Why I'm Ballz Deep Large Cap US Residential REITs in ~450 words

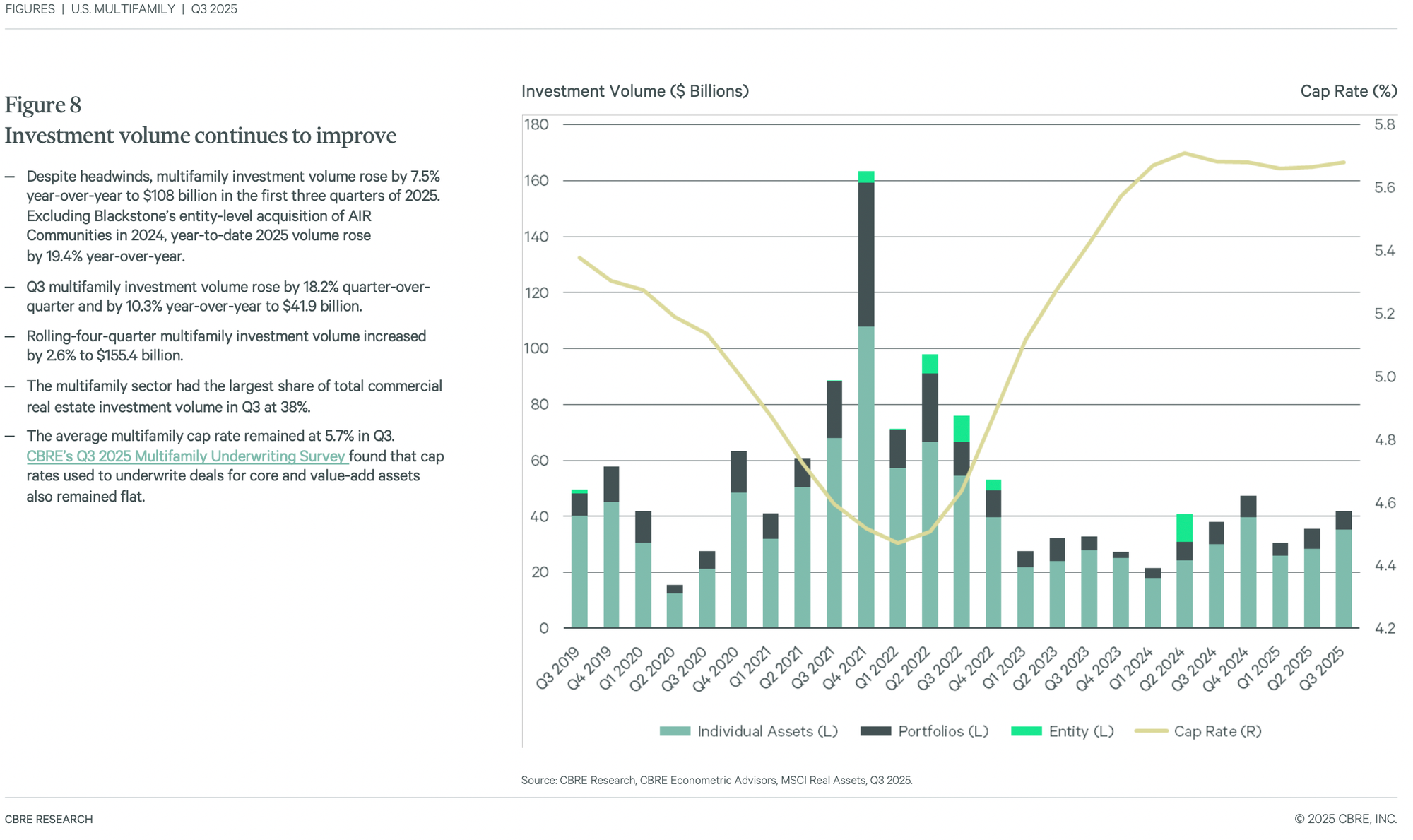

Exceptionally low risk - Balance sheets have LTVs in the range of 20-33%. B/S risk is pretty close to zero. Housing = most basic need / zero risk of obsolescence/disruption (there are few bizes you can truly say this for). Supply risk is behind us. Deliveries set to fall off dramatically in 2026/27. Valuations at a 20+% discount to private market (and greater discount to replacement cost). Private market is the REAL market as REITs represent sub 5% of total US apartment value. Private market volumes have been strong through 3Q25 which throws cold water on the notion that big drawdown in resi REITs portends future declines in pvt mkt values.

What risk remains? Macro/demand- AI could make many white collar jobs obsolete and dampen household formation. Widespread job loss would almost certainly lead to meaningful government intervention (rate cuts, stimulus payments, etc). This would fuck up the earning power of most businesses (even some of the revered MAG7 - i.e. META/GOOG huge economically sensitive advertising businesses likely to suffer far more than AI gains/ AAPL iPhone purchases could be deferred, etc).

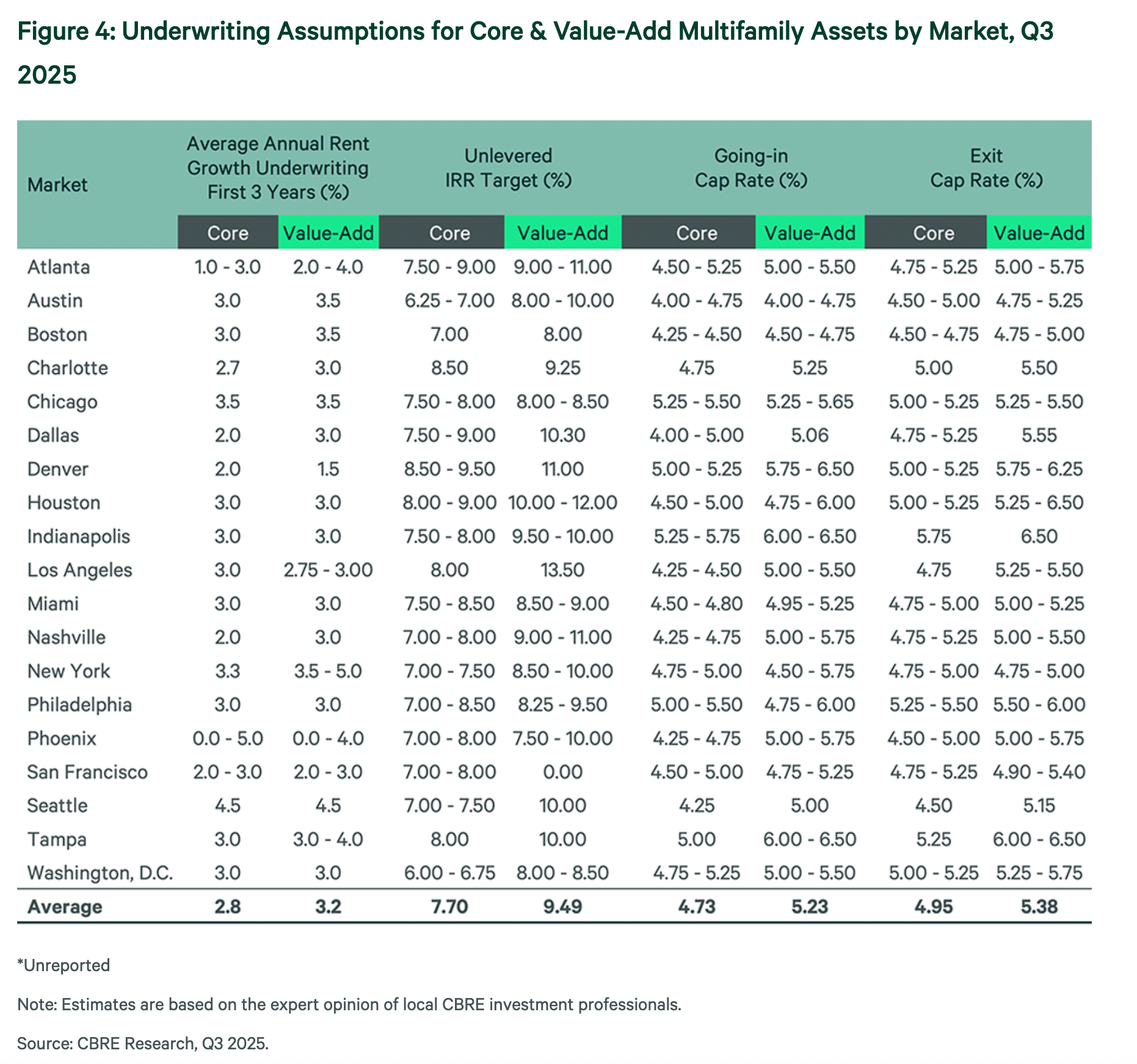

Base case: Mid teens expected return on a 4 year hold for AMH/CPT/INVH/MAA/UDR. This assumes 3-4% horizon NOI CAGR & exit cap rate in the 5-5.5% range (consistent w/ private market). My assumed NOI growth is slightly below the trough-to-trough, long-term (~15 yr) average of what these REITs have produced. There is an element of conservatism built into this given where we are in the supply cycle (with normal demand, rents should rip from 2027-29 as very little supply will be coming online).

What do I earn if the REITs remain at their historically wide discount & don't trade back to parity w/ private market value? My estimated unlevered perpetual IRRs for the REITs is in the 8-9% range which is the 6.2-6.7% nominal cap rate translated to the economic cap rate (adjust out capex and G&A to get to 5.1-5.4%) to which we add NOI growth (say 3.5%).

Some of you are probably thinking: if the REITs don't trade back to parity w/ private markets, 8-9% is sooooo boring. Ok. But if you believe that the REITs are very low risk (fundamentally), this is quite an attractive return.

Need more? Here are some charts/data I compiled after 2Q25 (2026 w/b a bit softer than I was thinking @ the time; otherwise not much has changed though share prices are lower): https://www.privateeyecapital.com/2q25-resi-reit-thoughts-cap-rates-per-door-4yr-irr/

Disclaimer:

This report should NOT be read by anyone. This is not investment advice. I am probably wrong about everything stated above. Author has positions in securities mentioned & is hugely biased.

Song:

Private Eye Capital Newsletter

Join the newsletter to receive FREE actionable investment ideas.