we'll see it again. It will be uncomfortable.

Disclaimer: This report should NOT be read by anyone. This is not investment advice. I am probably wrong about everything stated above. Author has positions in securities mentioned & is hugely biased.

Song:

Private Eye Capital Newsletter

Join the newsletter to receive FREE actionable investment ideas.